Difficult energy situation in Europe. Will Poland have enough coal and gas?

In recent weeks, a narrative has appeared more and more often that Poland is in for an energetic hell in winter. People and institutions warning against the energy crisis give arguments that the expiry of the contract with Gazprom, problems with importing coal and the lack of filling of the Baltic Pipe will bring a strong blow to the Polish economy. The black scenario mentions the lack of coal for some single-family households or interruptions in gas supplies for some customers. At Forex Club, we do not have a glass ball and we are aware that the situation may improve or worsen rapidly in the coming months. In today's article, however, we will introduce you to the energy situation in Poland at the present moment. In addition, we will look at companies from this industry listed on the Warsaw Stock Exchange. The article is based on national data (including the Central Statistical Office), international data (including Eurostat, European Commission), as well as independent centers analyzing the energy market in Europe and in the world. We invite you to read.

The energy situation in Poland

Russia's aggression against Ukraine in February 2022 made the existing stable trade agreements with Russia difficult to maintain for moral and political reasons. In Poland, even before the war, the government announced that it did not intend to extend the gas contract with Gazprom, which expires in 2022. What's more, an embargo on Russian coal was introduced, which meant that the Polish heating sector, which used this source, is beginning to have a problem. Due to the current raw material situation, the prices of electricity and energy raw materials have increased not only in Poland, but in most European Union countries. This may have a negative impact on industry and services (higher electricity costs) and on lower consumption in the economy (higher housing costs for households). At the same time, higher costs may contribute to the deterioration of the financial results of many companies for which energy is an important component of all company costs.

Black gold becomes more and more valuable

In Poland, coal with a high sulfur content is mainly mined. It goes to the power industry, which, thanks to desulphurization installations, can burn Polish coal and meet emission standards. It should be noted that the import of coal from Russia resulted from its low sulfation, which made it possible to meet the energy requirements of the European Union for Polish heating plants in a cheap way. Russian coal also went to households that were looking for cheap heating coal. Russian coal fulfilled this role perfectly because it was cheap and of relatively high quality. Cutting off Russian coal means that Poland must fill the hole in imports very quickly. Without this, it will be very difficult to provide heating plants and households with sufficient coal without disturbing the economic balance.

It is worth mentioning that in recent years Poland has imported about a dozen or so million tons of hard coal, 70% of which came from Russia. Low-sulfur coal has, inter alia, Colombia, from which it can be imported by sea. An open question remains whether the transshipment ports in Poland will be able to handle coal transports without disturbing the logistic system of the ports. The reloading efficiency of the ports in Gdańsk, Gdynia and Szczecin will be of key importance in ensuring coal on the Polish market. It is these three places that the coal imported by sea goes to. In the first half of 2022, approximately 5,4 million tonnes of coal were handled in these three ports. Out of this, as much as 3,9 million tonnes were transhipped in Gdańsk. As you can see, it is the efficiency of this transhipment port that is crucial in the distribution of imported coal. In addition, it is necessary to provide rail and wheel logistics to distribute the coal to local distribution points. Currently, the unloading capacity in Polish ports is 1,5 million tons per month.

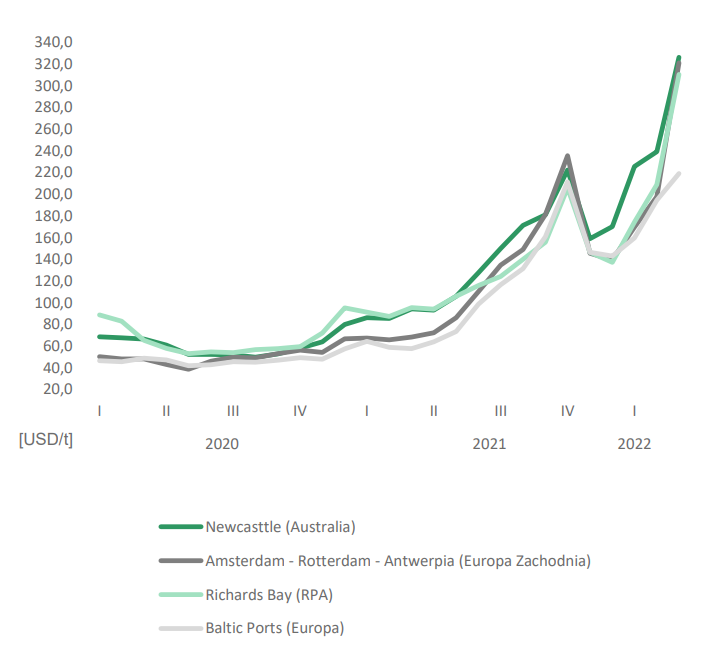

The increase in demand for coal, combined with the embargo on the import of this raw material from Russia, contributed to the increase in coal prices on the Rotterdam market. Prior to the aggression of February 24, 2022, the price of a coal futures contract for October delivery was just over $ 120 per ton. In August, the price of this contract rose to $ 329.

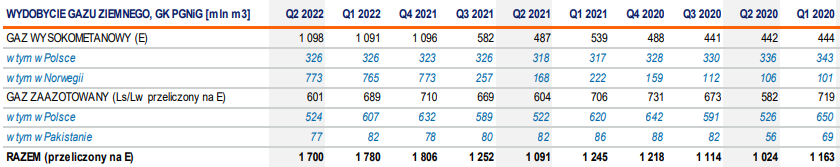

Source: Investor presentation for IQ 2022 Bogdanka

Will Poland have enough coal?

