XTB – income from foreign exchanges will be included in PIT-8C

In August, the Head of the National Tax Administration changed the individual interpretation related to the settlement by XTB clients of income from foreign exchanges achieved in a given tax year. As a result, the process of settling income from investments in shares and ETFs listed on foreign stock exchanges will be even simpler.

Income from foreign exchanges in XTB included in PIT-8C

The latest decision of the Head of the National Tax Administration means that investors will receive a PIT-8C covering income from all closed investments made in XTB (both CFD transactions as well as sales of securities listed on the WSE or on foreign exchanges). These data will also be automatically imported into PIT-38 on the e-Tax Office website at kontakt.gov.pl in the Your e-PIT service.

The tax report is still at your disposal

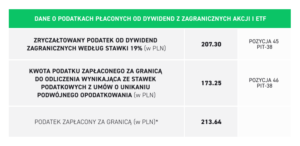

In the 2022 tax year, XTB clients received a personalized "Tax Report" that included all the information needed to correctly settle investment income with the tax office - both domestic and foreign in the PIT-38 declaration. Despite the changes being introduced, this document will still be sent to customers who will only find information on taxes on dividends paid by foreign companies. XTB is currently the only brokerage house in Poland that supports clients in such a comprehensive way in settling taxes on foreign dividends.

Complete Form W-8BEN and reduce your tax on foreign dividends!

We would like to remind you that XTB was the first brokerage house in Poland to also enable its clients to effectively reduce the tax on dividends paid by American companies. Thanks to the W-8BEN form, XTB clients who are Polish tax residents can use the tax rates resulting from the double taxation agreement between Poland and the USA.

The W-8BEN form for XTB clients is available entirely online - there is no need to sign and send any documents in paper form. The reduced dividend tax rate will be applied from the beginning of the month following the month in which the form was completed and approved as correct by XTB.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response