Wall Street in the grip of a pandemic

The fear of a pandemic is currently the greatest risk to the US stock market. The results of companies, usually better than expected, stand in opposition to it. And politics is just around the corner. This is a hot period on Wall Street. The high level of emotions will remain at least until the second week of November.

Falls on Wall Street

Wall Street started the last week of October in red. The Dow Jones index fell 2,29 percent on Monday S & P500 plunged by 1,86 percent, and the technological Nasdaq Composite by 1,64 percent. In the case of the first index, it was the worst session since the beginning of September.

The main driver of the sell-off was the growing fears of a second wave of the coronavirus pandemic day by day. Following the example of Europe, the number of cases begins to accelerate significantly. In the last day in the US there were almost 84 thousand. coronavirus cases. Because of this, 914 people died, and the total death toll reached 225,2 thousand.

If we assume that the pandemic in the US will develop along the same path as in Europe, and at the same time it is about 2 weeks behind Europe, then just after the presidential elections scheduled for November 3 in the US, the daily number of infections may reach 180.

The pandemic was the main reason for Monday's declines. Attention was also paid to the still unapproved new support package for the economy. However, it was more of an excuse than an actual reason to sell the shares.

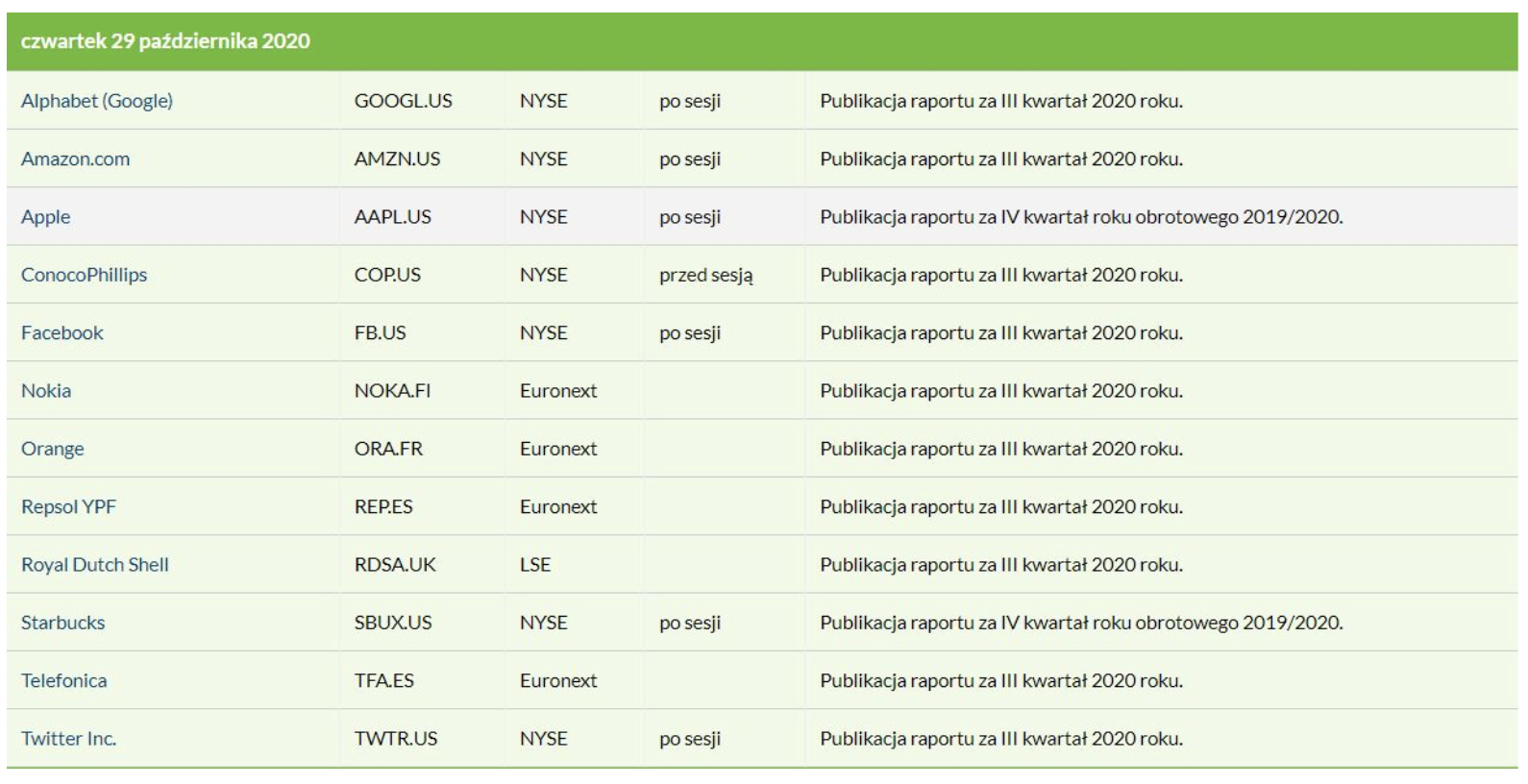

All the time on Wall Street, companies publishing their results for the third quarter of this year are in the center of attention. Thursday will be the key day here. This will be the real "super Thursday" result. Financial reports will be published, among others A (Google) Amazon, Apple Lossless Audio CODEC (ALAC),, Facebook and Twitter.

