JP Morgan Chase - one of the most famous investment banks [Guide]

The United States is now home to some of the largest banks in the world. Their scale is incomparable with most European banks. Over the years, American banking has developed a division into investment and commercial banks. Investment banks are known at least by name to most stock market participants. Many of them have been labeled "market manipulators". Defenders of investment banks, on the other hand, argue that they help better allocate capital in the economy. Sometimes, thanks to their financing, start-up businesses have a chance to multiply their scale. There are also universal banks that combine investment and commercial activities. In today's article, we will present the history of the bank JP Morgan.

JP Morgan - history

Currently, the JP Morgan Chase bank is the result of the merger of JP Morgan with Chase Manhattan Bank in 1996. In the following years, the acquisition of the Capital One bank took place (2004) and the rescue purchase of two banks that were in huge financial problems. These banks were Bear Stearns and Washington Mutual. Both banks were purchased in 2008, during the bursting of the US real estate bubble. The history of the bank is related to one of the greatest bankers and investors in the history of JP Morgan. It is worth bringing the history of the creation of this one of the largest banks in the world closer.

XNUMXth century – between London and New York

JP Morgan. Source: wikipedia.org

We will not describe the history of each bank that is currently part of the company. Instead, we will focus on the "branch" from which the name comes - the JP Morgan & Co. bank. The bank was founded in 1871 by a well-known financier John Pierpont Morgan (more often the beginning of the name was shortened to JP). Despite this, some researchers look for the origins of the bank in 1854. It was then that JP Morgan's father, Junius S. Morgan, joined the London bank to form Peabody, Morgan & Co.).

In 1864, Junius took control of the firm and renamed it JS Morgan & Co. The young Morgan opened his own company in New York that same year. Initially, she dealt with treasury bonds trading and currency exchange. Unlike his father, JP Morgan was not afraid of taking risks. For this reason, Junis Morgan sometimes did not finance his son's ventures as too risky. However, thanks to his father's connections, JP Morgan's company raised capital from Great Britain to finance ventures in the booming United States. The sectors to which capital flowed were railway, industrial and steel industries. They all needed additional capital to scale their business.

A new chapter - JP Morgan takes over

After the death of his father in 1890 JP Morgan combined its London and New York operations into one company. JP Morgan & Co. in the late 1901th and early 1,4th centuries it was one of the most important investment banks in the United States. The bank provided the financing that allowed the establishment of the United States Steel Corporation. The company was founded in XNUMX as a result of the merger of the Carnegie Steel Corporation and the Federal Steel Company. At that time, the company with the largest capitalization in the world ($ XNUMX billion) was founded. It was also the largest steel producer in the world.

JP Morgan grew in strength, which allowed it to increase its influence on the economic policy of the American government. The bank's reputation as a key element in the stability of the American financial sector was confirmed in 1907. During the Panic of 1907, JP Morgan helped save some New York banks from bankruptcy. At the same time, he managed to take over a competitor of TCI by US Steel, taking advantage of the financial problems of one of the banks.

6 years later JP Morgan was one of the supporters of the appointment Federal Reserve. It was to be the central bank tasked with directing monetary policy and becoming the lender of last resort (POI). POI was to provide liquidity injection in a situation when the banking market is unstable. In theory, this was supposed to smooth out economic cycles and reduce the "sharpness" of financial crashes. JP Morgan died in the same year in Italy, so he did not live to see the effects of establishing a central bank. JP Morgan's body was flown to New York. When the coffin with the body reached the Big Apple, trading on Wall Street was halted for two hours.

1914 - 1933: war and the Roaring Twenties

After the death of JP Morgan, the bank continued to operate in the investment field. The period of World War I was used to rebuild its position in Europe. The bank became the sole issuer of war bonds for France and Great Britain. This made it easier to finance the Entente's war effort against the Central Powers.

After the war, there was an economic recovery in Europe and the beginning of isolationism in the United States. The period of the XNUMXs was also marked by credit expansion in the global economy. The boom led to the coining of the term Roaring Twenties". However, in 1929 he was billed for living beyond his means. Great Depression caused a sharp drop in share prices. Investment banking also froze. What's worse, for JP Morgan, political circles wanting to regulate the banking market more strongly began to come to the fore. As a result, it was approved Glass – Steagall Actwhich forced banks to separate commercial and investment banking. JP Morgan had to choose.

