Dutch stock exchange - How to invest in AEX? [Guide]

The most important index in the Netherlands is AEX 25. It groups together the 25 largest and most liquid companies listed on the Amsterdam Stock Exchange. The index was launched in 1983 with an initial value of 100 points.

The Netherlands is one of the largest economies in Europe. Even though this small country is home to some 17,5 million citizens, it does GDP by about $ 1 billion (data Of the International Monetary Fund). For comparison, over twice as populous Poland has a GDP of $ 655 billion. The country, famous for its windmills and tulips, has a very developed economy. As a result, it has companies that in some industries are among the largest in the world. The history of the Amsterdam Stock Exchange dates back to 1602. Among the companies listed on the stock exchange there were, among others Dutch East India Company (VOCs).

AEX - basic information

The AEX index consists of companies with the highest turnover on Euronext Amsterdam, calculated in euro. Companies whose free float is less than 25% may not be included in AEX. It is worth mentioning that, unlike most indices, if a company has several types of listed classes, only the class with the highest turnover is included in the index scald. In case of delisting company, its takeover or other event that excludes the company from stock exchange listing, the adjustment is made only on one of the available index revision dates.

Since 2011, the AEX has been reviewed four times. In March, the index is adjusted annually, while in June, September and December, the composition of the index is revised on a quarterly basis. Each composition change occurs after the session expires every third Friday after the settlement of quarterly contracts (March, June, September, December). Between 2008 and 2011, adjustments to the index were made twice a year (March and September). Before that, changes were made only once a year (in March). AEX is a type of index whose weights are based on the capitalization of companies. During the March revision, the companies' shares in the AEX index are reduced to 15%.

Composition of the index

The index includes 25 companies with the highest liquidity. It includes both companies focusing on new technologies and companies "from the old economy".

At the end of December 2021, the largest components of the AEX index were:

- Unilever

- ASML

- Shell

- prosus

- Adyen

Looking at the sectors, companies from the industry have the largest share production of technological equipment (mainly thanks to ASML). The next sector is the consumer goods sector (mainly Unilever) and the petrochemical industry (Shell).

Selected components of the AEX index will be presented in the following part of the summary.

Adyen

The company was founded in 2006 and is based in Europe. It is one of the largest payment platforms in the world. The Adyen platform deals, among others, with payment processing and risk control. Adyen offers a back-end infrastructure for authorizing payments through the sales channels of stores. This applies to payments made via websites, mobile applications and stationary stores. The company is the beneficiary of sales digitization (e-commerce) and the trend to modernize the POS offer (Point of Sale). From 2019, the company offers sellers the option of providing customers with virtual and physical cards. Among the customers using the Adyen solution, the following can be mentioned: eBay,Uber, Netflix or Microsoft. The most important markets for the company in terms of revenues are Europe and North America. The company's current capitalization exceeds € 57bn.

The company was founded in 2006 and is based in Europe. It is one of the largest payment platforms in the world. The Adyen platform deals, among others, with payment processing and risk control. Adyen offers a back-end infrastructure for authorizing payments through the sales channels of stores. This applies to payments made via websites, mobile applications and stationary stores. The company is the beneficiary of sales digitization (e-commerce) and the trend to modernize the POS offer (Point of Sale). From 2019, the company offers sellers the option of providing customers with virtual and physical cards. Among the customers using the Adyen solution, the following can be mentioned: eBay,Uber, Netflix or Microsoft. The most important markets for the company in terms of revenues are Europe and North America. The company's current capitalization exceeds € 57bn.

