May weaker than in April in terms of Forex volume

"Sell in may and go away" - although this is a very popular saying in the light of the stock market, it also translates into the currency market very well. Investors' involvement is significantly decreasing. May turns out to be another weak month in terms of turnover. In April, analysts were quietly hoping that the next month would stop the negative trend on the volume. In the light of the data published by leading brokers and companies operating in the financial market, we can see an improvement in turnover in the coming months.

Be sure to read: Volatility on the Forex market is getting closer to the 5-year minimum

1,125 trill USD per day

One of the first volume reports to hit the market comes from the CLS group. The company is a leading provider of risk mitigation and settlement services for dealers and foreign exchange institutions. The publication contains detailed information on the May turnover. It shows that the average daily turnover fell by 4,2% compared to April. The total monthly volume is based on three trading sections - currency exchange, spot and currency trading. Out of the three, the FX swap by far attracted its highest ADV (Daily Average Volume) in May.

Taking into account May 2018, as a reference for current results, they are weaker by 5,3%. Therefore, the results from month to month and from year to year reinforce our conviction that this is not a one-off trend.

Saxo Bank and low volatility

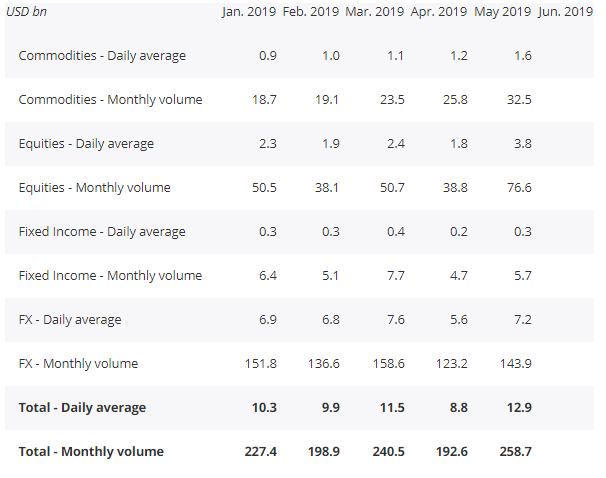

The Danish company on Monday presented the financial results for May. In summary (very generally) presented reports, the month ended for low turnover and low volatility for Saxo Bank. In the currency markets, the broker recorded the total trading volume at 143,9 billion USD. It was higher than in the previous month (123,2 billion USD), but lower than in March, where its equivalent amounted to 158,6 billion USD. Converting this result to days, it would be 7,2 billion.

Statement of Saxo Bank turnover. Source: Saxo Bank report

Looking at the above 7,2 table, the billion of daily turnover seems to be mediocre on the 2019 scale. To have a broader view of the issue of volume, it is worth to compare ADV to last year. In 2018, Saxo Bank presented results at the 12,3 billion level in May dollars a day.

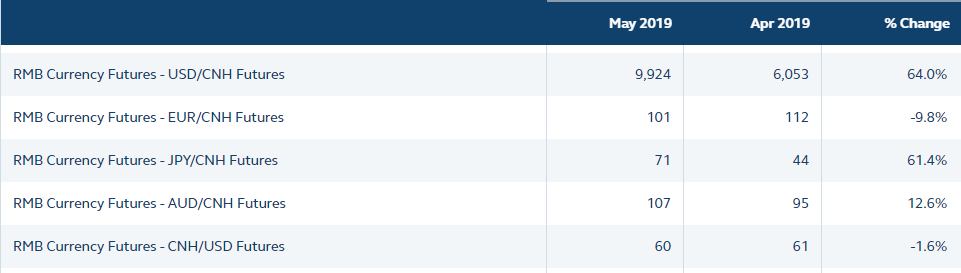

64% of contracts more

While the vast majority of brokerage firms publish weak data, the Hong Kong stock exchange can boast of truly remarkable results on currency pairs contracts. In May, the average daily trading in RMB currency contracts (Renminbi) amounted to 9 924 currency contracts USD / CNH. Compared to the previous month, where 6 053 trades on average on a daily basis, this means an increase of 64%.

Turnover on RMB futures. Source: HKEX Exchange

Interestingly, since the beginning of the year, the average daily trading of RMB currency contracts on the Hong Kong stock exchange was 8 664 contracts. This is a result of 60 a percentage higher than in 5429 contracts concluded in the same period last year. Looking at the above presented statistics (in terms of m / m), 3 currency pairs enjoyed great interest. Investors willingly concluded contracts for USD / CNH, AUD / CNH and JPY / CNH. With less interest in May traders have endowed a pair associated with the euro.

It is worth mentioning that the total number of forward contracts traded in May at HKEX was 588.290. This means an increase of 14,8 percent compared to 495,198 recorded in April.

Summation

It is difficult to talk about an extremely large improvement in volatility in the markets. From the beginning of the year, we "swing" between extreme results. 2019, for the time being, is a great unknown expecting improvement in forex trading. Despite the fact that there are exceptions to the rule (as HKEX), the industry publishes in the majority of still unsatisfactory results. Some traders decided to switch to stock market indices, which in recent months have been characterized by a quite large amplitude of fluctuations.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Introduction to volume analysis - Mieczysław Siudek [Video] Wyckoff techniques - volume analysis](https://forexclub.pl/wp-content/uploads/2023/05/Techniki-Wyckoffa-analiza-wolumenu-300x200.jpg?v=1683712395)

![Vitamins in the wallet - How to invest in orange juice [Guide] how to invest in orange juice](https://forexclub.pl/wp-content/uploads/2022/06/jak-inwestowac-w-sok-pomaranczowy-300x200.jpg?v=1654766384)