It should be noted that Poland, as one of the few countries in Europe, is very dependent on coal. According to data collected by the EIA (US Energy Information Administration) Poland was ranked 9th in the world in terms of coal consumption. This is a much higher position than the country ranks in terms of GDP. Coal in Poland is a key source of input in the energy sector and one of the key sources of heating for single-family houses. Despite having large coal deposits, decades of neglect have left the mining industry underinvested. As a result, the Polish mining industry extracts less and less coal. The decline in production (with a few exceptions) has been going on since 1979. In 2021, 42 million tons of thermal coal were mined in Poland. At the same time, Polish power plants burned 57 million tons. The deficit was therefore as much as 15 million tons. That year, the deficit was flooded with coal reserves accumulated by the Governmental Agency for Strategic Reserves and with imports. Coal inventories at that time amounted to 9 million tons. In 2021, approximately half of coal imports were supplied from Russia. However, there are no coal reserves this year. This means that this year Poland will need much more imported coal than in 2021.

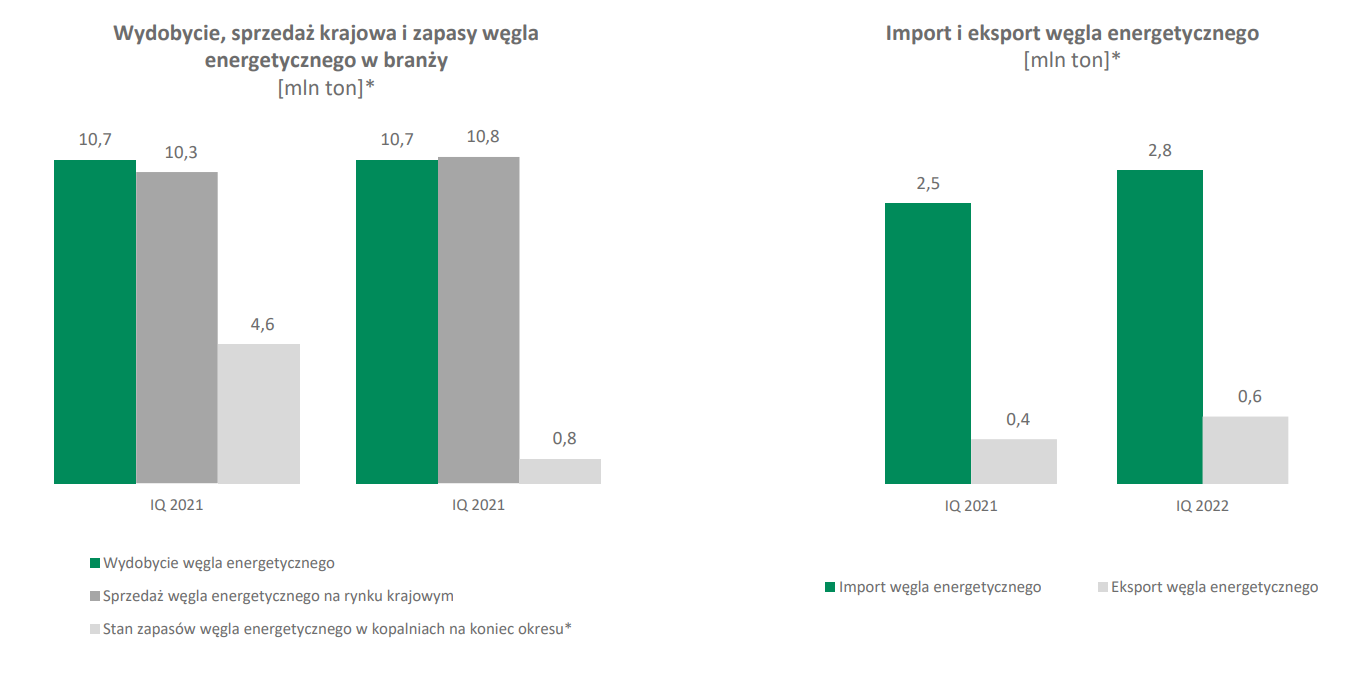

Source: Bogdanka SA investor presentation for Q2022 XNUMX

It is worth remembering that the coal burned in power plants is completely different than the coal used by households. Power plants use mainly fine coal, i.e. fine, uncleaned coal with an average calorific value. In turn, households need purified coal (lower ash content), high calorific value and more granular. In older boilers, coal such as nuts, cubes or billets is used. More modern boilers use less coal (peas). In 2021, households used about 9 million tons of coal. If the next winter is very cold, the demand will increase to 11 million tons. Out of the aforementioned 9 million tons, about 5 million were of Polish production, 3 million tons were imported (mainly from the East) and 1 million tons from stocks from the previous year. The important fact is that coal imported by sea has a lower share of medium and coarse coal than imported from the east. Even 30% of coal imported from Russia or Kazakhstan is classified as medium and thick. For comparison, coal imported by sea has a share of this type of coal at the level of 10%. This means that it will be much more difficult to meet household demand.

Electricity problems will also depend on the weather. If it is windy, the demand for electricity from thermal power plants will decrease as part of the energy demand will be met by wind farms. On the other hand, if it is warm, the demand for coal in combined heat and power plants will decrease. In the event of such weather conditions, there is a chance that the government will not be forced to interfere with the shaping of demand and supply for coal.

