Fed rate peak does not mean the end of the strong dollar

The US dollar depreciated sharply following a lower-than-expected US CPI reading, and further declines are possible this week if Biden's talks with Xi resolve some of the tactical tensions. However, the peak interest rate narrative still does not diminish the uniqueness of the United States, and the wave of USD buy orders could continue in the event that inflation and economic growth rates in other countries deteriorate.

Yuan strengthening may gain momentum as Chinese authorities stay away from rate cuts, instead injecting liquidity, while AUD and NZD show upward momentum.

USD: A low CPI reading may indicate a peak in rates, but not necessarily a soft landing

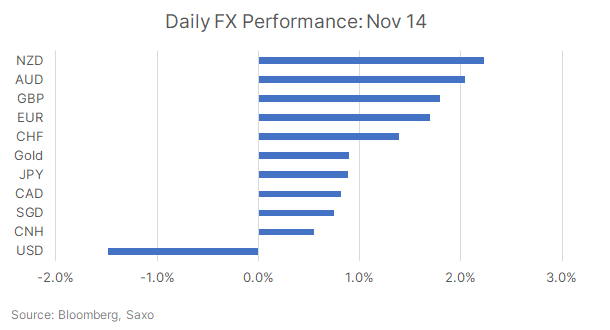

The US dollar depreciated by as much as 1,5% after a weak CPI feeling in the US last night, with dynamic AUD and NZD registering the biggest gain among G7 currencies. Both headline and core inflation fell more than expected. In October basic CPI index m/m remained unchanged, below the forecast level of +0,1% and September's +0,4%, while the y/y indicator fell to 3,2% from 3,7%, below the forecast 3,3%. The core CPI index increased by 0,2% m/m - less than previously and less than the expected 0,3% - while the y/y index increased by 4,0% - less than previously and less than by the predicted 4,1%.

Gasoline and car prices contributed largely to the decline; Rent inflation has also returned to a downward trend and may contribute to further disinflation. Fed representatives tried to maintain a neutral stance, emphasizing that there is still a lot to do, but the market has been convinced by the narrative regarding peak Fed rates and is now factoring in rate cuts of 100 basis points next year.

While we agree with the Fed's peak rate narrative, it's important to wonder what comes next. Will we see a soft landing in the economy after the end of the Fed's policy tightening cycle? recession? The recent reaction of individual market segments - in particular, the 6% increase in regional banks and the Russell 2000 Index's increase of 5% - suggests that the market is still betting on a soft landing. In this case, the dollar may remain weak.

Economic growth data will be extremely important, and one of those worth watching is yesterday's retail sales reading. The consensus forecasts negative retail sales due to low gasoline prices and new car sales. The rise in credit card delinquencies also points to increasing contraction in consumer spending.

If the market starts heading towards a recession, the dollar may become more attractive as a safe investment again. It is also worth emphasizing that the slowdown in the United States does not in itself mean that the story of American exceptionalism is coming to an end. In the event that other economies, such as the euro area or the UK, weaken faster than the United States, particularly given their greater dependence on volatile interest rates and energy prices, expectations for an easing of US monetary policy may persist in relative terms , which will continue to provide USD support.

This week, however, the most important event will be the Biden-Xi talks, where a conciliatory tone may contribute to an even further weakening of the dollar. There is still a risk of suspension of the work of the US administration, but it is limited for now due to the adoption of the bill on temporary financing by the House of Representatives.

Conclusions for the market

DXY is testing the 104 handle, which, if broken, paves the way for the two-hundred-day moving average at 103,61, but a break of the 0,618 retracement at 102,546 may be necessary to confirm the downtrend. For now, the dollar remains a selective buy option during slight declines, as expectations of a soft landing may prove too optimistic.

CNH: Favorable conditions for strengthening

The improvement in activity data in China is slow, overshadowed by weakness in the real estate sector. Industrial production in October increased by 4,6% y/y compared to 4,5% in September and the forecast value, while retail sales increased by 7,6% y/y compared to 5,5% in September. However, real estate investments disappointed once again, reaching -9,3% y/y year-on-year compared to the expected -9,1%.

Nevertheless, the yuan has clearly strengthened thanks to the weakening USD, and the efforts of the Chinese authorities to maintain rigid fixings despite the high USD volatility over the past few weeks are finally bearing fruit. Additionally, the People's Bank of China this morning conducted a major operation worth CNY 1 billion under its Medium Term Lending Facility, providing a massive net liquidity injection of CNY 450 billion. The injection was the highest in seven years and could mean there is less chance of an imminent reduction in reserve requirements, given authorities are reluctant to put more pressure on the yuan. There was unconfirmed information that China plans to allocate CNY 600 trillion to cheaply finance the modernization of "urban villages" and an affordable housing program, which improved market sentiment.

Biden-Xi talks will be in focus, with a conciliatory tone expected despite remaining strategic differences. This could have a further positive impact on the yuan. The USD/CNH rate closed below the 7,25-day moving average and was trading below 7,2124 on Asian markets. The next key support is at 0,618, i.e. a retracement of XNUMX.

Conclusions for the market

The People's Bank of China will likely continue to exercise a firm hand to prevent the yuan from depreciating, but a return to 7,10 will have to wait for Fed rate cuts.

Antipodes: NZD breaks higher, AUD may gain further boost from employment data

High-beta currencies have responded most strongly to the peak Fed rate narrative, gaining further momentum. Couple NZD / USD returned above the psychological level and the 0,60-day moving average at 0,65, while the AUD/USD pair strengthened to 130. Chinese liquidity injections also helped support the antipodean currencies, with iron ore prices reaching $XNUMX for the first time since March on reports of improving demand for steel in the Middle Kingdom. Growth expectations for these currencies have returned and may continue until concerns about global economic growth intensify.

The RBA's recent interest rate increase, despite its benign rhetoric, also contributed to AUD growth. However, hawkish comments may intensify again. The third quarter wage price index released this morning was 4,0% y/y compared to 3,6% in the previous quarter, reaching the peak of the RBA forecast. Markets are currently pricing in a 50% chance of another RBA rate hike, and the most important event will now be the release of Thursday's employment data.

Conclusions for the market

The peak rates narrative may support AUD and NZD strength until concerns about global economic growth intensify. The NZD/USD pair may retest the early October highs at 0,6056, while the AUD/USD pair has immediate resistance at 0,6524.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)