How to buy Facebook shares? Everything about investing in the company Facebook [Guide]

The shares of Facebook, the most popular social networking site in the world, recorded a dynamic growth from the bottom in March this year, reaching almost $ 300 per share. How to buy Facebook shares and profit from the ever-growing popularity of this social giant?

Chart - Facebook shares

Basic information about the company Facebook

| Logo |  |

| Name | |

| Headquarters | Menlo Park, California, US |

| creation date | February 4, 2004 |

| Stock symbol | FB |

| trade | social media, advertising |

| Capitalization | 710 billion USD |

| Dividend | - |

| Web page | http://facebook.com |

Company creation history

The progenitor of Facebook, as we know it today, was a game for students created by Mark Zuckerberg in 2003, during the 2nd year of his studies. It was called FaceMash and it involved comparing two photos of female students and judging which one was more attractive. The website gained enormous popularity in student circles, however, it was soon closed by the university authorities.

The actual social networking site, Facebook, was created a year later with the help of three other students - Eduardo Saverina, Andrew McCollum, and Dustin Moskovitz. Facebook served as a social networking site for communication and networking within the university. Over time, the reach of the portal expanded to other universities within Boston, and in the next step to the entire United States. In 2006, Facebook was opened to all people in the world with an email address and over the age of 13.

Facebook's listing on the stock exchange

Facebook's IPO took place in May 2012. The company turned out to be the highest-valued company in the history of the New York Stock Exchange on the day of its debut, with a capitalization of 104 billion dollars. Facebook shares were valued at $ 38 apiece on the stock market debut. The share value is currently $ 249. The chart below shows how Facebook's share price has changed from its stock market debut until today.

Facebook CEO - Mark Zuckerberg

Mark Zuckerberg in 2008 was recognized as the world's youngest billionaire with a net worth of 1,5 billion dollars. The creator of Facebook was then 24 years old. Mark Zuckerberg was born into a Jewish-American family with German, Austrian and Polish roots. His great-grandmother was born to Skala Podolska.

Mark Zuckerberg in 2008 was recognized as the world's youngest billionaire with a net worth of 1,5 billion dollars. The creator of Facebook was then 24 years old. Mark Zuckerberg was born into a Jewish-American family with German, Austrian and Polish roots. His great-grandmother was born to Skala Podolska.

Mark Zuckerberg was a gifted programmer from a young age. At the age of 12, he created a new patient notification program for his father, who ran a dental clinic.

In the early days of Facebook, many big companies like Yahoo! wanted to buy the portal from Mark Zuckerberg offering large amounts, but Mark rejected all proposals.

Selected Facebook products

Facebook generates its revenues mainly from advertisements displayed on the portal, Messenger and Instagram. According to a 2017 study by the US Securities and Exchange Commission (SEC for short), Facebook has an average advertising revenue of $ 20,21 per user. This meant $ 39 billion in ad revenue in 2017.

Messenger

Messenger released for the first time in 2011. It is used for private conversations, sending photos, videos, gifs and stickers. Facebook also allows you to chat with bots, answering, for example, frequently asked questions directed to company accounts. From 2015, you can use the Messanger application without having an account in the Facebook application.

The website and application for hosting and sharing photos was created in 2010. The application allows you to edit photos and videos and apply filters. The photos shared in the application have a square shape which refers to photos from Polaroid and Kodak Instamatic cameras. Facebook bought Instagram in 2012 for a billion dollars. At that time, only 13 employees worked on Instagram.

An instant messaging application for sending text messages and multimedia files. It also allows you to create group chats and video calls. Since 2016, the app has encrypted messages and files. The creators ensure that only the sender and receiver can read the messages. Facebook purchased the app in 2014 for $ 16 billion.

Libra cryptocurrency

Facebook is working on Libra cryptocurrencywhich he planned to put into circulation in 2020. Initially, companies such as PayPal, Visa, Mastercard, Spotify and PayU were involved in the work on the cryptocurrency. Unfortunately, PayPal withdrew from the project in November 2019, followed by eBay, Mastercard and Visa.

How to buy Facebook shares

To buy Facebook shares, you can set up an account at a brokerage house and buy shares directly on the American stock exchange through it.

ETF

For people who want to diversify their investment more, they may be a good choice ETFs including Facebook shares.

