During reflation, stock investors must become interested in raw materials

The last quarter has been marked by numerous dramatic events: allegations of irregularities during the US presidential election, the best monthly results of global stocks since January 1975 with a profit of 12,8%, and a wave of new cases of Covid-19 in the US and Europe due to with the onset of winter and a new, more contagious mutation.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

Inflation will be crucial this year and its possible impact on the activities of central banks, the further spectacular rise in "bubble action", political mistakes, the successful implementation of the vaccination program and whether the "green transition" will continue to define financial markets.

In the event of inflation, investors should get involved in the commodities sector

The inflation rate dropped to the lowest level in June 2020 and has been gradually increasing since then, with the pace of change clearly accelerating in November (i.e. in the month of the latest readings of the New York branch Fed Core Inflation Index - Underlying Inflation Gauge Index (which measures both offline and online prices). In July 2009 - during the period of the financial crisis - this new rate reached -0,72% as the credit crunch contributed to the creation of a deflationary environment. This time, the lowest level of the inflation rate was 1,05%, which, with a much broader stimulus from both monetary and fiscal policy (policymakers drew conclusions from the situation in 2008), will most likely lead to a red-hot economy at the end of 2021.

First of all, it should be realized that the policy has now taken on a task-oriented nature, which means that policy makers will continue to implement aggressive incentives until all major economies unemployment rate will drop to a suitably low level. Such modus operandi is caused by social unrest, or rather by attempts to avoid them. In our opinion, this will lead to inflation, as the actual cause of inflation is most likely the fiscal and psychological impact on society in order to prepare it for price increases, which in turn will initiate a feedback loop.

The Institute for Supply Management data series on prices in the manufacturing sector and the Chinese YoY index of producer goods prices are highly volatile, but after smoothing, they constitute reliable predictors of future inflation. The United States is showing the greatest price pressure since inflation last peaked in mid-2018, while China is more moderate so far, but is accelerating. Container freight and non-energy commodity prices are also going up.

