Central banks in the game. What will the future bring?

We start February on the global financial markets with a "high C". It has been known for a long time that every meeting of the Fed ignites the imagination of investors around the world. Yesterday's decision to raise the interest rate by 25 basis points was widely expected, however, the increased volatility on the stock exchanges made itself felt. Investors did not have time to rest and had to face another important news, which was the increase of interest rates by the European Central Bank by 50 basis points.

Highest level of interest rates since 2007

The body responsible for conducting monetary policy in the US decided to raise the interest rate to 4.50%-4.75%. Steps taken by Federal Open Market Committee herald that the cycle of interest rate hikes is slowly coming to an end. The pace of monetary policy tightening is clearly slowing down, which is reflected in the smallest scale of interest rate increases since the beginning (a cycle of increases (basis points): 25, 50, 75, 75, 75, 75, 50, 25). The Federal Reserve also confirmed its plan to continue the process of reducing the balance sheet total at the current pace.

The Fed's communiqué after yesterday's meeting turned out to be frugal in terms of investors' suggestions. Compared to the previous version, only cosmetic changes were noted. The Federal Reserve highlights solid job growth in recent months. At the same time, he draws attention to the decreasing dynamics of inflation, noting, however, that the index remains at an elevated level. In the perspective of further interest rate decisions, the key role will be played by macroeconomic developments, as well as the impact of the Fed's actions so far on economic activity and inflation. Factors that the Fed lists include: labor market conditions, inflationary pressures and expectations, and global economic developments.

Jerome Powell did not surprise investors

Boss Fed during the press conference, he presented a position in line with market expectations. At the outset, he noted that the main goal of the Fed is to bring inflation back to target. To achieve this goal, the central bank will have to do a lot of work. Lowering inflation will most likely result in a decline in economic growth dynamics below the trend. Over the past year, the pace and scale of monetary policy tightening has been extraordinary and not all effects of the measures are being felt at the moment. The need to maintain a restrictive approach is indicated, but the Federal Reserve does not want to lead to overshooting and excessive interest rate increases.

The previous decisions of the central bank are starting to be reflected in macroeconomic data. Jerome Powell drew attention to the clear slowdown in economic growth in the last 12 months. Moreover, it was possible to curb consumer demand, which is indicated by a moderate expenditure growth. At the same time, the situation on the real estate market is deteriorating. The labor market, characterized by many imbalances, remains a strong element of the economy. The situation in the segment is tense, which is reflected in the high dynamics of wages and the demand for labor significantly exceeding the supply.

Invaluable information is the disinflation process observed in recent months while maintaining a good condition of the labor market. However, the Fed will need more evidence to be sure that inflation is on a downward trend. Long-term inflation expectations remain stable, but the Fed will keep an eye on developments and pay close attention to the risks to current trends.

Further decisions of the Fed will be made from meeting to meeting and will depend on the development of the economic situation, and macroeconomic data will be crucial in the near term, which will flow from now until March. Powell also pointed out that the focus should not be on short-term changes in financial conditions. Currently, the Fed has not set a target level for interest rates, as well as a moment when the monetary policy easing cycle could begin. Powell pointed out that history warns against starting monetary easing too early. The head of the Fed emphasized that taking into account expectations regarding the development of the economic situation, interest rate cuts should not be expected in 2023.

Market optimism

Investors were much more wary of Powell's hawkish rhetoric during yesterday's press conference, which is best demonstrated by the behavior of the underlying asset classes. Stock indices in the US climbed to the highest levels in several months, ending the session with an increase of over 1%.

