Bear Spread - What is a Bear Spread Strategy?

In the previous parts cycle about options the strategies are described married put, covered call and bull spread. In the present article, we will introduce the bear spread strategy, which allows you to earn on declines in the prices of indices, stocks or currency pairs.

The bearish spread is one of the simplest trading strategies that use options. So it's no surprise that the bearish spread is also one of the most popular vertical spreads. What is vertical spread? It is a strategy that consists in simultaneously buying a CALL or PUT option and writing (selling) a CALL or PUT option with a different strike price but with the same expiry date. In the case of the spread, a bearish one can be distinguished bearcall spread and bear put spread.

Bear Call Spread

In the case of a bearish spread using a call option, the strategy is to buy a call option with a higher strike price and at the same time write a call option with a lower strike price. It should be remembered that the price of a call option with a lower strike price has a higher premium than the price of a call option with a higher strike price. This means that such a strategy causes the investor to receive funds that are the maximum profit from the transaction. The trader does not have to put in any funds when creating the strategy. So it is a credit strategy.

An example of such a transaction is, for example, assuming a bear call spread on shares Microsoft on May 7, 2021. For this purpose, you can use call options expiring on June 18, 2021. At the end of the session, the value of one share was $ 252,46. One option gives you exposure to 100 shares of Microsoft. Below is a synthetic table aggregating the prices of call options just before the session expires:

| The exercise price of the call option | Bid (sale) price | Ask price |

| 220 | 32,80 | 33,35 |

| 230 | 23,40 | 23,85 |

| 240 | 14,75 | 15,25 |

| 250 | 7,80 | 8,20 |

| 260 | 3,40 | 3,65 |

| 270 | 1,30 | 1,47 |

| 280 | 0,49 | 0,60 |

Source: yahoofinance.com

Issuance of ITM options and purchase of ATM options

It is a bear call spread that consists of ITM and ATM options. You can create a bearish spread by buying a call option with an strike price of $ 250 and writing an option with an strike price of $ 230. When buying a call option, the investor pays $ 820 ($ 8,2 in bonus multiplied by a multiplier of 100). By issuing a call option, the investor receives $ 2340 ($ 23,40 in bonus multiplied by a multiplier of 100). When creating the aforementioned strategy, the investor will receive $ 1520 (commission costs are omitted). Assuming such a position, the investor has a predetermined level of potential profit, which is equal to the premium received. Below are the base scenarios:

- Price drop to $ 220

In the event that on the option expiry date the share price drops to $ 220, both options expire worthless. As a result, the investor lost $ 820 and made $ 2340. As a result, the profit from the strategy was $ 1520.

- Maintaining the course around $ 250

In a situation where the share price stops around $ 250, the investor earns $ 340 from the issued call option and loses $ 820 as a result of the expiry of the purchased call option. As a result, the net loss on the transaction was $ 480.

- Price increase to $ 270

When the stock rises to $ 270, the loss on your call option is $ 1660 ($ 40- $ 23,40) * 100. At the same time, part of the losses was covered from the purchased call option. The profit on the call option was $ 1180 ($ 20- $ 8,2) * 100. As a result, the net loss on the strategy was $ 480.

Issuing an ATM option and buying an OTM option

It is a bear call spread that consists of ATM and OTM options. You can create a bearish spread by writing a call with an strike of $ 250 and simultaneously buying an option with an strike of $ 270.

When buying a call option, the investor pays $ 147 ($ 1,47 in bonus multiplied by a multiplier of 100). By issuing a call option, the investor receives $ 780 ($ 7,80 in bonus multiplied by a multiplier of 100). By creating the aforementioned strategy, the trader receives $ 633 (commission costs omitted). Assuming such a position, the investor has a predetermined level of potential profit, which is equal to the premium received. Below are the base scenarios:

- Price drop to $ 220

In the event that on the option expiry date the share price drops to $ 220, both options expire worthless. As a result, the investor lost $ 147 on the purchased call option and earned $ 780 on the issued ATM option. As a result, the profit on the transaction was $ 633.

