Hopes for a solid 2021 - the results of rolling over commodity contracts

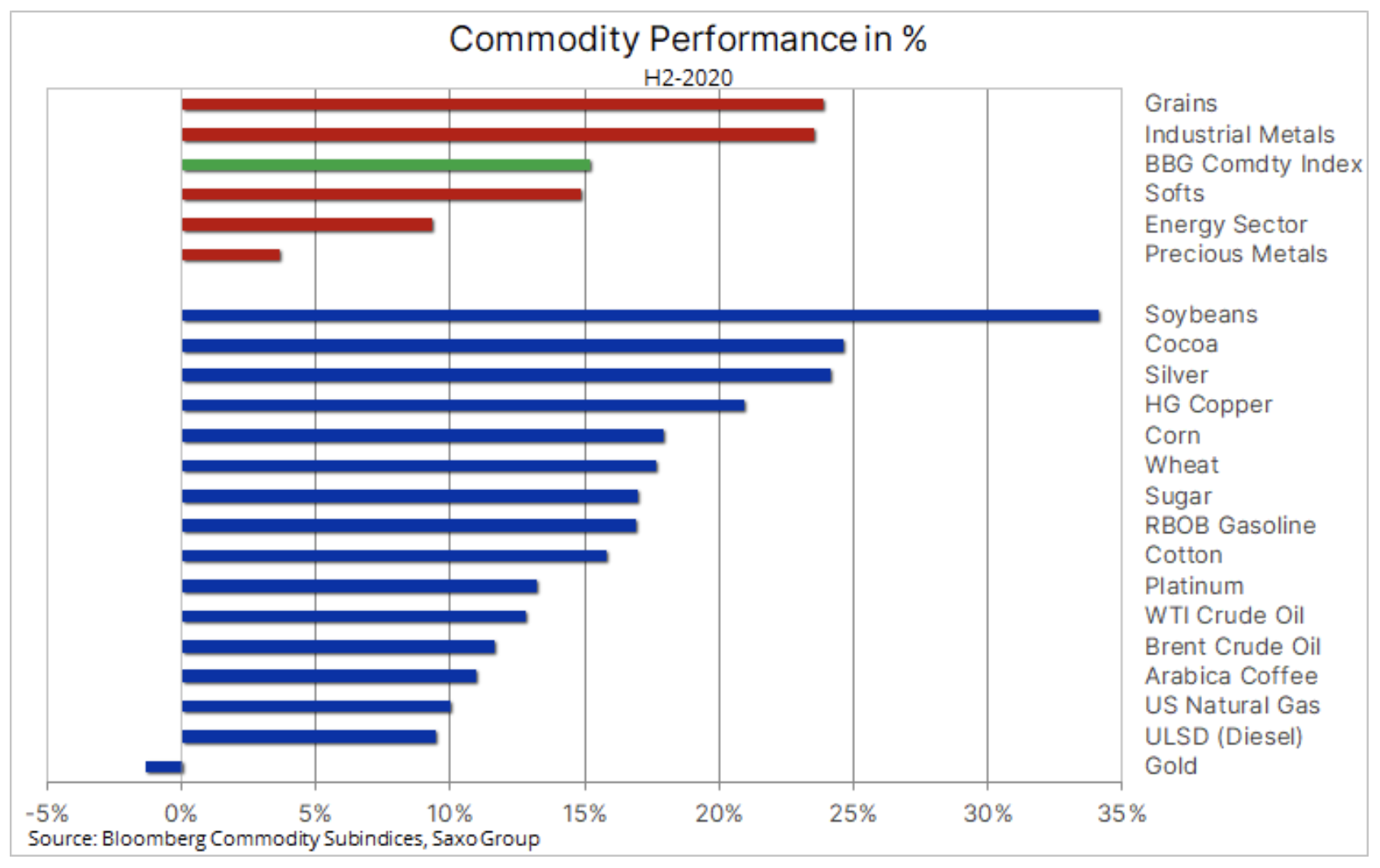

In the second half of 2020, there was a strong boom in the commodity markets. As a result, the Bloomberg commodity index gained 15%. Several long-term factors contributed to this. In addition to the natural normalization following a Covid-19-related decline earlier this year, the sector has also benefited from a strong recovery in demand in Asia - most notably in China - and the fact that concerns over weather conditions pushed up agricultural prices. In addition, investors focus on the effects of fiscal and monetary spending, and thus the risk of a weakening dollar and rising inflation.

