American IPO market in IQ 2021 - Eldorado continues

Since June 2020, there has been a recovery in terms of debuts on the American stock exchange. Eldorado on the IPO market also continued in 2021. As a result, the first quarter of 2021 was very abundant in new market debuts. 274 companies debuted on the NASDAQ market, while 128 companies entered the NYSE. This gave a total of 402 new companies on the stock exchange. The current year "outclassed" the first quarter of the previous year, when only 38 companies had their debuts.

The value of the IPO also increased. In the previous year, during the first In three months, debuting companies raised $ 10 billion. This year, thanks to initial public offerings, companies have placed shares on the market worth over $ 134 billion (including Direct Listing).

Check it out: The US IPO Market: 2021 Recap

SPACulation

In 2021, SPAC debuts, which on NASDAQ were responsible for 196 IPOs, were very popular. The ease of raising capital by companies of this type is partly due to their structure, which allows for easier listing of technology companies that do not have to conduct a time-consuming public offering. Thanks to SPAC, they can appear on the market "through the back door".

SPAC is a special purpose acquisition company that places the raised capital from the IPO market in an escrow account. Within two years, the funds are to be spent on the acquisition of a promising company. If the takeover fails, the company must return the funds to investors. At the same time, the company may be "forced" to buy shares from the investor before the takeover. The policy of low interest rates (low cost of capital) combined with the buy-back guarantee has found a very good ground for development SPAC.

Alex Rodriguez, Slam Corp

SPAC used to be treated with a great deal of caution because this type of debut is less transparent than the company's classic debut. The situation changed only in 2017, when an investor known from the Venture Capital industry (Chamath Palihapitiya) began to introduce SPAC on the stock exchange. Thanks to this he earned the nickname SPAC-man.

Currently, SPAC is created not only by recognized investors, but also by celebrities and sports stars. An example is worth citing Slam Corpwhose CEO became a former baseball player - Alex Rodriguez. When investing in this type of company, it is necessary to carefully track who the managers are and what SPAC should have an investment policy.

IPO market and a very interesting March

In the first quarter, March was dominant in terms of the value of capital raised from the IPO. In the last month of the first quarter, the companies listed equities worth $ 58,1 billion (including Direct Listing). This was helped by, among others direct listing of Roblox, which offered 198,9 million shares at $ 45. As a result, the "value" of the offer was $ 8,95 billion. The next big debut was Coupang, which sold 130 million shares for $ 35, raising $ 4,5 billion.

Interesting debuts on the American market

The past quarter brought some interesting debuts. This applies to both the size of the offer and the business model. Below are examples of selected debuts on the US market.

Bumble

In February 2021, the company made its debut in the United States. At the IPO, it sold 50 million shares at a price of $ 43. As a result, the value of the offer exceeded $ 2 billion. Bumble has two dating apps in its portfolio: Bumble and Badoo.

The Bumble application was created in 2014. The goal of the creators was to build an application that would be built for women. It is the decisions of users that constitute the center of "life" of this platform. The application is based on the assumption that women must make the first move to make a relationship with another user possible. Between September 2014 and 2020, women carried out over 1,7 billion contact initiatives. At the end of Q2020 12,3, the monthly number of users was XNUMX million.

Andrey Andreyev

The Badoo application is a dating application founded less than 15 years ago by Andrei Andreyev. It is the fourth most popular application in the world (according to Sensor Tower). The application is very recognizable on European markets (mainly Russian-speaking) and Latin American countries. The average number of monthly customers (MAU) in Q2020 28,4 was XNUMX million.

The company's revenues in 2020 (as of January 29) were $ 542,2 million. From this, the Bumble application generated $ 337,2 million in revenues, and Badoo and other applications generated $ 205 million. The number of paying users increased during the year by 22,2% to the level of 2,5 million. In turn, ARPU (Average Revenue per Paying User) was $ 18,89. The company's capitalization at the end of the session on April 8 was $ 11,6bn.