The companies extracting this raw material will certainly benefit from the growth in demand for coal. This is because the increase in coal prices improves the profitability of extraction (costs are relatively constant). As a result, even Polish mines that extract steam coal will be able to improve operating profitability. Of course, it also depends on the contracts signed by mining companies and the price indexation rules. It should be remembered that the threat of price regulation (maximum prices) is still looming over coal companies. The market immediately noticed that there would be problems with the supply of coal imported from the east. Just after the war, Bogdanka's course doubled its value.

Inamorata

Bogdanka has steam coal deposits located in the Lublin region. According to the data presented by the company, Bogdanka's share in the steam coal market in Q2022 23,9 was 2022%. The company's competitors are mines belonging to Polska Grupa Górnicza, Tauron SA. The results for Q30 731,7 were very good for the company. The increase in the volume of sales combined with the increase in prices caused the company's revenues to increase by 12,7% during the year to the level of PLN 24,7 million. The increase in prices resulted in a significant improvement in the gross margin on sales, which improved from 19,6% to 9,7% during the year. On the other hand, net profitability (net profit divided by revenues) improved to XNUMX% from XNUMX%.

Tauron

It is also worth taking a look at Tauron, which also has an upstream segment. However, it should be noted that this segment is not of key importance for the company in terms of generated revenues and results EBITDA. According to the data for Q2022 1,45, coal extraction amounted to 0,02 million tonnes, which meant an increase in production by 2022 million tonnes y / y. However, coal sales increased significantly. In Q1,5 20,96, Tauron's mines sold 6,80 million tonnes of coal (+ 1,1% yoy). It is worth adding that the sale of fine coal (for power plants) increased by 2022% y / y to 0,39 million tonnes. The sale of other assortments (peas, cubes, etc.) increased much more. In Q85,71 84,15, Tauron sold 558 million tonnes of this type of coal (+ 14% y / y). In turn, the quarterly revenues of the upstream segment increased by 2021% to PLN 117 million during the year. Due to the increase in volume and higher coal prices, the EBITDA improved from PLN -2022 million (QXNUMX XNUMX) to PLN +XNUMX million (QXNUMX XNUMX).

On the other hand, foreign coal mining and exporting companies (e.g. Australian) are beneficiaries of the increase in market prices of coal.

Europe's gas problem

While there is no problem with the availability of coal on the world market, then larger shortages of supply are visible in the market natural gas. Over the last dozen or so years, Europe has significantly increased the consumption of blue fuel. The main directions of gas imports were Russia, which accounted for up to 48% of imports (2019). The next directions of imports to the European Union countries were Norway (28%), Qatar (8%) and Algeria (7%). Of course, gas was transported through two channels: gas pipelines and gas carriers (LNG). It is worth mentioning that the most important economy in Europe - Germany - as much as 57% of their imported gas was imported from Russia.