| million € | 2018 | 2019 | 2020 | 2021 |

| revenues | 1 652,9 | 2 656,8 | 3 641,4 | 5 995,4 |

| operational profit | 173,1 | 256,8 | 373,7 | 594,7 |

| operating margin | 10,47% | 9,67% | 10,26% | 9,92% |

| net profit | 131,1 | 204,0 | 261,0 | 469,7 |

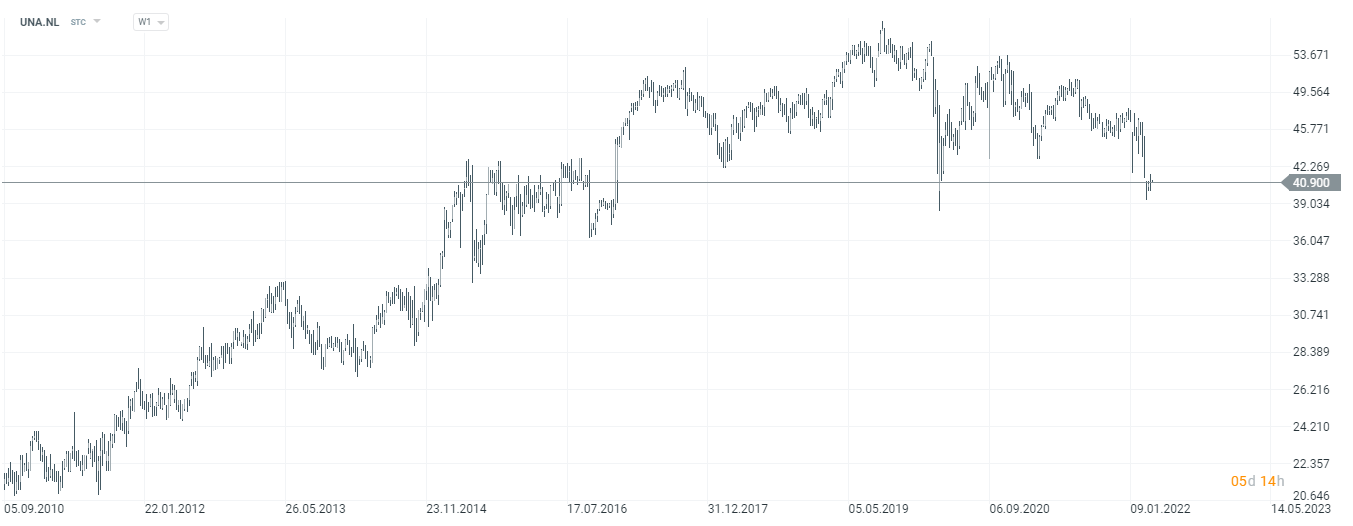

Adyen stock chart, interval W1. Source: xNUMX XTB.

ASML Holdings

The origins of the company date back to 1984 when it was As a result of cooperation between Philips and the semiconductor manufacturer - ASMI (Advanced Semiconductor Materials International), ASML was created. The growing demand for more and more efficient processors forces the miniaturization of integrated circuits. For this purpose, you need, among others, EUV (Extreme Ultraviolet Lithography) machines, which allow you to "bake" the latest integrated circuits with a size of several nanometers. The company specializes in lithography, metrology and devices that check the quality of finished products. Machines created by ASML are used by the largest chip manufacturers in the world (including Intel, Samsung). ASML devices are crucial in the chip production process, which allows the company to achieve a very high margin and a stable source of income. Each new chip factory must be equipped with this type of machine, which ensures a constant market for the company's products. The current capitalization of the company exceeds € 280 billion.

| million € | 2018 | 2019 | 2020 | 2021 |

| revenues | 10 944 | 11 820 | 13 978 | 18 611 |

| operational profit | 2 965 | 2 790 | 4 051 | 6 536 |

| operating margin | 27,09% | 23,60% | 28,98% | 35,12% |

| net profit | 2 592 | 2 592 | 3 554 | 5 883 |

ASML Holdins stock chart, interval W1. Source: xNUMX XTB.

