Germany - capital market and investment opportunities (part II)

The German capital market is not as developed as the economy. German companies account for 2,42% of the FTSE All-World index. It is worth noting that Germany's share in global GDP is over 4%. French (2,66%) and Swiss (2,65%) companies have a greater share in the index. In turn, Canada plays a similar role in the index (2,38%). Of the 3979 components of the FTSE index, 82 are German companies.

Be sure to read: Germany - economy and demography (part I)

Main places of rotation

Unlike in Poland, there is no single place for trading in shares and derivatives on the German market. Currently, there are, among others:

- Frankfurt Stock Exchange (Xetra)

- EUREX Derivatives Exchange

- Stuttgart Stock Exchange

- Berlin Stock Exchange

- Other regional exchanges

In addition, the European Energy Exchange (EEX) also operates in Germany.

Eurex is one of the largest places to trade derivatives in the world. It belongs to the German company Deutsche Börse. On Eurex, the investor can trade index futures, stock futures and interest rate derivatives. In terms of trading, derivatives on stock indices are unrivaled:

|

Eurex turnover in million pcs. |

2019 |

2018 |

|

Derivatives on indices |

953,0 |

949,8 |

|

Interest rate derivatives (e.g. bonds) |

506,8 |

628,5 |

|

Stock derivatives |

425,2 |

372,1 |

Looking at the monthly data, you can see that index derivatives trading increased sharply during the March 2020 panic.

Source: Eurex

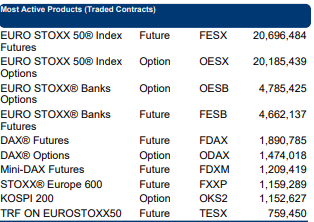

According to data for October 2020, trading on the EURO STOXX 50® Index dominates the market of index derivatives (futures and options). The second most popular index is EURO STOXX 50® Banks. It is only in third place DAX index.

Source: Eurex

The low position of the DAX index results from the difference in the size of contracts. EURO STOXX 50 has a multiplier of € 10 per 1 point. Which means the face value of the contract is over € 35. In the case of a DAX contract, 000 point has a multiplier of € 1. This means the contract has a face value of € 25. After adjusting the contract size, the difference between EURO STOXX 325 and DAX is not so great.

Frankfurt Stock Exchange

It is the largest stock exchange in Germany and one of the largest in the world. The operator of the stock exchange is Deutsche Börse. The stock exchange is located in Frankfurt am Main. Trading mainly takes place via the Xetra® platform. The platform concentrates over 90% of stock trading on all German stock exchanges (including regional stock exchanges). The system is also used on smaller European stock exchanges in countries such as: Austria, Hungary, Slovenia, Czech Republic, Ireland, Bulgaria, Malta, Croatia.

A residual part of the trade takes place outside the Xetra platform. In October 2020, the turnover on the Frankfurt Stock Exchange was € 99,8 billion, of which Xetra accounted for 99,5% of the turnover.

The most popular companies in terms of turnover in October 2020:

|

Company name |

Turnover (m €) |

|

SAP SE |

9 848,4 |

|

BAYER AG |

5 318,3 |

|

DAIMLER AG |

4 113,7 |

|

ALLIANZ SE |

3 981,7 |

|

Siemens AG |

3 889,6 |

|

BASF SE |

3 607,4 |

|

VOLKSWAGEN AG |

3 356,5 |

|

LINDE PLC |

3 199,3 |

|

TELECOM |

3 101,8 |

|

INFINEON TECH AG |

2 935,5 |

|

ADIDAS AG |

2 668,3 |

Stuttgart Stock Exchange

It is the second largest stock exchange. In 2019, the value of trading on the stock exchange was € 68,5 billion. In October 2020, the turnover amounted to € 8,1 billion (+ 34% y / y).

Since 2008, the stock exchange has enabled electronic trading in all financial instruments (shares, bonds, certificates, and derivatives). On the stock exchange in Stuttgart can also be traded with cryptocurrencies (via BISON and BSDEX).

Berlin Stock Exchange

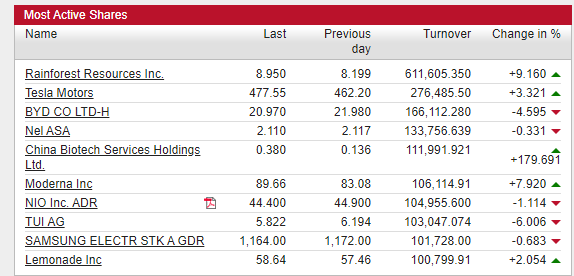

The stock exchange was founded in 1685. Despite its long history, it is a local stock exchange with marginal shares in trading in shares, ETFs, bonds and certificates. On the Berlin Stock Exchange, there is a very large offer of foreign shares (listed on the NASDAQ, Chinese or South African shares). Trading is mainly done through the platform (Equidict). The trading volume on the exchange is not very high. Usually it amounts to several hundred thousand euros on the most liquid shares. Below is a summary of November 25, 2020:

Source: www.boerse-berlin.com

In addition to the Berlin Stock Exchange, local trade also takes place in Hamburg and Dusseldorf, among others.

