BRIC – developing countries with (not) equal potential

BRIC is one of the abbreviations that originated in the financial market and quickly became popular in the media. The alternate name is the term “The Big Four”. Over time, South Africa was added to the BRIC block. It took place in 2010. The result was a block BRICS. According to Jim O'Neill, which we will mention later, the inclusion of South Africa should not take place because the country has too small a population and economy to make sense of adding a country to the BRIC. In today's text, we will introduce what the BRIC countries are. Due to the extensiveness of the material, we decided to write a few parts about this block. In today's article you will learn:

- What is BRIC,

- Who created this acronym

- We will present how views on BRUC have changed,

- We will briefly describe alternatives to BRIC concepts.

In the following sections, we will introduce the economies of the two most important BRIC components and show how to invest in these countries.

What is BRIC?

BRIC is an acronym for the first letters of major economies: Brazylia, Russia, Indie and China. These countries were intended to be the most dynamically growing emerging markets. Each country had its advantages that were supposed to stimulate economic development. China is also the largest (in terms of purchasing power parity) economy in the world. India, in turn, is growing into the next candidate for a global power.

The concept of a strategic triangle, which was to combine the interests of Russia, India and China, was outlined in the 90s by the Prime Minister of Russia: Yevgeny Primakov. This resulted from the desire to create a counterbalance to the interests of the "West". Of course, the first attempts at cooperation were very slow, because there was a lot of distrust on the China-Russia and India-China lines. At the same time, the Yeltsin era led to chaos in Russia, which stopped the development of the concept of creating a counterbalance to the United States.

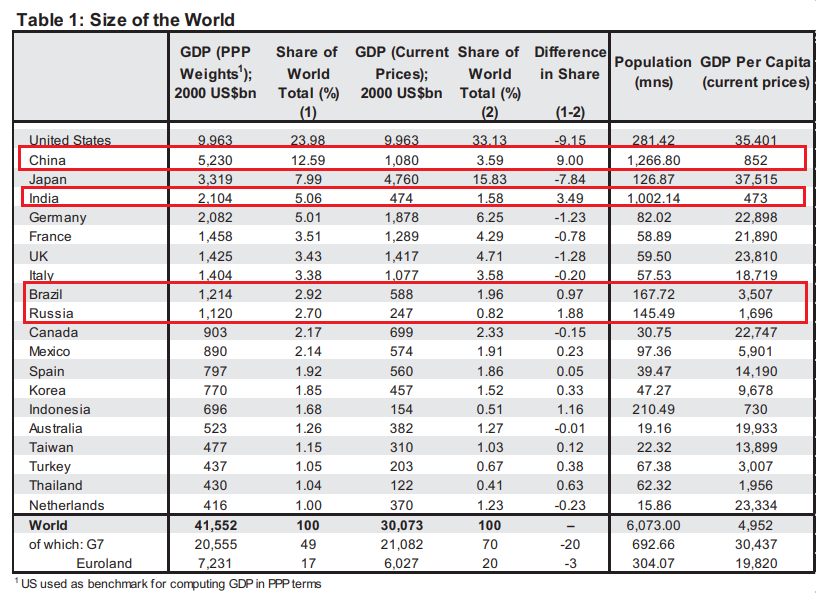

The term BRIC was coined by one of the employees Goldman Sachs. In 2001 Jim O'Neill created an acronym that combined countries at a similar level of development and dynamically developing. Of course, "similar level" is a gross simplification. India and China were then at a much lower level of development than Russia. However, they all had one thing in common - great prospects.

source: Goldman Sachs

Brazil - coffee, samba, oil and populism

Brazil was a country with a young population, large reserves oil and a relatively open economy. The demographic premium, combined with the wealth of raw materials and good education, made the country a contender for becoming one of the largest economies in the world. The country's flaw was still there high corruption and strong populism of political parties. As it turned out later, Brazil did not fully use its potential. The leftist President Lula was popular in Brazil thanks to the oil boom. He allocated funds for the development of social programs. Unfortunately, the areas of competitiveness of the Brazilian economy have been neglected. The successors were no better. Politicians were more interested in the polls than in the country's prospects. This does not mean that Brazil still has huge potential.

