Turkish short-term interest rate exceeded 1300%

This Wednesday the short-term interest rate on the Turkish offshore market reached a huge level of 1338%. It is known not from today that President Erdogan is not a supporter, on the contrary, many times he publicly criticized expensive loans, pointing out its negative impact on the economy. What led to such a high interest rate?

3,67% a day

That was exactly what had to be paid in a Turkish bank for a lire, on a scale of one day. Comparing it to the alloy of the central bank of Turkey, it seems absurdly high. Namely, it is now 24%. President Erdogan has repeatedly pressed the central bank to reduce interest rates as much as possible, which were supposed to reduce inflation and stimulate economic growth. Taking into account the generally accepted economic knowledge, this action has the opposite effect. Nevertheless, the president argued that it is at high interest rates that Turkey's current problem lies.

All guilty speculators

Turkey is currently in the pre-election period. At one of the meetings of the president with the youth in Ankara, he said that Western and American banks are speculating on the Turkish lye without any inhibitions. On behalf of the country, he intends to discipline in a certain way these activities so that the currency is more stable than before. However, the speech lacked specificity. Erdogan did not mention the specific names of banks, and his suspicions were directed by generalizing these institutions to Western and American.

In order to limit the actions of speculators, the power of President Erdogan decided to cut off the possibility of borrowing the Turkish currency. If someone still would like to play shortly against the lyre, he must first borrow it. In practice, this can only be done in a Turkish bank. The problem is that these have stopped lending money to foreign entities. This led to squeezing players who bet on the lira. Therefore, interest rate anomalies were related to short squeeze.

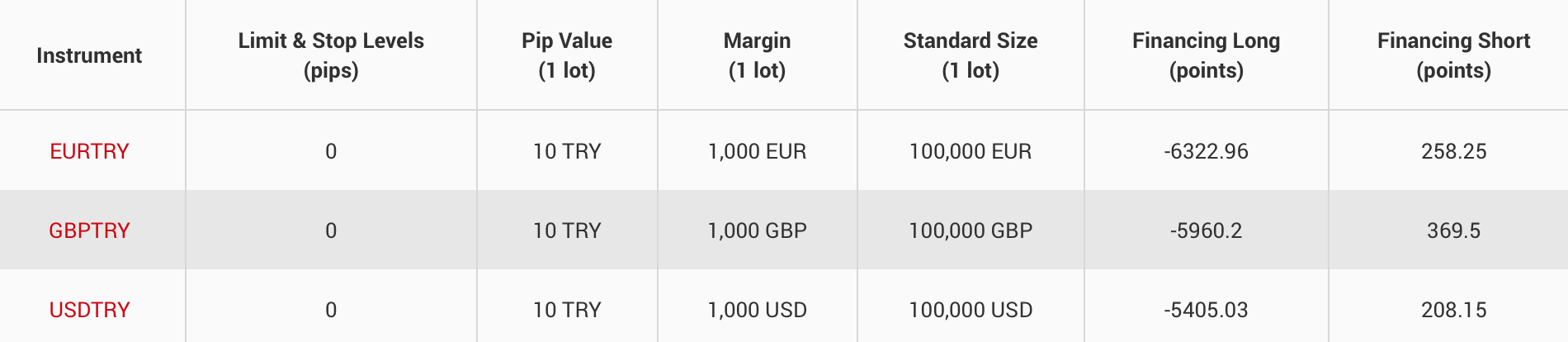

Forex brokers also reacted to this decision, raising swap rates to astronomical values.

Shot in the knee

The Turkish power from the market point of view was very short-term and - what is more, there is a very big chance that the currency will return to its normal state (before the short squeeze). Political intervention on the interest rate market has little to do with the free market. What's more, this move hit foreign investors who were on the other side of the barricade, meaning they held long positions. The actions of the authorities are therefore very risky, although understandable on the other hand. The Erdogan team intends to buy the peace of their voters a few days before the vote.

Extreme variability

The Turkish Lira course at the end of March is a real roller-coaster. Compared to the average daily volatility in February of 600.0 pips, in recent days we have been dealing with fluctuations of 1500.0 - 4000.0 pips. Some of the Forex brokers decided to drastically increase the spreads and even temporarily suspend trading on TRY instruments, assessing the risk as too high.

Daily graph USD / TRY, JForex Dukascopy

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)