Gold continues to focus on oil, not profitability

Gold, which has seen an increase of around 7% this year so far, continues to perform strongly despite the continued difficulties of rising real yields and the strengthening of the dollar. Instead, the yellow metal increasingly focuses on numerous sources of uncertainty, some of which existed before Russia's invasion of Ukraine. Concerns over inflation and economic growth have been turbo-charged by war and sanctions, and coupled with increased volatility in stock and bond markets, has led investors to increasingly seek safe investments in fixed assets such as investment metals.

Gold gained 7% this year

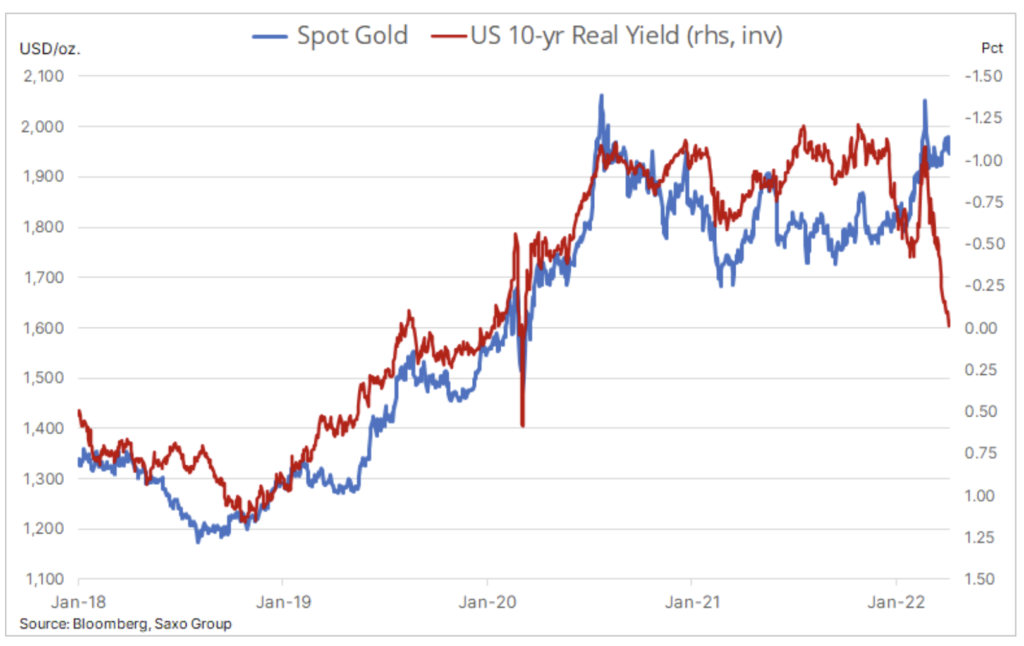

Impressive - this word best describes gold's performance in the current year. It is now showing an increase of around 7% at a time when ordinary factors such as real US bond yields and the dollar exchange rate have risen, which would generally have hindered gold strengthening. The prospect of aggressive monetary policy tightening by the American Federal Reserve contributed to the increase in ten-year bond yields by over 1%, while supporting the almost four% appreciation of the dollar against the broad currency index.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