CHECK: BOVESPA - How to invest in a Brazilian index? [Guide]

Russia – oil and failed transformation

Russia then was considered “world treasury”. The vast expanses of this country hid treasures such as hydrocarbons, metals and elements rarely found in other countries. The departure from the centrally planned economy and recovery from the 1998 crisis offered good prospects for this country. Great hopes were pinned on Vladimir Putin. In an optimistic scenario, it was supposed to modernize Russia and reduce corruption. With rich deposits, the country could become "Great Norway" with large reserves, developed infrastructure and a wealthy population. Everything was going according to plan (maybe apart from the fight against corruption) until 2008. After the end of the raw materials boom, the country stopped developing dynamically. It has not fully used the funds received from hydrocarbons for economic transformation. Demographic problems are growing. The current sanctions caused by Russia's aggression against Ukraine only add to the difficulties.

India – still below its potential

India was already considered a sleeping giant in 2001. With over billion population and healthy demographic pyramidThe country had great prospects. The demographic dividend was to drive the real estate and labor market. At the same time, wages were to remain competitive, which was to encourage investment in the region. Another plus of the young population is knowledge of English. Thanks to this, the country could become a transfer point for American companies' outsourcing. The country has indeed developed significantly from the perspective of 22 years. But it lagged far behind China. Nevertheless, the country's prospects are still very good. This will be the main growth engines of the global economy over the next few decades.

China – a spectacular transformation

China is a separate topic. In 2001, the country only aspired to the position it has today. The enormous industriousness of the Chinese, combined with the country's accession to the WTO, resulted in an economic boom. Another factor supporting development was the government's rational economic policy. At the beginning, the focus was on creating conditions for business development, then the infrastructure was developed. China has become the factory of the world. At the same time, the country jealously guarded the internal market. There was a kind of paradox. China has benefited greatly from free trade and the openness of Western economies. However, they themselves preferred a restrictive approach to the free movement of capital. This concerned both the stock market, finance, insurance and other key sectors. It is worth adding that the country from an imitator has become an innovator in some areas. Of course, the country has its problems, such as huge disproportions between the city and the countryside or an aging population. There are many challenges ahead for the country, but it is in an incomparably better position than Russia or Brazil.

Size does matter

The BRIC countries are very large in terms of economy, population (except Russia) and area. These countries cover ¼ of the land and have about 40% of the population. If these countries entered the path of rapid convergence, they would become even more significant players on the political, economic and military scene. Many studies have been written that described the perspectives of these countries.

It is worth noting that already in 2011 Forbes noticed that the number of billionaires in the BRICS countries has become greater than in Europe. On the other hand, it is not surprising, as there were over 300 million people in the European Union, and well over 2 billion in the BRIC countries at the same time.

BRIC is an alternative to Western countries?

It is worth remembering, however, that currently the combination of these countries into a common basket is already the result of tradition. Over the course of more than 20 years, each of these countries has followed a different path. The largest economic growth concerned China and India. In turn, Brazil and Russia experienced high turbulence. However, the acronym lives its own life. Currently, there are even meetings of countries included in this block. So it is an example that sometimes a simple abbreviation can connect countries with different development models, political interests and governance models.

Some analysts and publicists try to present these countries as an alternative to the Western World. However, it is not a homogeneous group. For example, India and China both cooperate and compete. It is worth mentioning the unregulated borders between these countries, which cause disputes between them every now and then. Moreover, China supports India's "eternal" enemy, Pakistan. On the other hand, India is "romanced" with the Quad alliance, which is supposed to be a counterbalance to China and its development model.

BRIC is neither a close alliance nor a project of economic integration between these countries. This does not mean that these countries are irrelevant from the point of view of economic development and world peace. On the contrary. China, for example, are trying to improve political relations between Saudi Arabia and Iran. This is all the more interesting because these countries are hostile to each other for political, economic and religious reasons (Iran is the leader among Shiites, and Saudi Arabia is Sunni).

All of these countries want to be the beneficiaries of the shift of the center of gravity of the global economy to the east. This is natural for India and China. In turn, Russia wants to be one of the main suppliers of hydrocarbons, industrial and precious metals to Asia.

The greater the economic integration, the blush the political cooperation becomes. Russia has a very long relationship with India, dating back to the times of the Soviet Union. Today, India is teetering between the West and Russia.