- Maintaining the course around $ 250

In a situation where the share price does not change much until the end of the option expiry. Investor loses $ 147 on the purchased call option and earns $ 780 on the issued ATM option. In effect, the profit from the bearish spread is $ 633.

- Price increase to $ 270

If the Microsoft stock price rises to $ 270, the investor earns nothing on the OTM call option purchased. At the same time, the net loss on the written call option is $ 1220 ($ 7,8 - $ 20) * 100. As a result, the bearish spread loss is $ 1367. This is the maximum loss that an investor can incur on such a combination of call options.

Issue of an OTM option and purchase of an OTM option with a higher strike price

It is a bear call spread which is composed of two OTM options. You can create a bearish spread by writing a call with an strike of $ 260 and simultaneously buying an option with an strike of $ 280.

When buying a call option, the investor pays $ 60 ($ 0,60 in bonus multiplied by a multiplier of 100). By issuing a call option, the investor receives $ 340 ($ 3,40 in bonus multiplied by a multiplier of 100). By creating the aforementioned strategy, the investor receives a net $ 280 (commission costs omitted). Assuming such a position, the investor has a predetermined level of potential profit, which is equal to the premium received. Below are the base scenarios:

- Price drop to $ 220

In the event that on the option expiry date the share price drops to $ 220, both options expire worthless. As a result, the investor lost $ 60 on the purchased call option and earned $ 340 on the issued option. As a result, the profit from the strategy will be $ 280.

- Price increase to $ 250

This is a similar situation to the previous example. Both options expire worthless and the net profit is $ 280.

- Maintaining the course around $ 270

In this trade, the trader makes a loss on the written call option of $ 660 ($ 3,4 - $ 10) * 100. At the same time, the purchased call option expires without value, which means a loss of $ 60. As a result, the loss on the entire strategy will be $ 720.

- Price increase to $ 280

If the Microsoft rate rises to $ 280, the loss on the call option will be $ 1660 ($ 3,4-$ -20) * 100. At the same time, a purchased call option with an exercise price of $ 280 expires without value. This results in a total loss of $ 1720. This is the maximum loss when using this bearish spread.

Below is a summary of the bear call spread strategy:

| Strategy Summary: | issuing ITM (230) + buying ATM (250) | issuing an ATM ($ 250) + buying OTM ($ 270) | issuing an OTM (260 $) + buying an OTM (280 $) |

| Strategy cost | 0$ | 0$ | 0$ |

| Expiration of $ 220 | + 1520 $ | + 633 $ | + 280 $ |

| Score at $ 250 | - 480 $ | + 633 $ | + 280 $ |

| Score at $ 260 | - 480 $ | - 367 $ | + 280 $ |

| Score at $ 280 | - 480 $ | - 1367 $ | - 1720 $ |

Source: own study

Bear Put Spread

Bearish spread strategy using the PUT option. The investor buys a PUT option with a higher strike price and to write a put option with a lower strike price. Due to the fact that the PUT option with a higher strike price has a greater premium than the option with a lower strike price, the investor must pay a premium to create a strategy. This means that the bearish spread when using a put option is a debit strategy.

An example of such a transaction is, for example, assuming a bear put spread on Microsoft shares on May 7, 2021. For this purpose, you can use the put options expiring on June 18, 2021. At the end of the session, the value of one share was $ 252,46. One option gives you exposure to 100 shares of Microsoft. Below is a synthetic table aggregating the prices of put options just before the session expires:

| The exercise price of the put option | Bid (sale) price | Ask price |

| 220 | 1,93 | 2,21 |

| 230 | 2,79 | 3,10 |

| 240 | 4,00 | 4,30 |

| 250 | 5,75 | 6,05 |

| 260 | 11,20 | 11,60 |

| 270 | 19,00 | 19,70 |

| 280 | 28,20 | 28,65 |

Source: yahoofinance.com

Issuing an ATM option and buying an ITM option

It is a bear put spread that consists of ITM and ATM options. You can create a bearish spread by selling a put option with a strike price of $ 250 and simultaneously buying a put option with an strike price of $ 270.