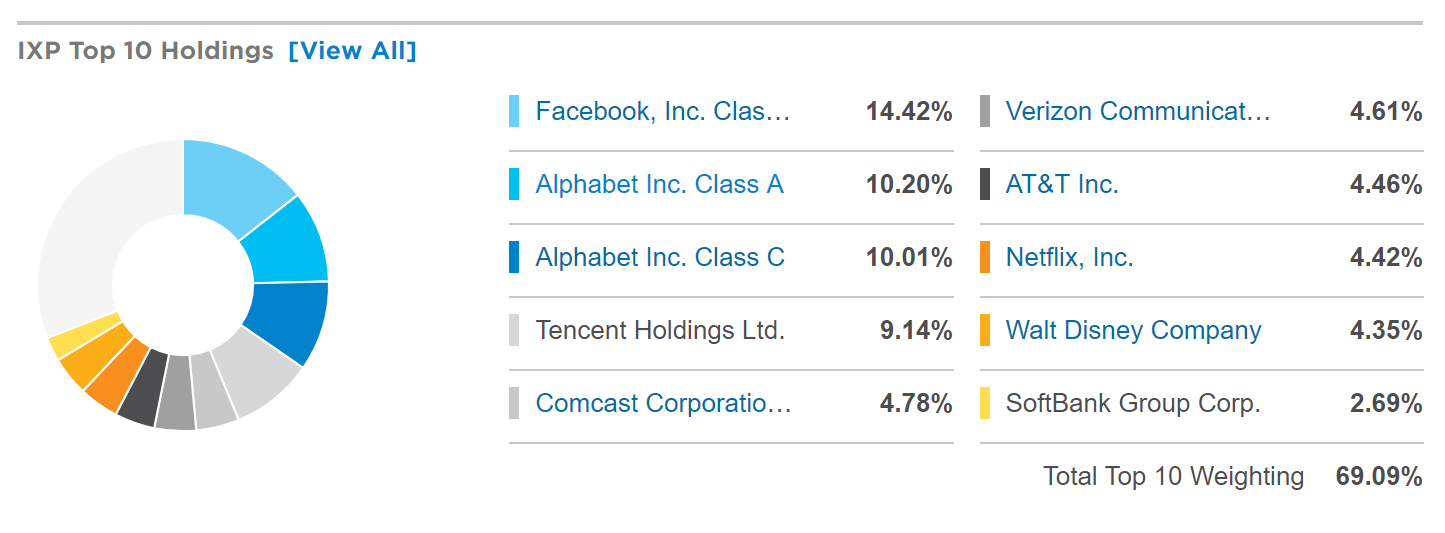

[IXP] iShares Global Telecom ETF

-

- Annual fees: Present in several = 0.46%

- Issuer: iShares

IXP is a fund that gives exposure to communications companies from the US stock exchange. The fund has relatively low annual fees of 0.46% and average daily spreads of around 0.22%. The fund has assets under management of $ 300 million. Facebook shares account for 14.42% of the fund. Other major companies are Google (Alphabet Inc. Class B and A), Tencent, Comcast, Verizon, AT&T, Netflix and Disney.

[XLC] Communication Services Select Sector SPDR Fund

-

- Annual fees: Present in several = 0.13%

- Issuer: State Street SPDR

Another fund that buys shares of companies from the telecommunications industry. However, unlike the IXP, XLC only buys shares of companies listed in S & P500 index. The fund has a $ 9 billion under management, daily spreads of 0.02% and annual maintenance costs of 0.13%. It is a very cheap and very liquid value. Facebook shares account for 22.25% of assets. The fund also has a lot Google shares (Alphabet), Comcast, Activision Blizzard, T-Mobile, Verizon, and Netflix. The fund also pays a dividend of 0.81%.

[FCOM] Fidelity MSCI Communication Services Index ETF

-

- Annual fees: Present in several = 0.08%

- Issuer: FMR LLC

FCOM is a fund that buys companies from the US telecommunications sector. Over half a million assets under management, low maintenance costs (0.08%) and low spreads (0.07%) make this fund attractive. Facebook shares account for 16.95% of assets. In addition to Facebook, this ETF owns companies such as Google (Alphabet), Verizon, Comcast, Netflix and Walt Disney. The fund pays dividends on profits of 0.87%.

Stocks and CFDs

Another possibility is to buy shares or CFDs for Facebook shares. This can be done e.g. Forex brokers. The advantages of this choice are direct and exclusive exposure to Facebook stocks and the ability to invest with leverage in the case of CFD instruments.

Where to buy Facebook shares

Below is a list of offers from selected brokers offering both ETFs, CFDs on ETFs, stocks and CFDs on Facebook shares.

| Broker |  |

|

|

| End | Poland | Denmark | Great Britain |

| Shares on offer | approx. 3500 - shares approx. 2000 - CFDs on stocks 16 exchanges |

19 - shares 8 - CFDs on stocks 37 exchanges |

approx. 3 - CFDs on stocks 16 exchanges |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 5 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MetaTrader 5 |

Traditional shares and CFDs

How to buy Facebook shares, i.e. which instrument is better - traditional stocks or CFDs? It all depends on our expectations, strategy and the time perspective of the planned investment.

| Traditional actions | CFD per share | |

| Investment time horizon | long | short |

| Financial leverage | None | max. 1: 5 (depends on value) |

| Swap points | None | so |

| Possibility of playing for declines | nie | so |

If we believe that the share price will increase in the long term, then traditional stocks certainly seem to be a better choice - we do not use financial leverage here and therefore, if we are successful, we earn less, but at the same time risk less and bear no costs due to fees holding positions (swap points).

In the short term, CFDs allow you to maximize your profit thanks to leverage, even if there is low volatility in the market and the fees are generally higher. In addition, we have the option of betting on price drops.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to buy Facebook shares? Everything about investing in the company Facebook [Guide] how to buy facebook shares](https://forexclub.pl/wp-content/uploads/2020/09/akcje-facebooka.jpg?v=1601239938)

![How to buy Facebook shares? Everything about investing in the company Facebook [Guide] playboy stocks](https://forexclub.pl/wp-content/uploads/2020/09/playboy-stocks-102x65.jpg?v=1600951733)

![How to buy Facebook shares? Everything about investing in the company Facebook [Guide] Correction or return of the crisis](https://forexclub.pl/wp-content/uploads/2020/09/Korekta-czy-powrot-kryzysu-102x65.jpg?v=1601282355)

Leave a Response