Gold is about to break [Commodity market overview]

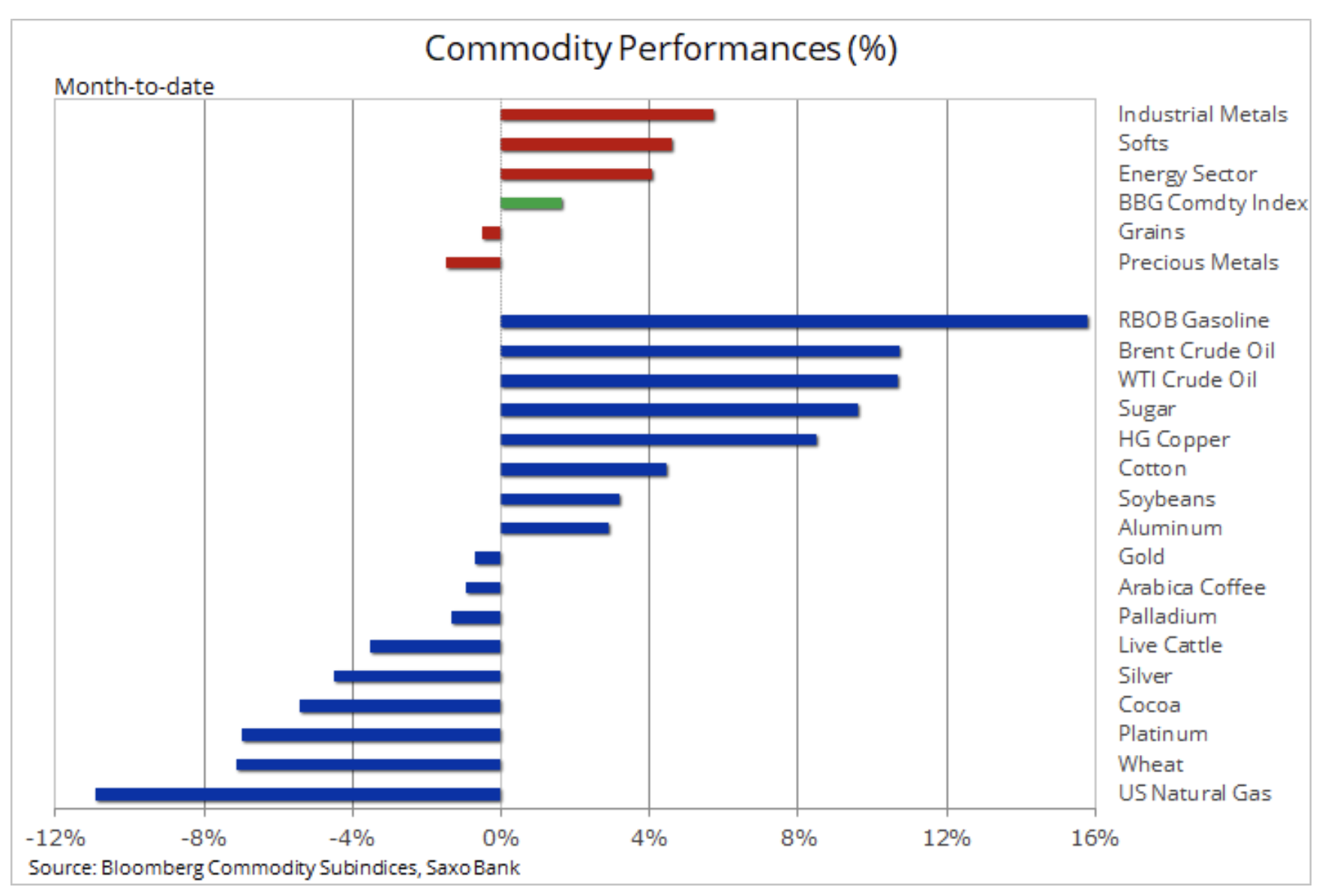

Commodity markets, with some exceptions, are still in relatively good shape as we approach the end of the very volatile and sometimes worrying first half of the year that has been marked by the worst collapse caused by the pandemic since World War II. Although the annual decline is still 20%, the Bloomberg commodity index gained 2% this month thanks to pro-cyclical raw materials such as industrial metals, oil and fuel products.