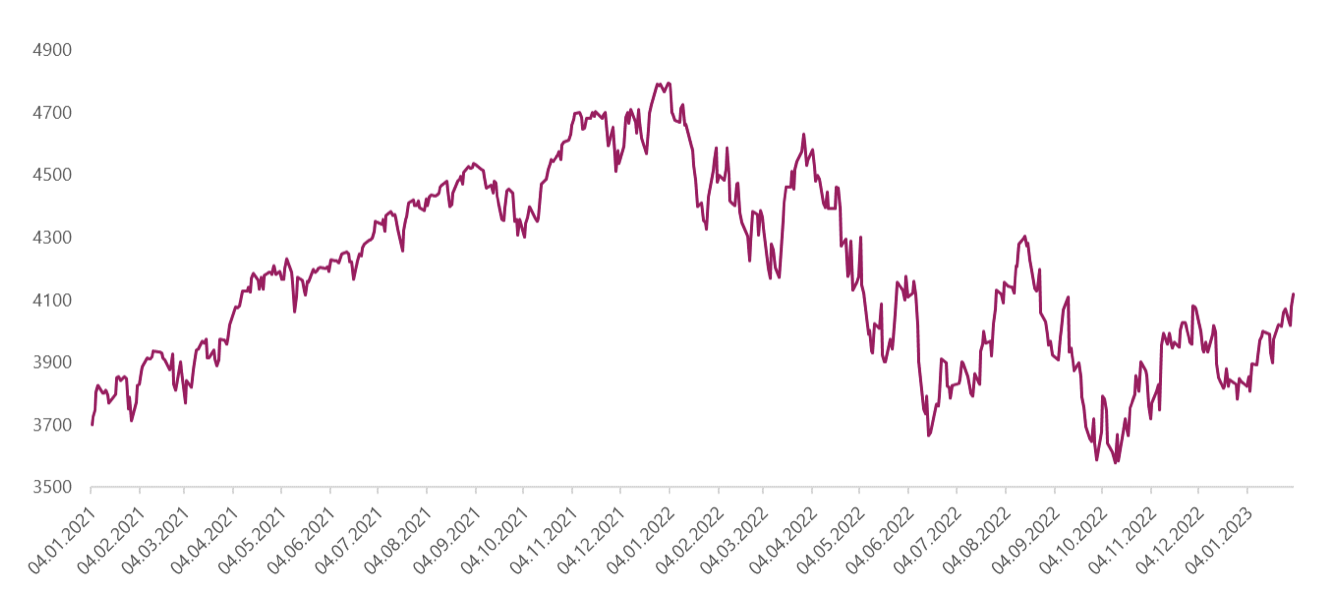

S&P 500 index quotations from the beginning of 2021. Source: Own study based on data from Stooq.pl

In recent weeks, the sectors most affected by the slump that hit the market in 2022 are making up for the losses in recent weeks. Yesterday, the leaders of the growth were companies from the technology industry (the S&P 500 Information Technology index increased by 2.29%). Tesla's very good performance (4.73%) is also driving growth the S&P 500 index Consumer Discretionary (1.89%).

Optimism is also manifested in bond prices. The yield on 10-year US government securities fell after the Fed's decision by almost 10 basis points to the level of 3.40%. Positive market sentiment is also visible on the currency market. The process of dollar depreciation and emerging market currencies strengthening continues. The EUR/USD exchange rate reached the round, psychological level of 1.1000, which was last recorded in April last year.

The end of the cycle is on the horizon

US interest rate hikes are coming to an end. For the time being, the Fed signals such a scenario quite sparingly, but market expectations quite clearly show that the last interest rate hike will most likely take place in March. Currently, the chance of a 25 bps rate increase at the next meeting is priced at 82.50% (17.50% unchanged).