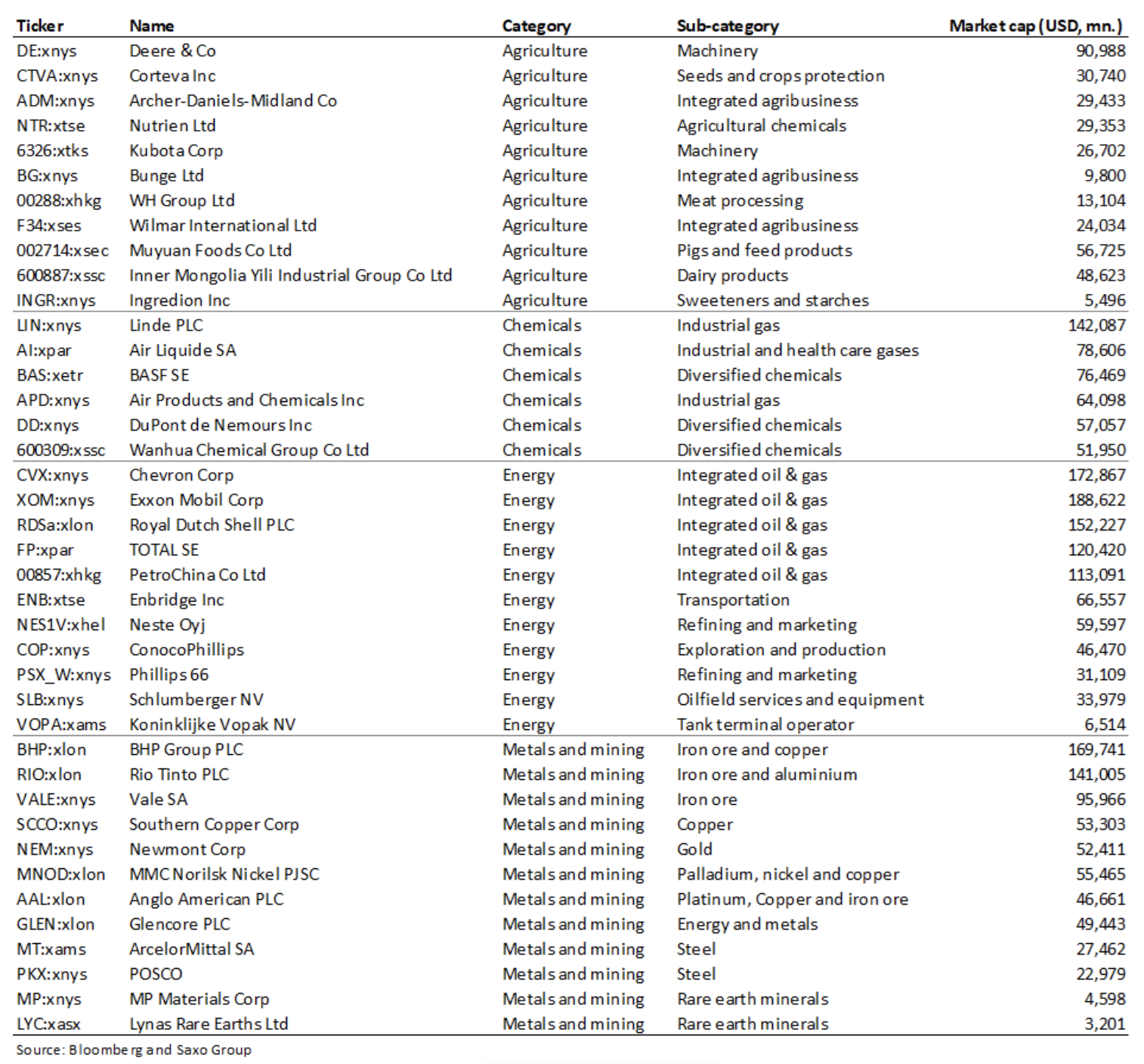

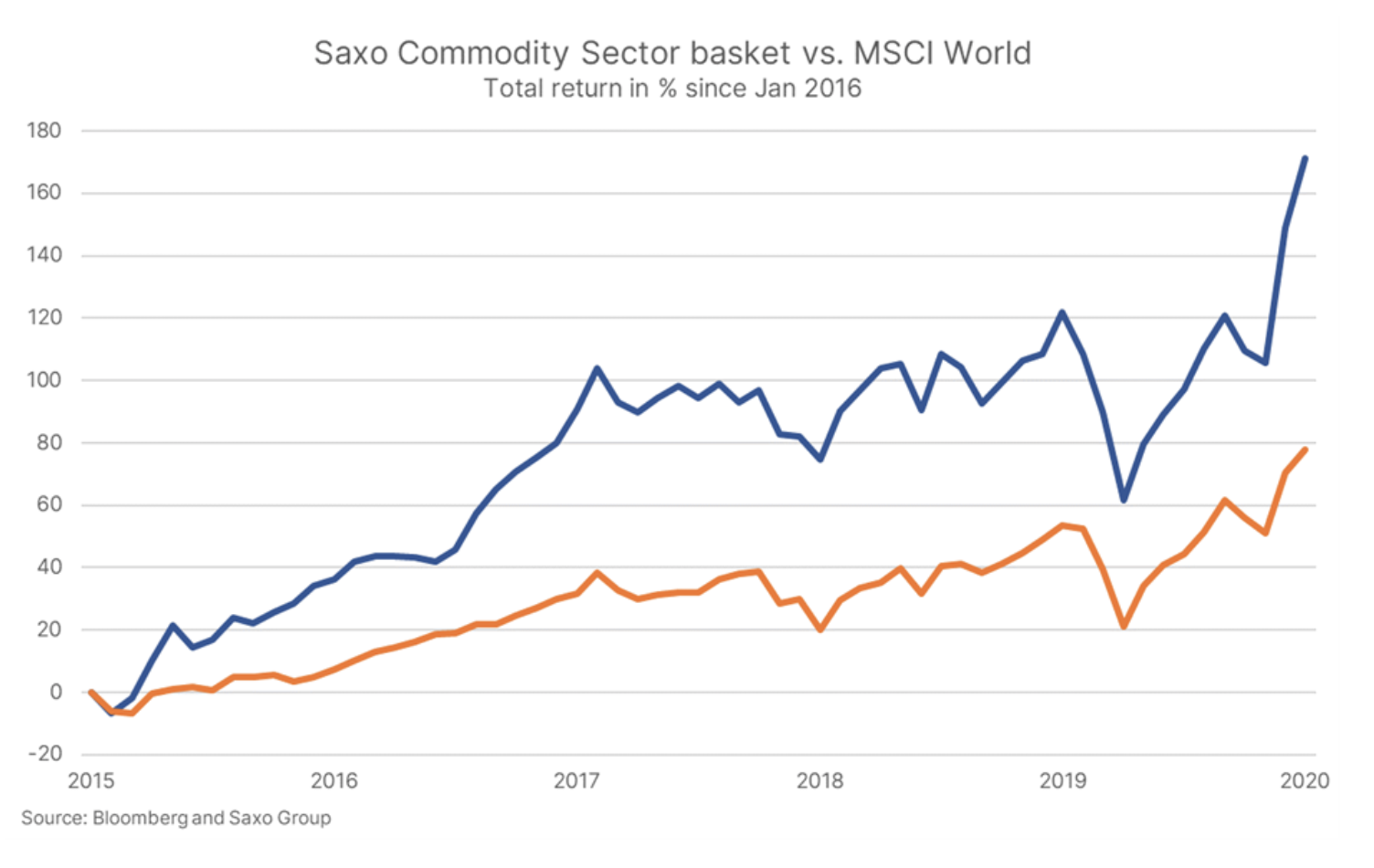

The classic hedges against rising inflation are gold, inflation-protected government bonds, and energy, however share market also offers interesting alternatives. At the beginning of the year, we launched the Saxo Commodity Basket, a list of 40 stocks with exposure to commodities sectors spanning agriculture, chemicals, energy, metals and mining, with global diversification. This list should be seen as a source of inspiration and not as an investment recommendation.

As of January 1, 2016, this basket has achieved an overall return of 171%, compared with 78% for the MSCI World index, underlining the high quality of the companies included. On a year-to-day basis, the basket gained 7,5%, thus recording one of the best performances in the stock market and indicating that investors are positioning for reflation. The advantage of our basket performance over the MSCI World index is also positively correlated with monthly inflation rate movements: in months when the inflation rate is rising, the monthly return from the basket is + 3,1% higher, while when the inflation rate goes down, it is higher by + 0,3%. In addition, investing in the commodities sector in a reflective period is also an intensive involvement in emerging markets; they are more commodity-dependent economies and will benefit from reflation as long as interest rates are rising slowly and the US dollar remains weak.

Will an increase in interest rates affect stock valuations?