For the first eight years of the 160st century, I worked in London for a multi-asset trend follower (CTA) with a high commitment to commodities. During this period, I personally witnessed the rise of China as an economic power, absorbing all kinds of raw materials to feed its growing economy. These were times of prosperity when the scarcity of supply allowed prices to skyrocket, and the Bloomberg commodity index climbed as much as 2000% from 2008 to its peak in XNUMX, before the global financial crisis led to the collapse that the sector has so far struggled to stand on your feet.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

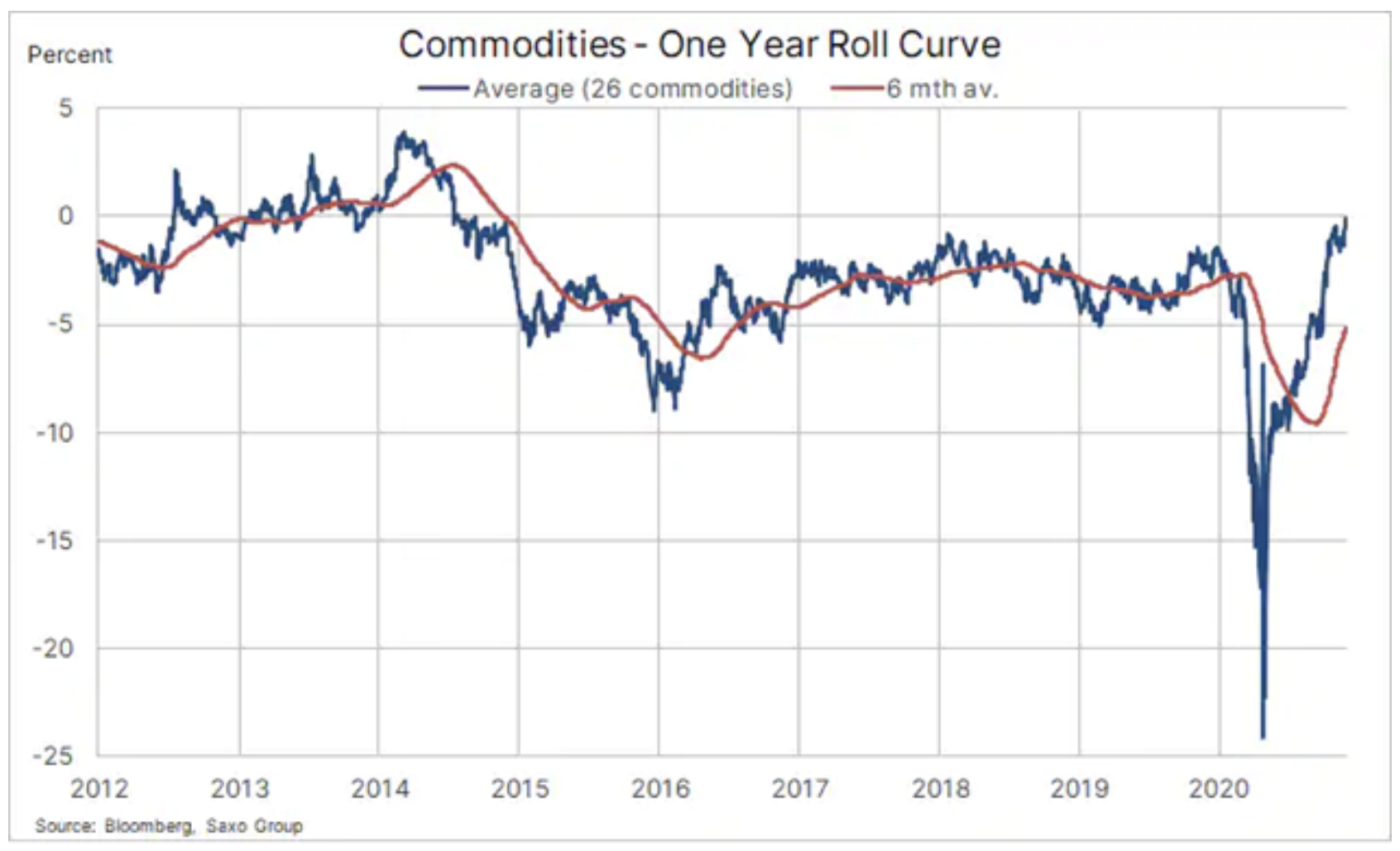

The surge in prices during that decade provided manufacturers with a powerful boost, making it possible to increase efficiency and production. The 2008 crash was followed by ten years of technological innovation that allowed the US to increase shale oil production, while farmers managed to increase both yields and the production of key crops. Along with the growing number of mining activities, this led to an almost six-year period, which continues to this day, in which large supply meant that many raw materials were in a constant state of report (contagion), i.e. the structure of the futures curve in which the spot price is the lowest due to oversupply.

During this period, long-only portfolios, reflecting the performance of major commodity indices, such as the Bloomberg General Commodity Index or the S&P GSCI Energy Index, were exposed to the risk of the annual cost of holding and rolling positions (the so-called negative carry, i.e. the cost of holding a position). exceeded the profits from it). Combined with an overall stronger dollar and reduced inflation risk, this has led to nearly a decade of low returns. However, over the past few months, we have seen a shift in attitude towards investment in raw materials.