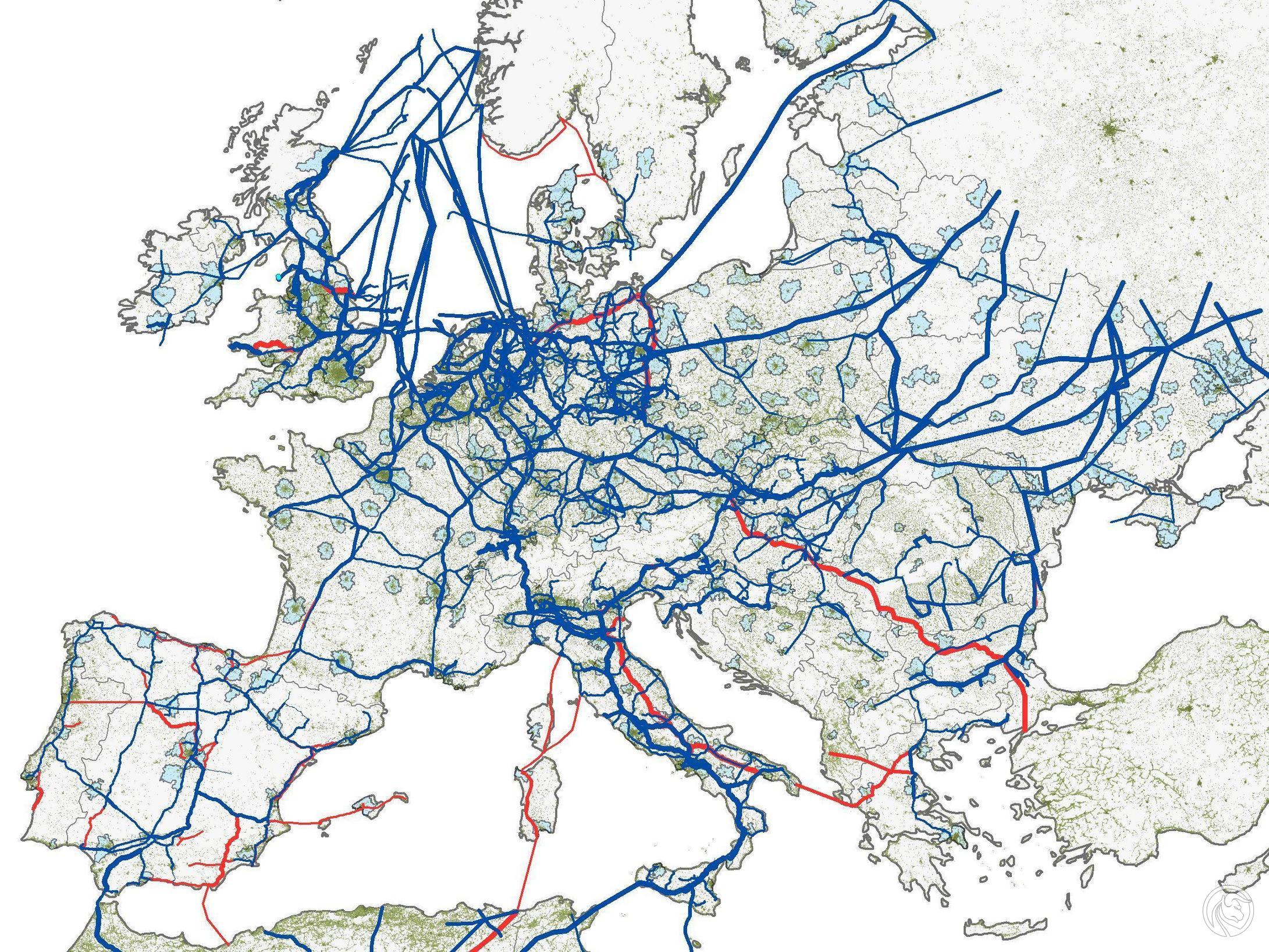

Only two countries supply blue fuel via pipelines: Russia (57% of imports via this channel) and Norway (35%). About a third of LNG came from Qatar. Due to the fact that transport via gas pipelines is very efficient and low-cost, many countries have not developed infrastructure to receive more liquefied natural gas (LNG), which requires gas ports and gas carriers.

The largest gas hubs in the European Union are Spain and the Netherlands. In Spain, there is a very large processing capacity of LNG, which, due to its geographical location, is mainly transported from Algeria. However, this direction of gas imports and transport to Europe is problematic due to the lack of significant interconnectors with the French gas system.

Natural gas transport network. Source: British Business Energy

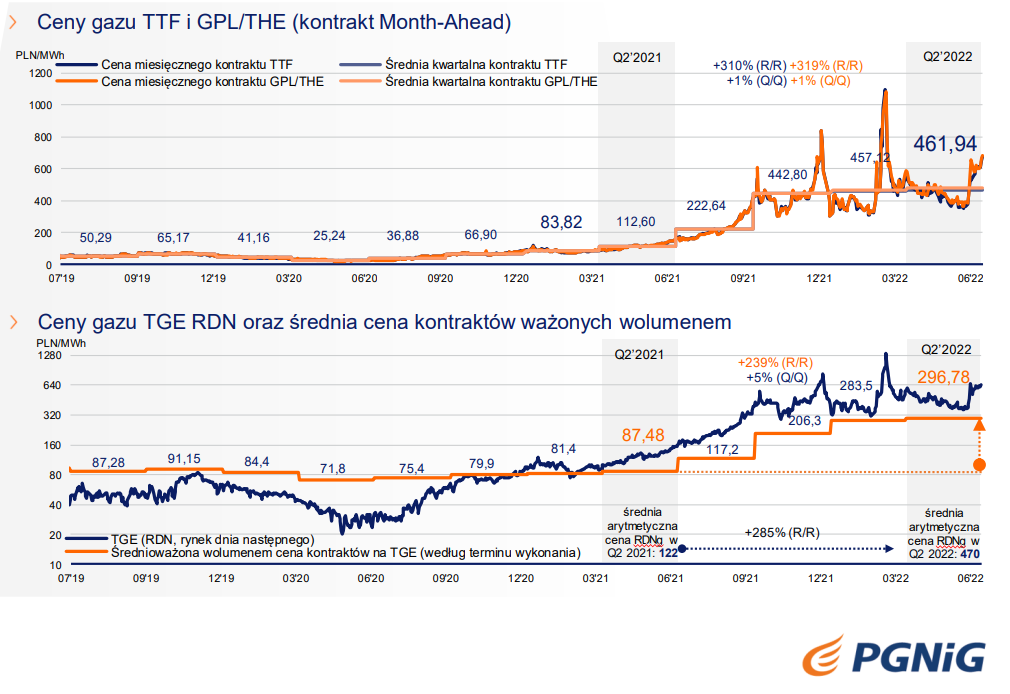

Russia's aggression towards Ukraine caused an increase in demand for LNG in Europe. Due to the high demand for liquefied gas, prices in Europe are much higher than in other regions of the world. This makes it profitable for gas carriers to turn back and choose one of the European gas terminals. As a result, Asian gas hubs are also raising their offers for the purchase of LNG. Some developing countries are unable to compete in terms of price. As a result, the risk of energy crises in countries is increasing Emerging Markets. Currently, the increase in natural gas prices can be seen in the chart below:

