Unprecedented moves in a historic week for commodities

The commodities sector headed towards a calmer close after what could be described as historic a week, which saw unprecedented moves for a number of key commodities. As the dust settled and markets waited for the next chapter in an extremely depressing war in Ukraine, it found that some markets and traders were hard hit. This concerned, inter alia, the London Metal Exchange, where nickel was stopped trading after the price went up 250%, endangering the survival of a number of traders, in particular a Chinese tycoon named "Big Short".

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

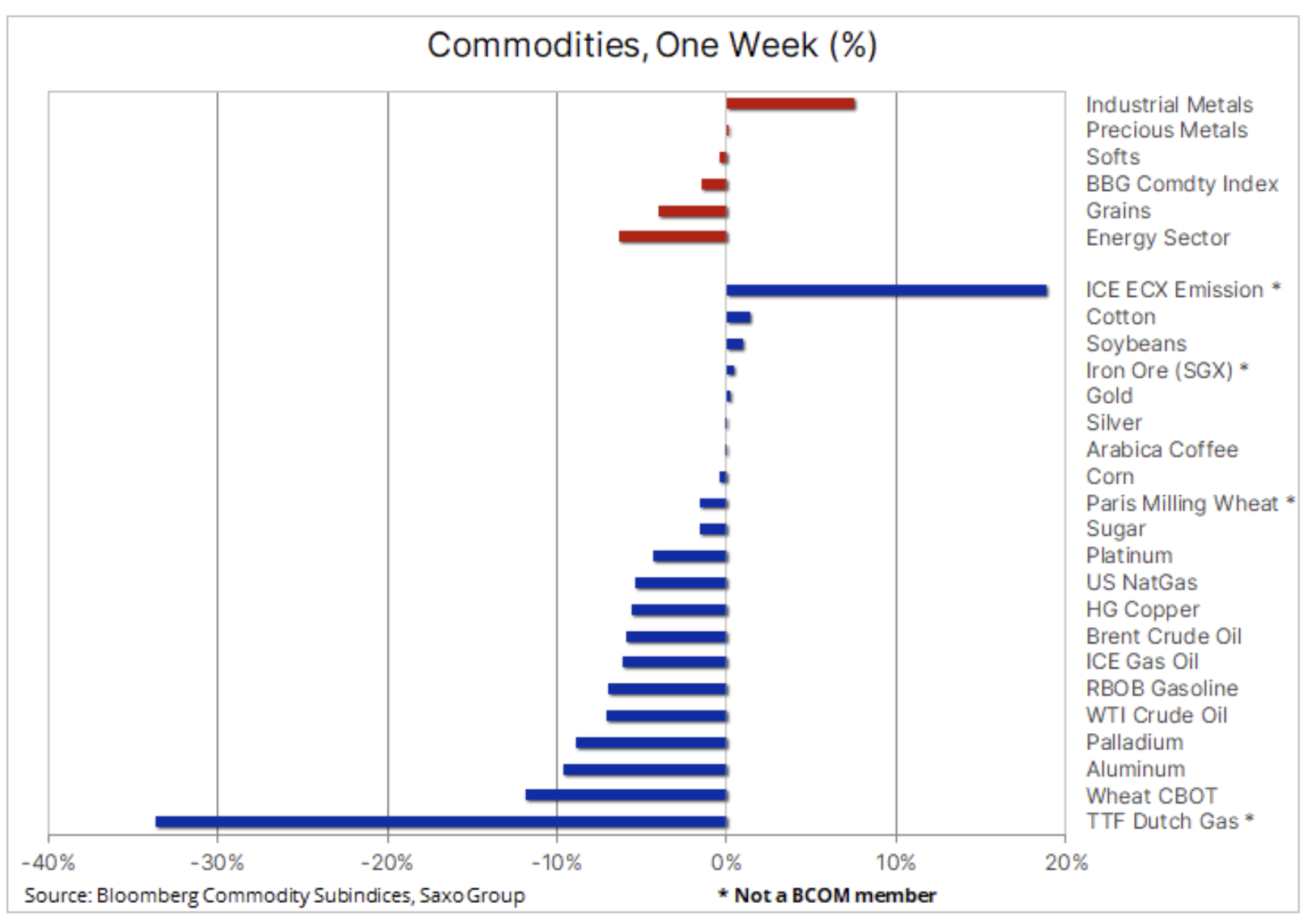

Raw materials, with isolated exceptions, have experienced strong growth since President Putin ordered his attack on Ukraine, resulting in a shift in a market that was no longer worried about supply constraints, but saw its actual decline. Because Russia is the second largest supplier of raw materials to the world economy, we are now witnessing historic movements - Russia's increasing isolation and the "self-sanctioning" of the international community are cutting off the main lines of supply of energy, metals and agricultural products. Before triggering a weekly decline in commodities for the first time since December, these developments triggered historic movements in terms of price performance and price ranges.

