America's IPO market - from hell to heaven

2020 was a strange year in terms of IPOs on the US stock exchange. Due to the pandemic, the IPO market on the US stock exchange practically froze. According to data collected by Nasdaq, only 14 companies debuted in March and April, selling shares worth $ 2,1 billion. A year earlier, 35 companies had their IPOs in the comparable period. The value of the offer exceeded $ 2019 billion in 3,75.

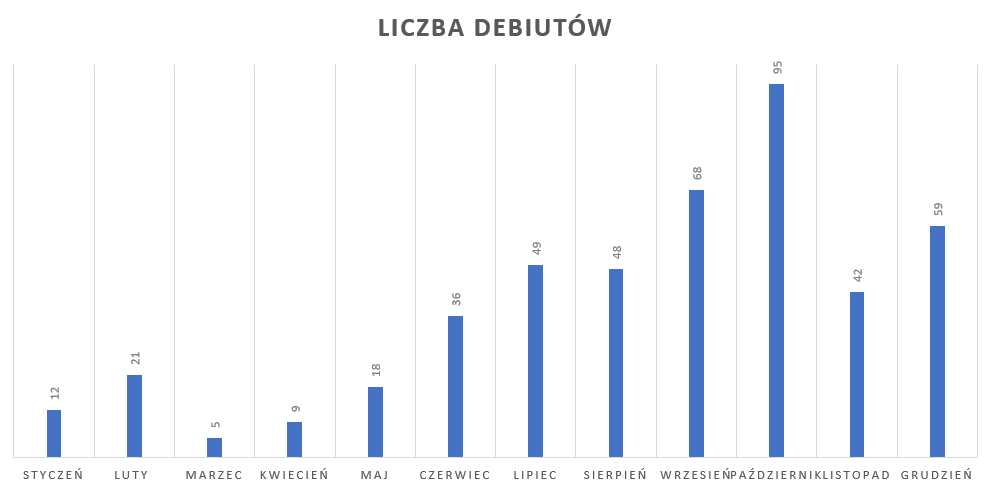

The situation on the IPO market started to improve in June, when 36 companies debuted. In the second half of the year, the debut market gained momentum. The peak was in September and October, when over 160 companies made their debut. For comparison, in the entire 2019, according to data from Nasdaq.com, 231 companies made their debut.

Source: own study based on data Nasdaq.com

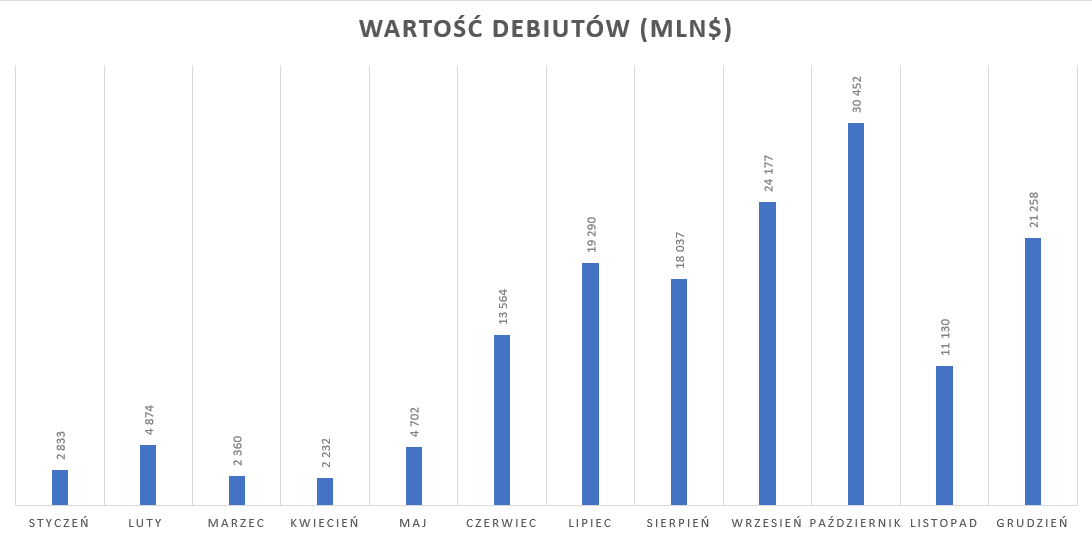

The value of debuts also increased. Since June, the value of debuts has not fallen below $ 10 billion in each subsequent month. As of December 17, the value of IPOs exceeded $ 150 billion. A year earlier, debuting companies sold shares for over $ 63 billion. The chart below shows the value of debuts in 2020.

October's debut Eldorado

October was the hottest period on the IPO market. According to data collected by Nasdaq, 95 companies made their debut and sold shares worth over $ 30 billion. Lufax Holding Ltd. was able to raise the most capital. Interestingly, it is one of the largest debuts in 2020. After the IPO, the company raised $ 2,3 billion. Lufax offers a financial platform dedicated to connecting clients and financial institutions. Thanks to the platform, customers can take out a loan or deposit free funds. Over 400 financial institutions offer their products on the platform. One of the main shareholders is Ping An.

