Will the zloty strengthen until the end of the year? Overview of pairs with PLN.

The recent dollar to the zloty attracted the attention of investors. The zloty, given a few backward quotations, is again seeing the depreciation of the domestic currency. The dollar, to which we have got used to practically since the beginning of the year, is no surprise in this respect. On the other hand, the situation of the zloty in relation to the euro or pound looks interesting. Taking into account the recent events in Europe, they created certain opportunities and threats for the zloty. Let's take a look at the most important pairs from PLN.

The dollar is rising

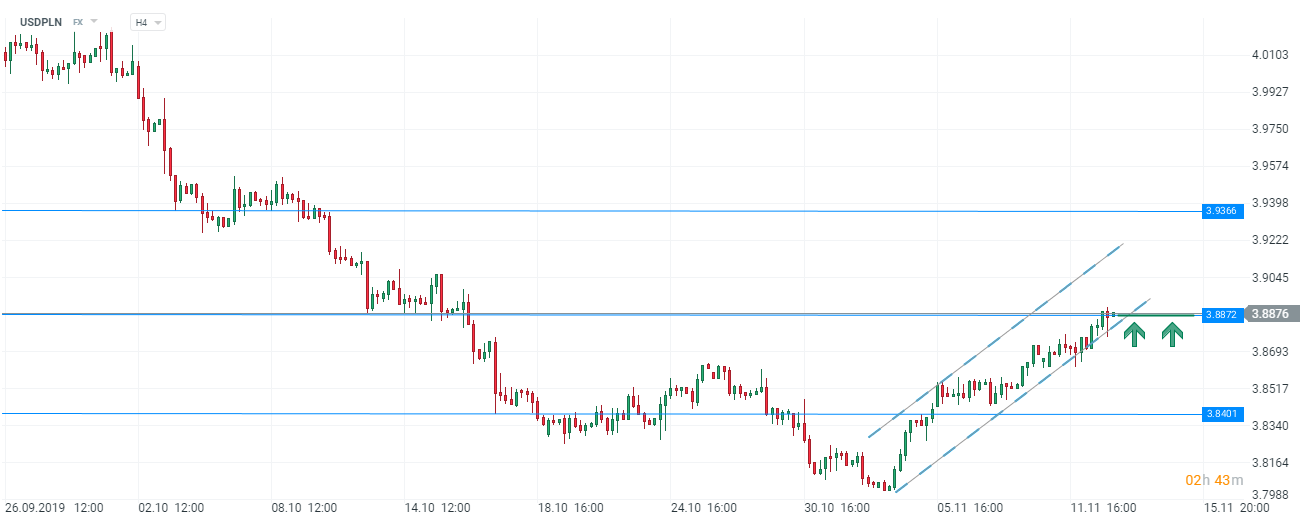

One of the most interesting charts that can be taken for quite a long time - typically swing trading, in the context of a long position is USD / PLN. The first good opportunity to enter was at the 3.8401 level, which was not only an important resistance zone (currently support), but also the site of the last confirmed low in the downtrend. We will see another attractive stop in the current quotations, at 3,8872. Taking into account the interchangeability of support and resistance, this level may be a place for a possible test and a slight consolidation of the current demand movement.

USD / PLN chart, H4 interval. Source: xNUMX XTB xStation

From the purely technical side, we have a "healthy" appreciation of the dollar against the zloty. Undoubtedly, the USD is currently in a more interesting fundamental situation, which does not mean that the current optimistic moods will not change. The dollar is also supported by its high prices in recent months, which slowed down considerably at the psychological level of PLN 4,00.

Chart USD / PLN, D1 interval. Source: xNUMX XTB xStation

In addition to small moves consolidation, at important levels (red zones), we have not yet had the opportunity to test more recent declines, which is generally happening now.

Fundamentally, the Polish currency does not look bad. Her biggest opponent (taking into account her quote against the dollar) is the strength of USD, created on the basis of geopolitical events of the last year.

October falls

A similar situation as on the dollar is also being created on the EUR / PLN exchange rate. Although this trend is a little less impulsive, it is worth noting that the supply movements that hit the market at the end of September have not yet been tested more strongly. The declines stopped around 4,2523, that is prices from the June-July period preceding strong increases.

EUR / PLN chart, H4 interval. Source: xNUMX XTB xStation

The creation of a new upward trend, or a larger correction of current traffic (from a purely technical point) is supported by intersecting EMA (20 and 40).

Given the fundamental conditions of both currencies, the zloty is in a better position (taking as a reference the situation in the German economy). However, the question arises whether the current market values and takes into account macroeconomic data? It is difficult to get a clear answer here. By analyzing recent increases and decreases in the euro, the last elections have had more impact than economic publications EBCor issues Brexitu, which inevitably exert some pressure on the euro.

Wholesale depreciation

The situation on the pound looks a little different. Despite the fact that the zloty is losing "in bulk" to the main (largely European) currencies in the pound exchange, the upward trend persists much longer.

GBP / PLN chart, D1 interval. Source: xNUMX XTB xStation

The pound quite intensively crossed the 4,9706 zone, which is currently its support. Taking into account the technical analysis, it is unlikely that its quotations will change radically to the south in the near future. A likely scenario would be a correction around 4,9964 given that it would be preceded by a stronger upward impulse.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)