The biggest and sharpest shift in world commodity markets, perhaps since the oil embargo in 1973, is likely to further support an already tense supply situation, not only energy, as was the case at the time, but also industrial metals and some agricultural products. In this context, we see each short-term correction as an opportunity to enter the market, and given the high level of individual price fluctuations, we prefer to focus on listed funds with exposure to broadly understood commodities.

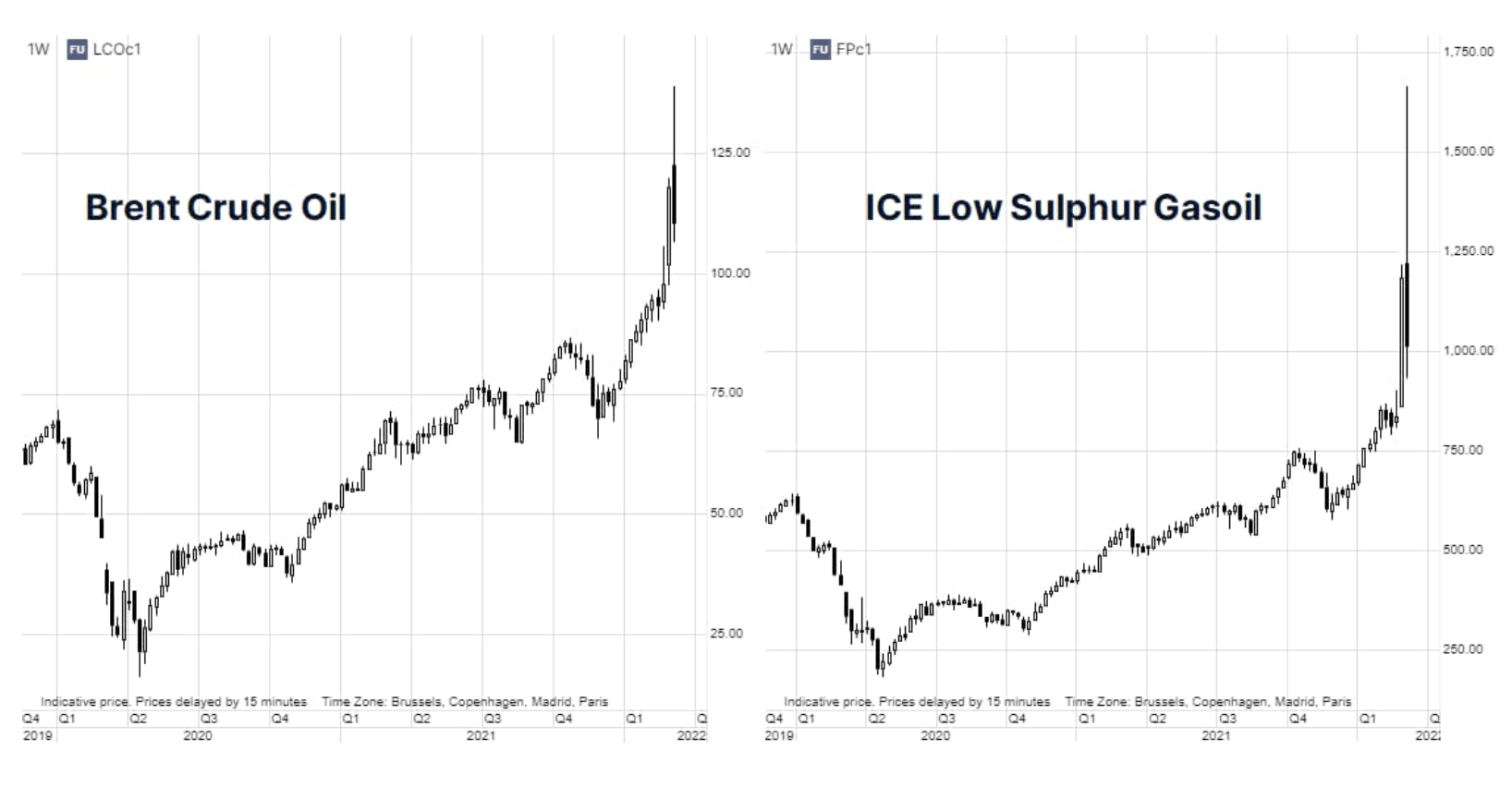

Petroleum

Meanwhile, the price Brent oil it was heading for its first fall in three weeks at the close after a tumultuous period where the May contract almost hit $ 140 / b, followed by a sharp reversal and during the week the price range rose to a record $ 33. The situation on the European diesel market was even more dramatic, and self-imposed sanctions on supplies from Russia raised concerns about significant shortages. ICE Low Sulfur Gasoil futures, the benchmark for all distillate trading in Europe and beyond, soared to a record USD 1 per tonne, nearly three times the five-year average. At petrol stations across Europe diesel fuel prices they exceeded gasoline prices for the first time in many years, which increased the risk of damaging demand due to unprofitable high prices for some industries.

