The resumption of the bull market resulted in numerous breakouts

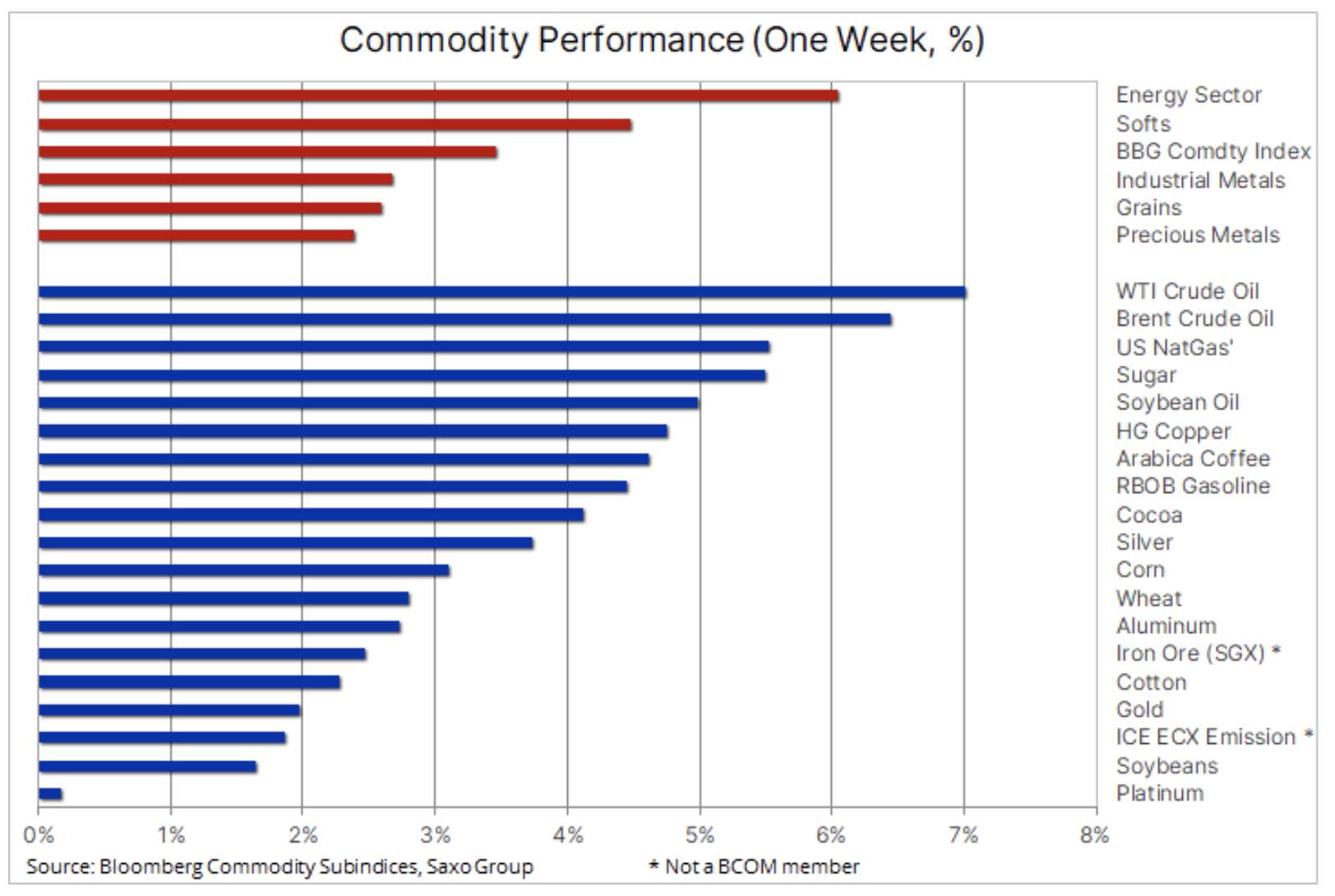

The commodities sector is showing a strengthening again: after six weeks of consolidation, the Bloomberg commodity index recorded its best week in four months. While all three sectors were positively influenced by individual reports and market developments, the overall performance also supported the surprising decline in US Treasury yields and the accompanying dollar weakness.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

A range of key commodities, from crude oil to copper and gold, have broken above the previous ranges, potentially signaling a new momentum that could attract more speculative buyers. While the global number of new daily Covid-19 infections appears to be hitting record levels, the market is encouraged by solid economic data from the world's two largest economies.

