Wheel Strategy, i.e. spin circles using options

Options are a great derivative instrument that allows you to create interesting investment strategies. With specialized strategies, you can make profits in various market situations. In this article we will focus on the so-called Wheel Strategy (i.e. wheel), a strategy that is an interesting method of making money by issuing options. We invite you to read!

READ NECESSARY: What are options - an introduction

Time bonus – a key issue

The option premium consists of the intrinsic value and the so-called time premium. Intrinsic value means how much an investor would receive for the option if it expired today. For example, a call option on Nestle shares has an exercise price of CHF 95, while the current share price on the market is CHF 99. This means that the intrinsic value of the option is CHF 4 (99 – 95). However, if they assumed that the call option has an exercise price of CHF 100, its internal value is 0. If the premium of such an option on the market is CHF 1,2, it is the so-called time premium. For the sake of simplicity, I present the consideration in tabular form:

| Execution price | Option premium | Worth. inside | Worth. time |

| 95 | 4,5 CHF | 4 CHF | 0,5 CHF |

| 100 | 1,2 CHF | 0 CHF | 1,2 CHF |

Source: own study

W Wheel Strategy the most important thing is the value of the time bonus. To put it simply, it is the value of the “chance” that the option will not expire as worthless. You can compare it to buying the lottery. As an option approaches expiration, its time value decreases. The closer the time to expiration of the option is, the faster the decline in the value of this parameter. As a rule, it is assumed that the fastest decline in the time premium occurs in the last 30 days until the option expires. For this reason, OTM or ATM options that are close to expiration are used for the Wheel strategy. This gives you the opportunity to quickly profit from the loss of time value.

What isWheel Strategy?

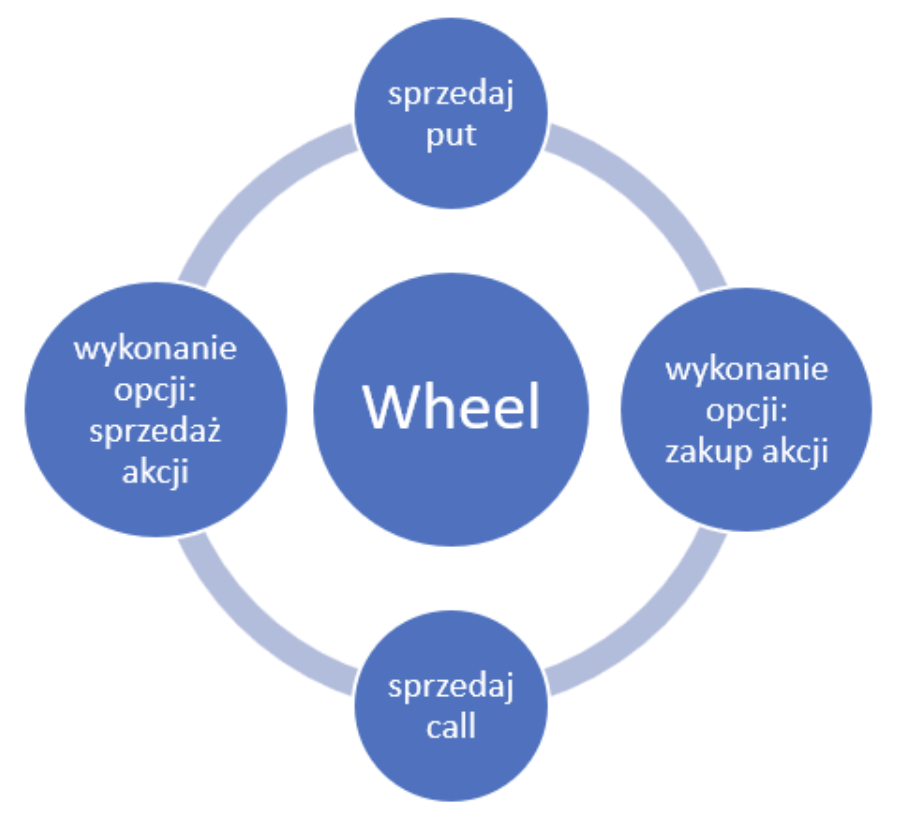

This is an investment method that is popular among options traders. It involves issuing put or call options depending on market conditions and... portfolio structure. Thanks to this strategy, it is possible to generate additional profit with relatively low investment risk. Of course, the level of risk itself depends on the methodology of selecting the underlying instrument on which the trader will be “spinning circles”.

