Macroeconomic indicators: German IFO index

The IFO index is one of the most important indicators that "predict" the future condition of economic growth in the largest economy in the European Union - German. IFO is prepared on the basis of questionnaires in which the respondents have to determine the current and future economic situation in a specific industry. This index can be called a complement to "hard data" such as retail sales, unemployment rate or change Gross Domestic Product (GDP), which are published by special state institutions. In the following text, we will answer, among others, the following questions:

- What is the IFO indicator?

- How is the IFO index calculated?

What is the IFO index?

The full name of the indicator is IFO Business Climate. As the name suggests, its task is to bring closer the "business climate" in Germany. It consists of two sub-indexes that describe:

- the current situation in business - IFO Business Situation,

- business expectations of the respondents - IFO Business Expectation.

The IFO index has been compiled since 1991 by Institute for Economic Research in Munich. The indicator describes the investment climate (economic activity) in Germany. As mentioned before, the index value is based on the results of surveys concerning the current business climate and forecasts for the next 6 months.

This indicator is published monthly in the second half of the month to which the data relate. For example, the IFO index for January 2021 was published on January 25, 2021. The following are the publication dates of the IFO indicator in 2021:

- 25/05/2021

- 24/06/2021

- 26/07/2021

- 25/08/2021

- 24/09/2021

- 25/10/2021

- 24/11/2021

- 17/02/2021

The surveys that allow to calculate the IFO index are directed to approximately 9 people. They are representatives of, among others, the construction industry, retail sales and the industrial sector. For the IFO Business Situation sub-index, interviewers must classify the situation as good, fair, or bad. In the case of the IFO Business Expectation index, respondents define how the economic situation will change. They have three answers to choose from:

- will improve,

- will not change,

- or worsen.

All survey responses are expressed as a percentage and broken down by sector.