1933 – 1989: as a commercial bank

JP Morgan decided to operate as a commercial bank. This was due to the mood that prevailed at the height of the Great Depression. The market for investment services froze, and the prospects for commercial banking seemed much better. The investment business was spun off by two people working at JP Morgan: Henry Sturgis Morgan (JP Morgan's grandson) and Harold Stanley. The investment business was named Morgan Stanley.

JP Morgan became a medium-sized commercial bank that was unable to compete with the largest US financial entities. In 1959, the bank merged with the Guaranty Trust Company of New York to form the Morgan Guaranty Trust Company. The company operated under this brand until the XNUMXs.

1989 – 2008: golden years of investment banking

In 1989, the impact of the Glass-Steagall Act was limited, which allowed JP Morgan to return to the investment banking market. Very quickly, the bank entered the forefront of the largest investment banks. The symbol was the merger of Exxon and Mobil, which created the largest petrochemical company listed on the stock exchange. JP Morgan was the sole adviser on this merger.

Jamie Dimon. Source: wikipedia.org

In 2000, there was a merger between JP Morgan and Chase Manhattan. The merger created one of the largest banks in the world. Its new name was JP Morgan Chase Co. Four years later, the bank merged with Bank One, but left the name unchanged. As a result of the merger with Bank One, there was a reshuffling of senior managers. JP Morgan Chase Co was joined by Jim Dimon, who served as COO and President. A year later, Jamie Dimon became CEO of the entire company. It fulfills this role to this day.

The boom period on the real estate market and the boom on the stock market resulted in golden years in investment banking. Huge earnings attracted the most talented students from the best universities. Mathematicians and physicists were employed to create increasingly sophisticated derivatives.

In 2008, the financial market will shake to its foundations. Many well-known companies began to have problems with liquidity: Bear Sterans, Washington Mutual or Lehman Brothers. The first two of them were acquired by JP Morgan Chase Co. This made it possible to increase the scale of operations and acquire competitors at a much lower price than would have been possible before the crisis.

2009–present: A new reality

Since 2009, banking around the world has been uphill. Regulations are multiplying (especially in Europe), which means that the profitability of banking activities is significantly decreasing. What's more, fintechs are entering the financial market more and more boldly, trying to "steal" the most profitable activity of banks.

On the other hand, the policy of ultra-low interest rates allowed investment banks to generate above-average profits. This was helped by a huge bull market on the stock market and a large number of IPOs and mergers.

Operating activities

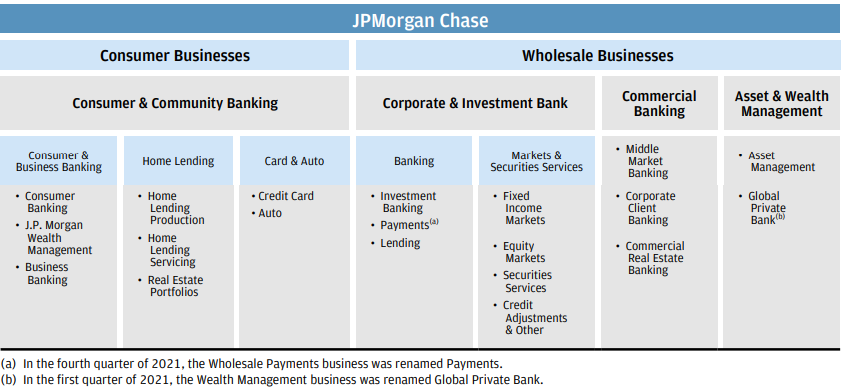

It is one of the largest banks in the United States. It has over $3 billion in assets and $700 billion in equity. JPMorgan Chase operates in 294 segments:

- Consumer & Community Banking (CCB),

- Corporate & Community Bank (CIB),

- Commercial Banking (CB),

- Asset & Wealth Management (AMW).

In the rest of the article, we will briefly look at the different parts of JPMorgan Chase's business. We took the company's last quarter results to the workshop.

