Why did Buffett buy Chevron stock and how did it come out?

Warren Buffett has proven over the decades that he has a nose for investment. However, the years of ultra-loose monetary policy made growth companies in fashion. It is the investors in this market segment that have become the stars in the financial world. The story of Cathie Wood is the best example. Ark Invest, whose face was Cathie, achieved fantastic results in 2020. The reason was investing in the "stars" of the market as an investment platform Robinhood, The peloton or Coinbase. The generated rate of return significantly exceeded that of the Omaha Oracles investment vehicle. It was then said that Warren Buffett was too old for "New times" and does not understand the "new economy" (ie "burn through" cash to build scale quickly). It's worth mentioning that Buffett was skeptical of most fast-growing and new companies "Cryptoeconomics". He preferred to be faithful to his investment philosophy, which he had been using successfully for many years. For this reason, he invested in stable companies with the potential to generate above-average profits. In today's article, we will follow the investment in one of the largest companies in the petrochemical industry - Chevron.

Market environment at the time of first purchase

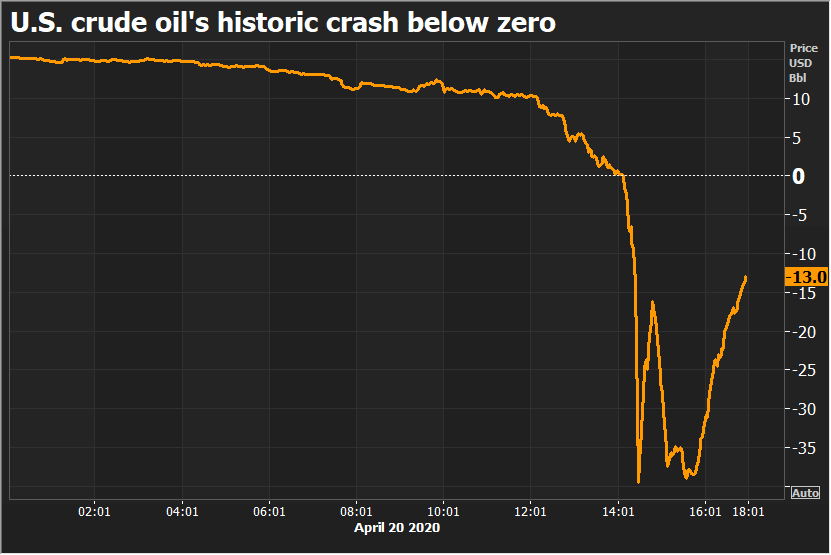

The pandemic period was not successful for hydrocarbon extraction companies. As the economy shut down, economic activity decreased significantly. This caused the price of crude oil to drop. At some point the forward price of crude oil for March delivery dropped to negative prices. This was due to the inability to store crude oil (most of the tankers were already full). Then the price returned to around $ 40. So they were low prices, well below pre-COVID-19 levels.

The lower oil revenues put companies in a worse liquidity situation. As a result, companies had to reduce capital expenditure as many projects became unprofitable. The more indebted enterprises had a problem with paying their liabilities. In turn, the most stable enterprises with a diversified income structure (upstream, midstream and downstream) had a problem with generating enough cash to finance investment projects and maintaining a policy of increasing dividends per share (dividends to aristocrats). Worse prospects had an impact on the price of oil extraction companies.

But low oil prices they couldn't go on forever. First, the drastic reduction in demand for crude oil was temporary, not fundamental. Of course, the trend to move away from fossil fuels is going well. An example may be the slow change in consumer habits and the increasing share of the so-called electricians. However, the changes are gradual, which meant that oil demand should return to pre-COVID-19 levels over time. This meant that perhaps the valuations of stable mining companies could be well below the intrinsic value. As a result, there was a chance to reap potentially high profits. Warren Buffett, who started buying Chevron in Q2020 XNUMX, decided to use this opportunity. Let's go back to this period to look at what the Oracle of Omaha saw in this company at that time.

Chevron stock chart, interval W1. Source: xNUMX XTB. The place where Buffett bought the shares is marked in green.

Chevron in Q2020 XNUMX

Chevron's situation during this period was not rosy. Let's look at the financial statements for Q2020 XNUMX. Back then, Chevron reported a $ 8,3 billion net loss. It is worth noting that a year earlier (Q2019 4,3) Chevron generated a net profit of $ XNUMX billion. There were several reasons. First, as a result of the decline oil prices there were write-offs of $ 1,8 billion. After excluding one-offs, the Q2020 3 net loss was $ 3,4bn vs. $ XNUMXbn in net profit a year earlier.

