Third halving on Bitcoin in May 2020

At the end of May 2020 will be held for the third time halving on Bitcoin. This event arouses more and more emotions and growing expectations regarding the behavior of Bitcoin's price. However, before we speculate on how halving can affect the Bitcoin price, let's start from the beginning and answer the question - what is halving?

Check it out: Cryptocurrency exchanges - A list of the most popular offers

What is halving?

Cryptocurrencies such as bitcoin have a limited amount in advance that will be available in circulation. In the case of BTC it is 21 million. This value is achieved by "extraction" or "digging" cryptocurrencies by so-called miners.

In practice, cryptocurrency mining means lending the computing power of computers to record and verify transactions with a given cryptocurrency. In return, miners receive a reward in the form of cryptocurrency. In case of Bitcoin at this point it is 12,5 BTC per block dug.

In the cryptocurrency mining process, the amount in circulation increases, which would inevitably lead to inflation. To prevent this from happening, cryptocurrencies are programmed with cyclical halving. It is a halving of the amount of mined currency and the reward for mining a block. In the case of bitcoin, this happens after 210 blocks have been excavated. In May 000, another 2020 Bitcoin blocks will be excavated and the block mining reward will decrease from 210 bitcoin to 000 bitcoin. After the planned halving, the number of bitcoins arriving daily will be halved to around 12,5 bitcoins per day. At the same time, in May, 6,25% (900) of the entire established supply of bitcoin (85) will be mined.

As a result of this operation, bitcoin inflation will decrease to 1,8%. For comparison, inflation on gold is around 3%. This means that, in theory, bitcoin will have more potential to hold value over time than gold.

Periodic reduction of extraction is a deliberate procedure programmed in cryptocurrencies to limit their inflation.

Previous phenomena of halving on bitcoin and its effects

In the recent history of Bitcoin, we have already had to split the mining reward in half, i.e. halving.

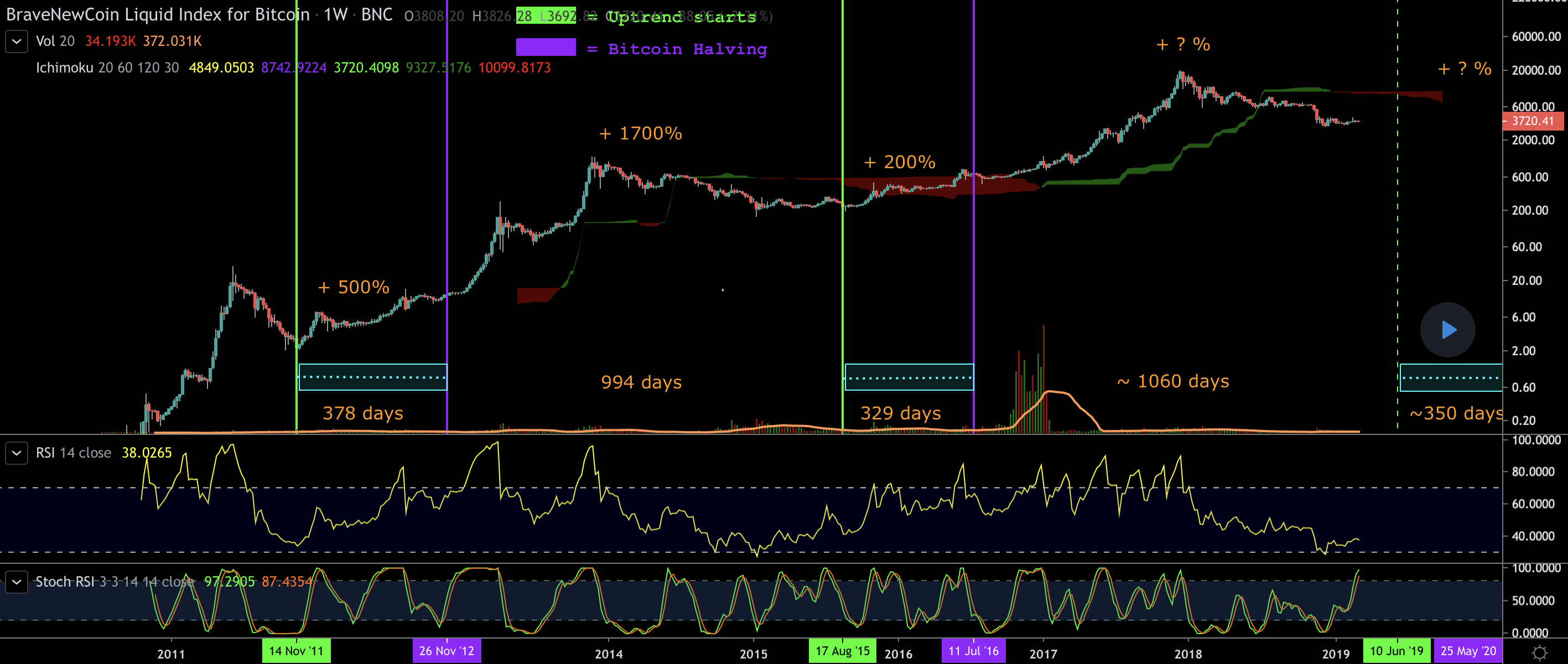

The first bitcoin halving took place on November 28, 2012. The event took place in a one-year upward trend. After halving, the price increase for bitcoin gained momentum and we had the first rally to astronomical then $ 1000.

The second half of the mining rewards fell on July 9, 2016. Again, this was in an upward trend. After halving there was a bitcoin price rally up to $ 20,000 called a bitcoin bubble.

The behavior of the bitcoin price with marked halving dates can be seen in the chart from TradingView.

Forex Club analyzes on Trading View - FOLLOW THE PROFILE

What will be the reaction to the third bitcoin halving?

Many expect the next rally to price this most popular cryptocurrency. However, this time the financial and political situation is different. We are in the middle of a crisis, the scale of which is still difficult to assess and measure. Bitcoin, like all other assets, has experienced a deep decline, which is slowly rebuilding. This can work both in favor of the price of cryptocurrency and ruin the dreams of the next rally.

I personally view bitcoin's price increase due to the current situation. Halving can be an additional factor increasing the interest in cryptocurrencies and popularizing them among people who have not been interested in this topic so far. The price increase, even if insignificant, due to halving may become an incentive for the inflow of capital into Bitcoin - due to the lack of other ways of allocating savings to the times of crisis. Physical gold is practically unavailable, more and more experts are forecasting a decline in real estate prices, and traditional currencies are not encouraging to invest in them due to mass reprinting. Especially the latter aspect and the collapse of the real estate market can shift a lot of capital towards digital currencies, i.e. bitcoin in the first place.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)