US Treasury bonds have become the worst asset

Last meeting Federal Reserve can be described in various ways, but it was definitely not insignificant for the financial market. Jerome Powell's persistent belief that inflation will be of a temporary nature, it should cause panic in the market, as there is absolutely no indication of it. On the contrary, the excessively oversized Fed balance sheet and an unprecedented amount of fiscal stimulus suggest that a further impact of inflationary forces is to be expected.

Perhaps my age will come out at this point, but Milton Friedman and his approach to monetary policy and inflation should be mentioned here. According to this infamous economist, inflation is always a monetary phenomenonand the effects of monetary policy appear with a delay. Therefore, inflation will be triggered by an exponential increase in the broadly understood money supply, which we have been observing since the beginning of the Covid-19 pandemic. However, a delay in the reaction of monetary policy may cause the central bank to commit a political mistake, for which the market pays dearly.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

In recent history, central banks have made political mistakes that eventually led to the so-called the great recession. The over-accommodative monetary policy in both the United States and Europe created macroeconomic imbalances that culminated in the global financial crisis of 2007-2008. At that time, the macroeconomic risks associated with such an accommodative policy were ignored. The situation is analogous today. Equity valuations are surprisingly high and the stock market records new records every other week. However, high valuations do not reflect the deterioration in corporate bonds due to the sharp rise in debt.

The current economic environment is challenging not only because assets are subject to greater risk than before and their cost has increased. For the first time in history, there are no safe harbors on the market. Interest rates remain ultra-low, offering no protection in the event of a rise in inflation (real interest rates are negative) and no particular upside potential in the event of a market crash (US Treasury yields will not fall below zero).

Check it out: How to invest in contracts for treasury bonds? [Guide]

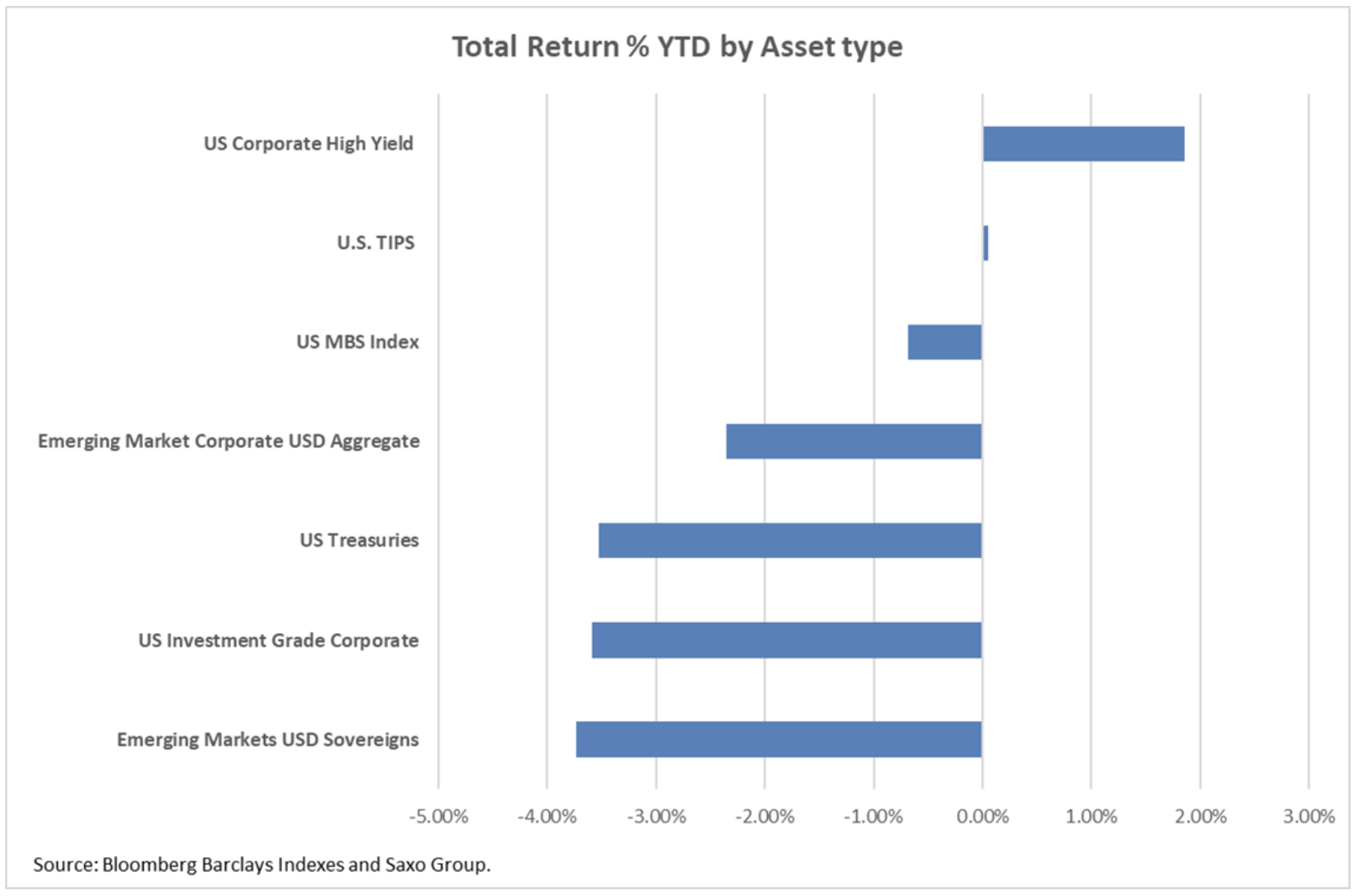

It is therefore easy to understand the situation in the chart below. Since the beginning of this year, the only assets generating a positive return are high yield corporate bonds and inflation-protected government bonds (Treasury-Inflation Protected Securities, TIPS). Why? The only option for bond investors is to take refuge among the highest-risk assets. Junk bonds are the only ones that offer enough profitability to provide a buffer against inflationary pressures. At the same time, TIPS act as a hedge against inflation.

