Actions await further problems as global economies open up

The second quarter of 2020 was definitely the "revival" of economies on the new platform of state capitalism, which was based on supporting monetary policy bringing the institutions of fiscal and monetary policy closer together as part of crisis management. Extensive stimuli aimed at counteracting the largest economic recession since the 30s have fostered "animal instincts" and speculation on a scale unprecedented since 2000, and maybe even from the crazy 20s.

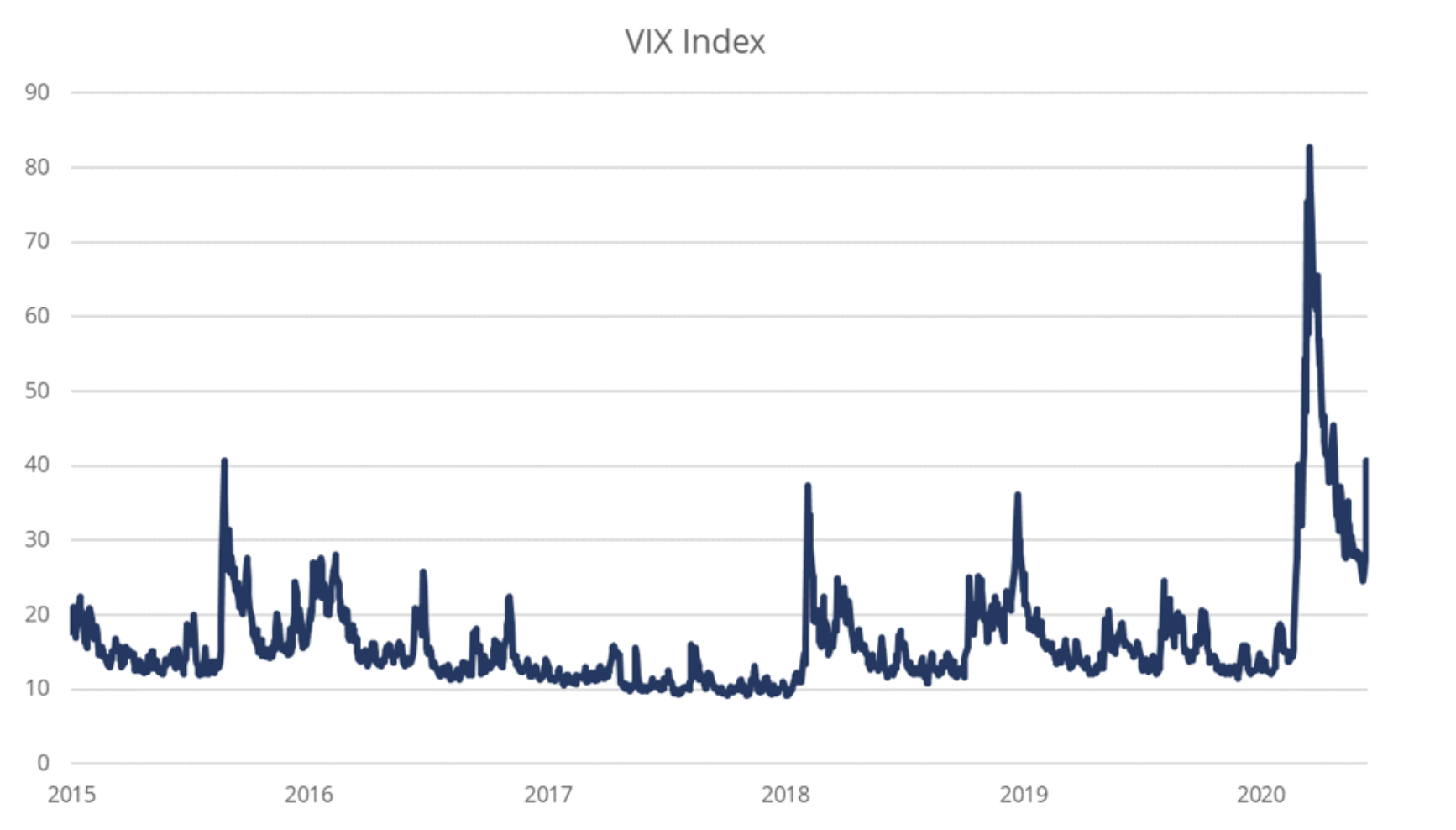

However, at the time of making this forecast S&P 500 index ended the worst session since March, and VIX index strongly went up; effects Covid-19 therefore they are not over yet. Both our economy and financial system remain in a very vulnerable position.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