Natural gas, nickel

Na European gas market Surprising and damaging price movements continued to be observed. Earlier this week, the price of the European benchmark of the Dutch TTF gas contract hit a record EUR 345 / MWh, equivalent to USD 630 per barrel of crude oil, but after a week of staying in the broad EUR 232 range, it ended the week close to the lower limit, falling by around 35%. This came after Russia decided not to limit its sales of energy and raw materials, which means for Europe an adequate supply of gas via pipelines during the transition to the spring season and the associated lower consumption.

Nickel, used for the production of stainless steel and electric vehicle batteries, ended up at the epicenter of the consequences of the war in Ukraine and the sanctions imposed on Russia. Following a sharp 250% appreciation on Tuesday, the metal briefly broke above $ 100 per ton on the London Metal Exchange, a fivefold increase from last year's average. This move was prompted by speculation in the market that one of the holders of a large short is having difficulty both reducing it and obtaining the funds necessary to meet the daily margin requirements.

Investors in any futures market need to make regular cash deposits with their brokers, known as 'margins', to cover potential losses on their positions. Brokers, in turn, must keep a security deposit at the clearing house. When the market moves in the opposite direction of these positions, they receive a "margin call" requesting more funds, and in the event of failure to pay, they may be forced to close out their positions.

This is exactly what happened on Tuesday, the Hong Kong-owned London Metal Exchange, when it became known that Chinese nickel titanium Tsingshan, owned by Xiang Guangda, i.e. "Big Short" could suffer a loss of $ 8 billion on its short position of 150 t. The stock exchange not only stopped trading, but decided to cancel all transactions made on that day, thereby restoring the price to the previous day's level, i.e. USD 48,00 per ton. Tsingshan has already secured sufficient margin to cover the margin, however as Mr. Guangda is not yet ready to close his short position, fireworks can be expected after contract opening, potentially dropping more than 40% given price movements on the Shanghai Futures Exchange Since that time.

Precious metals

Gold remained unchanged after its price rose to just a few dollars away from its 2020 record ($ 2 / oz), followed by profit-taking as markets' risk appetite improved and profitability improved they went up ahead of the FOMC meeting scheduled for next week. Silver hit its highest price since June, but faced resistance at $ 26,90 / oz, a 61,8% retracement of the 2021 mark-down line, following the start of profit taking for certain industrial metals, particularly copper, which, after breaking a new high above 5 USD / lb, began to sell off, and such a trend reversal resulted in a slight deterioration of silver against gold.

Apart from the difficult to estimate geopolitical risk premium present in the market and despite our forecast being exceeded, we maintain a positive forecast that inflation will remain high and central banks may find it difficult to slow down sufficiently amid the risk of an economic slowdown. In our opinion, the Russian-Ukrainian crisis will continue to support the prospect of rising prices of precious metals, not only due to the potential short-term safe haven offer, which will change, but mainly due to what this tension will mean for inflation (increase), economic growth (decline) and expectations of rate hikes by central banks (lower frequency).

Wheat

Futures contracts for wheat Stocks in Chicago and Paris on Tuesday soared to all-time highs, then plunged after the US Department of Agriculture raised its forecast for world inventories thanks to record harvests in Australia and strong exports from India. Ukraine and Russia export 29% of the world's wheat, mainly via the Black Sea, and from the point of view of world food security, the war in Ukraine, often referred to as Europe's granary, is of vital importance as wheat and rice are the two most important staple foods. Among the top ten importers of wheat in the world are several developing countries, from Egypt and Turkey to Indonesia and Algeria, all countries where rising food costs will have extremely negative effects. In its monthly report, the US Department of Agriculture lowered the estimates for exports from Russia and Ukraine by a total of 7 million tonnes to 52 million tonnes, which, however, remains subject to a high degree of uncertainty and may increase sharply as a result of the prolonged war, thus keeping prices high.