European Energy Exchange (EEX)

It is the main European electricity exchange. Its headquarters are in Leipzig. It has been operating continuously since 2002. In 2011, the stock exchange was taken over by Deutsche Börse. Trading takes place on the stock exchange, among others electricity futures, spot trading in electricity and alternating gas.

Major indices on the German stock exchange

The most popular index representing German companies is DAX® 30, which represents the 30 largest and most liquid stocks on the Frankfurt Stock Exchange. Other significant indexes are:

- mDAX

- sDAX

- TecDAX

|

Indeks |

Number of companies |

Type of companies |

Index type |

Method of calculating weights in the index |

|

DAX® |

30 |

Big |

performance |

free float market capitalization |

|

mDAX® |

60 |

Average |

performance |

free float market capitalization |

|

sDAX® |

70 |

small |

performance |

free float market capitalization |

|

TecDAX® |

30 |

technology |

performance |

free float market capitalization |

Performance indices reinvest dividends back into the index. Usually, the flagship indices are price indices that "deduct" dividends. For this reason, German indexes can be compared with foreign counterparts of the "Total Return" type.

German indices are also calculated as "price index". Below is a comparison of selected indices:

|

Index (November 25.11.2020, 12) at XNUMX |

"Performance" (TR) |

"Price" (PR) |

|

mDAX |

29 029 |

15 401 |

|

sDAX |

13 700 |

6 415 |

In March 2020, the DAX 50 ESG index appeared. From among the companies grouped in DAX, mDAX and TecDAX, the 50 largest and most liquid companies meeting the ESG criteria (environment, social responsibility, corporate governance) are selected. The ESG index does not include cigarette manufacturers or defense companies.

Read: What is ESG Rating and Sustainable Investing?

In September 2021, the indexes will change again. The DAX 30 will be forgotten and it will take its place DAX 40. The mDAX, whose number of components will drop from 60 to 50 companies, will also change.

Selected companies from the German market

Despite the financial scandal, the hero of which was Wirecard, you should not be afraid to invest in German companies. German indices are very diverse in terms of the industries in which they operate. As a result, you can invest in both the exchange operator (Deutsche Börse) and the football club (Borussia Dortmund). Each index includes companies that are recognizable throughout Europe. Below are some examples of well-known companies included in the DAX, mDAX and sDAX indices:

DAX

Siemens - It is also the largest company in the industrial sector in Europe. It operates in many industries, from the production of medical devices, rail vehicles to industrial automation solutions. The company's capitalization is around € 95 billion. Historical results of the company below. The fiscal year (FY) ends in September.

|

Siemens |

2017FY |

2018FY |

2019FY |

2020FY |

|

revenues |

€ 83 ml |

€ 83 million |

€ 86 million |

€ 57 million |

|

Operational profit |

€ 7 million |

€ 5 million |

€ 6 million |

€ 5 million |

|

Operating margin |

Present in several = 8,84% |

Present in several = 7,12% |

Present in several = 7,70% |

Present in several = 8,82% |

|

Net profit |

€ 6 million |

€ 5 million |

€ 5 million |

€ 4 million |

Adidas - manufacturer of footwear and sportswear. It is the largest company in this industry in Europe. He is the owner of brands such as Adidas and Reebok. Valued at over € 54 billion.

|

Adidas |

2016 |

2017 |

2018 |

2019 |

|

revenues |

€ 19 ml |

€ 21 million |

€ 21 million |

€ 23 million |

|

Operational profit |

€ 1 million |

€ 2 million |

€ 2 million |

€ 2 million |

|

Operating margin |

Present in several = 7,48% |

Present in several = 9,72% |

Present in several = 10,94% |

Present in several = 11,31% |

|

Net profit |

€ 1 million |

€ 1 million |

€ 1 million |

€ 1 million |

Adidas chart, interval W1. Source: xNUMX XTB.

Beiersdorf - a company from the cosmetics industry. Beiersdorf focuses on skincare products. It owns brands such as Nivea, Liposan and Eucerin. The company is valued at around € 24bn.

|

Beiersdorf |

2016 |

2017 |

2018 |

2019 |

|

revenues |

€ 6 ml |

€ 7 million |

€ 7 million |

€ 7 million |

|

Operational profit |

€ 1 million |

€ 1 million |

€ 1 million |

€ 1 million |

|

Operating margin |

Present in several = 15,34% |

Present in several = 15,36% |

Present in several = 14,78% |

Present in several = 14,20% |

|

Net profit |

€ 709 million |

€ 672 million |

€ 728 million |

€ 718 million |

Beiersdorf chart, interval W1. Source: xNUMX XTB.

