Great Erosion of purchasing power, enterprise margins and economic growth

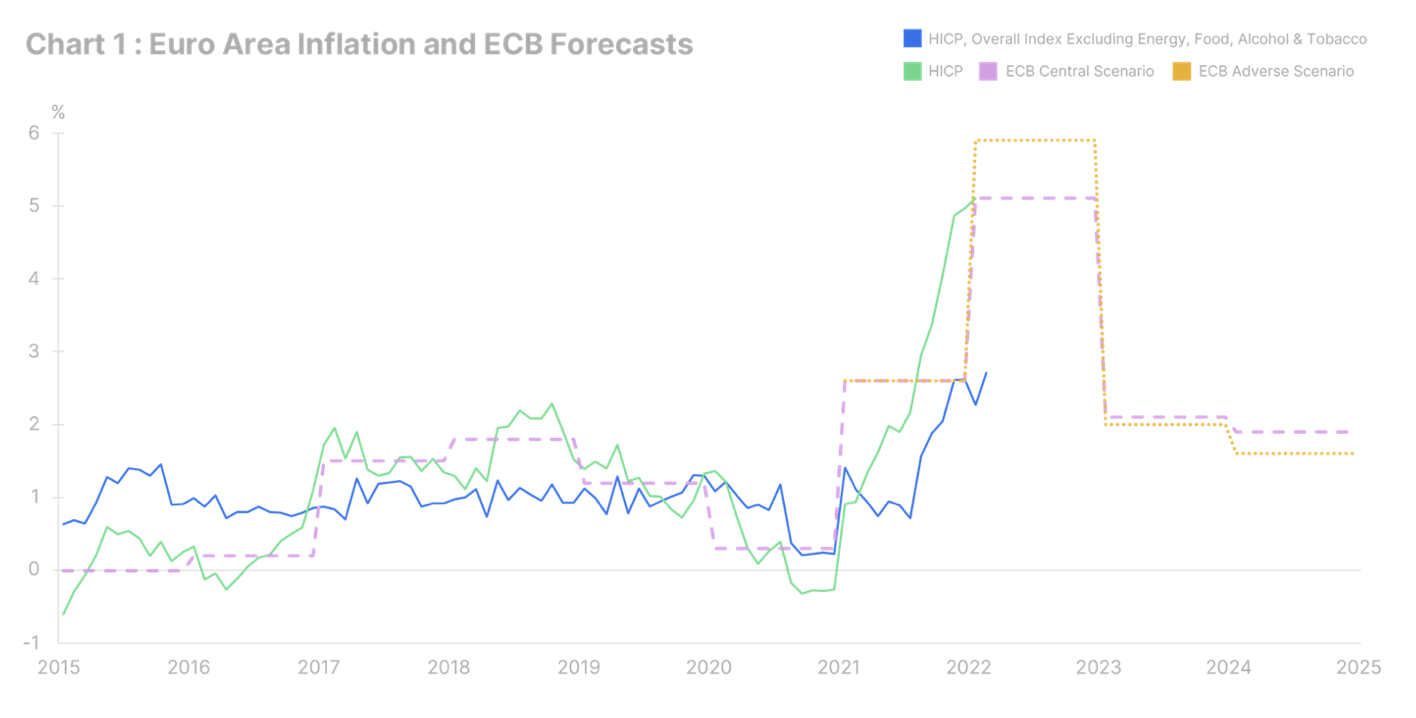

Inflation is by no means temporary. During the March meeting European Central Bank (ECB) has published its latest macroeconomic forecasts. In all scenarios, it is expected that in 2023 Consumer Price Index (CPI) in the euro area, it will decline to almost 2% year on year (see chart). This is wishful thinking; now it is 5,8% year on year (the latest data is for February). It's not just oil and energy prices that are booming fast. Food prices, non-energy related industrial goods and services are growing at a rate of more than 2%; inflation is now widespread. In addition, we do not yet know the full consequences of the war in Ukraine with regard to the inflation dynamics. Our baseline scenario assumes that the war will increase this year's average CPI in the euro zone by at least one percentage point. Due to this conflict, we discovered that Ukraine is the center of international trade; for example, it accounts for 70% of global neon gas exports. This purified version of the gas is crucial to the semiconductor industry, and we need it for the production of many everyday products such as smartphones, medical devices and household appliances. War, however, is not our only problem.