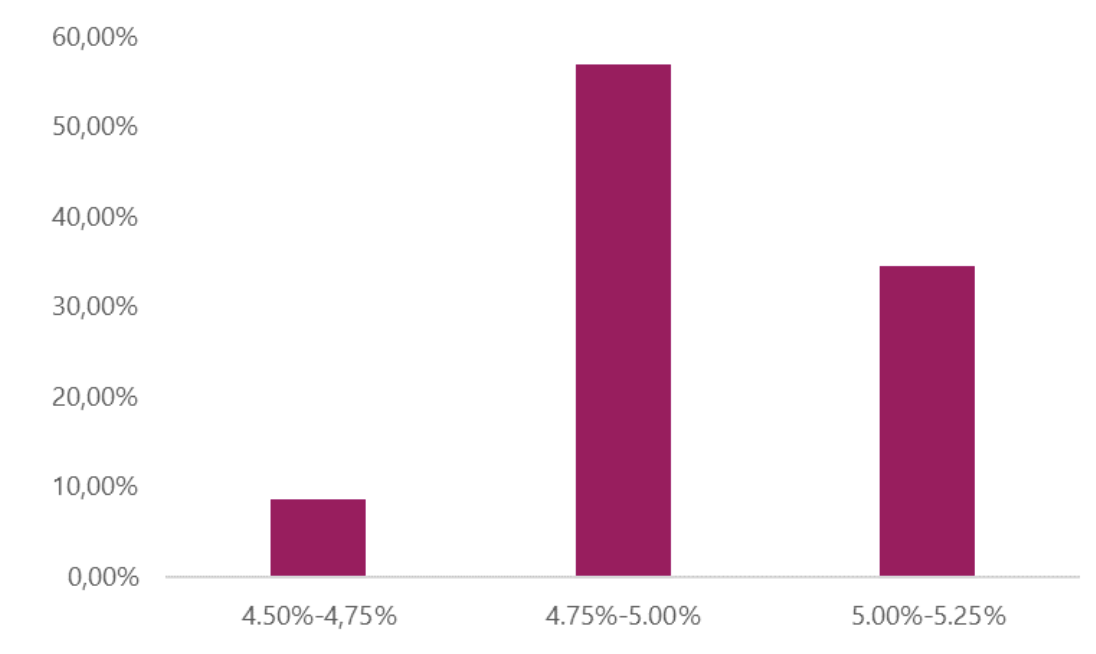

Expected level of interest rates after the Fed meeting on May 3, 2023 Source: Own study based on CME Group data

The probability of continuation of the cycle in May is currently forecast at 34.50%. Market expectations indicate that the monetary policy easing process will start at the turn of the third and fourth quarters of this year, which so far does not coincide with the central bank's suggestions.

The Eurozone lags behind the US

Results of the meeting European Central Bank were in line with market expectations. The Governing Council decided to increase the key interest rate by 50 basis points to 3.00%. At the same time, the central bank assured that a restrictive approach will be maintained until inflation returns to the medium-term target of 2%. The steps taken so far and keeping interest rates at a high level will allow to reduce inflation over time by suppressing demand and protect against the risk of a permanent increase in inflation expectations. The ECB has made its position on subsequent decisions quite clear. In March interest rates will be raised again by 50 basis points, after which the further direction of monetary policy will be assessed. As in the case of the Fed, the main determinant of actions will be the development of the macroeconomic situation.

The decision on the asset purchase program (APP) was also confirmed during the ECB meeting. As announced in December, from the beginning of March to the end of June there will be a reduction of the portfolio by 15 billion euros per month, after which the pace will be adjusted to prevailing market conditions. At the same time, it was announced that partial reinvestments will be carried out in accordance with the current practice.

The cycle of interest rate hikes in Europe is delayed by several months compared to the US. The current location of the central bank signals that there are at least a few more interest rate hikes ahead of us. The development of events in the euro area is also correlated with the macroeconomic situation. Inflation in the single currency area peaked in October and the road to the target is still long and bumpy.

Lagarde did not spoil the market sentiment

Christine Lagarde during the press conference, she was not tempted by fireworks, and her statements were very subdued. The head of the ECB drew attention to the deterioration of economic activity in the euro area, which is reflected in the slowdown in economic growth in the fourth quarter of last year to 0.10%. The weakness of the European economy will be visible in the coming months, which is a consequence of geopolitical uncertainty and the macroeconomic situation in the world. Lagarde also pointed to positive symptoms in the form of reducing bottlenecks in supplies, improving the situation on the gas market and catching up with orders by production companies.

During the press conference, Christine Lagarde also referred to inflation problems. She once again emphasized that the price pressure remains strong and the spread of high energy prices is visible throughout the economy. Core inflation remains elevated, which means that the central bank must continue its restrictive approach to monetary policy. The inflation outlook is subject to a high level of uncertainty, e.g. due to the risks associated with the situation on the energy market. There is also pressure from rising wages, with the main theme being wage negotiations aimed at catching up with inflation. A positive symptom is the development of long-term inflation expectations at a level close to 2%.

Compared to the previous meeting, risks to economic growth prospects became more balanced. The main threats to the European economy include a slowdown in global growth, the return of disruptions in supply chains and the escalation of risks related to the development of the situation on the energy market. The opening of the Chinese economy is also significant for the inflation outlook, which may give an impulse to an increase in commodity prices and stimulate global economic activity,

The tightening of financial conditions translates into lending. In recent months, the value of loans granted to enterprises has decreased dynamically. A similar tendency is observed in the case of households. A similar direction of changes is observed in the case of measures reflecting the creation of money, which shows that the steps taken by the European Central Bank are beginning to bear fruit.

