XTB publishes a report for the third quarter of 2018. Decrease in revenues by 43%

After exceptionally successful first half of XTB it's time for "winter" cool. The largest Forex broker in the region of Central and Eastern Europe published the results for the third quarter of 2018. They are clearly worse than in the same period a year earlier. Cause? Probably the "ESMA effect" and less volatility in the market.

Decrease in revenues by 43%

The scale of the difference in revenue seems huge. The company X-Trade Brokers, which includes the XTB brokerage house and the X-Open Hub platform, announced that in the third quarter of 2018, revenues reached PLN 47,6 million (USD 12,7 million), which is a decrease by 43% from 84,2, PLN 113,7 million in the second quarter. In the first quarter, XTB recorded the best quarter in history with record revenues of PLN XNUMX million.

XTB posted a net loss for the third quarter of PLN 2,9 million. However, these results include payment of a fine of 9,9 million PLN imposed by the PFSA in connection with the allegations regarding asymmetric slips (the decision of XTB will still be appealed). Without a penalty, XTB would have ended the third quarter with a net profit of PLN 6,2m.

More clients, less activity

An interesting phenomenon is the fact that in relation to the third quarter of 2017, as many as 21% more customers arrived, and a similar value, by 19%, also increased the number of active accounts. The volume expressed in flights increased slightly, but at the same time the sum of deposits and instruments on which customers traded decreased. It is a real mix of both very good and bad information. But the drop in revenues is significant.

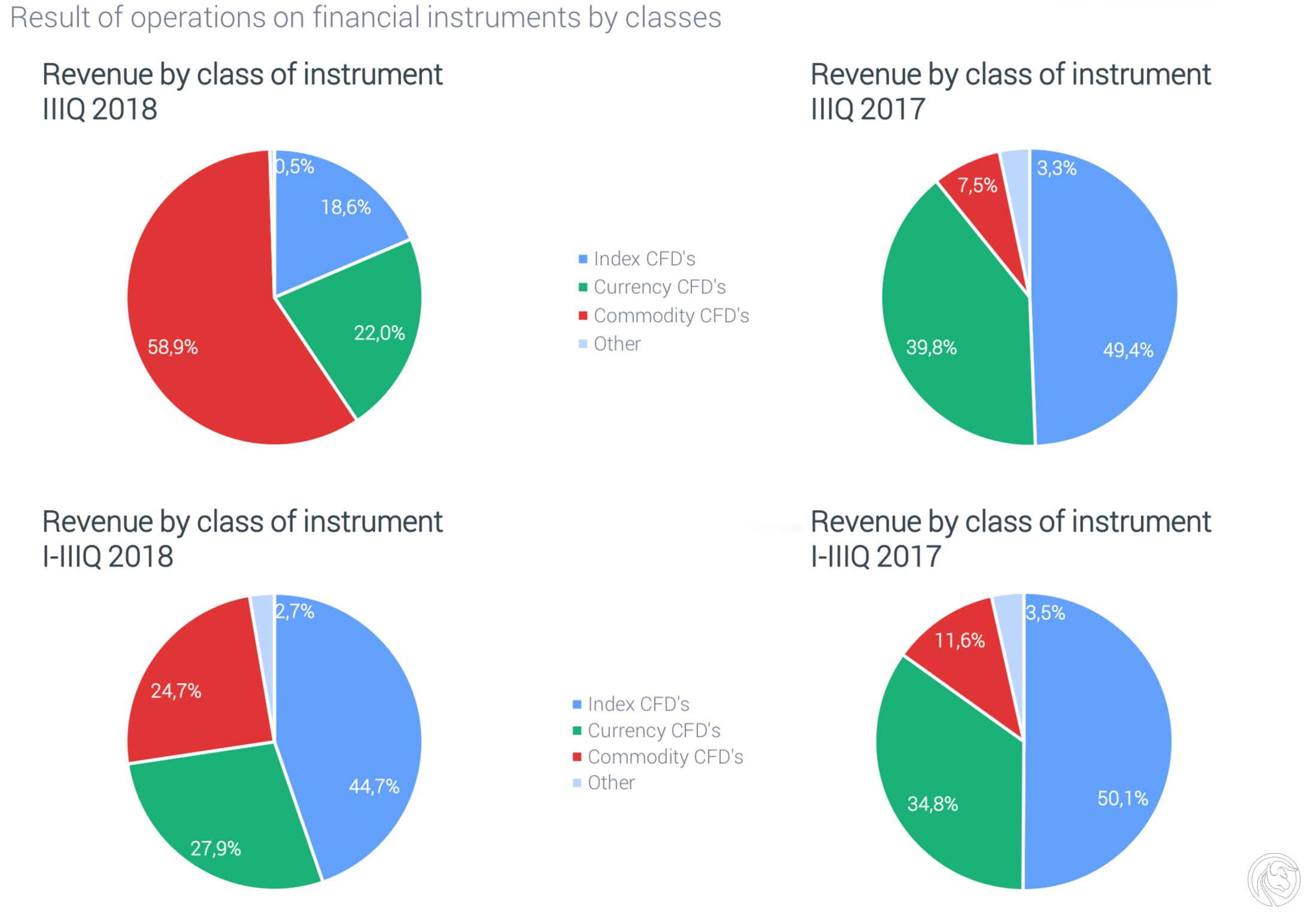

A year earlier, CFD transactions on indices (49,4%) were responsible for more than half of revenues. In the last quarter, this class of instruments is only responsible for just over 18%. A very large jump was recorded on goods that correspond to as much as 58,9% of revenues, while in the same period in 2017 they accounted for only 7,5%. Are traders switching to goods? Or maybe people who generate a significant volume on indexes have moved to the competition?

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)