The DAX index also includes well-known car manufacturers (Daimler, BMW, Volkswagen) and companies from the chemical and pharmaceutical industries (BASF, Henkel, Bayer, Merck). Recently, the online food ordering platform (Delivery Hero) has also joined the index.

mDAX

Puma - Adidas competitor. They focus on the production of footwear and sportswear. They own the Puma and Cobra Golf brands. The company is valued at around € 12bn.

|

Puma |

2016 |

2017 |

2018 |

2019 |

|

revenues |

€ 3 ml |

€ 4 million |

€ 4 million |

€ 5 million |

|

Operational profit |

€ 128 million |

€ 245 million |

€ 337 million |

€ 436 million |

|

Operating margin |

Present in several = 3,53% |

Present in several = 5,92% |

Present in several = 7,25% |

Present in several = 7,92% |

|

Net profit |

€ 62 million |

€ 136 million |

€ 187 million |

€ 262 million |

Airbus - one of the largest producers of passenger planes in the world. It also has a product segment for the military (eg Eurocopter). The company is based in the Netherlands, but is listed on stock exchanges in Germany, France and Spain. The company's capitalization is around € 70 billion.

|

Airbus |

2016 |

2017 |

2018 |

2019 |

|

revenues |

€ 66 ml |

€ 66 million |

€ 63 million |

€ 70 million |

|

Operational profit |

-429 million € |

€ 2 million |

€ 3 million |

€ 1 million |

|

Operating margin |

-0,64% |

Present in several = 3,54% |

Present in several = 4,92% |

Present in several = 1,45% |

|

Net profit |

€ 995 million |

€ 2 million |

€ 3 million |

-1 362 million € |

Airbus chart, interval W1. Source: xNUMX XTB.

Hugo Boss - owner of luxury brands of clothes, footwear and accessories. It is one of the largest clothing companies in Germany. In 2019, the company had over 14 employees. The company is valued at less than € 000 billion.

|

Hugo Boss |

2016 |

2017 |

2018 |

2019 |

|

revenues |

€ 2 ml |

€ 2 million |

€ 2 million |

€ 2 million |

|

Operational profit |

€ 279 million |

€ 348 million |

€ 355 million |

€ 345 million |

|

Operating margin |

Present in several = 10,36% |

Present in several = 12,73% |

Present in several = 12,69% |

Present in several = 11,95% |

|

Net profit |

€ 194 million |

€ 231 million |

€ 236 million |

€ 205 million |

Hugo Boss company chart, interval W1. Source: xNUMX XTB.

The components of the index also include: Knorr-Bremse (manufacturer of, among others, brake systems for rail vehicles), Nemetschek (software for architects and engineers) or Rational (manufacturer of professional kitchen appliances).

sDAX

Borussia Dortmund - it is a German football club. Polish fans associate him with three Poles: Piszczek, Błaszczykowski, Lewandowski. The company is valued at € 550 million. The fiscal year (FY) ends in June.

|

Borussia Dortmund |

2017FY |

2018FY |

2019FY |

2020FY |

|

revenues |

406 ml € |

€ 536 million |

€ 490 million |

€ 370 million |

|

Operational profit |

€ 9 million |

€ 32 million |

€ 22 million |

-46 million € |

|

Operating margin |

Present in several = 2,21% |

Present in several = 5,97% |

Present in several = 4,49% |

-12,43% |

|

Net profit |

€ 8 million |

€ 28 million |

€ 17 million |

-44 million € |

Borussia Dortmund chart, interval W1. Source: xNUMX XTB.

Zooplus - this is a German online pet products retailer (zooplus). The company focuses on selling pet food, supplements and accessories. They also sell products under their own brands, such as Purizon. They sell to over 30 countries around the world. The company is valued at around € 1,1bn.

|

Zooplus |

2016 |

2017 |

2018 |

2019 |

|

revenues |

909 ml € |

€ 1 million |

€ 1 million |

€ 1 million |

|

Operational profit |

€ 19 million |

€ 5 million |

-2 million € |

-15 million € |

|

Operating margin |

Present in several = 2,21% |

Present in several = 5,97% |

Present in several = 4,49% |

-12,43% |

|

Net profit |

€ 11 million |

€ 2 million |

-2 million € |

-12 million € |

Fielmann - is one of the largest optical salons in Europe and a leader on the German market. They sell frames for glasses of their own production (Fielmann) and external brands (Gucci, Ray-Ban). At the end of 2019, the company had over 770 stores, including 20 in Poland. The company is valued at around € 5,5bn.