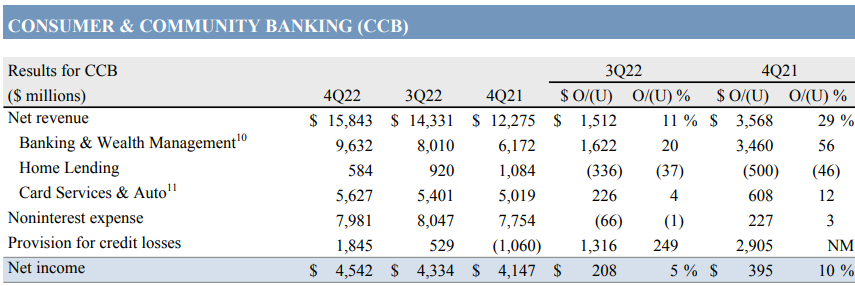

Consumer & Community Banking (CCB)

The revenues of the CCB segment in Q2022 15,8 amounted to USD 29,1 billion. This meant an increase of 56% y/y. The most important part of the business in this segment is Banking & Wealth Management. Revenues from this source increased by as much as XNUMX% during the year. The company explained that the reason for such an increase in revenues was higher margins on deposits.

The segment of loans and mortgage loans performed very poorly. Revenues from this segment amounted to only USD 584 million and were 46% lower than in the previous year. The poor macroeconomic environment certainly did not help. The slowing economy and rising interest rates caused mortgage products to sell less.

The Card Services & Auto segment grew by 12% y/y to $5,627 billion. The reason was higher profit from card handling, which more than covered the slower developing car segment.

Despite the inflationary environment, the company managed to keep non-interest costs in check. They amounted to USD 7,981 billion and were 3% higher than a year earlier, but almost USD 70 million lower than a quarter ago.

The results were weighed down by higher write-offs for losses on loan and loan portfolios. Despite this, the net result increased by 10%, i.e. USD 395 million, during the year.

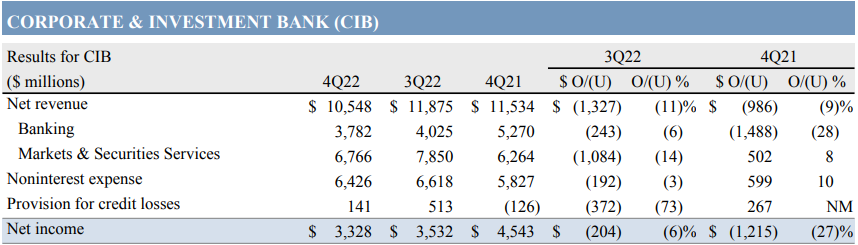

Corporate & Community Bank (CIB)

Corporate and investment activities generate less revenues and profits than the CCB segment. Corporate & Community Bank revenues amounted to USD 10,5 billion, which meant a decrease by 9% y/y. The culprit was the banking segment, with revenues of $3,78 billion. This meant a decrease by as much as USD 1 million, i.e. by 488% y/y. In the banking segment, investment banking performed very poorly, with revenues falling by 28% y/y to USD 57 billion. Banking's results would have been worse had it not been for the growth of the payments segment by approximately $1,4 million.

In the Markets & Securities Services section, revenues increased by USD 502 million, i.e. by approximately 8%. This part of CIB's business generated $6,8 billion in revenue. Revenue generated from fixed rate products amounted to $3,7 billion, an increase of approximately 12%. The reason for the increase was higher revenues generated on interest rates and currency transactions. This more than covered the weaker sales related to the offer of structured products. In turn, the equity market business generated $1,9 billion in revenue, which was similar to the previous year. Securities services performed well, growing 9% y/y to $1,2bn. The reason was the increase in interest rates, which more than covered the lower deposits of customers.

Non-interest expenses amounted to $6,4 billion, up 10% y/y. The reason was an increase in costs related to revenues. In addition, structural costs have increased. On the other hand, the advantage is the decrease in costs related to settlements and court disputes.

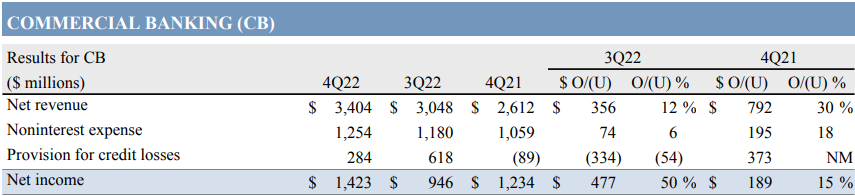

Commercial Banking (CB)

The CB segment grew by $792 million (or 30%) during the year to $3 million. The reason for the increase was higher interest margins, which more than covered lower revenues from investment banking.