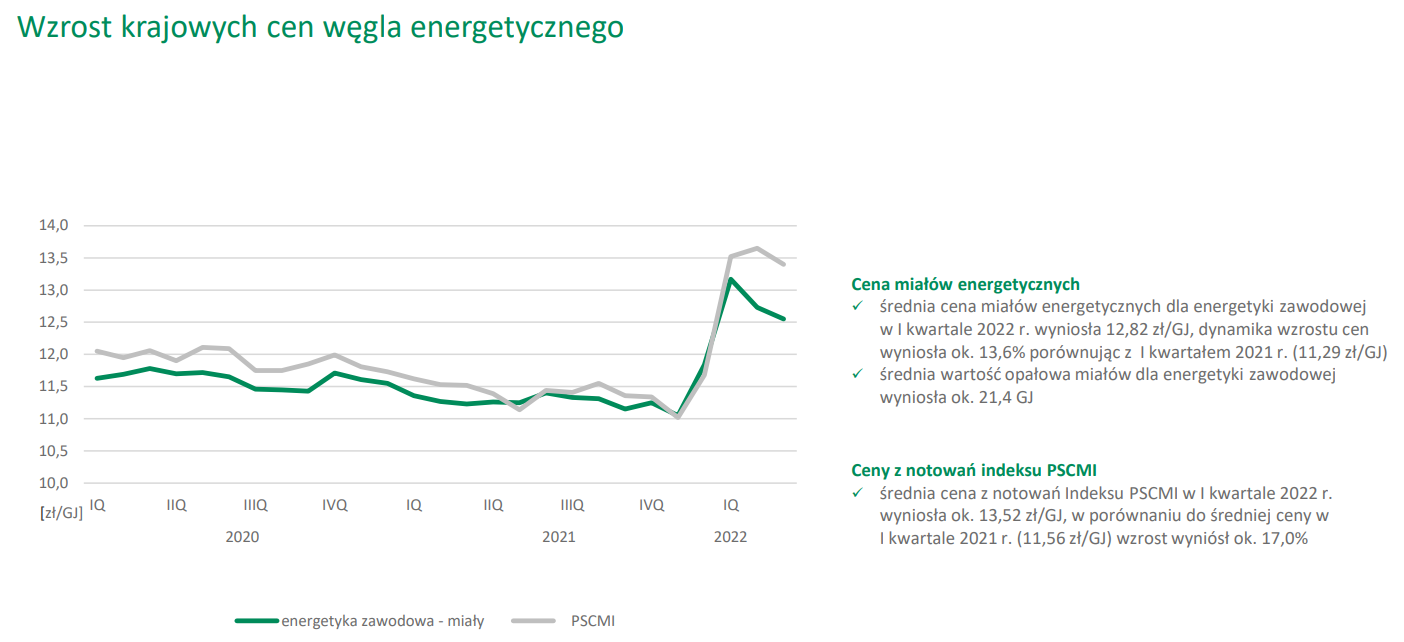

The prices on the chart are quoted in Polish zloty. Source: investor presentation for Q2022 XNUMX PGNIG SA

Is Poland enough gas?

From the beginning of the second half of 2022, gas supply from Russia decreased. The reason was the limitation of gas transmission to Germany via Nord Stream 1 (after technical works, transmission at the level of 40% of the capacity). Another reduction in gas supply to Europe was caused by the cessation of supplies via the Yamal pipeline.

The price of TTF gas, according to S&P Global data, reached a new price peak in August 2022. This means that the price of natural gas is already higher than during the panic at the beginning of Russia's invasion of Ukraine. On August 15, 2022, the price of TTF gas increased to € 221,475 / MWh. This was 4,2% above the peak on March 8, 2022. This is a signal that there is still a problem in Europe in supplying gas to the level of satisfying the normal demand for "blue fuel".

If you look at gas imports via gas pipelines, in Europe, apart from Russia, the only major player is Norway. Poland intends to open the Baltic Pipe in September 2022, i.e. a connection between Poland and the Norwegian gas thread (Norpipe). The maximum capacity of the Baltic Pipe is 13 billion natural gas, of which 3 billion is to go to Denmark and Sweden, and 10 billion to Poland. For now, Poland is to have 4,5 billion natural gas contracted. The remaining 5,5 billion of gas must be imported by Poland from Norway. Currently, Norway is able to increase production by 10-20 billion natural gas. However, Poland will have to compete for gas, e.g. with Germany. Part of the contracted gas comes from the fields owned by PGNiG. In 2022, the Polish company had 62 production concessions in Norway and in the North Sea.

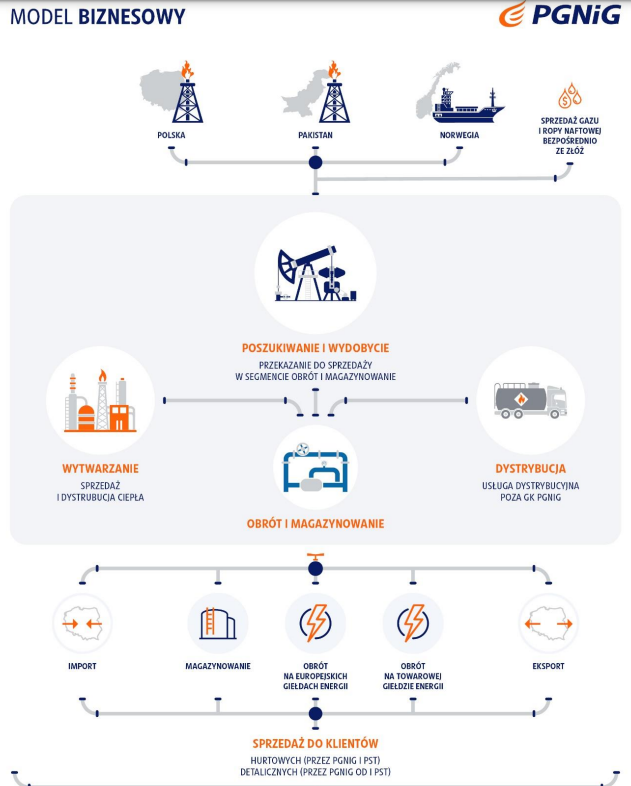

Source: PGNiG

The increase in the number of concessions means that PGNiG significantly increased the production of natural gas in Norway to a level slightly below 0,8 bcm per quarter. This level is insufficient to ensure Poland's energy independence, but this step allows diversification of gas suppliers to Poland.