By issuing a put option, the investor receives $ 575 ($ 5,75 in bonus multiplied * multiplier 100). When buying a put option, the investor pays $ 1970 ($ 19,70 bonus * a multiplier of 100). When creating the aforementioned strategy, the trader must pay $ 1395, which is the maximum loss. Below are the base scenarios:

- Price drop to $ 220

The trader earns $ 3030 ($ 50-$ 19,7) * 100 on a put option he buys. At the same time, the trader loses $ 2425 ($ 5,75-$ 30) * 100 on the put option written. As a result, the profit from the bearish spread strategy (without commission) was $ 605

- Maintaining the course around $ 250

In a situation where the Microsoft rate at the end of June 18 is trading at $ 250, the investor keeps the premium ($ 575) on the put put option. At the same time, it keeps a modest profit ($ 30)) on the put option ($ 20-$ 19,7) * 100. As a result, the net profit from the transaction was $ 605.

- Price increase to $ 270

Both options expire worthless, which causes the investor to gain $ 575 on the put option and generate a loss on the put option ($ 1970). As a result, the net loss on the strategy will be $ 1395.

Purchase of an ATM option and issuance of an OTM option

It is a bear put spread that consists of ATM and OTM options. You can create a bearish spread by buying a put option with an strike price of $ 250 and writing an option with an strike price of $ 230.

When buying a put option, the trader pays $ 605 ($ 6,05 bonus x 100). By issuing a put option, the investor receives $ 279 ($ 2,79 * multiplier 100). When creating the aforementioned strategy, the investor pays $ 326 (commission costs omitted). The premium paid is the maximum loss. Strategy results from the baseline scenarios:

- Price drop to $ 220

The investor gains on buying an option $ 2395 ($ 30 - $ 6,05) * 100, which more than covers the loss on the put option. The loss on your written option was $ 721 ($ 10 - $ 2,79) * 100. As a result, the net profit (without commission) from the transaction is $ 1674.

- Maintaining the course around $ 250

Both options expire worthless, which causes the investor to lose the premium paid as a result of building the bear put spread. The transaction loss was $ 326

Buying an OTM option and writing an OTM option with a lower strike price

It is a bear put spread that is a composite of two OTM options. You can create a bearish spread by buying a put option with an strike price of $ 240 and writing an option with an strike price of $ 220 at the same time.

When buying a put option, the trader pays $ 430 ($ 4,3 bonus x 100). By issuing a put option, the investor receives $ 193 ($ 1,93 * multiplier 100). When creating the aforementioned strategy, the investor pays $ 237 (commission costs omitted). The premium paid is the maximum loss generated by the bearish strategy. Strategy results from the baseline scenarios:

- Price drop to $ 220

The investor earns on the purchased put option $ 1570 ($ 20-$ 4,3). At the same time, profit is generated from the issued put option, which expires without value. The listing profit was $ 193. As a result, the profit on the transaction was $ 1763. This is the maximum net profit generated from the bearish spread strategy.

- Maintaining the course around $ 250

Both options expire worthless, which causes the investor to lose the premium paid as a result of building the bear put spread. The transaction loss was $ 237