Net losses also resulted in lower cash generated from operating activities. The lower level of generated cash had to lead to a reduction in capital expenditure. Of course, the expenses have not come to zero. Expenses with the lowest potential and in the initial phase were reduced. Despite the decline in spending, CAPEX reached the level of $ 2 billion (40% below the planned budget of capital expenditures).

The main area of the company's operations is focused on upstream (hydrocarbon production) and downstream (hydrocarbon processing). Unprecedented problems with the sale of products and an inflexible cost structure have led to large losses generated by these business segments.

Upstream

In the second quarter of 2020, Chevron achieved daily production equivalent to 2,99 million barrels of crude oil. It was a decrease of 3% year on year and about 8% quarterly. The decline was significant, but not tragic. Since oil demand has not fallen drastically, it was to be expected that prices would revert to pre-COVID-19 over time. Of course, skeptics believed that there was a risk that the coronavirus would enforce periodic lockdowns. Optimists, on the other hand, believed in creating an effective vaccine or drug that would make the coronavirus just a memory. The difficult "post-show" time meant that the activity on the upstream market generated losses both on the domestic and foreign markets.

In the US, the upstream segment generated a net loss of $ 2,1 billion. This result was about USD 3 billion lower than the year before. The reason for such a weak quarterly results was, among others, low price of crude oil sold. In Q2020 19, the average selling price of a barrel of crude oil was $ 52. For comparison, a year earlier, the average price of crude oil sold was $ XNUMX per barrel. The situation was slightly improved by the higher price reached for 1000 cubic feet. Over the year, it increased from $ 0,68 to $ 0.81.

Foreign activity in the upstream segment generated a loss of $ 4 billion. This result was USD 6,6 billion worse than the year before. The reasons for the loss were, among others About 3,2 billion losses from one-off events ($ 3,9 billion write-off and $ 700 million profit from the sale of shares in the Azerbaijan project. natural gas. The average selling price of a barrel of crude oil was just $ 21. For comparison, a year earlier, the average selling price was almost three times higher ($ 3).. Contrary to the US market, the price of natural gas abroad fell to $ 4,48 from $ 5,43.

Downstream

Hydrocarbon processing was also under the line in Q2020 1,5. The segment's net loss in the United States alone was approximately $ 39 billion. It was nearly $ 581 worse than the year before. The reasons were lower margins on refined products and lower sales volume. Daily production of processed crude oil fell by 000% y / y to XNUMX barrels per day. Sales also fell gasoline and diesel fuelwhich was lower by 35% year on year.

The result in the downstream segment on the foreign market net loss amounted to USD 22 million, which was a result by PLN 284 million worse than in the previous year. The weaker result was due to a lower margin on refining products and lower sales volumes due to a decline in demand, among others. for gasoline or diesel.

The quarterly results were very poor. Low crude oil prices prevented us from generating good downstream results due to weaker demand. It is also worth looking at the company's liquidity situation, the situation was not colorful. Low operating cash flows allowed to cover capital expenditures (CAPEX) but were too small to cover dividend liabilities. As a result, the company had to use the debt. As a result, Chevron was able to finance both capital expenditure and dividend policy, and to conduct a small share buyback.

Chevron also had to carefully track the profitability of its projects. For this reason, on October 27, 2020, he announced the sale of upstream and midstream business in the Appalachian region. The assets for $ 735 million were bought by EQT Corp. It is worth mentioning that Chevron bought the same assets in 2010 for $ 4,3 billion from Atlas Energy. By selling some of its least promising assets, Chevron freed up cash, which helped improve the company's liquidity. At the same time, the company tried to take advantage of the recession to make acquisitions of weaker competitors. An example was the completion of the acquisition of Noble Energy, issuing 58 million shares for this purpose. The value of the transaction (including the assumed debt) was estimated at $ 13 billion. As a result, Chevron increased its exposure in the upstream segment.

Therefore, let's take a look at the company's financial situation at the end of Q2020 XNUMX:

| $ million | IQ 2019 | Q2019 XNUMX | Q2019 XNUMX | Q2019 XNUMX | IQ 2020 | Q2020 XNUMX |

| revenues | 34 189 | 36 323 | 34 779 | 34 574 | 29 705 | 15 926 |

| net profit | 2 649 | 4 305 | 2 580 | -6 610 | 3 599 | -8 270 |

In Q2020 XNUMX, there was a sharp drop in revenues, which had a very negative impact on the operating and net result. This was because not all costs were perfectly flexible. This resulted in an operating loss and a net loss. However, it should be remembered that an accounting loss does not have to be synonymous with a cash outflow.