Supply chain disruptions will last at least until 2023.

Supply chain disruptions are increasing. There was no real improvement before the war, and now the situation is getting even worse - this is the biggest trend we will have to face. Apart from the suspended and sanctioned Russian exports of mineral resources, a number of countries are restricting the export of basic commodities. On March 14, Argentina suspended its exports of soybeans and soybean oil indefinitely (41% and 48% of global exports, respectively). At the same time, Indonesia tightened export restrictions on palm oil - the world's most used vegetable oil, and is used in many food products. Many countries are following the same path, including Serbia, Ukraine, Egypt, Algeria and Bulgaria. Others are still facing the pandemic. A lockdown was introduced in mid-March in Shenzhen, a port city in China that is a huge manufacturing hub. Shenzhen is home to some of the most famous Chinese companies, including Tencent Holding, operator of the popular WeChat messenger, and electric car manufacturer BYD Auto. It is also the fourth largest port in the world, accounting for 15% of Chinese exports. It may take six to eight weeks to catch up; Sustainable improvement in international freight transport can only be expected from 2023, when new containers will hit the market. Port congestion is not the only factor contributing to inflationary pressure. We have mentioned several times over the past few months that Europe's green transition is essentially an inflation shock to European households and businesses. Instead of a gradual shift away from coal as a result of COP26, the sad reality is that coal and gas are gaining in importance. Hopefully, the war in Ukraine will make Germany and Belgium rethink their plans to quit nuclear power, but it will be at least 7-10 years before the new nuclear power plants get operational. Until then, inflation will continue to hit us hard.

History does not repeat itself, but it does rhyme

In our opinion, comparing today's inflation with the 70s or the 1973 oil crisis makes no sense. There are at least two main differences: Covid-19 policies in developed countries have been completely out of proportion to what we know from the past, and most euro area countries do not have a price-wage loop. In the 70s, wages were automatically indexed to inflation. Currently, with few exceptions (in Cyprus, Malta, Luxembourg and Belgium, the indexation is based on the core CPI), this is no longer the case. So far, wage negotiations in euro area countries have led to average wage increases below inflation (eg less than 1% in Italy and between 2% and 3% in the Netherlands, Austria and Germany); this is not the stagflation we experienced in the 70s. low inflation - persistently low inflation). We call him Great Erosion: erosion of purchasing power, corporate margins and economic growth due to sharp increases in supply costs at the global level. This is the fifth systemic change in the last twenty years: the previous four are Great Temperance, the Housing Bubble, Century Stagnation and Hysterical Containment. The big question right now is: who will bear the greatest costs? What's our opinion? Enterprise margins. What can prevent it? Basically, we need an increase in productivity. Unfortunately, the data do not support a sustained increase in productivity as a result of remote working, and whether the green transition will have a positive or negative impact on productivity is debatable.

The "inflation / recession" dilemma

All central banks are officially involved in the fight against inflation - it goes without saying. At the March meeting, the hawks clearly took control of the ECB's narrative, but some central banks are much more involved than others. We suspect that they are more willing to accept sustained inflation of 3-4% per annum than to trigger a recession in order to lower inflation. This means they can bluff, and aggressive rhetoric will not be followed by equally courageous actions. This applies to the US Federal Reserve much more than the ECB. Let's not forget that inflation above the 20-year average also has a positive effect on the debt burden, which is an added benefit. After the global financial crisis of 2007-2008, many countries tried to reduce their debt by the conventional method, that is through austerity and structural reforms. This method has failed, and it is time to take a more unconventional approach: inflation, repression and, in a few cases, insolvency. This will have serious consequences for investment (commodities and real estate prevail over other options), but also for fiscal policy due to increased redistribution of income for the lowest quintile of households. Not everyone is prepared for what lies ahead: a prolonged period of high inflation before it falls.

All Saxo Bank's forecasts are available at this address.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)