VIX suggests that the stock market is still bear market

It is accepted that for the VIX 22 index it is a long-term equilibrium point. In other words, at this level, the stock exchange from the upward trend (positive return and low volatility) goes into the downward trend (negative return and high volatility). The VIX index broke above this level on February 24 and has not fallen below it since then - despite the impressive bull market in the stock markets.

Although some argue that the bear market has never been there because the decline has stopped so quickly, implied volatility suggests that the structural bear market is still underway. History, in turn, shows that this period is associated with a negative return on shares with high volatility.

At the beginning of the third quarter, the position of markets is still uncertain. The VIX index indicates that the summer period will be characterized by considerable volatility, and after the publication of QXNUMX profits we will finally get to know the real losses of the enterprise sector, as well as, perhaps, a general vision of the situation in the coming months.

Extremely unfavorable profit / risk ratio in stock markets, but what is the alternative?

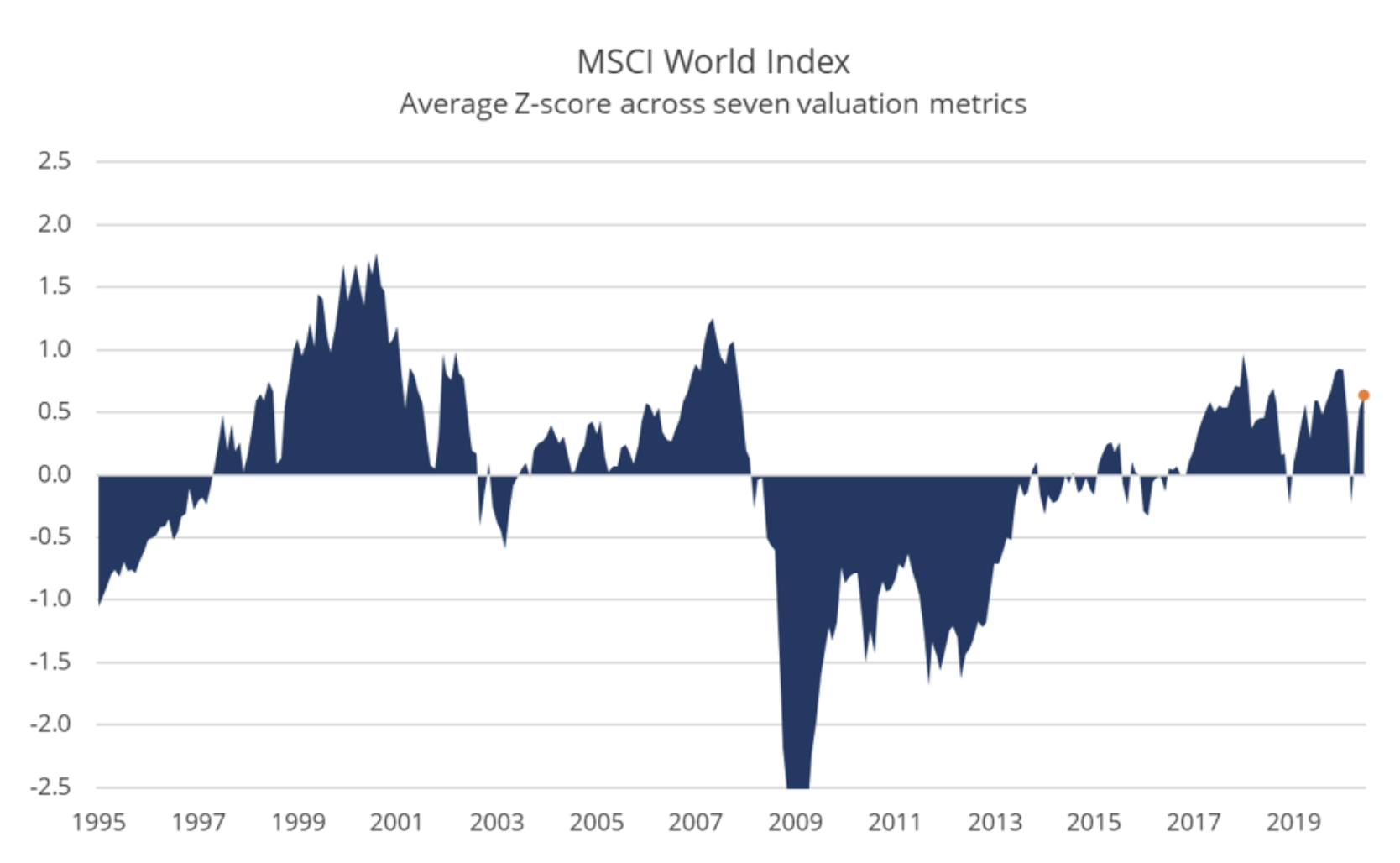

Valuations have returned to levels where the profit-risk ratio is not attractive in a historical context. History shows that at current valuation levels, there is a 33% probability that investors in international equities over the next 10 years will get a negative real rate of return.

Can valuations increase further, thereby proving that this relationship is wrong? Of course, and if the Fed implements the control of the yield curve, there could be a real return. In a recent analysis, we showed that the control of the yield curve proved to be very beneficial for US stocks in 1942-1951, while it was unfavorable for Japanese stocks from September 2016. The main difference between these periods is that the United States had a large deficit at the time fiscal, while the Japanese government de facto exacerbated the fiscal impulse. If the control of the yield curve is associated with a large fiscal deficit, it can be very beneficial for shares, in particular shares of companies from emerging markets that are dependent on a weak dollar and good financial conditions.

While the control of the yield curve can solve the problem of high nominal growth and high inflation - due to deleveraging the public debt-to-GDP ratio - it can also have catastrophic effects when interest rates are at a very low level. A BIS study published in 2018 showed that since the beginning of the 90s, the percentage of global listed companies that have gone "zombie" has increased dramatically, in particular after the global financial crisis. It seems that the price of low rates, which reduce financial pressure on enterprises, is the unproductive use of capital and widespread misallocation of capital and labor. This is not a good recipe for the future.