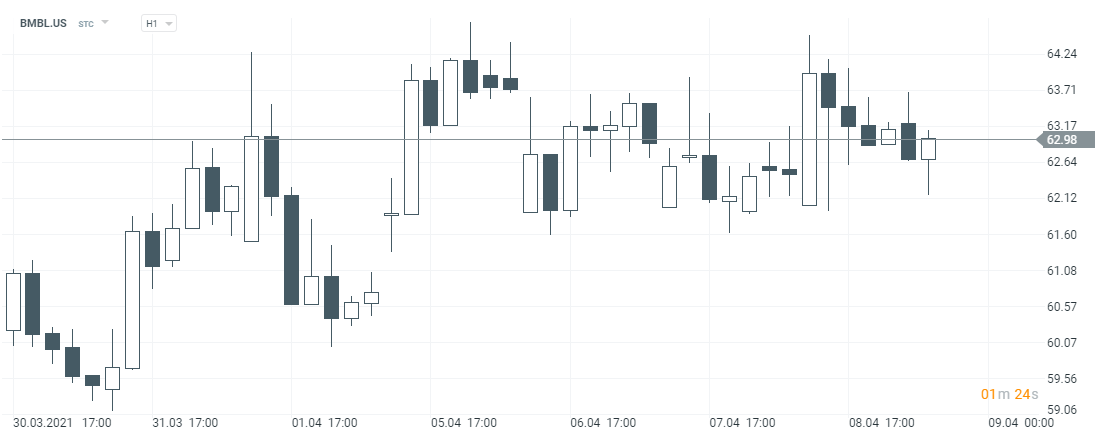

Bumble chart, interval H1. Source: xNUMX XTB.

Coupang

The company made its debut in the first half of March closing a 130 million share offer at $ 35 apiece. This meant that the value of the offer amounted to $ 4 million. Coupang is one of the largest e-commerce companies in Asia. It is also the largest company of this type operating on the South Korean market. Although the company was founded only in 550, it successfully managed to compete on the market with such a giant as Amazon. Coupang introduced the Rocket Delivery service to the Korean market, which significantly increased customer satisfaction with online shopping. Coupang has invested in a logistics network that includes, among others, 200 warehouses with an area of over 20 million square feet. Investments in the company at an earlier stage of development include Vision Fund (Softbank), Sequoia Capital, BlackRock or Fidelity.

The company's slogan is:

"How did we ever live without Coupang?"

In 2020, the company generated $ 11,97 billion in revenues, which meant an increase of 90,8% y / y. The company also achieved an operating loss of $ 527,7 million. The company managed to improve its operating margin, which in 2020 was -4,4% vs -10,3% in 2019. Coupang generated a net loss of $ 567,6 million and positive operating cash flows of $ 301,5 million. At the end of the session on April 8, the company's capitalization exceeded $ 78bn.

RLX Technology

The company develops, produces, distributes and sells e-cigarettes in the People's Republic of China. On January 26, the company closed its IPO offering ADS 133,98 million (American Depositary Shares) at $ 12 per ADS. As a result, the total offering closed in the region of $ 1 million. In 1, the company generated RMB 607,7 million in revenues, an increase of 2020% y / y. The company's net loss was $ 3 million. In the second half of March, the company's share price fell by more than 819,7% due to the information that the PRC government intends to “tighten” regulation on the Chinese e-cigarette market. At the close of the session on April 8, the company's capitalization was $ 15,6 billion.

Qualtrics,

The main shareholder of the company is the German company SAP. Qualtrics is the creator of the experience management platform. The products focus on customer experience (CX), which is supposed to reduce churn (note churn rate - the number of customers leaving a given cohort) and improve customer loyalty to products or services. solutions allow you to analyze the customer's "life cycle" and online and offline purchasing behavior. Solutions in the field of "employee experience" (EX) are aimed at improving the workflow, giving clearer feedback from both the supervisor, the employee and the candidate for the job. Another type of product is Brand XM (increasing brand recognition) or Product XM (e.g. helping to shorten the time to market). The company boasts of cooperation with such companies as BMW, JetBlue and Under Armor. One of the company's competitors is Medallia, which is listed on the American stock exchange.