Most markets, including commodity markets, are currently following the US Federal Reserve and index S & P 500 as key sources of inspiration. As a result of some weakening caused by the increase in the number of COVID-19 infections in the United States and for a short time, Beijing experienced a temporary drop in share prices before FOMC announced the planned purchase of corporate bonds. These changes still force us to ask ourselves whether current stock market valuations are no longer completely detached from the real economy, in which growth has slowed down and unemployment has gone up. At this point, the market behaves as if the Federal Reserve was to enter at the slightest sign of weakness.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Energy

The energy sector is still recording a discrepancy between oil and its products on the one hand, and natural gas on the other. Extensive OPEC + cuts combined with a high degree of compliance and reports that demand is growing at a rapid pace have contributed to a strong recovery in oil and oil prices since the minimum of the end of April. In the latest report on the oil market, the International Energy Agency (IEA) maintains that demand for oil will increase in 2020, but will remain 8,1 million barrels a day lower before rising by 5,7 million in 2021. overall IEA does not foresee a total improvement at least until 2022 due to the slow increase in demand for jet fuel and the change in consumer behavior.

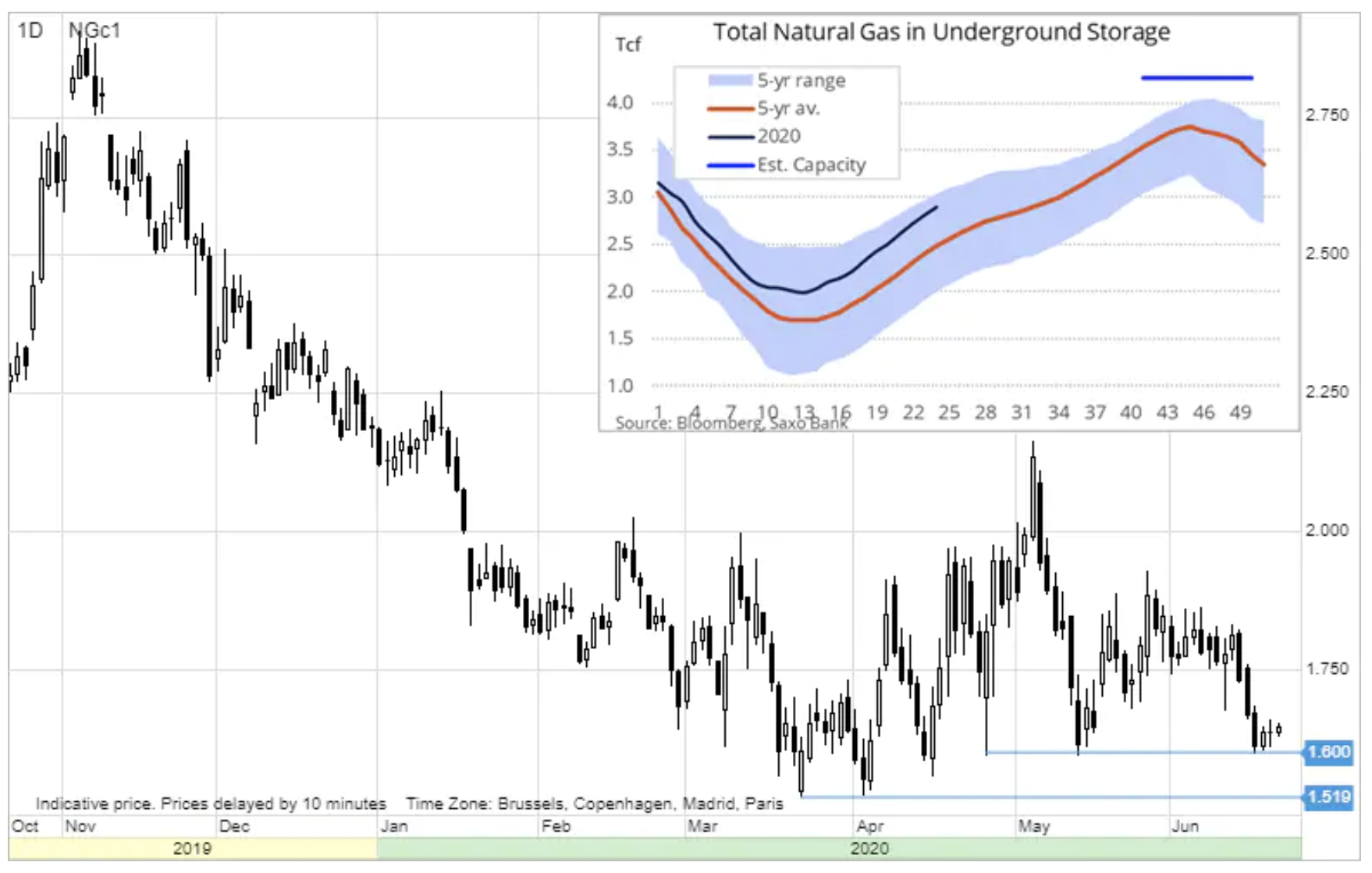

While Petroleum is well on the way to recovery, natural gas prices in the United States and Europe in the coming months may remain under pressure. This is a response to seasonal increases in stocks, which could potentially fill tanks. The US natural gas supply in July is just slightly above the support at 1,60 USD / MMBtu before the March minimum of 1,52 USD / MMBtu. Without a strong recovery in demand due to warming or without an increase in demand from the industrial sector, short-term risk is still associated with falling prices.

Contrary to the uncertainty that the retreat from recent oil-related production cuts in the United States may soon follow. After the return of WTI oil above USD 40 / b, shale oil producers are ready to increase production, which would mean additional production of natural gas. Another challenge is the recent fall in LNG exports due to lower gas prices around the world, which have reduced the profitability of LNG exports, taking into account transport and liquefaction costs.

