Brexit - there is an agreement. But what's next?

The Prime Minister of Great Britain Boris Johnson and the President of the European Commission Jean-Claude Juncker announced on Thursday that a new agreement was reached on the conditions for Great Britain's exit from the European Union. This caused a lot of excitement on the currency market.

Brexit and the pound situation

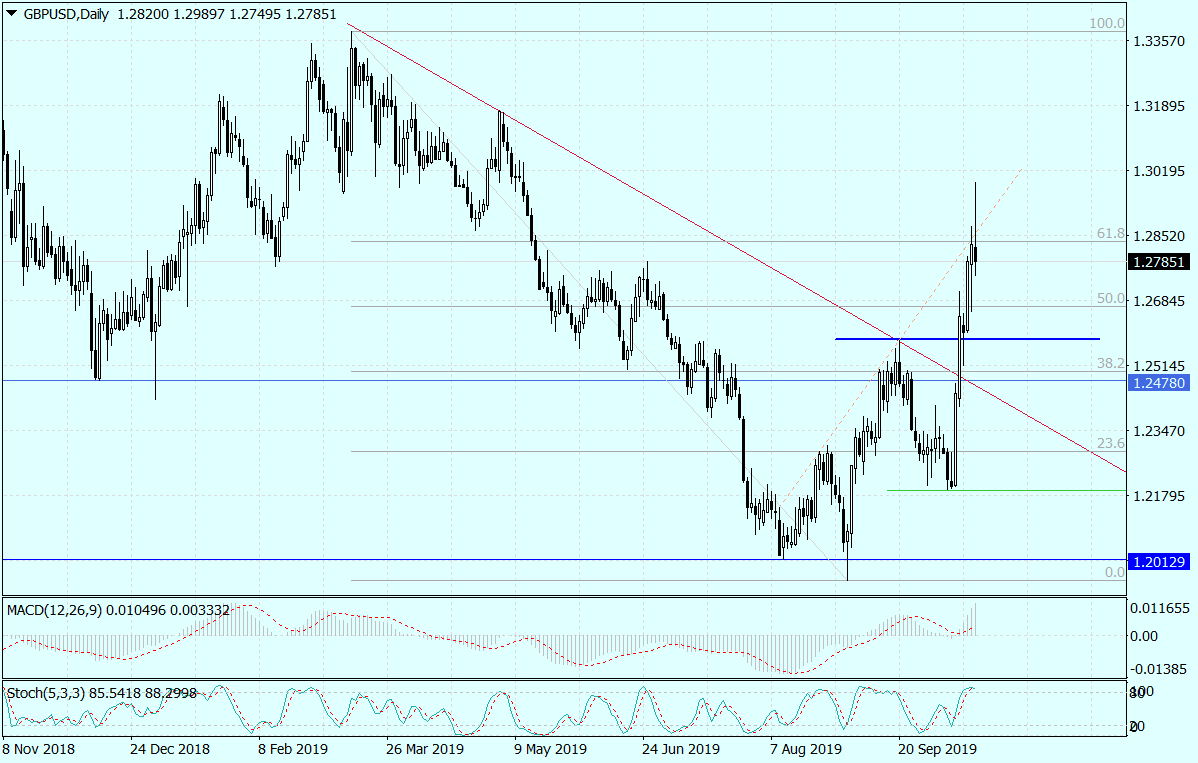

The GBP / USD exchange rate in response to information about the agreement shot from around 1,2820 to 1,2990, testing levels not seen since mid-May this year. This outburst of euphoria, however, was only temporary. The course returned very quickly to the starting point and then dropped even lower. On Thursday at 15: 00, this pair tested the 1,2797 level.

This quick withdrawal from 5-monthly maxima is the most logical move. On the pound, the game under agreement has already begun on October 10 from the level of 1,2470. Profit-taking, on the basis of selling facts, is therefore understandable behavior in such a situation. Understandable and often observed.

However, this is not just ordinary profit taking. It is important to know that setting the terms for a future agreement is not over yet. Now both parties must approve it. And while there will be no problems with the European Union, there is a considerable risk that the British parliament will reject it. Such conclusions can be drawn by listening to British politicians. And so, for example, Jeremy Corbyn, head of the British Labor Party, says directly that he is dissatisfied with this agreement and will vote against.

Analysts see the risk that agreement will not be accepted in the UK. Deutsche Bank estimates that the chances of its rejection reach 55 percent. Hence, the observed GBP / USD return from the 1,2990 level is the most logical one, because the confusion around Brexit may still spoil investors' blood, pushing the pound lower.

Is there a strong discount on the British currency? No. Rejection of the agreement will not lead to hard Brexit, but to its next shift (by 3 months). This will allow you to work out a new compromise or convince the current British parliament. Therefore, it can be assumed that the GBP / USD rate should not fall below 1,2581, i.e. below the local peak in September.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)