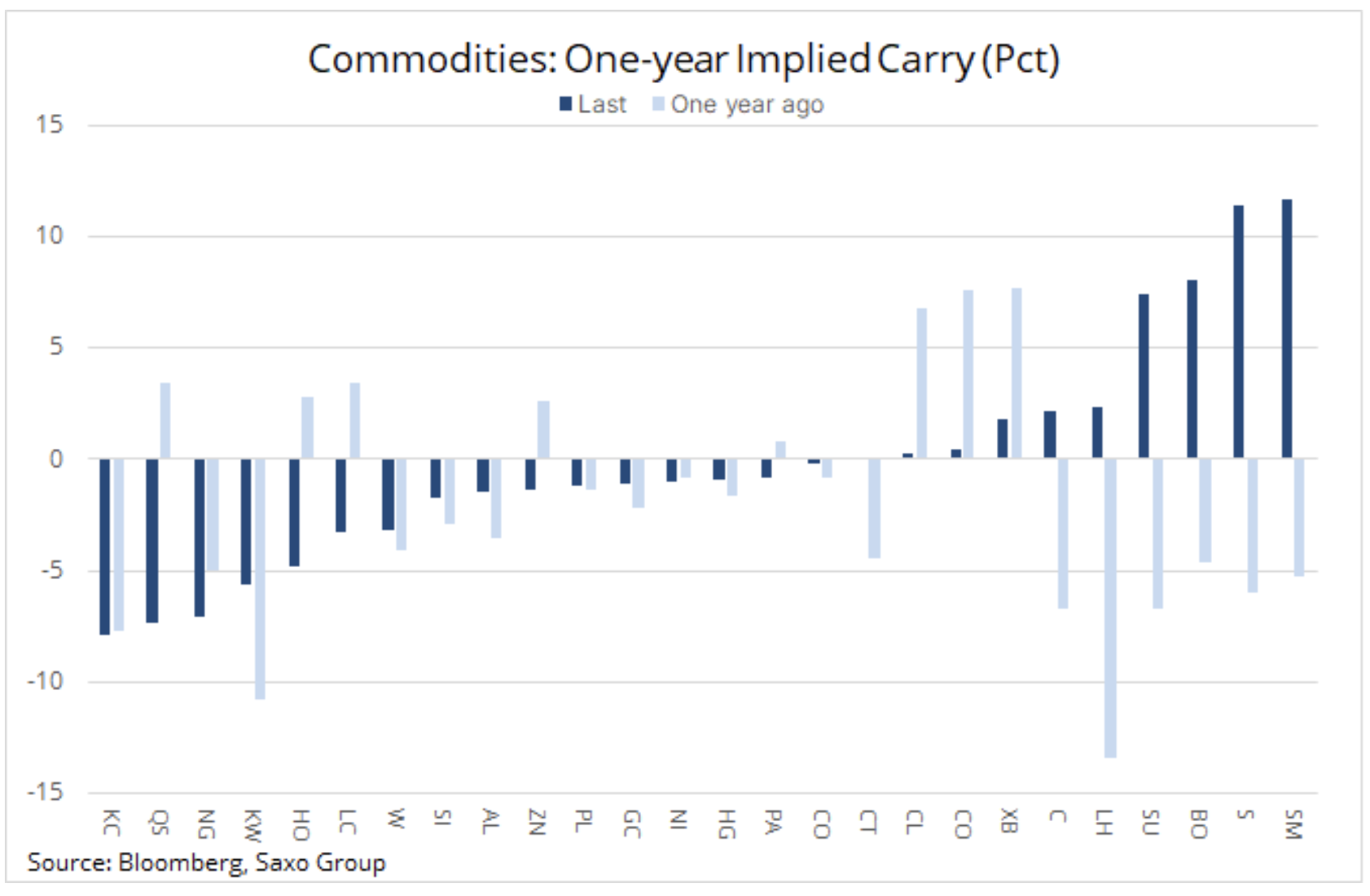

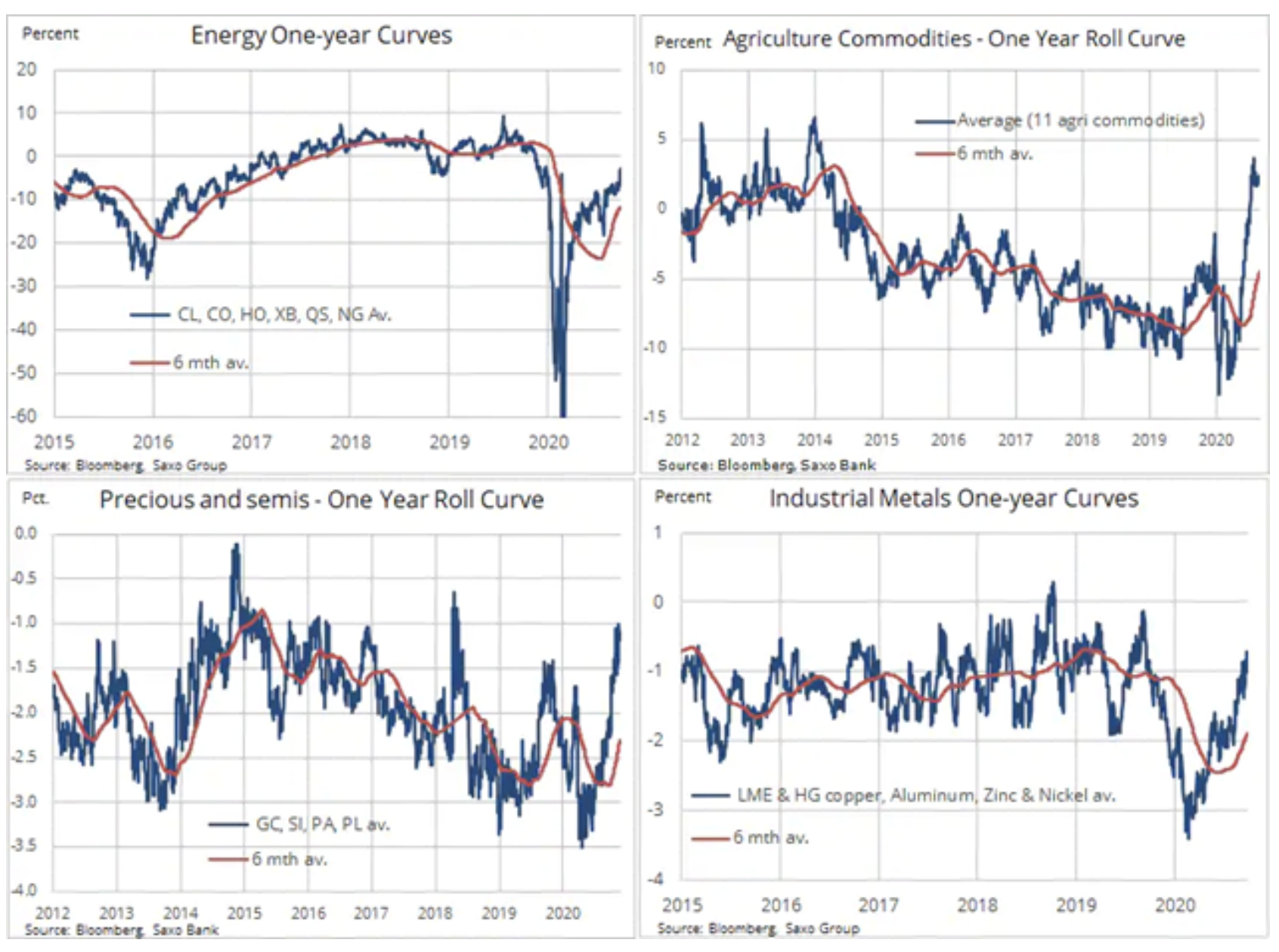

The agricultural sector has strengthened significantly amid worries about the weather and solid export demand, metals have once again been swallowed up by China, and the energy sector has begun to prepare for a recovery in global fuel demand after the pandemic ends. There is a growing demand for precious and semi-precious metals, which can be a hedge against political errors and the risk of reflation. The impact of these phenomena on the futures curves is presented in the table above.

A year ago, the cost of holding (and rolling) positions in corn, sugar, soybean, soybean oil and soybean meal futures exceeded 5% over a 12-month period. These goods are now positive carry between two and more than ten percent. In addition, other commodities saw a significant improvement, with arabica, diesel and natural gas being the most expensive to maintain from a rolling cost perspective.