Currently, Poland has its gas storage facilities practically full. However, these warehouses are able to meet the national demand for just 40 days. Poland consumes 20-22 billion of natural gas per year, of which blue fuel consumption in the heating season is around 12 billion. If Poland fails to contract the full capacity of the Baltic Pipe, other solutions are to use the gas terminal capacity, the connection with Lithuania (GIPL) and the interconnector with Slovakia. Of course, using the interconnector is actually consumption of Russian gas, so it will be treated as a last resort (for political reasons). The interconnector with Slovakia enables the maximum import of 5,7 billion cubic meters of natural gas to Poland annually. It is possible to transmit 4,7 billion cubic meters of gas annually to Slovakia. It remains an open question whether Russia will respect long-term contracts with partners from Europe during the heating season, or whether it will opt for energy blackmail.

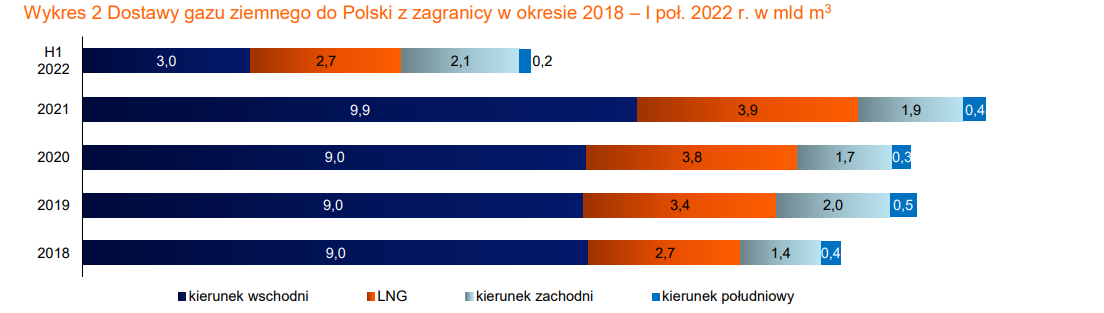

Source: PGNiG Q2022 XNUMX report

Companies extracting and selling natural gas, which sell their product at spot prices, are the beneficiaries of the current situation on the gas market in Europe. A company operating on the gas market is listed on the WSE. It is PGNIG, which is to merge with PKN Orlen soon. PGNiG deals with the extraction, storage, trading and distribution of natural gas. Despite the fact that the company has a very strong market position in Poland.

PGNiG

PGNiG is practically a monopolist on the market of gas distribution to individual consumers and has a very strong position in the corporate client segment. The company mainly deals with the extraction, trading and distribution of natural gas. It also has a smaller oil-focused segment. In addition, the company also deals with gas and liquid storage as well as heat and electricity production. PGNiG SA also has a segment of specialized geophysical and drilling and maintenance services.

Source: Q2022 XNUMX, PGNiG SA report

The majority shareholder is the State Treasury, which holds over 70% of the company's shares. In 2022, it is planned to merge PKN Orlen with PGNiG. As a result, an energy concern will be created, in which the State Treasury will own approximately 52% of the shares.

It should be remembered that PGNiG operates on a regulated market. On August 16, President Andrzej Duda signed the act to increase Poland's gas security. Pursuant to the act, the obligation of the President of the Energy Regulatory Office (ERO) to approve tariffs for the sale of gas to household consumers and strategic public benefit institutions (hospitals, schools, kindergartens) was extended until 2027. In turn, other buyers must accept market prices. In 2022, gas prices for many companies increased at a three-digit pace. The government is trying to limit the impact of gas price increases. He introduced, inter alia, temporary reduction in VAT on natural gas (from 23% to 0%). If the government decides to freeze natural gas prices in order not to increase energy costs for households and companies, then PGNiG will need government compensation in order not to worsen its economic situation.

Energy - a European problem

In addition to the problems with the raw material, problems have also appeared in Europe with the production of electricity from nuclear power plants. Low water level in rivers means that power plants cannot cool reactors easily. Rivers were one of the main methods of supplying the water that cooled the reactors. Currently, problems with drought cause power plants to run at much lower levels than during "normal" times. As a result, the French energy company EDF turned from a net exporter to an importer of electricity. One of the directions of energy import is the United Kingdom. To make matters worse, Norway has announced that it intends to reduce electricity exports should the levels of tanks needed to produce hydro electricity fall below the seasonal average. This significantly reduces the potential supply of electricity on the European market, which causes the electricity prices on the exchange to increase significantly.

READ: How to invest in energy during the energy crisis? [Guide]