Shell

Previously, the company was called Royal Dutch Shell and was created as a result of a merger of a British and Dutch company. The history of the company dates back to 1907. The company changed its name to Shell in January 2022. Shell is one of the largest companies in the energy and petrochemical sectors in the world. The company operates in Europe, Asia, Africa, Oceania and both Americas. Shell operates in the following segments: upstream, downstream, energy (including activities related to renewable energy sources). In addition, Shell is also involved in midstream activities (such as the transmission of hydrocarbons, gas and oil pipelines). As you can imagine, the company deals with sale and trade of crude oil, LNG, electricity, CO2 emission rights or processed products (bitumen, lubricants, aviation fuel). Shell also has a retail segment where it sells at petrol stations, incl. petrol or diesel. The dowstream segment includes chemicals (ethylene, propylene, solvents. The current capitalization of the company exceeds € 190 billion.

Previously, the company was called Royal Dutch Shell and was created as a result of a merger of a British and Dutch company. The history of the company dates back to 1907. The company changed its name to Shell in January 2022. Shell is one of the largest companies in the energy and petrochemical sectors in the world. The company operates in Europe, Asia, Africa, Oceania and both Americas. Shell operates in the following segments: upstream, downstream, energy (including activities related to renewable energy sources). In addition, Shell is also involved in midstream activities (such as the transmission of hydrocarbons, gas and oil pipelines). As you can imagine, the company deals with sale and trade of crude oil, LNG, electricity, CO2 emission rights or processed products (bitumen, lubricants, aviation fuel). Shell also has a retail segment where it sells at petrol stations, incl. petrol or diesel. The dowstream segment includes chemicals (ethylene, propylene, solvents. The current capitalization of the company exceeds € 190 billion.

| $ million | 2018 | 2019 | 2020 | 2021 |

| revenues | 388 379 | 344 877 | 180 543 | 261 504 |

| operational profit | 31 189 | 22 946 | -25 530 | 22 283 |

| operating margin | 8,03% | 6,65% | -14,14% | 8,52% |

| net profit | 23 352 | 15 842 | -21 680 | 20 101 |

Shell stock chart, interval W1. Source: xNUMX XTB.

Unilever

The origins of the company date back to the end of the XNUMXth century. Unilever is one of the largest producers of consumer goods in the world. The segments in which the company operates include: care products, food and household chemicals. The company has a wide portfolio of global brands. As a result, it can sell its products at higher prices than most competitors. This allows for a high operating margin. In the skincare segment, Unilever has recognizable brands such as Dove and Rexona. As for the "Foods & Refreshment" segment, the company sells, among others, ice cream, teas, broths, mayonnaises, ketchups and other food products. The most famous brands include Knorr, Magnum, Hellmann's and Ben & Jerry's. In the household chemicals segment, detergents are the best known brand home. The company is listed, among others on the London and Amsterdam stock exchanges. The company's current capitalization is in excess of £ 87bn.

| million € | 2018 | 2019 | 2020 | 2021 |

| revenues | 50 982 | 51 980 | 50 724 | 52 444 |

| operational profit | 12 535 | 8 708 | 9 367 | 9 636 |

| operating margin | 24,59% | 16,75% | 18,47% | 18,37% |

| net profit | 9 389 | 5 625 | 5 581 | 6 049 |

Unilever stock chart, interval W1. Source: xNUMX XTB.

Heineken

The company's history dates back to 1864, when Adriaan Heineken bought a small brewery in Amsterdam, and in 1873 introduced a beer brand signed with his name. The company's headquarters are still located in Amsterdam today. The company is the largest beer producer in Europe and the second largest in the world. The company has a wide portfolio of brands such as Heineken, Amstel, Desperados, Bulmers, Tiger or Strogbow. It is worth mentioning that the Heineken brand itself generates about 20% of the sales volume. According to the company, the Heineken non-alcoholic beer brand is the most recognizable in its niche in the world. The company's capitalization now exceeds EUR 50 billion.