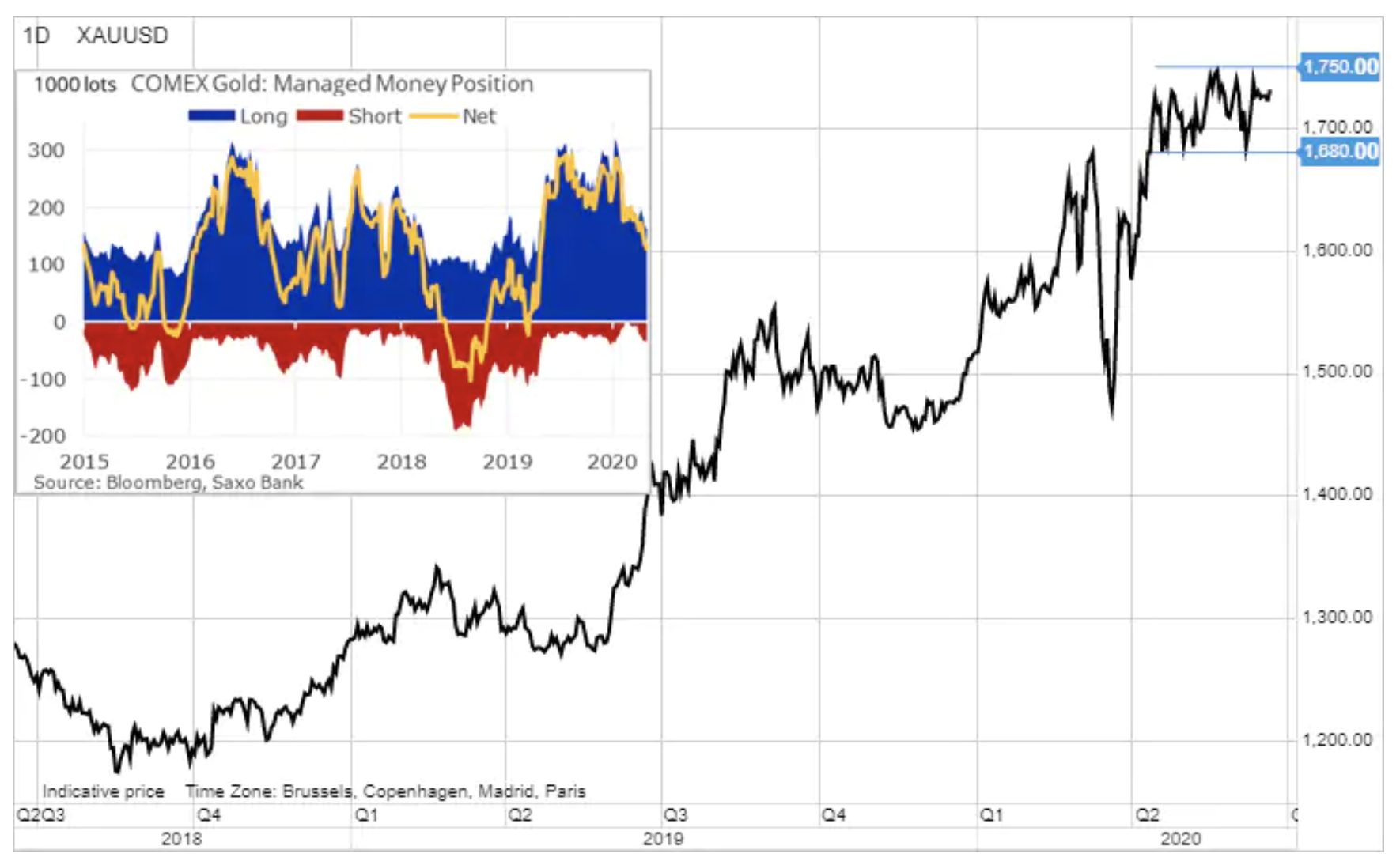

Precious metals: gold and silver

In the case of gold a side course around 1 USD / oz has already lasted for the ninth week, because this metal is not able to find a strong enough motive to strengthen or fall. The lack of a positive reaction to additional stimuli from central banks, the recent dollar depreciation and lower real yields contributed to the reduction of speculative long positions of hedge funds on the futures market. Since the February maximum, the funds have reduced their upward orders by 700% to their lowest level in a year.

At the same time, gold-based stock exchange funds continue to grow: according to Bloomberg data, the overall volume of gold held by investors this year has risen by 565 t to 3 t this year. Thus, they have offset the loss of physical demand from the largest demand caused by pandemic and isolation. the world's gold consumer - Asia.

An increase in demand for ETF is visible in all categories of investors, from retailers to pension funds and some of the world's rich. In a study by Reuters, nine private banks with a total volume of managed assets to global rich of $ 6 trillion said they advised their clients to increase their investment in gold.

Two reasons to uphold the positive forecast for gold we have mentioned in the last few months - fear of depreciation and decline in real yields - have been mentioned in the latest Goldman Sachs communiqué. In the statement, the bank increased its six-month price forecast for gold to 1 USD / oz, and for silver up to USD 21 / oz. The second forecast predicted a 90,5 gold to silver ratio, which is an increase of 9% compared to the current market situation.

The current price action on the precious metals market emphasizes their ability to frustrate investors and the need to remain patient. There is currently no impetus for strengthening due to risk appetite and optimism in all financial markets. However, these changes do not change our view that in the short term gold will play a role as a significant diversification factor, while in the long term it will most likely go up as the dollar weakens and real yields fall due to higher inflation.

To this should be added the increase in geopolitical risk, potentially driven by shifting the blame in the COVID-19 case, in particular due to the fact that polls indicate a significant defeat for President Trump in November this year. In addition, the risk of a pandemic accelerates deglobalization and reshoring processes initiated by the trade war between the United States and China.

The spot price for gold has not yet exceeded 1 USD / oz at closing, and if and when this occurs, we suspect that the renewed impetus and new wave of buy orders from insufficiently investing hedge funds will push gold towards 750 USD / oz, and silver around 1 USD / oz.