"Super Thursday" on Wall Street. Source: macroNEXT

Forecast for the S&P 500

The results of this group of companies should give a positive impulse. First, because they are technology companies that are benefiting from the pandemic. Secondly, so far almost 84 percent. companies included in the S & P500 index, which have already published financial reports, boasted better than expected results. And this awareness may support the US indices before Thursday (if there are no other negative impulses). However, it is not certain whether these expectations will translate into increases in share prices after the publication of earnings. Especially since the risks associated with the pandemic will increase.

Performance and the pandemic are not the only topics stock investors will pay attention to. The US presidential election is also approaching. The Americans will decide on November 3 whether Trump will remain in the White House. Or will Biden replace him? For many weeks now, polls indicate that the latter is the case. But we know what the specifics of the American elections are.

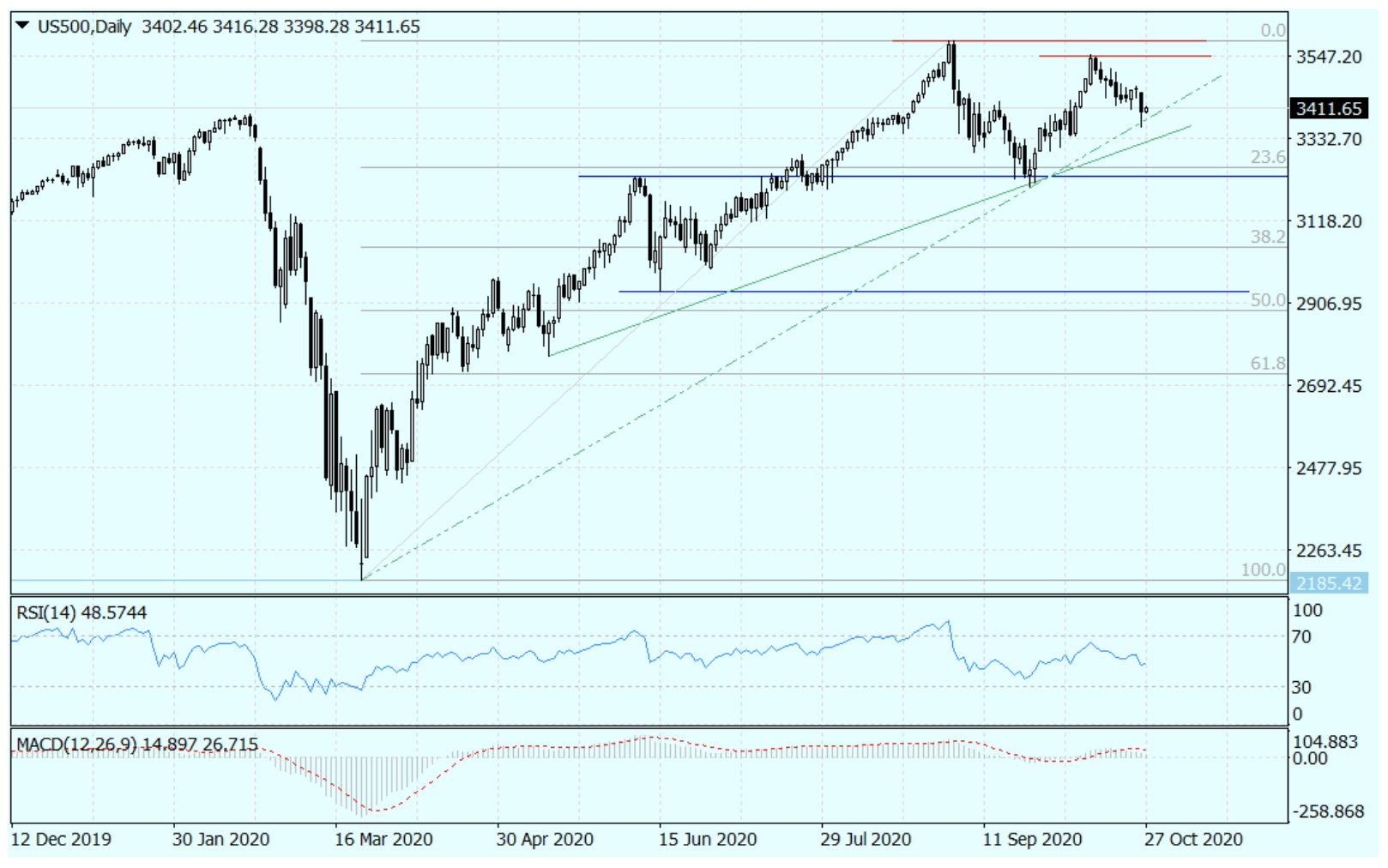

US500 Chart (CFD on S&P 500), D1 interval. Source: MT4 Tickmill.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response