Hot week in the markets. Indexes at record levels.

The week on the market promises to be very intense. Despite the lack of major moves at the Monday opening and marathon in currencies, Wednesday and Thursday may have a positive impact on the market volatility. We expect the boss's speeches these days Federal Reserve Jerome Powell. Trade tensions are putting increasing pressure on the markets. A quick look at the indices and their results from last week does not indicate any improvement, especially in Europe. The division between the European indices (which are recording declines more and more) and the American indices is visible, where the Dow Jones, S&P 500 and NASDAQ 100 set new, record levels.

Interest rate reduction?

Positively on the equity market (and therefore also on US indices) the comment of the head of the Federal Reserve of the United States rebounded. Jerome Powell stressed the possibility of lowering interest rateswhich becomes highly probable. Good data from the US labor market strengthen the strength of the dollar against currencies - especially European ones. Last week, "Green" suffered from the comments of the head of the Fed, which is why we are watching EUR / USD wider downward trend. Similarly, the situation looks like USD / JPY. Thanks to the improvement of US relations with China and the resumption of trade talks, we can observe slight optimism in Asian markets. The lack of negative news was also a factor in the growth of indices and companies in the United States.

NASDAQ100 index chart, D1 interval. Source: xNUMX XTB xStation

We have a NASDAQ chart in front of us. There is no indication that the good situation would change. Investors and analysts expect a possible correction after a wave of intense growth. Almost from mid-December to mid-May, supply was successively selected from the 76,75 zone, 83,47 points and 89,62 (which we marked with green arrows on the chart). At the beginning of June, we observed a significant upward move that broke through two significant levels of 93 and 95 points.

China's economy with better results

At night, a number of economic data about the Chinese economy was published. Although the results met the analysts' forecasts, the economic slowdown is undoubtedly in the air. The growth rate was the slowest since the 27 years. The report indicates that in the second quarter, the economy increased by 6,2%. Reports on sales and growth in urban agglomerations also met, even with more than expected analysts' expectations.

However, there is no point in approaching good data (mainly from sales) with extremely high optimism. Through the waning dollar, the yuan gained a little breath. Let's not forget, however, that good data is currently being seen on a monthly basis. Therefore, it is not worth taking them so positively. We could say that consumers and producers are currently struggling against time and accelerating with consumption if the failure scenario were to come true. USD / CNY has been in a downward trend for some time.

In the Chinese economy (which in the long run and the negative scenario of the war with the USA), we can see a slight modernization of the economy. I mean the creation by the authorities of economic growth based more on internal sales than exports. This should positively affect the stabilization of results and in subsequent years for good and similar economic data. Therefore, the main question is, how will this affect Renminbi?

Europe in red

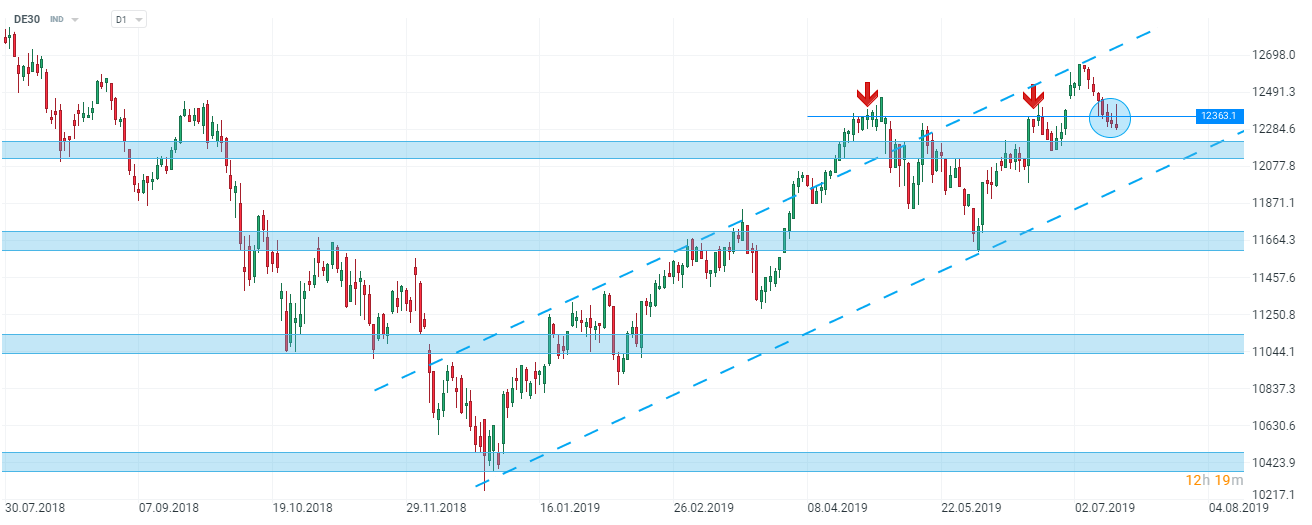

We wrote about weak results on European indices in the introduction. Nevertheless, the most interesting is the German DAX. DE30 begins the Monday session on increases. Currently, the German index does not look too optimistic. It seemed that on Friday he was following the indexes from overseas. Practically after three weeks of strong increases, we see a reflection in the other direction. Poor data from the market, mainly from the wholesale price index, may disturb the positive sentiment. At the time of writing this article, the DAX, despite its good opening, does not look pro-growth (especially watching the last day candles). EUR / USD remains in a similar suspension.

DAX30 index chart, D1 interval. Source: xNUMX XTB xStation

Stay up to date with the Forex Club!

More current market analyzes (currencies, indices, raw materials, cryptocurrencies) can be found on our Trading View profile.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)