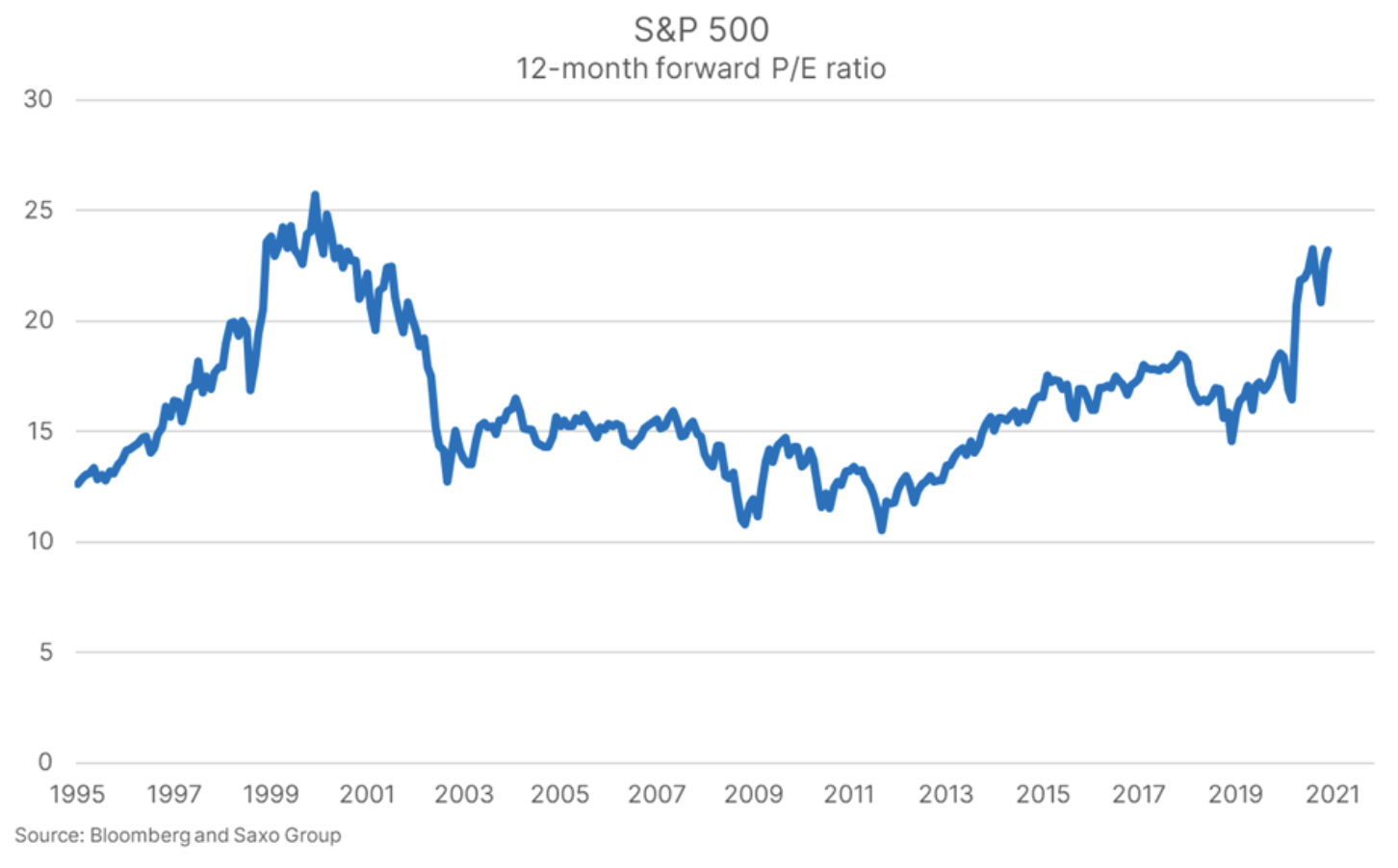

In December, global equities hit a new high of a 500-month continuous valuation, lagging behind the record from the Internet bubble. Although this indicator may not be a very reliable illustration of the current situation, taking into account the downturn in economic activity in February and March, for investors it is a sign of optimism related to the stock market. The S&P 2020 Index recovered most of the losses from the first few months of the pandemic, in Q10 2019 down by just 2021% compared to QXNUMX XNUMX; however, these were the easiest gains, and we will know the scale of real profit growth in XNUMX. Based on the XNUMX-month forecast P / E ratio, S&P 500 index dangerously approaching the historic peak of December 1999, the period of the Internet bubble.

If we were to make any investment law, it would read:

"Higher Valuations Lower Future Profits".

In early December 2020, Robert Shiller was justifying current stock valuations, even though his famous CAPE model had sent out the alarm signals for many years. Shiller changed his mind about the concept of excess equity profitability, that is, linking equity profitability with government bond yields. Excess profitability of stocks does not show a speculative bubble in the stock market and suggests that valuations are reliable, which means that investors' situation has become complicated: if we want to make any profit, we have to do it with stocks, regardless of their high valuation.

However, if we take Shiller at face value, then an increase in interest rates that may occur during a period of reflation would lead to an increase in equity yields and a fall in their prices, assuming that the ratio of equity yields to government bond yields remained unchanged. Naturally, this decline would be partially offset by an increase in profits in 2021 as well as an increase in growth expectations, but it would not be enough to make up for all losses. According to our calculations, assuming an increase in free cash flow in 2021 and an unchanged relationship to government bond yields, corporate bonds and free cash flow, an increase in 100-year US government bond yields by 15 basis points would translate into a 20-100% decline in shares listed on the the Nasdaq XNUMX index, which is the most responsive of any major equity index.