Qualtrics generated revenues of $ 2020 million in 763,5. This meant an increase by 29,16% y / y. The company still does not generate operating profit as it allocates large funds to acquire new customers. Sales and marketing expenses amounted to $ 431,8 million (56,55% of revenues), however, this is less than in 2019, when the company spent $ 440 million (approx. 74,5% of revenues) on this purpose. The operating margin in 2020 was -33,4%. Qualtrics' net loss for the prior year was $ 272,5 million. The company's capitalization as of April 8 was $ 16,7 billion.

Qualtrics chart, interval H1. Source: xNUMX XTB.

playtika

It is an Israeli company listed in the United States. Playtika, which was founded in 2010, develops mobile games. The games are distributed using stores Apple Lossless Audio CODEC (ALAC),, Google etc. In 2021, the company announced that it had 35 million monthly active users. At the beginning, the company specialized in mobile games included in the "casino games" category. From 2017, the company began to diversify its activities, mainly through acquisitions of development studios. At the end of 2017, they took over the Israeli studio Jelly Button and in 2018 they acquired the German studio Wooga (including Jelly Splash and Diamond Dash) for 200 million dollars. At the end of 2020, the company employed over 3 employees in 700 offices (including Tel Aviv, London, Berlin, Sydney, Minsk, Kiev and Las Vegas).

In 2020, the company generated $ 2 million, which meant an increase of 371,5% y / y. The company's operating profit was $ 25,6 million, resulting in an operating margin of 387,2%. Net profit was $ 16,33 million.

Playtika also released operating data. In the whole of 2020, the average number of daily users (DAU) was 11,2 million. It was an increase of 9,8% y / y. The conversion of paying customers also improved, which increased from 2,1% in 2019 to 2,6% in 2020. The ARPDAU (Average Revenue per Daily Active Users) index rose from $ 0,51 to $ 0,58. The company's capitalization as of April 8, 2020 was $ 11 billion.

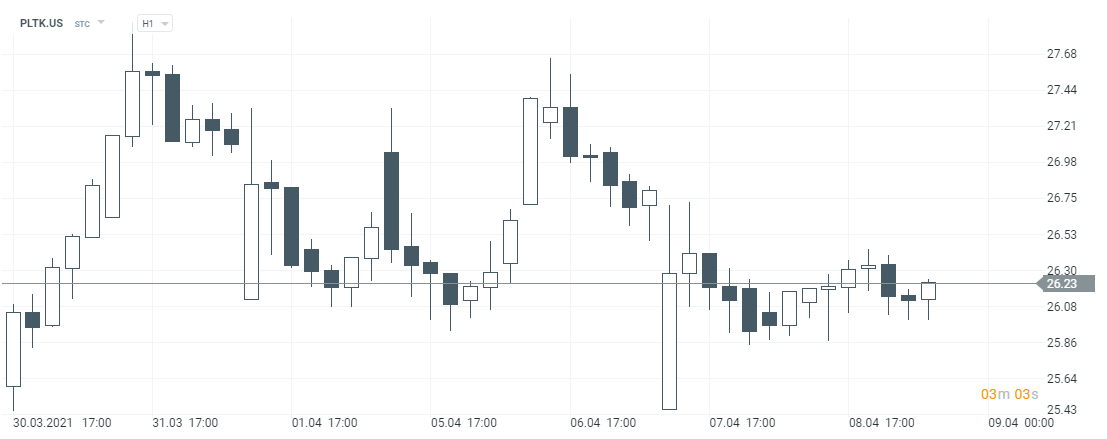

Playtika chart, interval H1. Source: xNUMX XTB.

IPO market in Q1: Summary

According to data collected by Nasdaq, 402 companies made their debut in the first quarter. SPAC companies were especially popular, with less than 200 appearing on the American stock exchanges. In the last quarter, there were also many interesting companies that may become one of the stars of the market in the future. However, it should be remembered that even a top-quality company that is bought at too high a price will not bring you staggering rates of return. It is also worth remembering about the risk (e.g. regulatory), as demonstrated by the recent debut of the Chinese company RLX Technology.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)