The company's history dates back to 1864, when Adriaan Heineken bought a small brewery in Amsterdam, and in 1873 introduced a beer brand signed with his name. The company's headquarters are still located in Amsterdam today. The company is the largest beer producer in Europe and the second largest in the world. The company has a wide portfolio of brands such as Heineken, Amstel, Desperados, Bulmers, Tiger or Strogbow. It is worth mentioning that the Heineken brand itself generates about 20% of the sales volume. According to the company, the Heineken non-alcoholic beer brand is the most recognizable in its niche in the world. The company's capitalization now exceeds EUR 50 billion.

| million € | 2018 | 2019 | 2020 | 2021 |

| revenues | 22 471 | 23 969 | 19 715 | 21 941 |

| operational profit | 3 062 | 3 538 | 157 | 4 334 |

| operating margin | 13,63% | 14,76% | 0,79% | 19,75% |

| net profit | 1 903 | 2 166 | -204 | 3 324 |

Heineken stock chart, interval W1. Source: xNUMX XTB.

Just Eat TakeAway

It is a Dutch company founded in 2000. Its headquarters are in Amsterdam. Just Eat TakeAway focuses on running marketplaces with online food deliveries. In Poland, the company operates under the name "Pyszne.pl". Just Eat Takeaway operates in markets such as the United States, Israel, Australia and most European Union countries. After merging with the American Grubhub, they have a strong position in the USA. They are also a leader in countries such as Poland, Germany, the Netherlands, Italy, Spain, Belgium, Switzerland, the United Kingdom, Ireland and Denmark. In 2021 alone, the company handled over a billion orders worth more than EUR 28 billion. The number of active users of the platform has reached 100 million. Just Eat Takeaway also has a minority stake in the Brazilian market leader - iFood.

| million € | 2018 | 2019 | 2020 | 2021 |

| revenues | 232,3 | 415,9 | 2 042 | 4 495 |

| operational profit | -32,8 | -74,9 | -107 | -925 |

| operating margin | -14,12% | -18,00% | -5,23% | -20,58% |

| net profit | -14,0 | -115,5 | -151,0 | -1 016 |

Just Eat Take Away stock chart, interval W1. Source: xNUMX XTB.

Philips

The company was founded in 1891 and its current headquarters is in Amsterdam. The company currently employs nearly 80 employees from over 000 countries around the world. It also has over 120 patents. Despite many years of tradition, the company constantly introduces new products, which can be seen in the financial results - approximately 60% of revenues come from products launched for sale in the last 3 years.

Philips is one of the largest MedTech companies in the world. After 2010, the company began restructuring and focused on offering medical solutions. The Diagnosis & Treatment segment is responsible for over € 8 billion of the company's revenues. The company manufactures, among others, diagnostic devices such as magnetic resonance imaging, computer tomograph and x-ray systems. Another segment is Connected Care, which generates less than € 5 billion in revenues. In this segment, it also provides software to support the abovementioned systems. It is also worth mentioning that the company provides software for patient management in medical facilities (e.g. a system for monitoring patients connected to ventilators or sleeping patients). However, Philips is much more than medicine. The company has a wide range of care products (OneBlade shavers, trimmers, hair clippers). The company also sells toothbrushes (magnetic, electric, etc.) to its customers. The company also generates approximately € 0,5bn in brand rights and patent revenues, which has a significant impact on the company's profitability.

| million € | 2018 | 2019 | 2020 | 2021 |

| revenues | 18 121 | 19 481 | 19 535 | 17 159 |

| operational profit | 1 655 | 1 671 | 1 683 | 623 |

| operating margin | 9,13% | 8,58% | 8,62% | 3,63% |

| net profit | 1 090 | 1 167 | 1 187 | 3 319 |

Philips stock chart, interval W1. Source: xNUMX XTB.

Ahold Delhaize

The company was established as a result of the merger of the Dutch company Ahold with the Belgian Delhaize. It is one of the largest supermarket chains in the world (approximately 7,5 outlets). The company operates under many brands. The company's offer includes, among others Gall & Gall (the largest alcohol store in the Netherlands), Albert (Czech supermarket chain), Dalhaize (Belgian supermarket chain), Etos (pharmacy chain in the Netherlands) or Albert Heijn (leading supermarket chain in the Netherlands). In addition, the e-commerce offer is also being developed. In addition to the offer of online orders (from stores), the sales platform is also being developed bol.com. This concept is being developed in the Netherlands and Belgium. It is worth mentioning that 55 million consumers shop in the company's stores each year.

| million € | 2018 | 2019 | 2020 | 2021 |

| revenues | 62 791 | 66 259 | 74 736 | 75 601 |

| operational profit | 2 395 | 2 662 | 2 191 | 3 320 |

| operating margin | 3,81% | 4,02% | 2,93% | 4,39% |

| net profit | 1 810 | 1 766 | 1 397 | 2 246 |

Ahold Delhaize stock chart, interval W1. Source: xNUMX XTB.