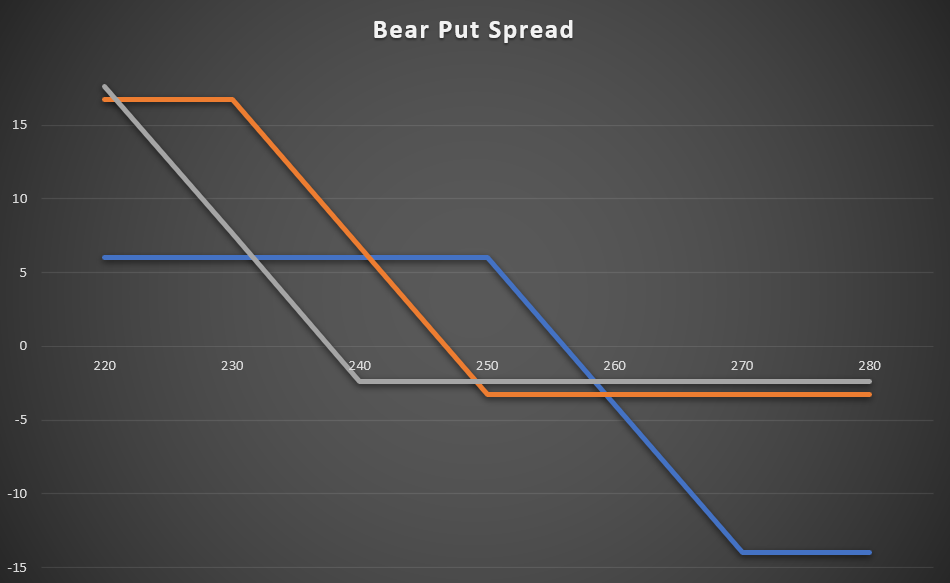

Below is a summary of the bear put spread strategy:

| Strategy Summary: | Purchase of ITM (270) + issuance of ATM (250) | Buying an ATM ($ 250) + issuing an OTM ($ 230) | Buying an OTM ($ 240) + issuing an OTM ($ 220) |

| Premium paid | 1395$ | 326$ | 237$ |

| Score at $ 220 | + 605 $ | + 1674 $ | + 1763 $ |

| Score at $ 240 | + 605 $ | + 674 $ | - 237 $ |

| Score at $ 250 | + 605 $ | - 326 $ | - 237 $ |

| Score at $ 260 | - 395 $ | - 326 $ | - 237 $ |

| Score at $ 280 | - 1395 $ | - 326 $ | - 237 $ |

Below is a summary of the Bear Put Spread strategy in graphic form:

Source: own study

Rolling over a profitable position

A bearish spread strategy can arise from writing put options on profitable put option positions.

To better illustrate this strategy, Beyond Meat's stock options expire on June 18, 2021. On January 26, an investor bought a put option with an exercise price of $ 160. He paid $ 1850 ($ 18,5 * multiplier) for it. At the time the position was opened, the share price was above $ 200.

As of May 7, the option was trading at $ 46,15- $ 52,80 (bid-ask spreads). This was due to the sharp drop in Beyond Meat's price. During the May 7 trading session, one share of the company was worth $ 110,75. The investor is concerned that there will be an increase in the share of Beyond Meat shares. At the same time, the passage of time will cause the value of the time bonus to drop to zero.

For this reason, it tries to hedge against potential loss and the impact of time decay. To this end, it may issue options expiring on June 18, 2021 at a price of $ 135. With this transaction, the investor receives $ 2510 ($ 25,1 in bonus multiplied by the multiplier). Thanks to such a transaction, the investor has already secured profits from the transaction on Beyond Meat shares. This is confirmed by the following scenarios:

- Price drop to $ 100

In this case, the trader earns $ 4150 from the put option he buys ($ 60 - $ 18,5) * 100. At the same time, the investor loses $ 990 ($ 25,1-$ 35) * 100 on the put option. As a result, the net profit from the transaction was $ 3160.

- Maintaining the course at $ 110

In this case, the trader earns $ 10 on the put option ($ 25,1-$ 25) * 100. At the same time, the net profit on the purchased put option was $ 3150 ($ 50-$ 18,5) * 100. As a result, the net profit from the bearish spread was $ 3160.

- Price increase to $ 160

Both options expire worthless. As a result, the investor loses the funds invested in the option premium on the purchased put option. As a result, the loss was $ 1850. The loss was more than covered by the profit on the put option ($ 2510). The net profit from the bear put spread was $ 660.

Source: own study

If the put option is issued, bear put spread is created. In this case, it is a defensive strategy that protects the investor from an increase in Beyond Meat's price. In the case of the negative scenario, the investor finishes the strategy with a profit of $ 660. The "cost" of the strategy is to accept the maximum profit of $ 3160.