The biggest debuts on the American market

Pershing Square

It is SPAC, or Special Purpose Aquisitio Company. A special purpose acquisition company is established in order to take over another enterprise. The company was founded by Bill Ackman, one of the most famous investors in the world. Pershing Square rallied from the market $ 4 billion.

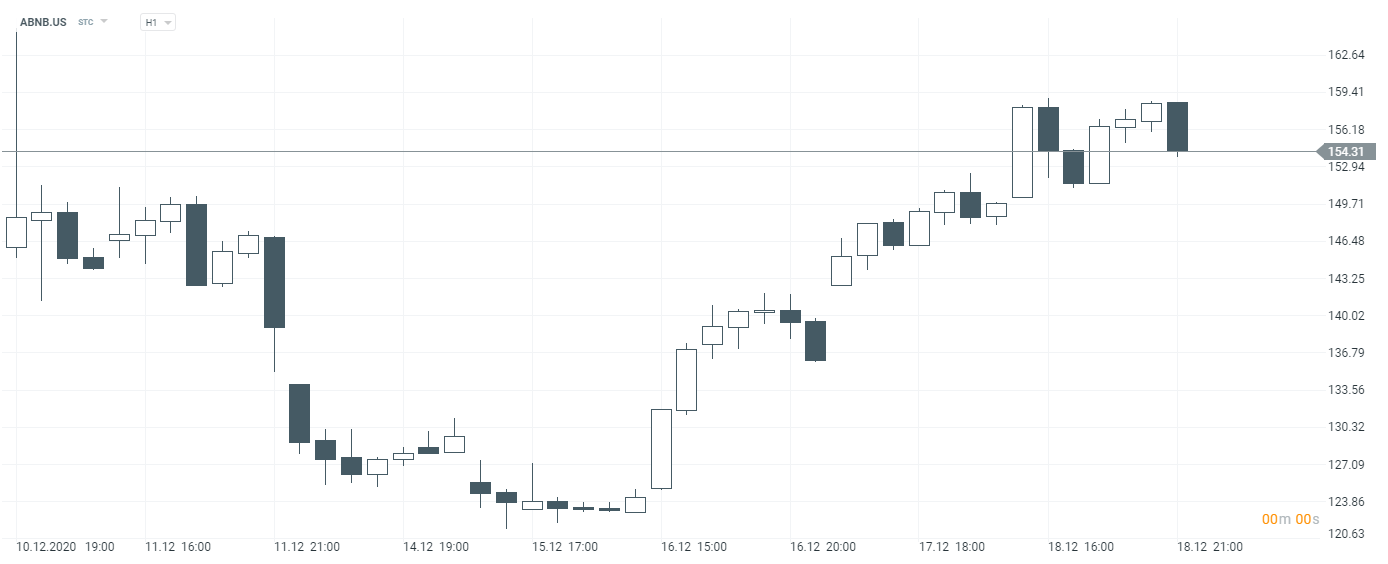

airbnb

It is a company that offers a platform for short-term rental. Through the platform you can rent a room, whole houses or luxurious villas. Airbnb operates in 220 countries and regions. In 2019, the company generated a transaction volume (GBV, i.e. Gross Booking Value) of $ 38 billion. The company generated revenues of $ 4,8 billion from brokerage. The company reported a net loss of $ 674 million. The company sold over 51 million shares at $ 68 on the IPO. As a result, the value of the offer amounted to $ 3,49 billion. Airbnb was valued at approximately $ 18 billion at the end of December 94.

AirBNB stock price, H1 interval. Source: xStation

Doordash

It is the largest platform offering food for delivery in the United States (the equivalent of Polish Pyszne.pl or Glovo). According to data collected by Second Measure, DoorDash is a leader in cities such as San Francisco, Pheonix, Atlanta, Philadelphia and Houston. The company has approximately 50% of the US market in November 2020 (according to Second Measure estimates). In December 2019, DoorDash held 33% of the market share. The company's competitors include: Grubhub, UberEats and Postmates (acquired by UberEats). In the last four quarters, the company generated $ 4 billion and reported a net loss of $ 2,2 million. The company made its debut in December 283. She sold shares worth $ 2020 billion. DoorDash was valued at approximately $ 3,37 billion at the end of December 18.

Snowflake offers solutions in the field of database in the cloud. With it, you can analyze large amounts of data. Snowflake works with both report building solutions (Qlik, Tableau) and ETL solutions (extraction, transformation, loading). Warren Buffett invested in the company $ 0,5 billion. Snowflake's IPO sold 28 million shares at $ 120 apiece. The bid was worth $ 3,36 billion, the largest offering in October. The company is currently valued at approximately $ 94 billion. The company achieved revenues of $ 2019 million in 264 and a net loss of $ 349 million.