What affects the value of the index

The condition of the Dutch and world economy

The index includes both companies operating mainly on the Dutch market (Ahold) and international corporations whose products are sold mainly on foreign markets (Unilever, Shell, JustEat, ASML, Prosus). For this reason, the index is influenced both by the condition of the world economy (for the most part), but some companies are more exposed to the domestic condition of the economy.

Financial results of companies

In the long term, the company's improving financial results are the most important. Increasing revenues, profits and free cash flow (FCF) are solid arguments for long-term increases in stock prices. For this reason, it is worth following the financial results of companies included in the index. Especially those that have the greatest impact on changing the index value.

How to trade the AEX 25

AEX Futures

Exposure to the AEX can be obtained by purchasing futures on that index. Thanks to futures, an investor can have a long position (buy a contract) and play against a downturn in the index (sell a contract). The AEX futures are listed on the Amsterdam Stock Exchange.

The base contract value is € 200 per 1 index point. This means that the notional value of the futures contract is currently around € 144.

For investors who do not have sufficient capital, it is possible to invest in mini contractswhose value is 1/10 of the value of the base contract. When investing in futures, remember to roll over futures (close positions in old series contracts and open positions in a contract with a longer period until expiry) and keep a margin.

CFDs

A good and more accessible option for retail traders is to speculate on contracts for differences (CFD). Although the AEX index is relatively rare in the offers of Forex brokers, it can be found on the lists of instruments of some of the most popular companies from Europe with a lever at the level of 1:10. Below we present selected offers of brokers on CFDs based on AEX 25.

| Broker |  |

|

|

| End | Poland | Great Britain / Cyprus | Cyprus * |

| AEX symbol 25 | NED25 | AEX25 | Netherlands 25 (CFD instrument) |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

200 USD | PLN 500 |

| Min. Lot value | price * 200 EUR | b / d | - |

| Commission | - | - | - |

| Platform | xStation | MT5 | Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

ETF Funds

If an investor does not want to select companies from the AEX index himself, he can use investment products that give exposure to the index. An example of such a product is ETF. One of the most famous ETFs with exposure to the AEX index is iShares AEX UCITS ETF. ETF was founded in 2005 and over 17 years has accumulated nearly € 490 million in assets under management. The benchmark for the ETF is the AEX index. The annual cost of maintaining the index is 0,30%.

Brokers offering stocks and ETFs

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Options on AEX

It is a solution for investors who want to either build more advanced investment strategies either purchase an option in order to take advantage of asymmetric risk-sharing (the option buyer only risks the premium paid). The Amsterdam Stock Exchange offers a wide range of options (weekly, monthly, quarterly, LEAPS). It is possible to use both the traditional options with a value of € 200 and the mini option with a multiplier of € 10. Mini options only expire in the next 3 months.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Dutch stock exchange - How to invest in AEX? [Guide] dutch stock exchange aex 25](https://forexclub.pl/wp-content/uploads/2022/03/holenderska-gielda-aex-25.jpg?v=1648543666)

![Dutch stock exchange - How to invest in AEX? [Guide] bitcoin cash hard fork](https://forexclub.pl/wp-content/uploads/2020/11/bitcoin-cash-hard-fork-102x65.jpg?v=1604996084)

![Dutch stock exchange - How to invest in AEX? [Guide] ctrader brokers platform](https://forexclub.pl/wp-content/uploads/2022/03/platforma-ctrader-brokerzy-102x65.jpg?v=1648550230)

Leave a Response