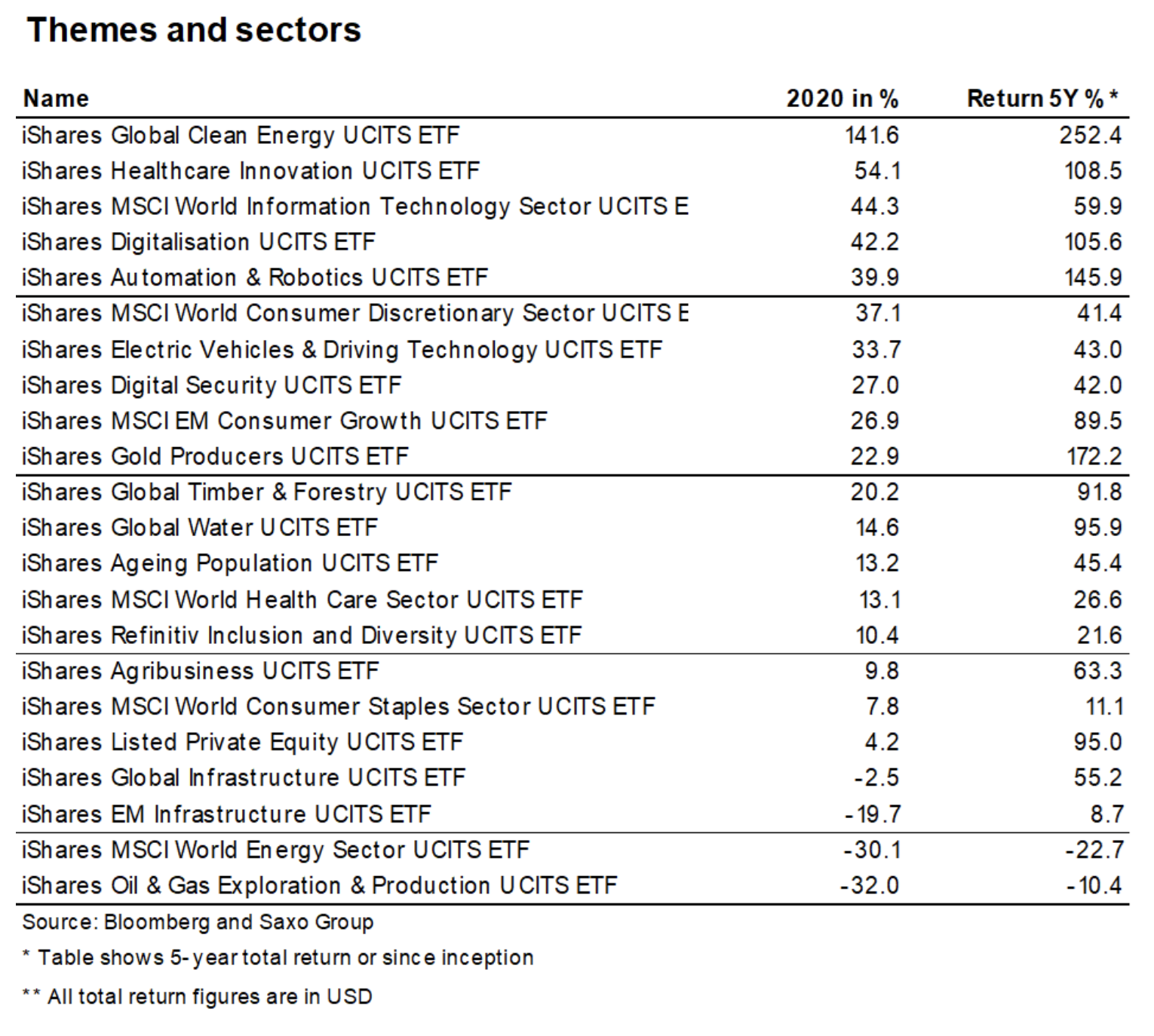

Will the boom associated with the "green transformation" be able to sustain?

In early January 2020, we published a study which concluded that the green (green) transformation of the economy towards reducing carbon emissions will be a mega-trend in the coming decade. At the time of preparing the analysis, we did not expect that this process would begin like this. Equities of global companies in the green energy segment rose by 2020% in 142 (see table), surpassing all other thematic groups on the stock market. The continued boom in clean energy equities was the result of strong political signals from the EU and China, not to mention President-elite Biden. This strong trend, however, has its dark side in the form of very high valuations: XNUMX-month forecast P / E of iShares Global Clean Energy UCITS 'biggest investment ETF, Meridian Energy, is 83. This is a fairly aggressive estimate of a state-owned company generating 90% of revenues in New Zealand, a low growth economy with negative projected revenues. The main question for 2021 is whether the boom associated with the "green transformation" will be sustainable.

The political capital of the green transition is intact and will receive another positive impetus from the new US administration, assuming it will fulfill its ambitions of clean energy and transform the US into an carbon neutral economy by 2035. Despite political intentions and grants, green companies they will have to justify their valuations. As we are convinced that it will be a year of reflection and victory for the physical world, we believe that conventional energy sources will perform better than ecological sources, and investments in green transition will be divided into "qualitative" and "speculative", with the latter segment a dramatic sell-off may occur.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)