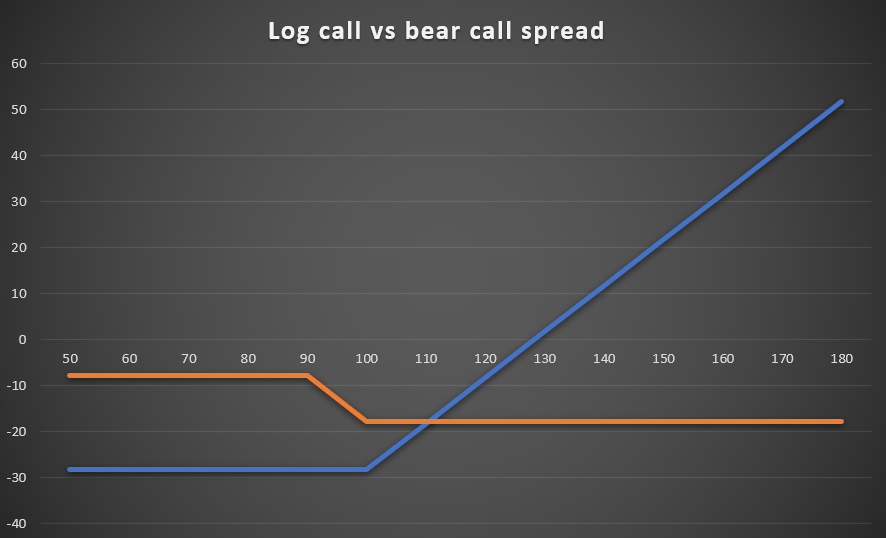

Rolling over a losing position

A bearish spread strategy may arise from writing a call option in order to reduce the potential loss from a purchased call option.

To better illustrate this strategy, Beyond Meat's stock options expire on June 18, 2021. On January 11, the investor bought a call option with an exercise price of $ 100. He paid $ 2827 ($ 28,27 * multiplier) for it. At the time the position was opened, the stock was trading above $ 116,5.

As of May 7, the option was trading at $ 13,25-$ 14,25 (bid-ask spreads). This was due to the sharp drop in Beyond Meat's price. During the May 7 trading session, one share of the company was worth $ 110,75. The investor is concerned that Beyond Meat's shares will experience a further decline in share prices. At the same time, the passage of time will cause the value of the time bonus to drop to zero.

For this reason, it tries to hedge against potential loss and the impact of time decay. To this end, it may issue options expiring on June 18, 2021 at a price of $ 90. With this transaction, the investor receives $ 2045 ($ 20,45 in bonus multiplied by the multiplier). Thanks to such a transaction, the investor has already secured the maximum loss from the transaction on Beyond Meat shares. This is confirmed by the following scenarios:

- Price drop to $ 90

In this case, both options expire worthless. As a result, the investor loses $ 2827 from the purchased call option. At the same time, part of the losses is covered from the issued call option ($ 2045). As a result, the maximum loss on a trade is $ 782.

- Maintaining the course at $ 110

In this case, the investor earns on the put option $ 45 ($ 20,45 -20 $). At the same time, the investor loses $ 1827 on the call option ($ 10 - $ 28,27) * 100. As a result, the net loss on the transaction is $ 1782

- Price increase to $ 160

In the event of an increase in the price, Beyond Meat shares result in a profit on the purchased call option of $ 3173 ($ 60 - $ 28,27) * 100. At the same time, a loss of $ 4955 ($ 70- $ -20,45) * 100 was generated on the issued call option. Consequently, the position's net loss is $ 1782.

Source: own study

The bear call spread strategy can be used as a transaction to minimize losses on a purchased call option in the event of a decline or maintenance of the share price. The "downside" of such a strategy is the increase in transaction loss in the face of an increase in Beyond Meat stock. The greater the growth of the stock, the greater the difference between the result of the long call strategy and the bear put spread. For this reason, such a strategy can only be used in situations where the trader is expecting a sideways or downtrend.

Do you know that…?

Saxo Bank is one of the few Forex brokers that offers vanilla options. The investor has a total of over 1200 options at his disposal (currencies, stocks, indices, interest rates, raw materials). CHECK

Bear Spread: Summary

Using a bearish spread strategy can be a very interesting alternative to simply buying a put or writing a call. At the same time, the formation of a bearish spread may arise from defensive strategies for prior strategies.

The bear spread can be used in the following situations:

- Reduce transaction costs on options (compared to an ordinary long put)

- Minimizing the impact of "time decay"

- rolling profitable transactions

- rolling over losing trades

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)