Petroleum

Clothing was on track to record its best weekly result since early March; both WTI and Brent crude oil broke out of the consolidation range. Strong economic data from the United States and China - two of the world's largest oil consumers - bolstered the positive demand forecasts from OPEC and the International Energy Agency. Despite the short-term challenges of Covid-19, the outlook for demand for 2021 in both countries has improved due to the dynamic recovery expected in the second half of the year. Production cuts in OPEC + have contributed to a rapid reduction in the significant overhang of global oil stocks accumulated in the past year. Combined with improving vaccination rates, this had a positive impact on the mobility and fuel demand prospects in the second half of the year.

A potential risk to the latest price rebound attempts lies in the possibility of increasing production in the United States and resuming negotiations on the Iranian nuclear program, which could result in a further increase in oil sales beyond that already recorded since Biden's presidential election. In addition, a number of countries, including India, are facing a sharp increase in the number of Covid-19 cases, which could put the global number of new infections at an all-time high.

After breaking out of a month long consolidation bracket, Brent crude oil will seek to continue this move with the price potentially hitting the new range between $ 65 and $ 70, but not higher until the current tide is contained as the risk of spreading the virus threatens positive forecasts of demand growth in the second half of the year.

Copper

One of the commodities with the most robust fundamental outlook, it also broke above the previous consolidation range of between $ 4 and $ 4,2. This was in response to the Goldman Sachs report "Green Metals - Copper Is The New Oil", which raised price forecasts and indicated that by 2025 copper may gain over 60%.

The green transition is a key source of increased demand as electric cars and renewable energy projects such as solar and wind proliferate. In the forecast, both Goldman and the Trafigura capital group warn that in the next few years the market will experience a "drastic" shortage of copper, unless there is a significant increase in prices resulting in an increase in supply. The high initial level of investment expenditure and the period of 5-10 years from the decision to invest in production may extend the period of mismatch between growing demand and inelastic supply.

The biggest challenge in the short term is the current events in China, which is the world's largest consumer of this metal. The People's Bank of China restricts liquidity to contain asset price growth through leveraged accounts. The stock market has suffered the most so far: the CSI 300 has lost 18% since it hit its ten-year high in February this year.

Gold

Gold - the commodity most sensitive to changes in interest rates and the dollar exchange rate, rose above the resistance level at USD 1 / oz - we emphasized the importance of this level in recent analyzes. While interest rates and the dollar are taking the overall direction, it is clear that the loss of momentum in recent months has been the main reason cash managers reduced upward futures contracts by 765% in early March from their February peak.

However, there was a return of buyers last month, and the latest rejection below $ 1 resulted in a 680% increase in net long position to 53 million ounces in the week ending April 7,7. As you can see in the chart above, a continuation of the break would significantly improve the technical outlook and potentially trigger a new momentum, and with it, investor demand for both futures and listed funds.

Crops

The Bloomberg Crop Index recorded another nearly five-year high on strong demand as farmers in the United States, Canada and Europe are battling drought early in the seeding and growing season. Added to this are lingering concerns about the situation in South America and the risk of a further decline in global inventories. As a result, maize price hit an eight-year high, while spring wheat (Minneapolis) futures hit an almost four-year high; The wheat listed on the Chicago Stock Exchange is also showing some impetus.

Wood

The average cost of building a new home in the United States rose by more than $ 24 due to rising timber costs. After many years of low prices, supply was limited and sawmills closed; the unexpected boom did not come until last year as the pandemic and lockdowns favored repairs, renovations and the purchase of larger homes. The severely limited supply across the entire timber supply chain has caused timber futures, which currently hit a record $ 000 per 1 plank feet, to exceed the average price of the past five years by more than $ 260.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)