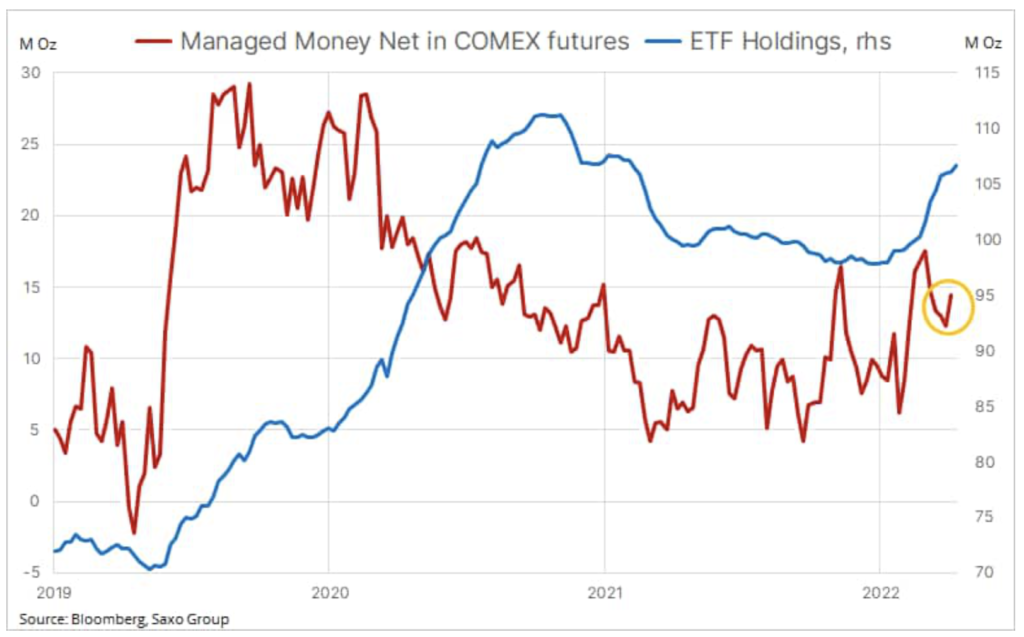

Relatively weak performance last year, especially against the dollar, despite emerging inflation concerns, was due to the fact that portfolio managers lowered their 2020 exposure as equity markets gained and bond yields remained relatively stable, which reduced the need for diversification. Meanwhile, in 2022, there are numerous sources of uncertainty, some of which existed before Russia's invasion of Ukraine. Concerns over inflation and economic growth have been turbo-charged with war and sanctions, and coupled with increased volatility in bond and equity markets, have led investors increasingly to seek safe investments in fixed assets such as investment metals.

Last year, gold and 300-year real yields struggled to follow their usual paths of inversion, a phenomenon that escalated in QXNUMX as gold increasingly ignored the rise in profitability. At current levels, gold is theoretically overvalued by around $ XNUMX, indicating a significant change in benchmark.

Last year's net reduction in gold-based equity funds slowed down at the end of December; since then, the gold volume held by the funds has increased by 282 tonnes to 3 tonnes. At the same time, leveraged funds, mainly active in the futures market, were much more dependent on the directional movements of the market thanks to their ability to trade lots valued at $ 325 with a margin of less than $ 195. After an unsuccessful attempt to reach the new record high on March 000, investors were gradually limiting their exposure in the following weeks. This process ended around April 8, when investors returned as net buyers, thus matching the aforementioned current demand for stock exchange funds.

Galloping (?) Inflation in the world

While inflation was the topic we discussed last year, the real impact of soaring prices for just about everything is now being felt more and more all over the world. In effect investors are increasingly realizing that the fat years of high equity returns and stable returns are over. Instead, there was a need to adopt a more defensive stance, and there was a risk of what Russia, now a pariah to most of the world, could do if the war did not produce the expected results.

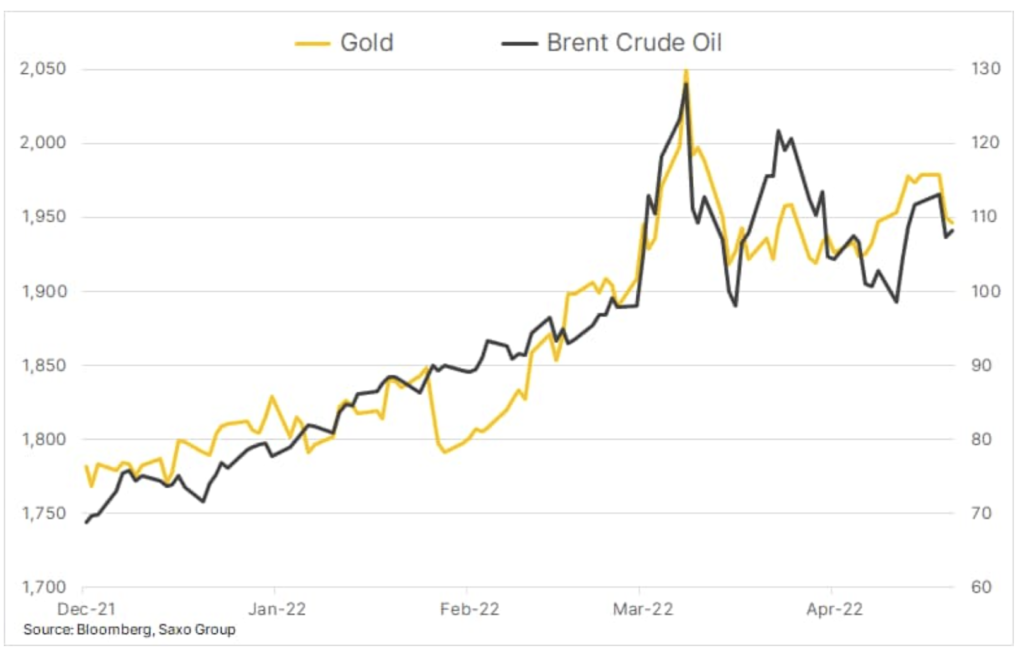

More and more we observe that gold - instead of real yields - is partly driven by oil prices, which makes sense. Oil price fluctuations influence inflation through refined products such as diesel and gasoline, and the strength or weakness of oil prices gives us some picture of the geopolitical risk in this system.

In our recently published quarterly forecast we discuss the reasons why, in our opinion, the price of gold will rise and will reach a new record high this year.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)

Leave a Response