Source: own study

This is not a perfect strategy. It has both advantages and disadvantages. It is also not a way to make money in all market conditions. The "Wheel" strategy consists of four stages:

- choosing an instrument to trade,

- selling put options,

- possession of a security,

- sale of call options.

Now let's look at each of them in turn.

Choosing an instrument to trade

At the very beginning, you should select interesting assets that can be used for the mentioned strategy. It is best if the selected companies have very good fundamentals. It is worth looking for companies whose profits and revenues are growing FCF per share. This is important because a stable company is less likely to go bankrupt. Another advantage of a stable company is that it will grow moderately in the long term. Thanks to this, the generated premium from issued put and call options may be greater than the increase in the value of the shares themselves. Of course, for this to be possible, appropriate risk management is necessary. Another interesting asset to use the Wheel strategy is indices or liquid assets ETF. Due to the fact that ETFs are liquid, there is a chance that the spread between the purchase and sale prices of options will be at a reasonable level.

Issuing the PUT option

Once you have chosen the companies, ETFs or indexes to invest in, you need to determine a good purchase price. It's best if it's a price level you feel comfortable with. The next step is to issue a put option. It is best when the option offered is OTM, i.e. out of the money. This is beneficial for two reasons. The first is that a lower price of the written option will allow you to purchase a given underlying instrument at a favorable price. Another advantage is that the option will most likely expire worthless, which means receiving cash just for being willing to buy a given ETF or stock. The disadvantage of writing an OTM option is relatively low premium. However, this is understandable because the risk of exercising an out-of-the-money option is lower than exercising a put option with an exercise price equal to the current market price of the underlying asset. Therefore, if you want to maximize the net bonus you receive, it is worth considering writing an ATM option.

It is worth remembering that when the put option expires with no value, we issue another one. The best situation to write options is during a period of high volatility. This is because the bonus received is then high. It is very important in this strategy that the sale of options is based on the so-called CSP, i.e Cash Secured Puts. This means that you must have sufficient cash in your account (or very liquid assets, e.g. very liquid bond ETFs) to cover any obligation to buy shares or ETFs. Of course, you don't have to hold regular cash. You can use, for example, money market instruments. They provide a small profit, which will increase your average annual rate of return on your investment.

If the listed option is not exercised, you receive the option premium. This means generating a small profit. As soon as the option expires, another option must be issued. The strategy should be repeated until the option is exercised. If you need to buy a given asset at a specific price, you can proceed to the next point. This stage of action is simply staging Naked Put, but secured by existing liquid assets. Therefore, it is a safer strategy than "ordinary" selling leveraged put options.

Holding your assets – next steps are up to you

If you purchased shares of a dividend-paying company that is about to pay out dividends, then it is worth considering whether it is a good idea to wait for her payment. Thanks to this, you will receive additional cash that can be used for further investments. It's also reasonable if you want to be a long-term investor and use Wheel just to increase your rate of return a bit.

It's up to you how you want to take a long position on shares or ETFs. You can decide to hold the stock until it reaches the level you set. You can then decide on slightly longer deadlines and issue an OTM option. This is somewhat at odds with the book's use of this strategy. The most frequently used strategy is to sell as quickly as possible at a price equal to the purchased shares.

Issuing a Covered Call – a chance to make profits

Strategy Covered Call involves selling a call option in order to close the position at a predetermined price. The higher the time value, the higher the bonus up for grabs. Of course, according to theory, ATM options have the largest time bonus. However, this strategy severely limits the potential profit from an increase in the share price. In turn, OTM options provide room for growth, but result in a lower premium. You can also issue an ITM option, but it only makes sense if you issue it for a slightly longer period and assume a slight decline in the price of the underlying instrument. The disadvantage of issuing an ITM option is blocking the space for an increase in the share or ETF price.