Avoid US Treasury Bonds

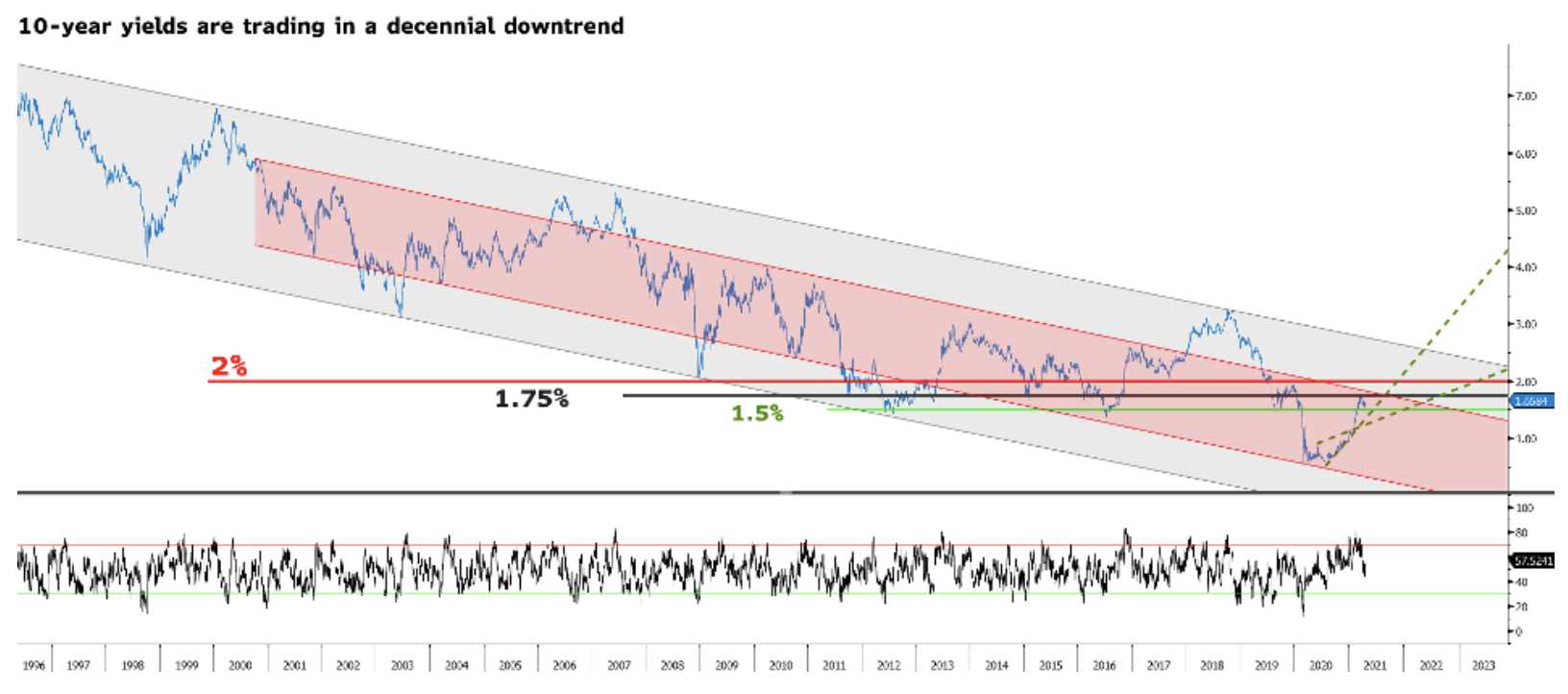

Jerome Powell has significantly exposed US Treasury bonds to risk by keeping monetary policy unchanged and slightly improving the economic outlook. Indeed, as the economy improves and inflationary pressures increase, US Treasury yields will continue to rise. In our view, the yield on ten-year US treasury bonds may reach 2% by summer. These securities will face strong resistance at this level. The question is: what will happen at the 2% level? Will there be a stock market crash or will the market survive this growth? In the event of a significant decline in stocks, yields on US securities may fall below their turning point. However, it is more likely that due to the correction, macroeconomic conditions will continue to improve, further pushing up yields.

In this context, it makes no sense to hold onto US Treasury bonds. Even if ten-year government bond yields go below 1%, the potential for growth will be limited as the Fed has repeatedly stated that it does not intend to tolerate a policy of negative interest rates. However, the downside potential is unlimited as yields may rise well above 2%, depending on inflation expectations.

Follow the economic recovery

In our opinion, the US high yield corporate bond area will be a better choice than emerging market bonds, as the former will be more closely related to the economic recovery. In addition, junk corporate bonds offer significantly higher yields than emerging market sovereign bonds. In fact, high yield corporate bonds offer a yield of 4% with a duration of less than four years. To achieve the same yield on emerging market sovereign bonds, the duration would need to be extended to eight years, thereby further exposing the portfolio to interest rate risk.

All these assets carry risk. In fact, leverage, both in the corporate sector and in emerging market sovereigns, is increasing. Therefore, it is necessary to carefully select investments and to assume that the debt will be held until it is redeemed. The aim is to secure a sufficiently high profitability, avoiding possible insolvencies. However, these assets should be overestimated as government bond yields increase.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)