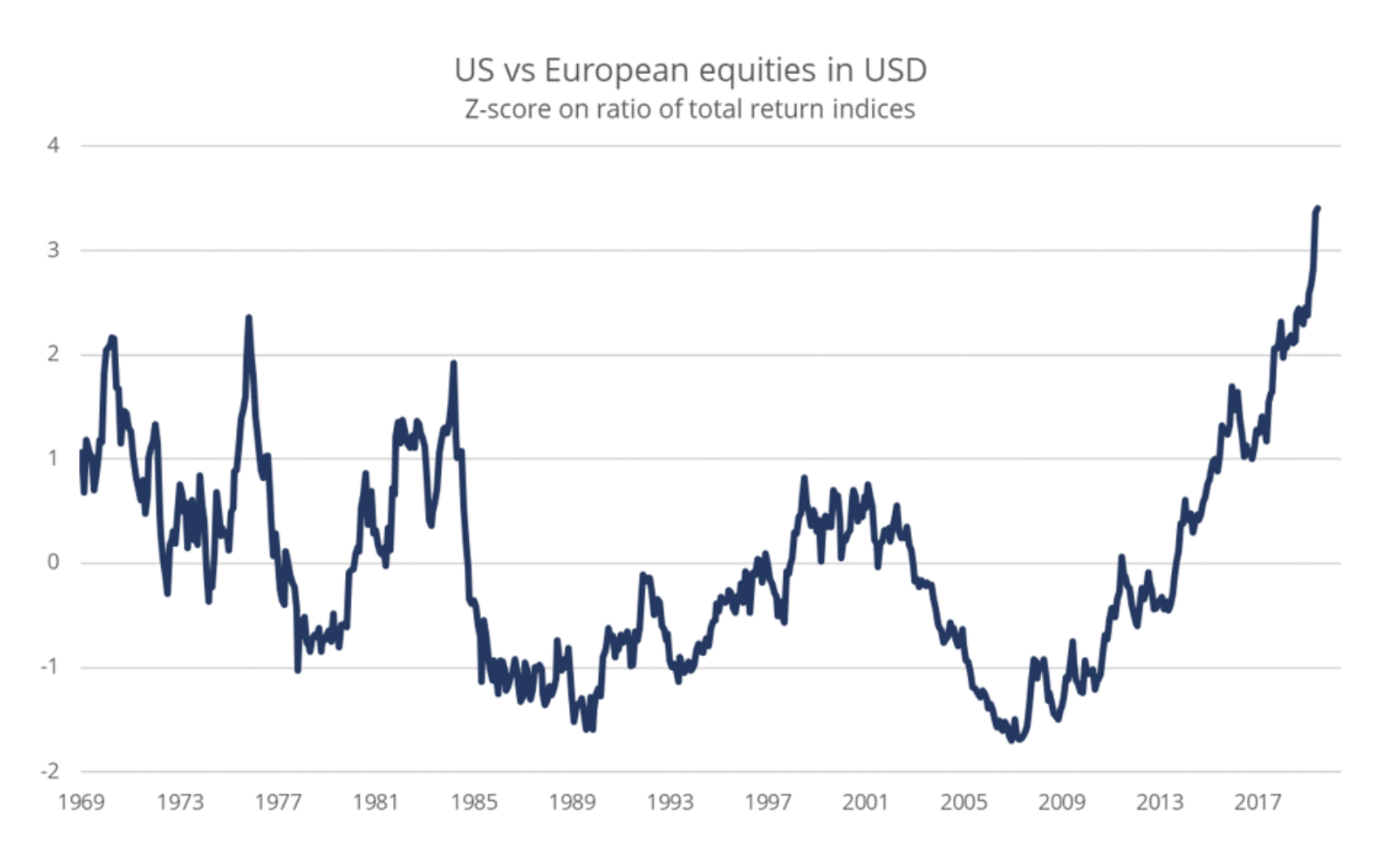

Is it time to buy shares of European companies?

Last year, the advantage of American over European shares increased to a record level in historical terms. Since 2007, European companies' shares have lost approximately five standard deviations in relative terms relative to American companies. It was caused by strong USD, higher valuations of American shares than European shares, higher profit growth in the United States combined with extensive share repurchase programs and a tectonic shift of market capitalization towards technology companies, i.e. an area in which Europe lags behind.

Based on the 65-month EV / EBITDA moving multiplier, American company shares are valued XNUMX% higher than European company shares. Such a huge valuation difference requires a perfect profit path in the United States.

As a rule, US equities have less financial leverage than European equities, which is naturally a plus in an uncertain macroeconomic environment. Valuation is, however, a key factor explaining the future return, which is why, given the historical advantage of US shares combined with high valuations, we are convinced that investors should invest more heavily in European companies - despite political risk in the EU.

The world needs a weaker dollar, a Fed will provide it over time. This will benefit European actions. In addition, European companies are in a better position in the context of the ecological transformation and focus on robotics in the healthcare sector. Although Europe has lagged behind in the area of IT, there are signs that it is finally beginning to accelerate.

Investment topics in an increasingly localized world

Location will be resolved within a decade, both in the economy and in stock markets. One of the themes that makes sense in this transformation is investing in low-capitalization companies with domestic revenues from non-cyclical economy segments (health care, consumer basic goods and utilities). The transformation towards a more local economy for many enterprises means an uncertain path, so in our opinion the good old strategy of investing in high-quality companies with low leverage is also attractive.

We believe that certain sectors of the economy, such as the ecological transformation, will also remain in good shape due to the fact that the current economic model is clearly harmful to the environment. A good starting point in the context of inspiration is our initial list of "green actions" from January 2020. Other industries, such as health care, robotics and 3D printing, will also receive support from the policy of self-sufficiency and domestic production in developed countries.

In our opinion, good results will also be achieved by companies with a strong digital position and a solid business model - such long-term stocks can be selected based on our latest list of online companies. However, due to the extreme valuations of some companies in this segment, investors should be cautious about what we refer to as "bubble stocks".

In the future environment of state capitalism and location relatively good results can also be noted gold. However, beware of the mythical gold mines. In one of our recent analyzes, we show that they do not record better results than spot gold, despite balance leverage. Investors who prefer gold should therefore remain vigilant.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)