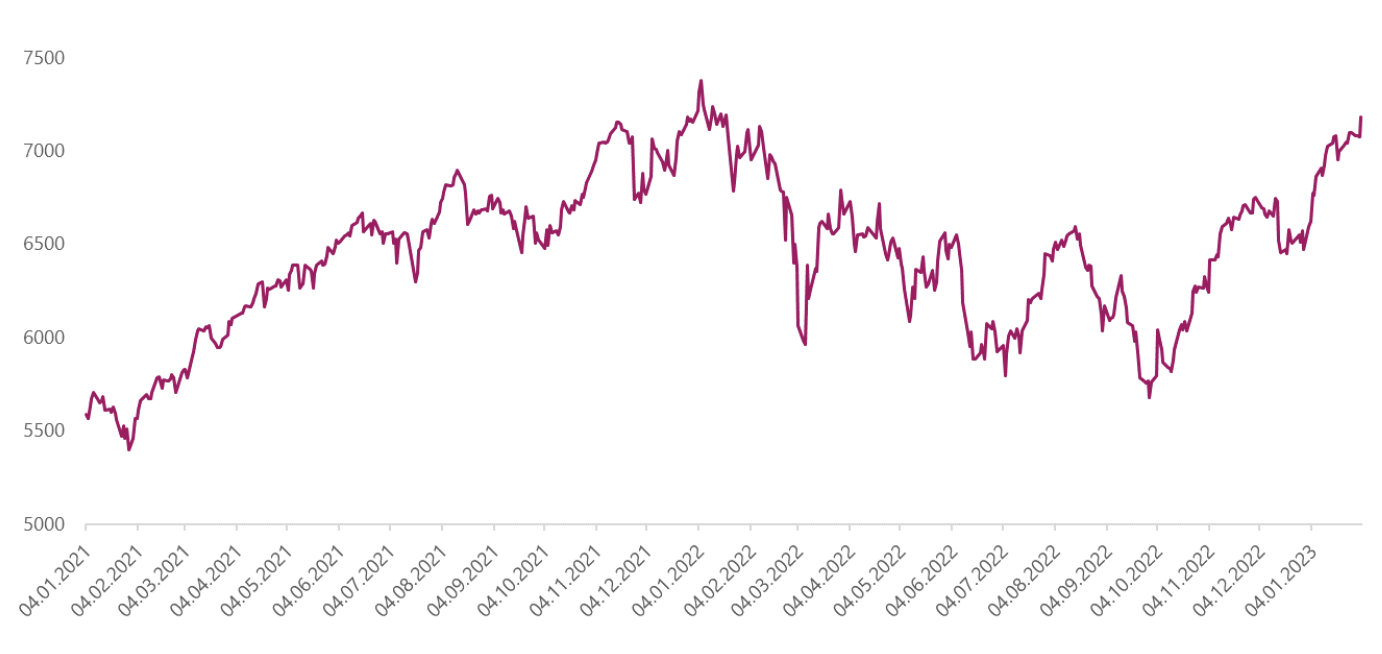

The reports from the ECB were very well received by investors. Yields on 10-year Bunds fell by more than 20 basis points today. The scale of traffic is extraordinary, the last time we had to deal with such a situation was in 2011. Optimism is also visible on the stock exchange floors. DAX is growing by more than 2%, reaching the highest level since February last year. Breaking key technical levels paves the way towards historic records, which for many weeks ago was an unthinkable scenario. DAX has increased by more than 30% over several months. French is even closer to the maximum CAC40, which also benefits from favorable market sentiment.

CAC40 index quotes. Source: Own study based on Stooq.pl data

The market can often surprise, and recent events only confirm this thesis. Despite the war in Ukraine and the energy crisis, European indices may be the first to reach new highs, which will only confirm that we will be able to think about the slump in terms of the past.

Summation

Decisions of major central banks turned out to be in line with market expectations. The markets reacted to the key events with great optimism, which is reflected in the dynamic growth of stock indices. Investors predict that the US economy will manage to avoid a black scenario in the form of a "hard landing". The ongoing disinflation processes, coupled with the strength of the labor market, give hope for a quick end to the cycle of interest rate increases, which is currently the baseline scenario. Whether the market expectations will turn out to be in line with reality, or perhaps we will experience the situation Jerome Powell talks about and interest rates will remain at the maximum level until the end of the year, we will see in the coming months. In Europe, the cycle of interest rate increases is approaching its climax and is delayed by several months compared to the US. The improving balance of risk in the euro area gives room for greater optimism and allows investors to increase exposure to risky assets. Despite the currently prevailing optimism, the global markets will certainly not lack emotions in the near future, which is a signal for investors to be vigilant and take advantage of emerging investment opportunities.

Author Piotr Langner Investment advisor, WealthSeed

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)