Non-interest expenses increased by 18% y/y, slower than revenues. This is a positive signal because it means that the company was protecting its margin. Unfortunately, in Q2022 284, there were losses in the loan portfolio worth USD XNUMX million. The reason for the write-offs was an increase in non-performing loans.

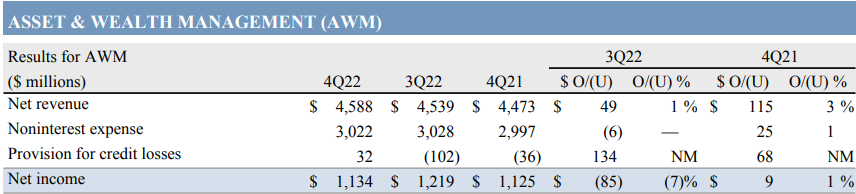

Asset & Wealth Management (AMW)

Net revenues from the asset and wealth management segment increased y/y by 3%, i.e. USD 115 million. As a result, the segment generated $4,6 billion in net revenue. The reason for the increases was the higher margin achieved on customer deposits, which more than covered the weaker commissions for performance and asset management. Non-interest expenses increased by only $25 million, i.e. by approximately 1% y/y. Lower costs depending on the level of revenues or volume helped in part.

Assets Under Management (AUM) amounted to USD 2 billion and were lower by 800% y/y. The reason was the market situation (declines on the stock and bond market) and a partial outflow of customer funds. The decline would have been greater had it not been for the inflows into long-term products offered by JPMorgan Chase.

How to invest in JPMorgan Chase stocks?

You can invest in JPMorgan Chase through a brokerage house with access to the American stock market. Thanks to this, the investor will be able to buy the bank's shares. Some brokers also allow you to invest in JPMorgan Chase shares with:

Let's look at the basic financial data of the bank:

| JPMorgan Chase | 2018 | 2019 | 2020 | 2021 |

| revenues | $ 109,029 billion | $ 115,627 billion | $ 119,475 billion | $ 121,685 billion |

| Net profit | $ 32,474 billion | $ 36,431 billion | $ 29,131 billion | $ 48,334 billion |

| EPS | 9,56$ | 11,31$ | 9,45$ | 16,00$ |

| DPS | 2,98$ | 3,83$ | 4,12$ | 4,26$ |

Source: own study

The company is currently valued at $408 billion. This means the company is trading at 8,4 times its 2021 profit.

JP Morgan chart, interval W1. Source: xNUMX XTB.

Forex brokers offering ETFs and stocks

How to buy JP Morgan Chase shares? Of course, the simplest option is to buy only shares, but for people who want to well diversify and balance their portfolio, investing in dividend companies through entire ETFs will be a better choice. An increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

When investing in bank shares, you need to be aware that you buy trust in the institution. The collapse of Lehman Brothers showed that it is impossible to estimate the risk to which a bank is exposed. No one knows what is actually held in assets during the bank's daily operations. This applies in particular to investment activities. Moreover, there is a network risk. The collapse of an important financial institution can "infect" other banks as a result of mergers. This was evident during the subprime crisis.

On the other hand, JPMorgan has proven more than once that in difficult periods for the sector it is able to take advantage of emerging opportunities and take over competitors at a really attractive price. You should be aware that the mentioned bank is not growing too fast. Revenues between 2018 and 2021 increased by 11,6%. On the other hand, JPM shares can be an interesting idea for dividend portfolio. Every year, the bank pays out a dividend, which is also growing all the time. Between 2018 and 2021, the dividend per share increased by 42,95%.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![JP Morgan Chase - one of the most famous investment banks [Guide] jp morgan chase](https://forexclub.pl/wp-content/uploads/2023/02/jp-morgan-chase.jpg?v=1675281125)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![JP Morgan Chase - one of the most famous investment banks [Guide] chat gpt](https://forexclub.pl/wp-content/uploads/2023/02/chatgpt-102x65.jpg?v=1675338680)

![JP Morgan Chase - one of the most famous investment banks [Guide] Nasdaq index](https://forexclub.pl/wp-content/uploads/2020/06/Nasdaq-indeks-102x65.jpg?v=1591792351)

Leave a Response