An important issue – what dates should options be issued for?

“Bookish” use Wheel Strategy requires ATM options to be issued as often as possible. Of course, it is necessary to recalculate the bonus received. The larger the spread, the less profitable it is to write options frequently. Therefore, before making an investment decision, you should carefully calculate what the IRR of individual option selling strategies would look like. It may turn out that 2-day options are issued instead of 1-day ones.

The strategy depends on the investment idea. If the investor has calculated the optimal level of share purchase, it may turn out that issuing a 2-day option is not profitable. Let's use an example. On February 1, Nestle's share was valued at CHF 98,4. The investor believes that a good idea to buy shares of this food giant is around 97 francs per share. However, it turns out that the put option expiring on February 2 this year with this strike price is trading at 0,07. This means that from 1 option the investor will receive 7 francs. However, if they issued an option with an exercise date of February 16, he would receive CHF 0,67 per share, or CHF 67. Subtracting the commission costs of 3 francs, it turns out that the daily option generates CHF 4 profit, while the second choice gives CHF 64 profit, i.e. 21 times more. Considering that an investor could issue 11 daily options, after the costs it is more profitable to take a 2-week option.

Advantages of Wheel Strategy

One of the biggest advantages Wheel Strategy jest generating regular income from writing options. However, the right selection of instruments is crucial. It is best when given assets are in a sideways trend or a slight upward trend. Then the profits from issuing options can be very attractive.

Another advantage of the "circle" is purchase of shares at a lower price. This is due to receiving a premium that lowers the effective cost of acquiring an ETF or shares. Similarly, thanks to the regular sale of call options, the investor has a chance to improve the average selling price of assets.

Disadvantages Wheel Strategy

The disadvantage of the strategy is that the bonuses obtained do not guarantee long-term profits. This may be the case when given assets lose much more than the profits from issuing options. This may cause what is called “hanging on a hook”. For example, the investor issued a 2-week put option on Nestle shares with an exercise price of CHF 97. The bonus received was 0,67 francs per share. This means that the effective purchase price is CHF 96,33. If the share price drops to CHF 85 during this time, the investor will have to complete a transaction that is CHF 11,3 higher than the market price. This will mean that the investor will have to write options for a long time to make up for the loss resulting from the decline in Nestle's share price.

Another disadvantage is limited profits, because the issued call option may be exercised at a lower price than the market value of the shares. However, it is precisely for the materialization of such risk that the investor receives premiums from the issued call options.

Weaknesses can also be mentioned the need to monitor positions and make difficult decisions (e.g. about rolling over positions). Knowledge of such issues as implied volatility and time decay is certainly helpful when using the Wheel strategy.

The next problem that is evident in this strategy is high capital requirements. This is because the investor must have capital corresponding to the nominal value of the option, so the ROI of a single transaction is low. This is compensated by the frequency of transactions with a small profit. As a result, the annual rate of return from such a strategy in the optimistic variant ranges from several to a dozen or so percent per year. However, according to one analysis, the strategy applied to the ETF on S & P 500 in the years 2009 - 2020 it brought a lower average annual profit than the regular strategy “buy & hold”.

Summation

Wheel Strategy is also called “triple income strategy”. This is because the investor has a chance to receive 3 types of income:

- from issuing a put option,

- selling call options,

- profit generated from shares.

The strategy involves constantly writing put or call options. The strategy requires frequent trades, which means it is not worth using it on low-liquid option series or with an expensive broker. Then the benefits of issuing call or put options will not be very high. This means that in such conditions the profitability of the strategy will be unsatisfactory.

However, it is worth remembering that no strategy guarantees high profits. It all depends on market conditions, your capital management skills and the liquidity of the options market.

Do you know that…?

Saxo Bank is one of the few Forex brokers that offers vanilla options. The investor has a total of over 1200 options at his disposal (currencies, stocks, indices, interest rates, raw materials). CHECK

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response