Profit-taking order, i.e. how and where to take take profit. Part 2

In Part I we discussed the most common mistakes when it comes to exiting the transaction and taking profits (read the article here). In the second part, we will focus on presenting selected methods of making profits and tools helpful in setting the goal for the transaction.

The method of hard profit and open accounting

As for the actual and practical "taking" of profits on the market, there are 2 main methods. We will look at the pros and cons of each of them.

The first method is the so-called "Hard profit". It is certainly more secure, especially for those who are just starting their adventure with trade. This is the conventional approach of placing your take profit order at a predefined level, which is then automatically executed when the price reaches it. The advantages and disadvantages of such a solution are as follows: we eliminate the guesswork and thus we can measure the risk-reward ratio on each of our transactions at the very beginning. Hard goals also allow you to establish an objective and repeatable approach to getting out of position. There is basically one minus - a certain kind of barrier is created at a certain predefined level, which means that larger movements can be ignored.

We call the second method "Method of open profit accounting". In this case, traders do not use orders like "hard take profit"At predetermined price levels, but allow their profits to grow until an exit signal is given, after which they manually close the trade. An undoubted plus of this approach is that traders who use the open profit method can potentially hold their profitable positions much longer and not limit their growth potential from the very beginning. However, there is also a serious minus of this method. Inexperienced traders who have discipline and risk management problems can lose more than gain. You have to be very careful and careful, and the most important thing is to be able to "read" the market well in order to successfully use open accounting. Otherwise, it always ends in the same way, giving away profits.

Tools for setting a transaction target

Regardless of whether we use the first or second method, the following tools can help to establish a more decisive and reasonable approach to TP (take profit).

# 1. components Price Action (support / resistance / peak / hole / demand / supply)

From experience I can say that the first obstacle technique works interestingly. Looks like this: when entering a position, we are looking for the first potential obstacle to price, i.e. resistance, supply / demand level, peak / hole, and then we estimate chances to maintain or overcome this zone. With a more conservative approach, we place our take profit gently before this important level. It is important to focus only on the most important so-called main zones, not every single support or resistance. When playing aggressively, of course, we react to price behavior on a regular basis. If the movement lasts e.g. several candles and we see signs of reversal, we can, for example, move the profit relative to the next candles.

Determining the level of Take Profit based on Price Action. Chart EUR / USD, D1 interval. Source: xNUMX XTB xStation

# 2. Fibonacci Abolition

Using Fibonacci ranges you can often measure the profit potential of a trending market. It is not always possible to find a good ABC pattern, but some Fibo ranges and levels may offer a reliable and credible profit opportunity. This works especially well for the top-down approach: if you specify Fibo reach at a higher time frame, you can move to a lower time frame to look for trading opportunities there. You can also use specific retracements to set the take profit level in advance.

Determining the level of Take Profit based on Fibonacci abolition. Chart USD / CHF, D1 interval. Source: xNUMX XTB xStation

# 3. Moving averages

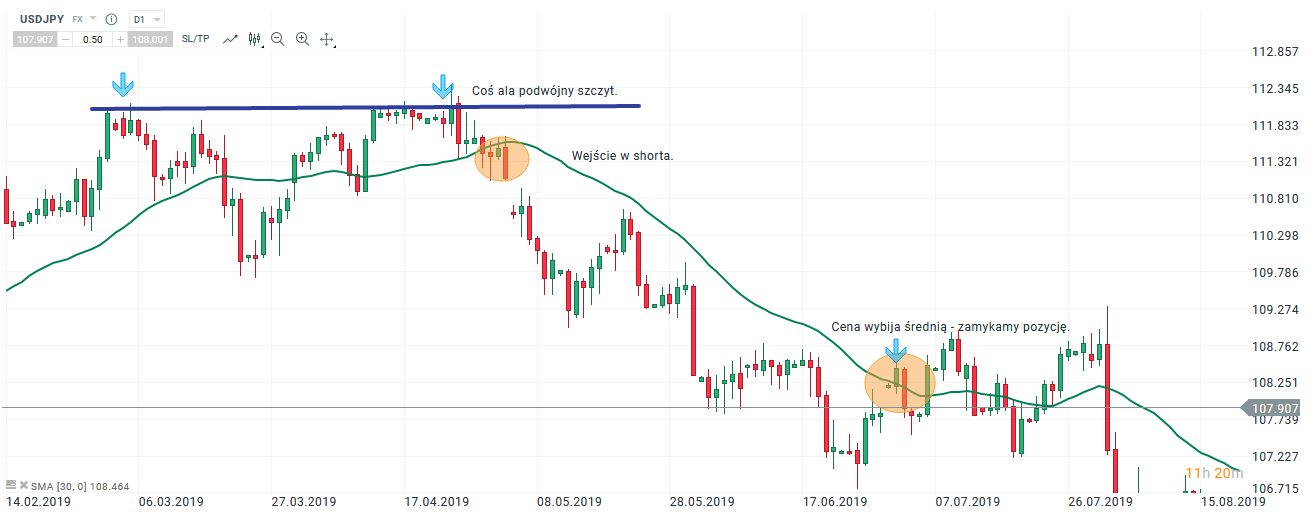

Especially during periods of strong trends, moving averages can help establish a good take profit approach. The main assumption is that during a strong trend the price usually stays above or below the average for a long time. The exit signal occurs when the price exceeds the average on the opposite side to the ongoing trend.

Determining the level of Take Profit based on moving averages. Chart USD / JPY, D1 interval. Source: xNUMX XTB xStation

Summation

Price Action can also be used as an independent method of making profits - especially if we use an open approach: we are looking for a Price Action signal that announces a change in sentiment. You can also use pin bars, outside bars, heads and shoulders, rejections on tops and holes, and other formations. Techniques from both methods can be successfully combined. Hard goals (stiff take profit) eliminates guessing and allows you to be less emotional with transactions. It is always worth, however, to be flexible and manage your positions based on price behavior and market context.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Price gaps on charts - where they come from [VIDEO] price gaps in the charts](https://forexclub.pl/wp-content/uploads/2021/06/luki-cenowe-na-wykresach-300x200.jpg?v=1622796021)