"Soft" food products

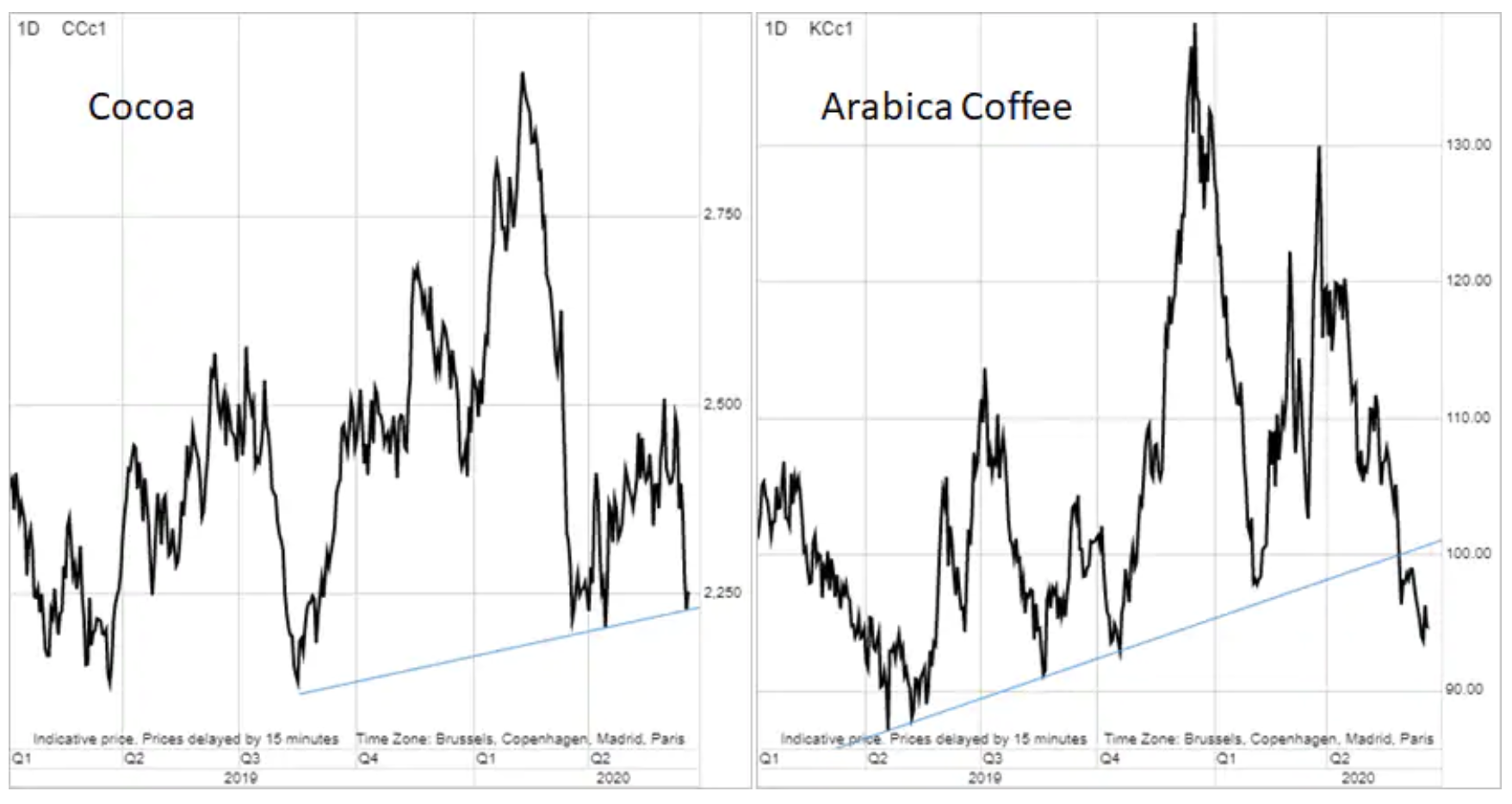

Arabica coffee, cocoa and, to a lesser extent, sugar they show little or no signs of recovery in the shape of the letter V, given the strong performance results and overall risk appetite. Coffee has been experiencing the longest decline in 10 months, falling below USD 1 / lb due to weak demand from foreign restaurants and cafes for record Brazilian production and real depreciation. Sugar consumption is expected to fall due to low total consumption, while ethanol demand has fallen along with the collapse of oil prices. A similar situation applies to cocoa, for which demand is closely linked to GDP growth. As a result of fears that the slowdown will negatively affect demand, its price has fallen to its lowest level in two months. On June 9, hedge funds maintained short positions in coffee and cocoa and a small long position in sugar.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Gold is about to break [Commodity market overview] gold increases](https://forexclub.pl/wp-content/uploads/2020/06/zloto-wzrosty.jpg?v=1592819997)

![Gold is about to break [Commodity market overview]](https://forexclub.pl/wp-content/uploads/2020/06/etfy-syntetyczne-fizyczne-102x65.jpg?v=1592808255)

![Gold is about to break [Commodity market overview] eToro test reviews 1](https://forexclub.pl/wp-content/uploads/2020/06/eToro-opinie-test-1-102x65.jpg?v=1592836242)

Leave a Response