Earnings season in the US has started, this will be the number one topic from now on

Quarterly earnings season kicked off on Wall Street on Friday. For the next 2-3 weeks, this will be the main topic that will absorb investors' attention in most stock markets. Not only in New York.

Wall Street's earnings season has begun

The start of the American earnings season for Q2023 2020 can be considered successful. Although the season itself will be very weak. For Wall Street companies, this will be the worst season since mid-XNUMX, when the pandemic was raging around the world. But more on that in a moment.

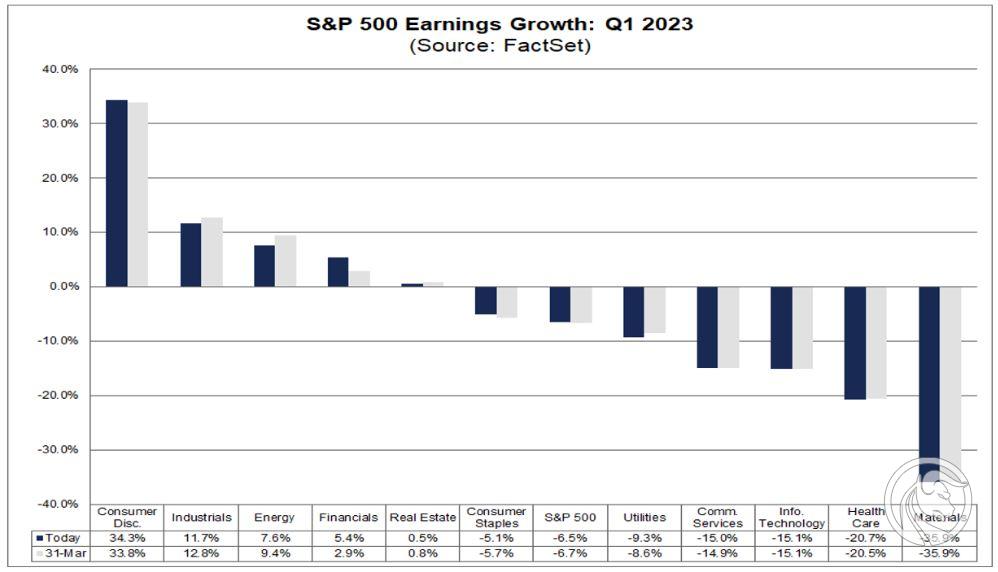

Citigroup shares rose 5,48 percent on Friday. up to $49,56. Bank exchange rate JPMorgan Chase while it increased by as much as 7,55 percent. up to $138,73. Strongly positive reaction to the expected worst earnings season since Q2020 2023. Because it's going to be a bad season. According to the forecasts collected by FactSet, in the first three months of 500, the profits of companies from the S&P6,5 index were 20220 percent higher than in the first three months of 30. lower than the year before. This is the worst result since the aforementioned "pandemic quarter" from 2, when their decline exceeded 500 percent. This is also the second consecutive quarter when the annual growth rate of profits of companies included in the S&PXNUMX index is declining. And not the last. It is estimated that the negative dynamics of profits will also be maintained in the second quarter of this year. The good news is that according to forecasts, in the fourth quarter of 2023, corporate profits will again grow by about 10%. per year and in this area will last at least until the end of 2024.

Profit forecasts for S&P500 companies. Source: factset

Positive revenue forecasts

The revenue forecasts of listed companies look much better. According to data collected by FactSet, they are to increase in the first quarter of 2023 by 2 percent. The financial sector will be the best in this regard. Their revenues are expected to increase by more than 10%.

The results for the quarter ended March 31 will be one of the elements of quarterly reports published by American companies analyzed by investors. Another will certainly be how the company's margins developed in the high inflation environment, and the third element that investors should look at will be the results forecasts for the coming quarters. And it is this mix of factors that will determine the overall impact of the earnings season on Wall Street in the coming weeks (and indirectly on many other equity markets). Here, undoubtedly, a big plus for the stock market bulls is that market expectations are quite pessimistic. Hence, at least theoretically, it will be easier to get a positive surprise than a negative one. Especially that investors can quickly come to the conclusion that the deteriorating results of companies will be another argument for the fact that the Fed may cut interest rates faster in the future.

The current situation on the US500 daily chart does not yet give a clear answer to the question of how Wall Street might react to the earnings season. Yes, after a strong turnaround in mid-March, which then resulted in a breakthrough of the 50- and 200-day averages, the demand side has an advantage. However, on the other hand, the proximity of the resistance zone of 4195,39-2439 points. does not allow to put forward an unambiguous thesis that the stock market will continue the increases observed for a month. There is a shadow of a risk that at the end of April it will make a strong downturn again, as it did earlier in early December and early February. However, now the chances of this are less than in the two cases described.

US500 daily chart (S&P 500 Index CFD). Source: Tickmill

On Tuesday, before the start of the session in the US, quarterly reports will be published, among others by Bank of America, Goldman Sachs and Johnson & Johnson. After the session, Netflix will do it. By the end of the week, the results will be published by such well-known companies as IBM, Morgan Stanley and Tesla. In total, 14 percent will publish reports by Friday. all companies from S & P500 index. However, the real flood of reports will be in the next week, when they will be published by over 40 percent. of these companies.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response