|

Fielmann |

2016 |

2017 |

2018 |

2019 |

|

revenues |

€ 1 ml |

€ 1 million |

€ 1 million |

€ 1 million |

|

Operational profit |

€ 240 million |

€ 254 million |

€ 250 million |

€ 254 million |

|

Operating margin |

Present in several = 17,95% |

Present in several = 18,29% |

Present in several = 17,51% |

Present in several = 16,70% |

|

Net profit |

€ 166 million |

€ 168 million |

€ 169 million |

€ 172 million |

Fielmann chart, interval W1. Source: xNUMX XTB.

The sDAX index includes the largest sugar producer in Europe (Südzucker, in Poland it owns the "Cukier Królewski" brand), Deutsche Asset Management (including asset manager and supplier of ETFs from the "Xtracker" family) and the insurer Talanx AG (the main shareholder of the in Warta Poland).

German market - wide selection of ETFs

On the Frankfurt Stock Exchange, an investor can invest in over 1500 ETFs. You can invest in both the video games and e-sport industries (VanEck Vector Video Gaming and eSports UCITS ETF) as well as robotics and automation (iShares Automation & Robotics UCITS ETF USD). Below is a list of the 10 most popular ETFs in October 2020:

|

ETF name |

Turnover in October 2020 (million €) |

|

iShares Core DAX UCITS ETF |

1 500,92 |

|

iShares Core EURO STOXX 50 UCITS ETF |

407,55 |

|

iShares STOXX Europe 600 UCITS ETF |

293,58 |

|

iShares Core MSCI World UCITS ETF |

284,38 |

|

Xtrackers DAX UCITS ETF |

277,29 |

|

Deca DAX UCITS ETF |

212,96 |

|

iShares Global Clean Energy UCITS ETF USD |

194,84 |

|

iShares Core S&P 500 UCITS ETF USD |

191,09 |

|

iShares NASDAQ-100 UCITS ETF |

182,98 |

|

Xtrackers ShortDAX x2 Daily Swap UCITS ETF |

155,41 |

ETFs for German companies

You can invest in German companies through ETFs. Among the most popular are:

iShares MSCI Germany ETF (EEC)

-

- Issuer: Blackrock

- Annual fees: 0,49%

The fund has fairly low fees and tight spreads (0,03%). The fund manages $ 2,8 billion. EEC maps to the MSCI Germany index. This means that it holds both shares of large and medium-sized companies. As of November 25, the ETF had 64 companies in its portfolio. The 3 largest components of the ETF (SAP, Siemens, Allianz) have a share of the fund of 23,3%.

MSCI Germany ETF Chart, Interval W1. Source: xNUMX XTB.

iShares mDAX UCITS ETF (EXS3)

-

- Issuer: Blackrock

- Annual fees: 0,51%

The fund manages EUR 1,6 billion. EXS3 maps to the mDAX index. This means that it focuses on investing in the mid-cap segment. As of November 25, the ETF had 61 companies in its portfolio. The three largest components of the ETF (Airbus, Symrise, Zalando) account for 3% of the fund.

MDAX UCITS ETF Chart (EXS3), Interval W1. Source: xNUMX XTB.

iShares tecDAX UCITS ETF (EXS2)

-

- Issuer: Blackrock

- Annual fees: 0,51%

The fund manages EUR 885 million. EXS2 maps the tecDAX index. This means that it focuses on investing in German technology companies. As of November 25, the ETF had 30 companies in its portfolio. The 3 largest components of the ETF (Infineon, Sartorius, Deutsche Telekom) have a 33% share in the fund.

TecDAX UCITS ETF (EXS2) chart, interval W1. Source: xNUMX XTB.

Xtrackers DAX UCITS ETF (XDAX)

-

- Issuer: DWS

- Annual fees: 0,09%

The fund manages over 3,1 billion euros. XDAX maps the DAX index. The benchmark is the DAX 30 index. As of October 30, the ETF had 30 companies in its portfolio. The three largest components of the ETF (Linde, Siemens, SAP) account for 3% of the fund.

DAX UCITS ETF (XDAX) chart, interval W1. Source: xNUMX XTB.

Summation

The German stock exchange is an interesting place to diversify your investment portfolio. Germany is not only the automotive industry. The range of industries is really wide. Interesting companies will be found by anyone looking for growth companies from the modern technology industry, as well as an investor looking for companies with strong foundations, which generously share profits with shareholders. Another benefit for investors from investing in Germany is access to a large number of ETFs. There are over 1500 on the Frankfurt Stock Exchange.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)