Znow it's time to take a look at the operational flows:

| $ million | IQ 2019 | Q2019 XNUMX | Q2019 XNUMX | Q2019 XNUMX | IQ 2020 | Q2020 XNUMX |

| OCF * | 5 057 | 8 783 | 7 817 | 5 657 | 4 722 | 80 |

| CAPEX ** | 2 953 | 3 584 | 3 369 | 4 210 | 3 133 | 2 092 |

| FCF *** | 2 104 | 5 199 | 4 448 | 1 447 | 1 589 | -2 012 |

| Dividend | 2 244 | 2 250 | 2 237 | 2 228 | 2 402 | 2 394 |

| Purchase of shares | 15 | 825 | 1 005 | 1 090 | 1 573 | 0 |

* operating cash flow, ** capital expenditure, *** free cash flow

Q2020 0 was very difficult for the company, despite the positive cash flow from the liquidation of some inventories and collection of receivables, operating cash flows were still around 1,5. This did not allow to finance CAPEX expenses and dividend payments. Due to problems with generating cash, spending on share purchases was stopped. Additionally, Chevron raised approximately $ XNUMX billion from the sale of some assets.

In such a situation, it is not surprising that the company had to rely on debt. In Q2020 1,6 alone, Chevron incurred $ XNUMXbn net (after paying off other interest debt).

| $ million | IQ 2019 | Q2019 XNUMX | Q2019 XNUMX | Q2019 XNUMX | IQ 2020 | Q2020 XNUMX |

| interest debt krt. | 7 023 | 5 588 | 7 774 | 4 882 | 8 688 | 3 751 |

| debt interest debt ... | 26 064 | 25 061 | 24 807 | 23 409 | 23 663 | 30 302 |

| cash | 8 699 | 8 513 | 11 697 | 5 686 | 8 492 | 6 866 |

| net debt | 24 388 | 22 136 | 20 884 | 22 605 | 23 859 | 27 187 |

Net debt increased drastically, which worried some investors. First, if the price of crude oil does not rise sharply, the company will have to cut capital expenditure and possibly relinquish its dividend aristocrat status. Another solution would be to keep increasing the debt burden, which would have an impact on the credit rating. A worse rating means higher interest costs. Second, if the company were to maintain the current pace of capital expenditure and continued to be generous to shareholders, it was to be expected that the issue of shares to obtain liquidity or a sell-off of assets would be threatened.

As a result, the mood in Chevron stocks was not the best. Right after the crash in March 2020, there was a quick rebound to around $ 100, but then there was a cooling down of moods. At the end of October, the Chevron price was around $ 70. For comparison, in mid-March 2020 the company's price was around $ 60.

However, already in Q2020 2020 it was known that QXNUMX XNUMX would be much better than the second. The reason was higher oil prices. For this reason, a positive FCF could be expected to be generated. Hope for a vaccine to be implemented appeared on the horizon, which would free the economy from fear of further lockdowns. Over time, the price of oil would return to "normal" levels.

Q2020 XNUMX

| $ million | Q2019 XNUMX | Q2020 XNUMX | Q2020 XNUMX |

| revenues | 34 779 | 15 926 | 23 997 |

| net profit | 2 580 | -8 270 | -207 |

| OCF | 7 817 | 80 | 3 537 |

| CAPEX | 3 369 | 2 092 | 1 630 |

| FCF | 4 448 | -2 012 | 1 907 |

| Dividend | 2 237 | 2 394 | 2 390 |

| Purchase of shares | 1 005 | 0 | 0 |

The results were getting better, the revenues started to grow. This caused the operating lever to show its power. The net loss was relatively small. Moreover, the company started to generate quite solid operating flows, which more than covered CAPEX (which was reduced). As a result, FCF nearly covered the quarterly dividend payments. The financial situation began to improve.