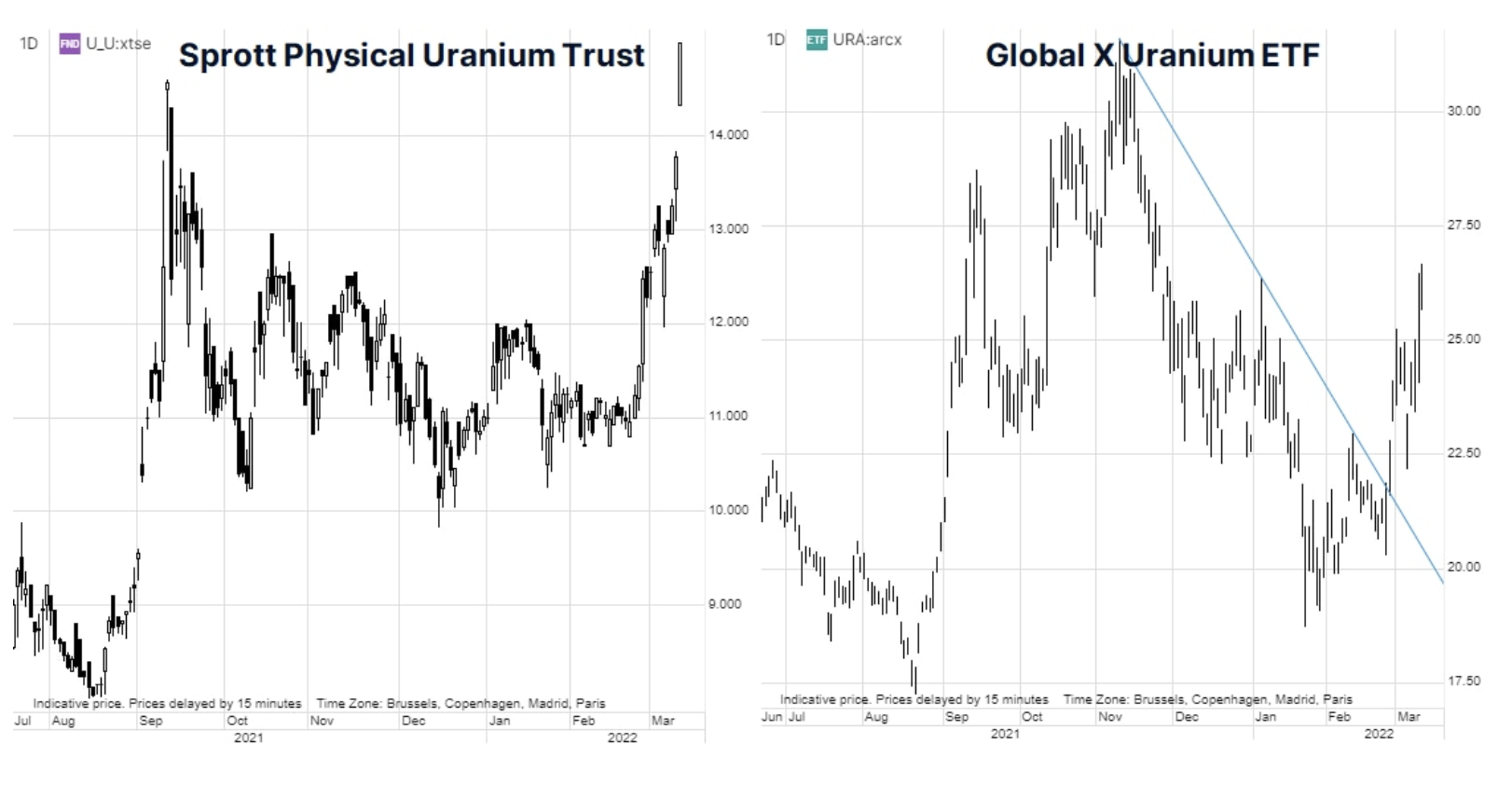

uranium

Spot prices uranium surged to the highest level since the 2011 Fukushima nuclear disaster after the White House said it was considering sanctions against a Russian state-owned nuclear power company - Rosatom Corp. The uranium market has already enjoyed increased investor attention given the current rise in other fuel prices and Europe's recent drive to reduce its dependence on Russian oil and gas. However, a decision to impose sanctions on Rosatom would further limit the already small supply, given that Rosatom and its subsidiaries account for more than 35% of global uranium enrichment, and in 2020 16,5% of uranium imports to the United States came from from Russia. Investors in this area were rewarded as both the Sprott Physical Uranium Trust, a fund that invests in physical uranium, and the Global X Uranium ETF, which offers exposure to a range of companies involved in the extraction and production of nuclear components, appreciated strongly.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response