Social trading in practice - Choice of technology and technical aspects

Signal copying, fund management and various forms of Social Trading have been around for some time. The beginnings of this way of trading were very simple and "wild". Investors tried to copy transactions from one account to another by running a special machine on both. This algorithm was supposed to duplicate the actions buy, sell, close based on logs from the platform. Gradually, the EAs were expanding more and more and it made more sense.

Finding the right, effective trader who will record regular profits is undoubtedly a difficult task. However, contrary to appearances, it is not only depends on whether we, while copying his actions, we will also earn. The technology used is also very important, which will be used to duplicate the position.

Delays, server speed

The speed of data transfer from one account to another is one of the most important technological aspects in transmitting transactional signals. This is due to the fact that any slips will open the position at a worse price, and with a large difference they can even hinder or prevent the setting of orders Stop Loss and Take Profit. Small time slips in copying transactions will play a key role mainly in scalping and short-term strategies. With such strategies, as a rule, there are more positions and they end up with less profit. This makes the loss of a single pip already a larger share of the potential profit.

Before trading on real money, it's a good idea to test the speed of the demo, then the small real capital and check the opinions on the internet or talk about it with the service itself.

Before trading on real money, it's a good idea to test the speed of the demo, then the small real capital and check the opinions on the internet or talk about it with the service itself.

Sometimes possible delays in transmitting signals or slow operation of the platform are not caused by the fault of the broker / website creator. It may well be due to inefficient internet bandwidth, firewall running on the computer or temporary overload somewhere on the road Server <-> Platform. There may be individual time shifts during the transaction. However, the fact that it is notorious at different times of the day should be worrying.

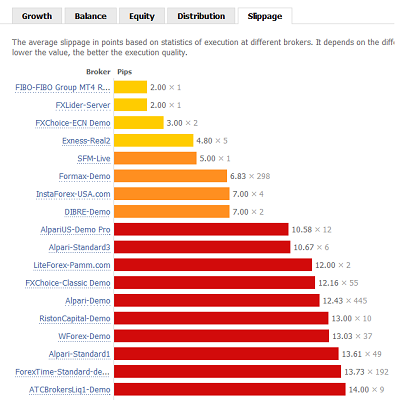

Social Trading website created by MetaQuotes within the MetaTrader 4 platform, it brings together traders who invest funds with various brokerage companies using their software. Due to the different locations of these companies' servers, data transfer may be extended in time in certain configurations. Additionally, there is the issue of different quotes depending on the brokers, which also affects possible slippages. To make your investors aware of the scale of such imperfections, when selecting each signal provider in the tab Slippage the average estimated estimate is shown depending on which server we will copy transactions to.

Platform activity and Social Trading

Some websites limit the number of suppliers that we can connect to our account at the same time. Such restriction is intended to limit the use of funds on the account. Additionally, it is supposed to prevent the platform from overloading caused by opening multiple positions (10 providers who scalp could definitely influence this). It is inconvenient for the investor as he has to open new accounts and divide his capital between them.

Security and configuration options

An extensive panel for configuring activities that will be duplicated on the account and security measures protecting at least some of investors' funds are undoubtedly important aspects of Social Trading and PAMM accounts. In a situation where we indirectly give access to third parties to take actions on our account, we have limited control over what happens with funds and positions. It is impossible to monitor the platforms around the clock. And yet it is not known when the trader will open the transaction and how it will proceed. Due to this danger, we will need extensive configuration options for copying transactions.

A trader operates with a certain capital and transaction volume. We do not necessarily have to have the same deposit and the willingness to conclude equally large (or small) transactions. The possibility of different configuration of volume copying according to the value of the bill, multiples of the 'original' volume or indicating a fixed value of the lot will undoubtedly be important. This will allow us to adjust the level of risk accepted by us accordingly.

It has a very interesting solution Dukascopy, which allows you to set the Stop Loss Level (SLL) that applies on the invoice. For example, we have $ 10 in our account and we set SLL at $ 000. Once our account loss reaches this level, open trades will be closed. In addition, the platform trading option will be suspended until we unlock it ourselves.

On the MT4 platform, you can protect yourself similarly with the help of a machine with a similar function (eg Swiss Army EA) but without the possibility of hanging the trading.

Social Trading and player statistics

Extensive statistics (and their analysis from various angles) that will allow us to choose the right signal provider is the basis. Access to data such as the number of transactions concluded, the rate of return, capital drawdown and the like should be standard. If someone provides a very limited amount of information, it will make it difficult for us to choose the right signal provider. It may also suggest that the website creator himself does not want us to see too much. The greater the range of information, the better - of course, as long as we can interpret it and know what to pay attention to.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![SyncTrading TeleTrade - Another week with profit [TEST # 3] synctrading teletrade test week 3](https://forexclub.pl/wp-content/uploads/2020/10/synctrading-teletrade-test-tydzien-3-300x200.jpg?v=1602656245)

![SyncTrading TeleTrade - First positions, first profits [TEST # 2]](https://forexclub.pl/wp-content/uploads/2020/10/synctrading-teletrade-test-2-300x200.jpg?v=1601987632)

![SyncTrading TeleTrade - We choose traders [TEST # 1] synctrading teletrade test 1](https://forexclub.pl/wp-content/uploads/2020/09/synctrading-teletrade-test-1-300x200.jpg?v=1601361410)