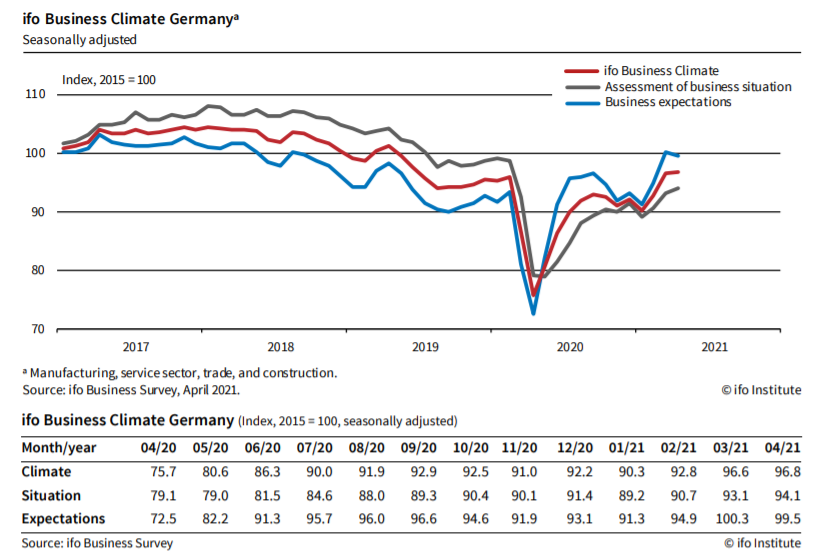

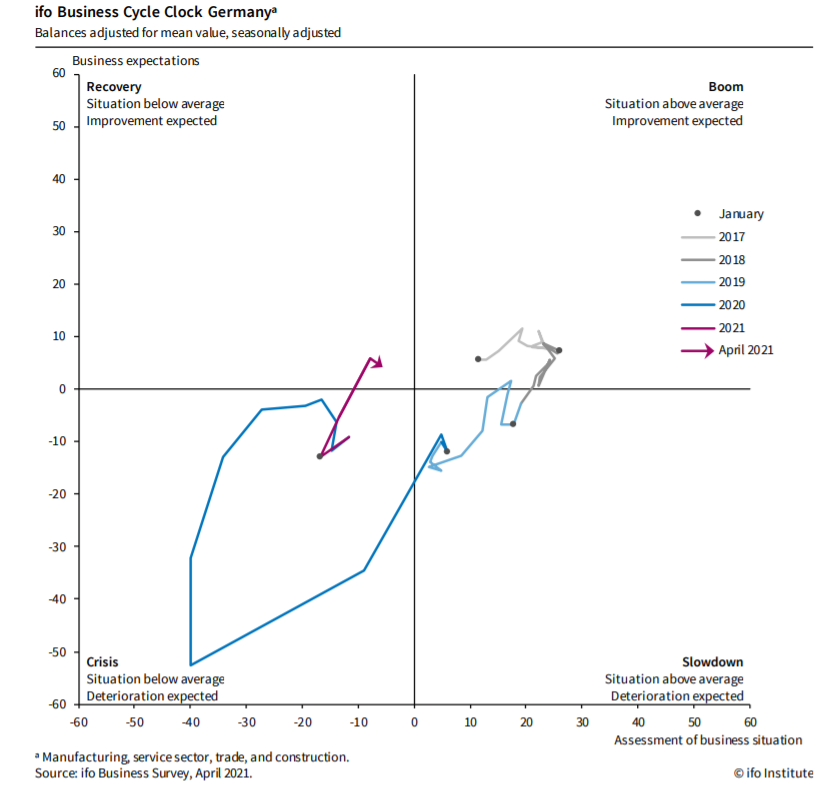

As a rule, it is assumed that if both sub-indices are above 0, the economic boom continues. This is due to the fact that despite the good economic situation, respondents expect improvement in the next 6 months. On the other hand, when both indicators are negative, there is a "crisis" because despite weak current readings the market expects a further one worsening moods. Below is a chart presented by the Ifo Institute, showing the aforementioned relationships over the years 2017-2021:

The IFO index shows the difference between a positive and negative assessment of the condition of the German economy (present and future). Due to the fact that the indicator focuses only on positive and negative assessments, neutral values are ignored (they do not affect the indicator size).

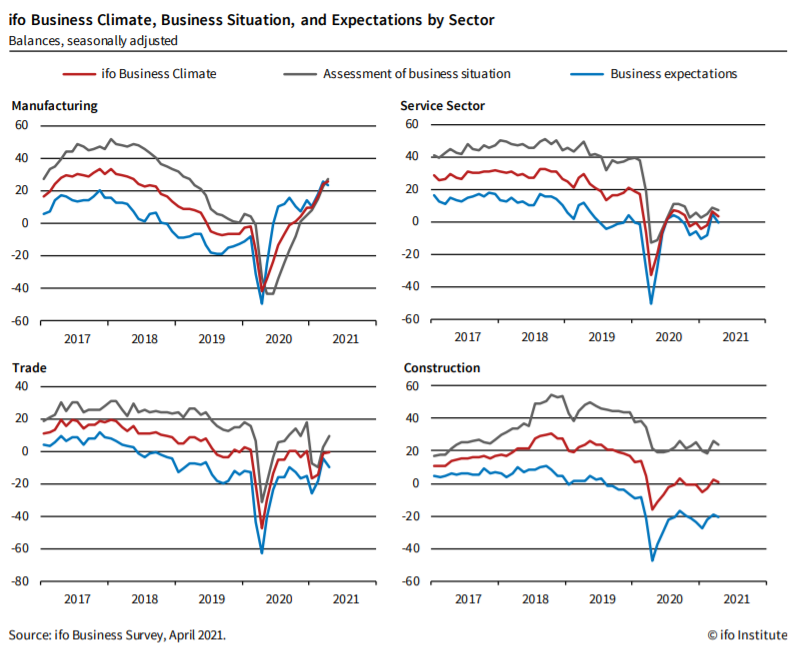

Thanks to the decomposition of the index value into individual sectors, differences in the "condition" of individual components can be seen. For example, in the industrial sector, the slow deterioration of both moods and expectations began at the beginning of 2018. The business expectations for this industry were permanently negative from the end of 2018, a few quarters before the coronavirus crisis. In turn, the service sector behaved much better during this period. Below is a list prepared by the Ifo Institute:

How is the index calculated?

