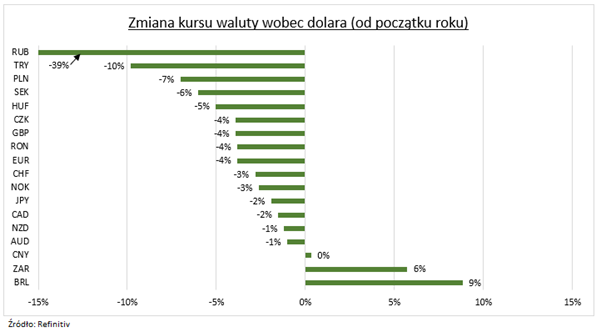

The zloty is the world's third weakest currency since the beginning of the year

Since the beginning of the year, the zloty has been the third most depreciating currency against the dollar in the world. He was only weakened more Russian ruble i Turkish lira. One of the consequences of the war in Ukraine is the sharp fall in the value of all currencies in our part of Europe.

About the author

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Polish zloty on defense - for how long?

From the beginning of the conflict in Ukraine, the zloty has been depreciating significantly. On March 7, at the time of its greatest weakness, EUR 1 cost PLN 5, and USD 1 cost PLN 4,61. In the following days the zloty was strengthening, due to another interest rate hike in Poland and some stabilization of the international situation, today we pay PLN 1 for EUR 4,73 and PLN 4,30 for USD. However, despite this, the zloty remains the third weakest currency in the world since the beginning of the year (among major currencies), losing 7% against the dollar. They only weakened more Russian ruble (-39 percent) and Turkish lira (-10%). You can see that the weakening of the currency is influenced by the proximity of the conflict in Ukraine, because they also weakened Hungarian forint (-5%), the Czech crown, Romanian leu (both -4%). The currencies of Poland and these three countries weakened despite interest rate increases. The average level of interest rates in these countries is 3,5 percent, which is the same as the current base rate in Poland. For comparison, the euro also depreciated since the beginning of the year against the dollar by 4%, although the rates in the euro zone have not been raised and amount to 0%.

Macroeconomic background

The economic foundations of the countries in our region are stable. Although the economic growth forecasts are currently being revised downwards, S&P Global Ratings has lowered its GDP growth forecast for Poland this year from 5 to 3,6 percent. However, this risk of recession in the region seems to be small. Especially that low exchange rates make exports more attractive. Economic growth may also be higher due to increased refugee spending and an increase in military spending. On the other hand, the region has to deal with very high inflation. Record growth was recorded in the Czech Republic, where inflation in February was as high as 11,2 percent. In Poland, on the other hand, inflation, due to tax cuts on food and fuel, fell to 8,5 percent in February. (from 9,2% in January).

The Swedish krona also showed a weakness this year, losing 6 percent. against the dollar. Sweden also keeps interest rates at 0% all the time. The British pound lost 4% against the dollar and the Swiss franc 3%. It is rather an effect of the sheer strength of the dollar, which is strengthening on the eve of the first interest rate hike in the US. Most likely it will happen tomorrow. The dollar also gains on the outflow of assets from risky markets to safe markets. This situation may continue if the situation in Ukraine does not de-escalate.

The Chinese yuan has kept its value against the dollar since the beginning of the year. On the one hand, it is also considered a safe haven in difficult times, but at the same time the Chinese government is now trying to weaken it in the face of the growing economic effects of subsequent lockdowns. The currencies of the countries which are important producers of the more expensive raw materials gained the most against the dollar. About 6 percent The South African Rand appreciated against the dollar, and by as much as 9 percent. brazilian real.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)