In turn, with China, Russia had very tense relations (sometimes on the brink of war). Currently, Russia and China have very good political and economic relations. Countries also cooperate militarily because they participate in joint military exercises. It is worth mentioning that the Chinese leader recently visited Russia. This is another signal that China and Russia want to create an alternative political bloc to the West.

An example of the slow tightening of political and economic relations was the involvement of the three mentioned in joint projects. Russia and China belong to the Shanghai Cooperation Organization. India acts as an observer. Moreover, countries cooperate at G-20 meetings as part of a coalition supporting the interests of developing countries.

A critical look at BRIC

Not everyone was positive about the prospects of the BRIC countries. One of them was Ruchir Sharma. He was the head of the department responsible for investments in developing countries at Morgan Stanley Investment Management. In 2012, he published an item titled “Breakout Nations”. The book's thesis was that it is difficult to sustain high growth rates for more than a decade.

For many analysts, BRIC is a very heterogeneous organism. This is due to the fact that China weighs the most in this group of countries. It is the largest economy in the world (in terms of purchasing power parity). It outdistances the rest of the BRIC countries in terms of development, patents and political and economic impact.

In turn, David Rothkopf mentioned in Foreign Policy that China has effective "veto power" on any BRIC initiative. This is simply due to the potential difference between the partners. Suffice it to say that China's trade with other countries is greater than the sum of the trade turnover of the other BRIC members. As a result of socio-economic problems in Russia and Brazil, the difference in economic growth (the so-called growth gap) is constantly expanding. This can be seen e.g. after China has already overtaken Brazil in terms of GDP per capita in purchasing power parity.

The graph below shows a sharp increase in China's wealth, but a significant stagnation in the case of Brazil and Russia. Noteworthy is Poland, which is increasingly distancing Brazil and Russia in the level of economic development.

source: world Bank

It is also worth looking at how much China has "drifted away" from India. In part, such economic development resulted from the large investments made by China in the XNUMXst century. While developing countries spent an average of 2% to 5% of GDP on infrastructure projects, in the case of China it was 9% of GDP. This makes it possible to catch up with developed countries. Of course, development is not even. In particular, China focused on the development of areas close to ports, because this was and still is the industrial and financial heart of China. Admittedly, this takes place at the expense of the interior, where cheap labor comes from. This reduces the wage pressure, but it is still growing. China is no longer cheap. This causes part of the production to move to other Asian countries. An example is Vietnam, Bangladesh or India, which are the beneficiaries of the transfer of part of the production from China.

BRIC is not an acronym for the fastest growing EM economies. It is also not a list of all the most prospective markets. An example is Indonesia, which is classified as one of the most promising Asian economies. But no one is including it in the bloc countries. In terms of GDP in purchasing power parity, Indonesia has already overtaken Brazil and is getting closer to Russia. Indonesia's foundations are really solid. Further growth is supported by the demographic issue and favorable geographical location (close to the new economic center of the world - the Pacific).

Another skeptical view is that BRIC is not a homogeneous bloc by any means. An example may be the political system, where China and Russia are very far from democracy. India and Brazil, on the other hand, have a more liberal regime than the rest of the BRIC members. According to Henry Kissinger, the BRIC countries have conflicting interests, which means that they will not act as one bloc of countries.

Another problem is that the last two letters of the acronym are the most important. India and China have everything to become the most important players in the economic and political arena. In turn, Brazil and Russia are still untapped potential. Both countries are currently a less attractive area for investment than the emerging “young” economies of Asia and the Pacific.

Goldman Sachs views on BRIC

The marketing success of the acronym BRIC meant that in the following years Goldman Sachs developed further analyzes of these four countries.

It is worth mentioning that despite the optimism regarding the prospects of the BRIC countries, it did not translate into investment successes of Goldman Sachs. In 2010, the bank had to close a fund investing in the BRIC countries due to the loss of 88% of assets under management (as a result of losses and withdrawal of capital by investors). In 2010, the fund changed its name and investment policy. He started investing in EM (Emerging Markets) countries.

