Brexit - Postponement will not hurt the pound

Brexit: Wednesday on the GBP / PLN market is marked by stable price fluctuations above PLN 3,94, after yesterday evening the pound got cheaper by almost PLN 4 from PLN 4,98, reacting to the results of the new Brexit agreement.

Voting on Brexit

On Tuesday, the British parliament first approved the draft of a new agreement negotiated by Prime Minister Boris Johnson on the withdrawal of Great Britain from the European Union, but later in the next vote rejected the proposal to adopt within 3 the days of laws implementing this agreement. This means that there will be no Brexit on October 31. Especially that Prime Minister Johnson withdrew the Brexit Act, waiting for the Brussels movement. According to the emerging suggestions, the leaders of the European Union will agree to postpone Brexit by 3 months, but with the possibility of Britain's early exit from the Union, if only the parliament there can deal with all the necessary laws.

Yesterday's Brexit vote had one more dimension. Another defeat of Prime Minister Boris Johnson increased his determination to strive for early elections in Great Britain. However, as parliament must agree to such elections, so they will be real only after the Brexit case is finally closed. This is important because, while playing under Brexit with the contract will strengthen the pound, choices can be a risk factor.

Pound reaction

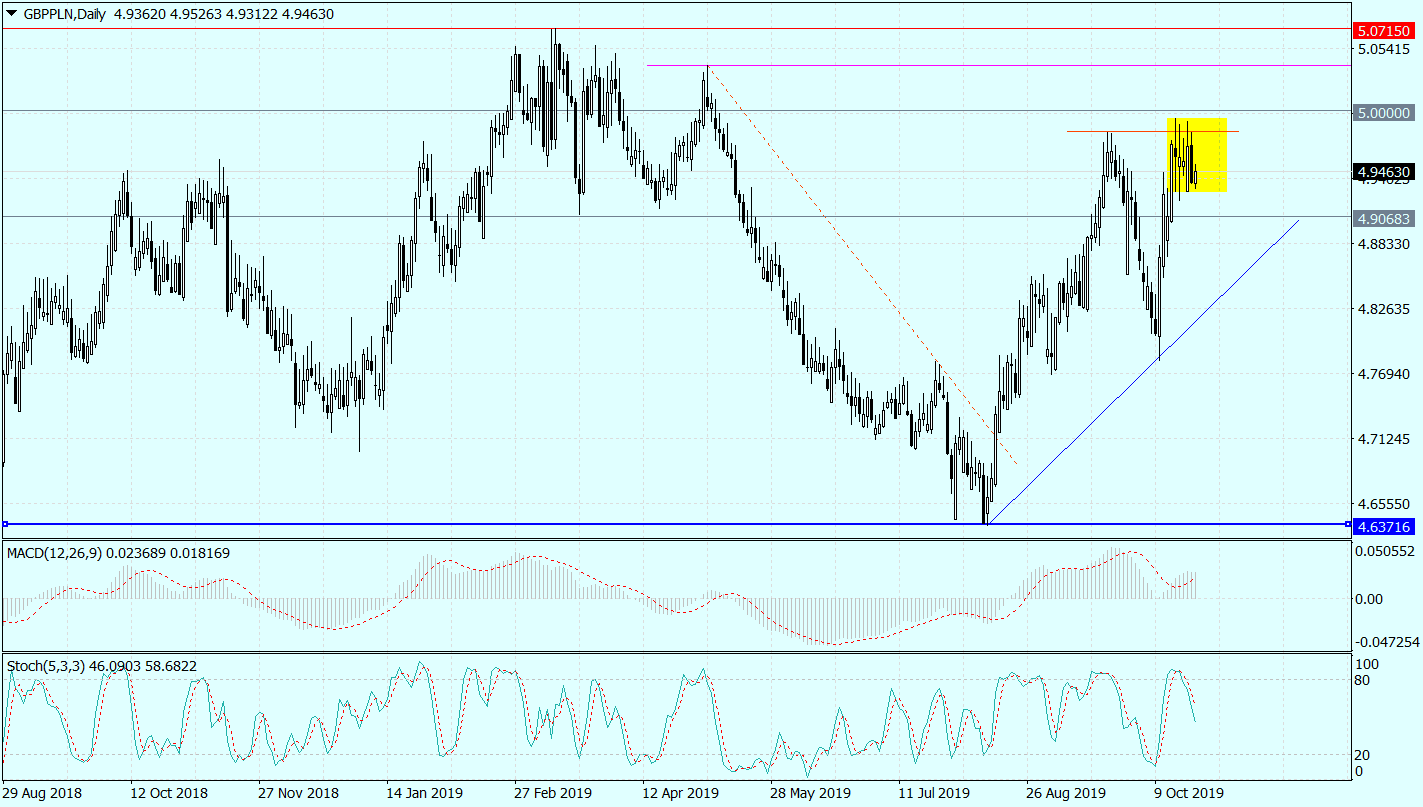

Yesterday evening the pound reacted weakening by almost 4 gr. However, this did not change the balance of power on the GBP / PLN chart. Quotations still remain in the weekly sideways trend in the general range of PLN 4,93-4,99, stabilizing at the level of September highs (PLN 4,9825). Breaking out of this short consolidation will show the direction the market will follow in the next days.

Rejecting the hard Brexit scenario, and at the same time assuming the correct assumption of a large undervaluation of the pound caused by Brexit fears, one should take into account the future strengthening of the pound in the currency basket. Including also to the zloty. Such a game to strengthen the pound could continue until the issue of Britain's exit from the EU is finally closed. Later, other topics will matter. Including the mentioned topic of elections, macroeconomic data from the British economy, or signals sent by Bank of England.

Given the above, it should be assumed that the short GBP / PLN exchange rate will break the 5 PLN barrier and move towards the resistance created by the March summit this year. (PLN 5,0750).

GBP / PLN chart, D1 interval. Source: MT4 Tickmill.

The only question is whether such upward movement will start from current levels or sooner GBP / PLN will go back a bit? This second scenario is indicated by, among others large buyout on GBP / USD, which threatens with corrective profit taking.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)