Warren Buffett starts shopping

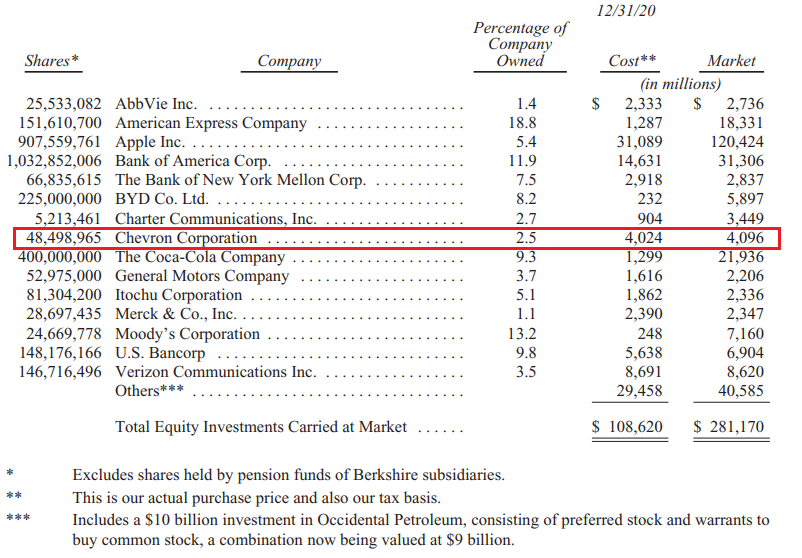

This was noticed by Warren Buffett, who began the slow buyback of overpriced Chevron stock. With the help of his investment vehicle, he began to spend the accumulated in Berkshire Hathaway cash. In the 2020 report, Chevron appears in the position investments:

According to the 2020 report, Buffett purchased approximately 48,5 million shares. The median purchase price was $ 82,97. It was not a "down" price. Once again, it turned out that in the case of fundamental investing, it is not necessary to hit the market trough to generate a very high rate of return. According to a report filed by the SEC (13F), Chevron's first purchases took place in Q2020 44,2. At that time, XNUMX million of the company's shares were purchased. In the following quarters, the number of shares was as follows:

| Chevron | the number of actions | value | stock change q / q |

| Q2020 XNUMX | 44 272 770 | $ 3 million | +44 272 770 |

| Q2020 XNUMX | 48 498 965 | $ 4 million | +4 226 195 |

| IQ 2021 | 23 672 271 | $ 2 million | -24 826 694 |

| Q2021 XNUMX | 23 123 920 | $ 2 million | -548 351 |

| Q2021 XNUMX | 28 703 519 | $ 2 million | +5 579 599 |

| Q2021 XNUMX | 38 245 036 | $ 4 million | +9 541 517 |

| IQ 2022 | 159 178 117 | $ 25 million | +120 933 081 |

own study based on 13F reports

As you can see, the Oracle of Omaha significantly reduced its position in IQ 2021 (by more than half). However, there was a slow increase in exposure to Chevron in the following quarters. At the end of 2021, it was the 9th largest item in the "stock exchange" portfolio. The average cost at the end of 2021 was $ 89,42. Berkshire Hathaway reported earnings per share of $ 1 million (+ 068%).

What was the situation for Chevron after 2021?

| $ million | 2019 | 2020 | 2021 |

| revenues | 139 865 | 94 471 | 155 606 |

| net profit | 2 924 | -5 543 | 15 625 |

| OCF | 27 314 | 10 577 | 29 187 |

| CAPEX | 14 116 | 8 922 | 8 056 |

| FCF | 13 198 | 1 655 | 21 131 |

| Dividend | 8 959 | 9 651 | 10 179 |

| Purchase of shares | 2 935 | 1 531 | 0 |

| interest debt krt. | 4 882 | 5 627 | 62 |

| debt interest debt ... | 23 409 | 42 320 | 30 664 |

| cash | 5 686 | 5 596 | 5 640 |

| net debt | 22 605 | 42 351 | 25 086 |

In 2021, the company was in a very good financial condition. After the acquisition of Noble Energy in 2020, there was an increase in debt. However, after just one year, the company managed to significantly reduce its debt. The high FCF helped, which allowed for the financing of CAPEX and the payment of $ 10 billion in dividends.

Buffett's exposure increase occurred in IQ 2022. The reason was Russia's invasion of Ukraine. This event increased the risk of economic sanctions against Russia. The growing tension between the 'West' and Russia made it more and more real to 'cut off' Russia from oil revenues. As a result, European Union countries will be forced to buy crude oil from other contractors. As part of the production (of the Russian Ural crude oil) will fall partially off the market, there will be a greater demand for crude oil. Companies with high upstream activities will be the beneficiaries. One of such companies is Chevron. After the purchases, Chevron became the 4th largest item in the equity portfolio, ahead of, among others, Coca-Cola and Moody's.

Summation

Certainly, purchases started in 2020 and 2021 generated a very high rate of return (especially taking into account the wide market). Chevron's current share price is more than twice as high as it was when Berkshire Hathaway began buying back the company's shares. Warren Buffett once again proved that investment discipline is very important if you want to generate above-average rates of return.

Chevron stock chart, interval W1. Source: xNUMX XTB.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response