Shares of the XTB brokerage house are record-high

When at the end of April we wrote about the profit XTB broker rose in I quarter 2020 by sky-high 22 962%, many investors argued that it couldn't get any better. But it turns out that they were wrong, as shown by the share price. This week, the price of XTB reached PLN 18,10 - the company is the most expensive in the history of trading.

If someone had a New Year's decision to invest in XTB shares, because it is a promising Polish broker and he kept his word at the beginning of January, he can drink cream today. He will sell his package with a profit of 300% without much problem. Moreover, there is little indication that the upward trend is likely to reverse quickly in the near future.

XTb Stock Chart, W1 interval. Source: Trading View

The XTB has been rising since the beginning of the year because of the market environment. Everyone has heard about negative prices on the market oil, many watched the dynamic rebound of stock indices and rising commodity prices. Most have therefore concluded that it is high time to set up an account with a broker and earn a fortune in the financial markets.

Earning a fortune by individual investors will probably be as usual, i.e. few will succeed and most will lose, but XTB is already earning a fortune on all of them. In the first quarter of 2020, it was PLN 176 million of consolidated net profit, compared to PLN 0,8 million of profit a year earlier. In the second one, it should not be too weak, as indicated by the share price - usually ahead of the publication of results, which should be released in a week. Last week, XTB already cost PLN 17,05 and it is an absolute record price in the history of this company's listing.

The interest in XTB does not drop, the competition also breaks records

Why such an enthusiastic XTB assessment among investors? The forecast of good results can be derived from several data.

The first is the results of the competition. As the first data for the first half of 2020 he stated Plus 500 broker, operating all over the world and aggressively advertising also in Poland. The company's revenues in the first six months of this year amounted to USD 6 million. In the same period of 564,2, it was USD 2019 million. So it is clear that new investors are constantly appearing, and those who started earlier, remained (at least in part) still active. The company also admitted that in the second quarter it gained more new customers than in the first.

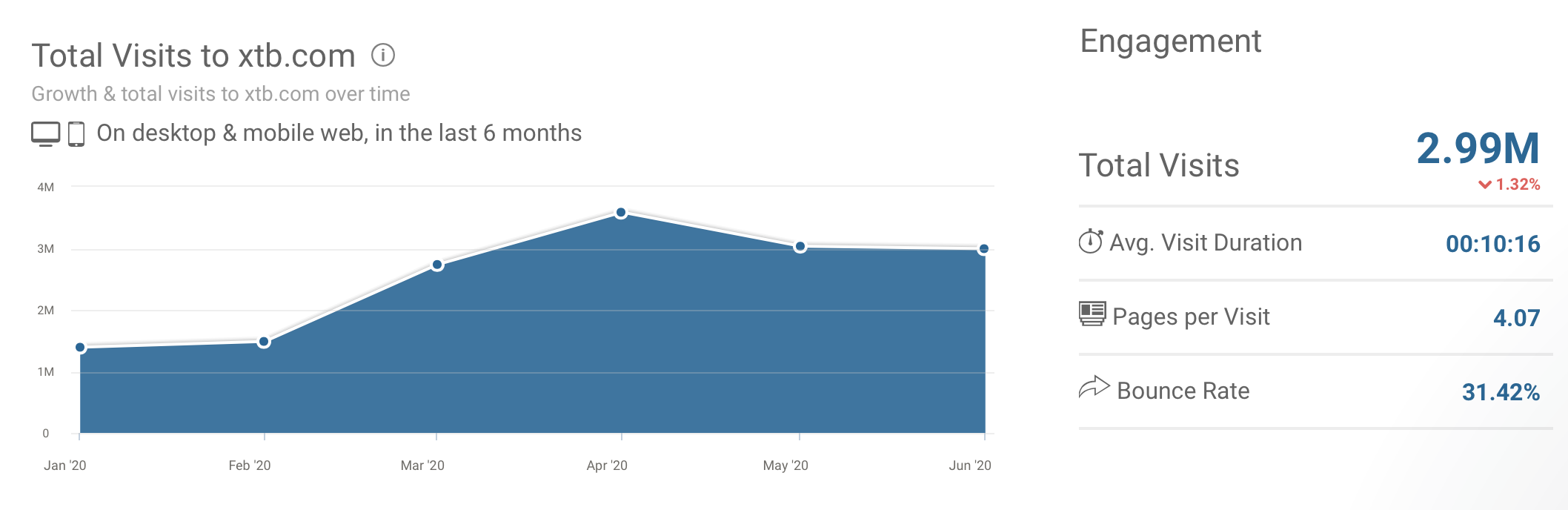

Further information that may indicate unflagging interest in XTB can be found on the Internet. This is data about the visits to pages that are on the portal SimilarWeb. In April 2020, the website was visited by the largest number of people in history - 3,6 million people. In the following months, the number of visits also remains around 3 million.

Site statistics XTB.com. Source: SimilarWeb.com

The dividend will cool or warm up the mood?

However, it can be assumed that in the third quarter - in which we observe much lower volatility caused by holidays, as well as investors getting used to the coronavirus - there will be no such spectacular increases. There will be a lot of speculation about the dividend that XTB will pay for 2020. Let us recall that a year earlier it was PLN 0,24 per share, but then they cost a little over PLN 4, not PLN 17,05, and the cash in hand was much less. The cost of XTB dividend payment for 2019 amounted to PLN 28,2 million. Now, after the first quarter of this year, the company's cash desk had PLN 731,2 million. Does this mean you can expect a huge dividend?

Not necessarily. The company has more and more customers, which translates into the need to increase the financial reserves held. The Polish Financial Supervision Authority must also agree to the payment of a large dividend, and with it - as we know - the KNF is at stake.

With such large free funds, you can also think about acquisitions of other companies or business diversification to secure revenues in potentially more difficult periods, but for now the management of XTB has not even signaled that it should take steps in this direction. Which does not mean that we will not soon find out that XTB is taking over a company from the industry or investing, e.g. in real estate.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)