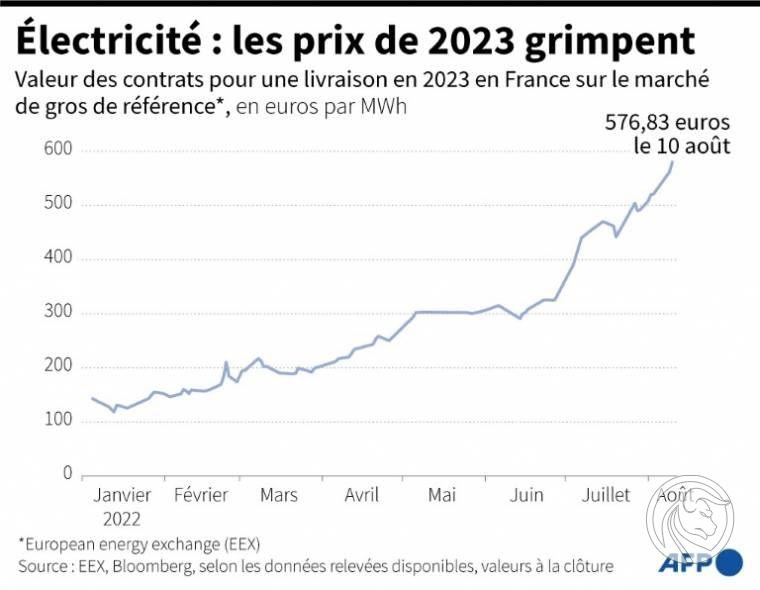

Cutting off German suppliers from some of the natural gas from Russia meant that Uniper had to buy gas from the spot market at much higher prices. As a result, the German company announced very bad financial results on August 17. The loss exceeded € 12bn. It should be noted that in Germany some electricity is generated from gas. In 2020, natural gas accounted for around 12% of our western neighbor's energy mix. It is increasingly being said that Germany will be forced to increase the production of electricity from coal and nuclear power. The topic of restarting nuclear power plants also appears among some politicians from the Green party (so far opposed to nuclear energy). France is also struggling with rising electricity prices.

Electricity prices in France. Source: France.detalzero.com

Looking at all the factors that occurred in 2022, it is no wonder that the European Union has now been hit by rising electricity prices. As a result, enterprises and households will have to spend more on paying energy bills. This, in turn, will have an impact on lower consumer spending of households and will increase the pressure on lowering the level of investment in manufacturing companies.

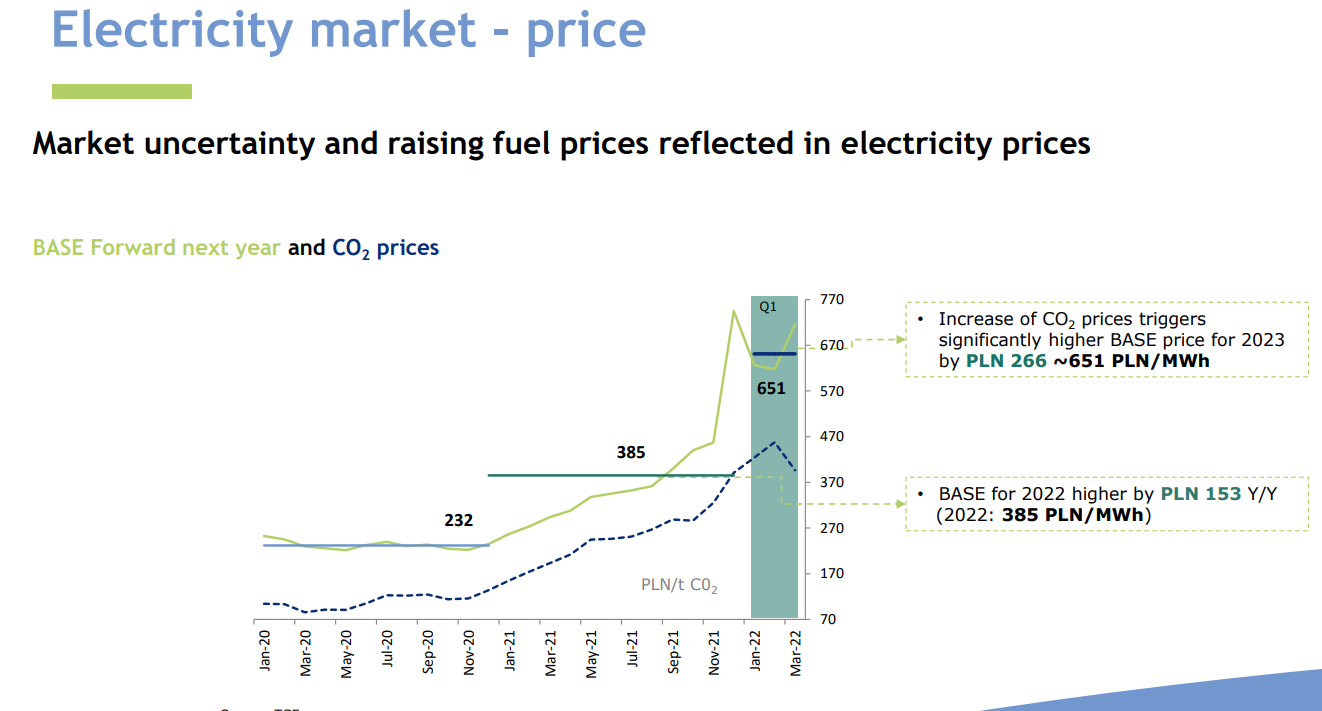

In Poland, there is a noticeable increase in the costs of electricity production due to the increase in the prices of fine coal and natural gas. As a result, there was pressure to increase electricity prices. Due to the fact that the Energy Regulatory Office (URE) regulates prices for retail customers, the increase in electricity costs is much lower than it would result from market incentives. On the other hand, energy companies have significantly increased prices for commercial customers. According to Rachuneo, the average increase in the price of electricity for small businesses was 280%.