The questionnaire consists of approximately 20 questions in total. Respondents must answer, inter alia, on the following issues:

- The current business situation of the company

- The company's expectations for the next six months

- Demand situation (improvement, unchanged, deterioration)

- Number of employees (increase, unchanged, decrease).

The above-mentioned answers translate into the "aggregate" value of individual sub-indices. As mentioned earlier, neutral values are ignored.

The easiest way to illustrate this indicator is to use an example. If in a given month 50% of the respondents described their situation as satisfactory (neutral value), 30% as "good" and 20% as "bad", then the neutral values are ignored. As a result, only half of the surveyed votes are taken into account. As a result, the indicator has a positive value because more respondents described the situation as good (30%) than bad (20%). The same is done in the case of forecast surveys for the next 6 months.

Then Business Climate is calculated, the formula of which is as follows:

![]()

The value of this component ranges from -100 (when both sub-indices have the value -100) to +100 (both sub-indices have the value +100). As mentioned before, sub-indices do not take neutral values into account. So the extreme values need not arise when "Everyone thinks the same". It is enough for 99,9% to be neutral and 0,01% to have a negative view of the present and future situation.

Looking at the formula, it can be concluded that Business Climate is the geometric mean of the "results" of individual sub-indices. To calculate the value of the IFO index, it is normalized to the base year average. In 2018, it was changed from 2005 to 2015.

The value of the IFO index is calculated by dividing the value of the (Business Climate) component for a given month plus 200 by the mean value for the base year plus 200. The result of the division is multiplied by 100. The value obtained is corrected for the influence of seasonal factors. The procedure is followed for this X-13ARIMA-SEATSwhich was developed by the US Census Bureau.

Application of IFO

The IFO index may constitute an important predictor of the business climate as is the case in the German economy. For this reason, it is a “faster” indicator than the Gross Domestic Product published once a quarter. The condition of the German economy, in turn, translates into many German companies listed, among others, in indices such as DAX, mDAX, sDAX.

Check it out: German capital market and investment opportunities

The impact of the economic situation in Germany is particularly important for companies that generate the majority of revenues in this country. For multinationals, the impact is smaller, but there are also some exceptions. After all, it should be remembered that Germany is the largest economy in the European Union. The economic slowdown in this country automatically translates into a cooling down of the economic situation also in CEE countriesas well as economies such as France and Italy. So if the company generates most of its revenues in the European Union, the slowdown in Germany will also affect sales results in the rest of the main markets of the European Union.

Another useful function of the IFO index is its use as a litmus test of market sentiment. If the IFO index negatively surprised investors and European indices are rising, it is quite a bullish signal. Conversely (IFO better than expected but indices are falling) the market sentiment is dominated by the supply side.

Summation

The great advantage of the IFO index is that the "base" of the index comes directly from respondents who are representatives of enterprises. So they are closest to the "heartbeat" of the entire economy. Another positive aspect of the indicator is that it is published much faster than "standard" macroeconomic government publications. Thanks to this, the IFO can indicate in advance a deterioration or improvement in the economic situation in individual sectors of the economy. As a rule, it is considered that the IFO only shows a more permanent direction after three months. A decrease in IFO in one month is not reliable. For this reason, it is waiting for confirmation or negation of the signal. On the other hand, the indicator has the disadvantage of its conventional nature. The respondent only answers whether the economic situation is good and whether it will improve. So it is a sentiment indicator and not hard data.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response