For 26 of the most popular commodity futures, the cost of the annual rollover has returned to zero for the first time in more than six years. The graphs below show positive developments in all three sectors, primarily in the agricultural sector, secondly in metals - both precious and industrial - and energy. The energy sector, in particular, has seen significant improvement since November 9, when the first of many information on a vaccine gave rise to the prospect of a return to normal in 2021.

For 2021, we envisage fundamental support for energy and industrial metals as the cyclical recovery spreads beyond Asia as the pandemic ends. The agricultural sector may face the risk of rising prices as weather problems will drag on into the new year, mainly due to the lingering La Ninä phenomenon, already making life difficult for South American farmers. Finally, we do not expect an end to the gold boom, given that central banks will continue to finance interest rates at the lowest possible levels, the dollar will be more and more exposed to the risk of depreciation, and the need to hedge against the rising risk of inflation will continue to support not only the zloty and semi-precious metals, but also raw materials as such.

From an investment perspective, exposure to the commodity sector can take the form of ETF and/ or CFD following major indexes.

The table below lists the three largest stock exchange funds, but there are many more. However, for most of them, the underlying exposure is one of the three indices mentioned. Note that energy and metal preferences are best expressed by choosing the S&P GSCI index, which is highly energy-exposed (62%), but if your primary goal is to hedge against inflation in general, you'd better choose the Bloomberg Commodity Index due to its greater diversification and less exposure to raw materials such as energy, which still characterize negative carry.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)