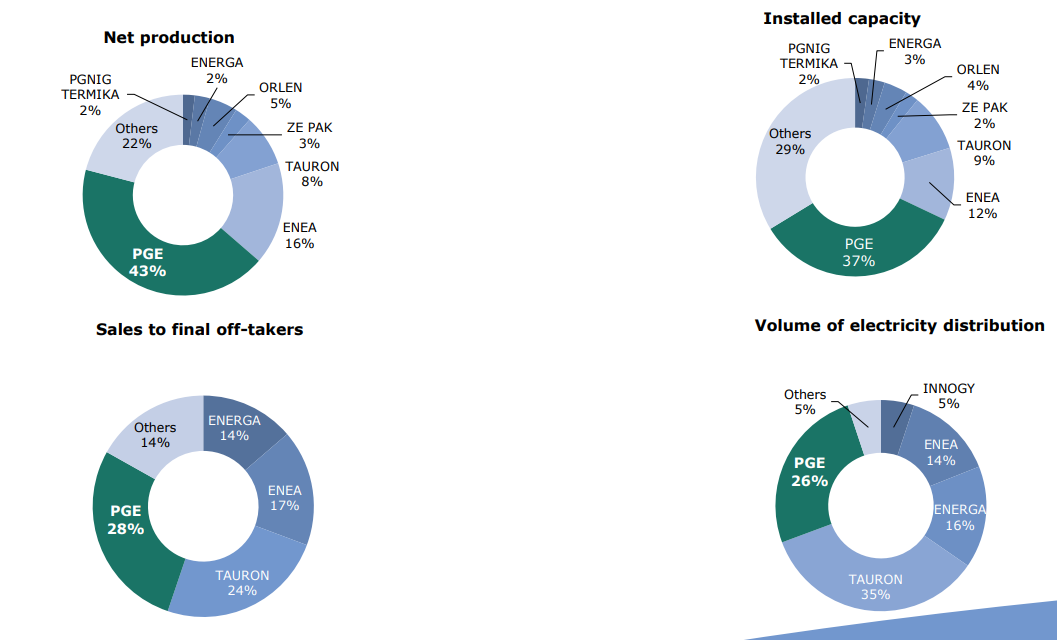

Source: PGE SA investor presentation May 2022

The government introduced protective programs, in which there was a reduction of VAT from 23% to 5%. At the same time, there are rumors about a planned freezing of electricity and gas prices. Such a solution may adversely affect the profitability of energy companies listed on the Warsaw Stock Exchange. The most important energy companies in Poland include PGE SA, Enea SA and Tauron SA It should be remembered that the Polish energy sector is facing a serious problem of energy transformation, which will require large investment outlays.

Increase in electricity prices and production costs

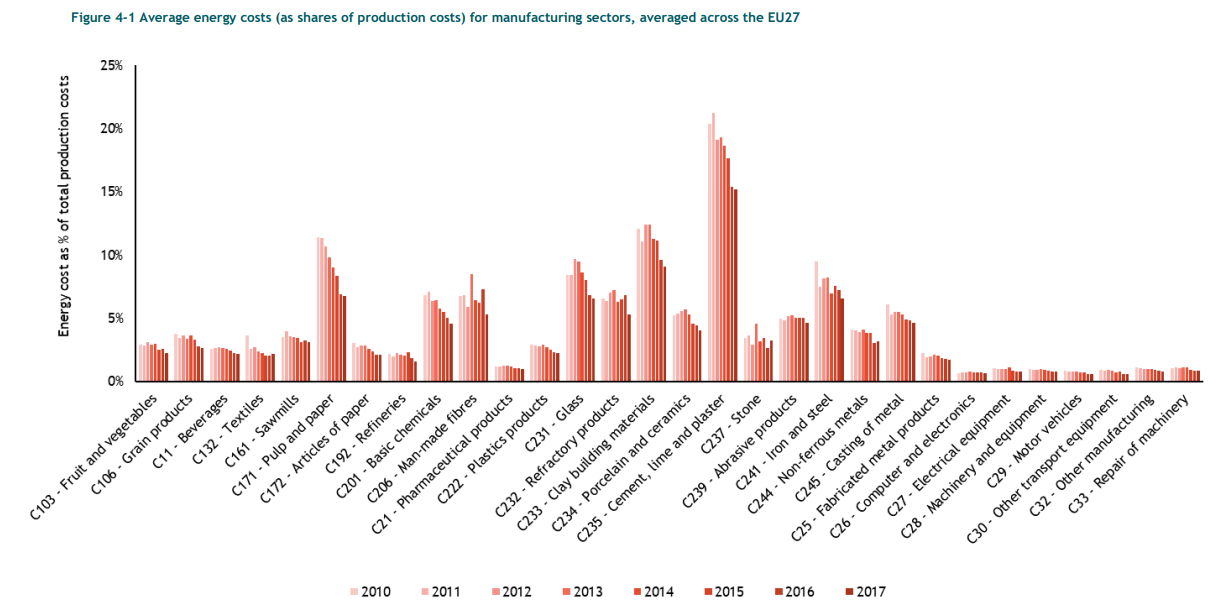

Energy problems in Europe will certainly affect the condition of industrial companies. Of course, not all companies consider energy prices to be crucial in the production process. A very interesting light on the situation of many energy companies is shed by the European Commission's report from October 2020 on the energy market in the European Union ("Study on energy prices, costs and their impact on industry and households"). According to this report enterprises operating in industries such as paper, cement, glass, steel or chemical are quite sensitive to changes in the prices of energy and energy resources. For these companies, a deterioration in financial results can be expected, as not all costs will be passed on to producers to their customers.

Source: Study on energy prices, costs and their impact on industry and households report - European Commission October 2020.

It is possible that the sell-off of many production companies will be an investment opportunity for the coming years. Electricity and energy commodity prices will eventually stabilize, allowing the hardest hit companies to rebuild their margins. In the near future, Polish manufacturing companies will struggle with high inflation, an increase in electricity costs and a probable economic slowdown (high interest rates combined with an economic slowdown in the "Old Union" countries).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)