Snowflake stock price, D1 interval. Source: xStation

Polish accent

There are also Polish accents on the American market. The most visible was the debut of ContextLogic Inc, which owns the Wish shopping platform. One of the co-founders of the platform is Piotr Szulczewski, who emigrated to Canada with his parents at the age of 11. Wish Platform allows customers to purchase cheap items from China. The company achieved revenues of $ 2019 billion in 1,9. The net loss was $ 136 million. ContextLogic sold 46 million shares at $ 24 apiece. The value of the offer exceeded $ 1,1 billion. The company's current capitalization is $ 16 billion.

Wish stock price, D1 interval. Source: xStation

High growth after debut

The fever on the market resulted in the achievement of rapid increases. Some stock market debuts provided a staggering rate of return. As of December 18, the highest rate of return was achieved by the shareholders of Wunong Net Technology. An online Chinese food retailer sold ADS 6 million for $ 5 in IPO. As a result, the company raised $ 30 million from the market. The company made its debut on December 15, 2020. One ADS of the company was traded at $ 17 during the price peak established on December 160th. After Friday's session, the share price was $ 77,98. This resulted in a rate of return on the IPO price exceeding 1400%. At the end of Friday's session, the company's capitalization was over $ 1,9bn. The company's revenues in 2019 amounted to $ 7,6 million, which meant an increase of over 600% y / y. The company's loss exceeded $ 1,7 million. It seems that the current valuation already evaluates the great success of the company.

Below is a list of 10 debuts with the highest rate of return than the price established during the IPO. Data as of December 18, 2020:

|

Company name |

Price for an IPO |

Market price (18.12.2020/XNUMX/XNUMX) |

Rate of return |

|

Wunong Net Technology |

5$ |

77,98$ |

1460% |

|

Greenwich Life Sciences |

5,75$ |

38,22$ |

565% |

|

CureVac NV |

16$ |

104,33$ |

552% |

|

Keros Therapeutics |

16$ |

80,96$ |

406% |

|

Schrödinger |

17$ |

79,86$ |

370% |

|

ALX Oncology |

19$ |

83,16$ |

338% |

|

Berkeley Lights |

22$ |

94,21$ |

328% |

|

Beam Therapeutics |

17$ |

72,35$ |

326% |

|

Prelude Therapeutics |

19$ |

76,10$ |

301% |

|

Fubo TV |

10$ |

39,25$ |

293% |

Source: own study

Debuts are not only profit

Not all companies provide profit after IPO, as shareholders of Phoenix Tree Holdings found out. The company rents flats from property owners, then renovates them and rents them out to individual or corporate clients. At the end of 2019, the company had 438 apartments. The company is positioning itself as a 'new rental' segment that uses AI to make business decisions (eg rent). The company generated revenues of RMB 309 billion in 2019. The net loss was RMB 7,1 billion. The company sold its ADS for $ 4,1. After its debut in January 13,5, the rate began to decline. At the end of December 2020, the rate was $ 18. This means a decrease of over 3,04%.

Below is a summary of the 10 debuts with the lowest rate of return from the price established during the IPO. Data as of December 18, 2020:

|

Company name |

Price for an IPO |

Market price (18.12.2020/XNUMX/XNUMX) |

Rate of return |

|

Adix Therapeutics |

9$ |

1,98$ |

-78% |

|

Phoenix Tree Holdings |

13,5$ |

3,04$ |

-77% |

|

Lizhi Inc. |

11$ |

3,53$ |

-68% |

|

Muscle maker |

5$ |

1,97$ |

-61% |

|

PROGENITES |

15$ |

6,32$ |

-58% |

|

Zhongchao |

4$ |

1,81$ |

-55% |

|

Velocity Financial |

13$ |

6,25$ |

-52% |

|

AnPac Bio-Medical Science |

12$ |

5,78$ |

-52% |

|

root, inc. |

27$ |

14,05$ |

-48% |

|

Casper Sleep |

12$ |

6,59$ |

-45% |

Source: own study

Summation

According to data collected by Nasdaq, 18 companies had their IPOs by December 462. In quantitative terms, these numbers are close to the dot-com bubble period. According to Statista, 1999 IPOs were carried out in 486, followed by 406 companies a year later. As a result of the bursting of the Internet bubble, the number of debuts decreased. Over the next 3 years, it was a total of 225 IPOs.

The current boom in the market has encouraged more companies to debut. The market is so hot that the company is able to double its value a few days after its debut. An example is Airbnb, which was valued at $ 42 billion at the time of the IPO. On the first day of trading, the company's valuation increased by 115%. After several sessions, the company is valued at around $ 94bn. Excessive market enthusiasm should be a warning signal to investors as for many companies the market success is already largely priced in.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)