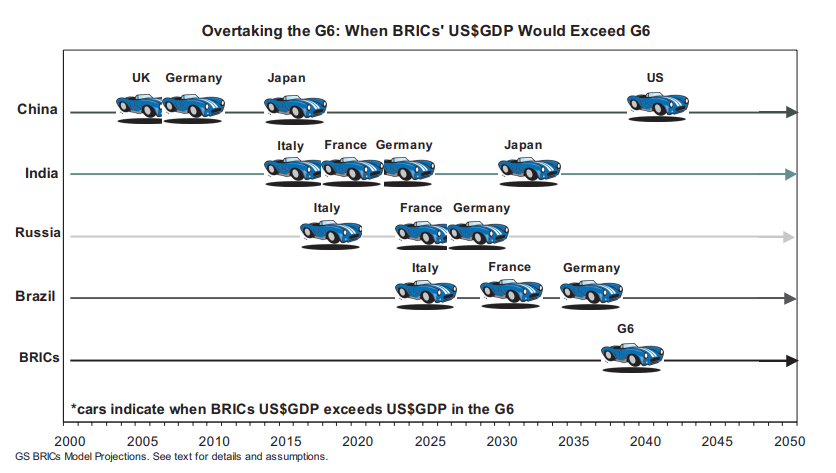

“Dreaming with BRIC: The Path to 2050”

It was a 2003 study. According to the authors of the report, the center of gravity of the global economy will shift from the Atlantic to the Pacific. This will be driven by rapid economic growth in countries such as China, India and Indonesia. Goldman Sachs predicted that China and India would become major suppliers of products and services in the world. They will not be world factories and service centers. In turn, Brazil and Russia were to dominate the supply of raw materials in which they specialized. Interestingly, Brazil was to be the only country that would both gain advantages in the raw material and processing markets. Already in 2003, the American bank expected that the countries, due to mutual commercial cooperation, would also start political cooperation.

source: Goldman Sachs

Report update (2004)

In 2004, Goldman Sachs published an extended update to the report. According to it, by 2025 the number of people in the BRIC countries with annual earnings over $15 will exceed 000 million. This will increase domestic demand for higher-order goods. As a result, the internal market is to grow. This will stimulate economic growth. This will reduce dependence on exports. According to Goldman Sachs, China comes first "dominate the world". India will be next in line, but only a decade after the Middle Kingdom.

According to analysts, there will be a peculiar phenomenon. Countries will remain much poorer than developed economic areas (USA, EU, Japan). Nevertheless, in terms of wealth, they will outshine countries G6. Scale will work and enclaves of wealth will be created, which will not be inferior to Western metropolises, and many regions will still be very poor. Moreover, the transformation of economies will force global brands to adapt to the tastes of customers from developing countries. The "swarm" of the new middle and upper classes will simply be more and more important in China and India, for example, than in France or Germany. The report noted that the weakness of the BRIC countries is the underdeveloped capital market. This was to reduce the efficiency of capital allocation in the economies of these countries.

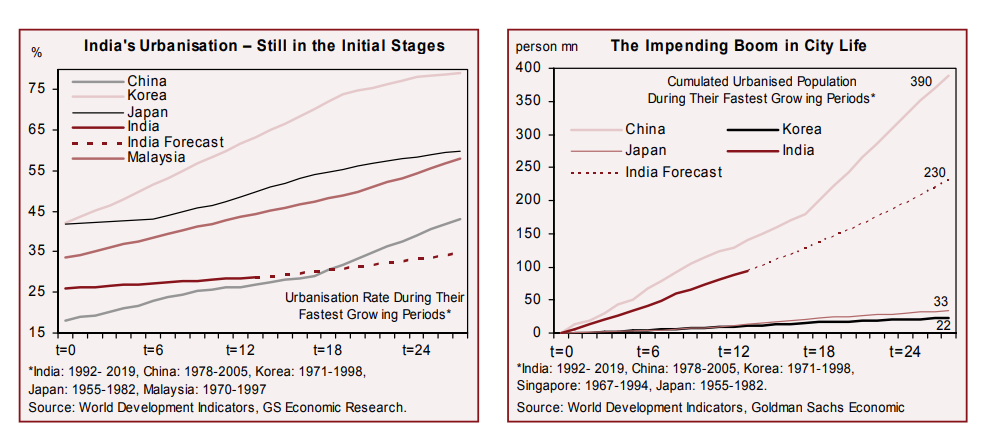

“India's Rising Growth Potential”

This is another report that came out of the pens of Goldman Sachs analysts. It was published in 2007 and was the 3rd report on the BRIC countries. This time they were authors Tushar Poddar and Eve Yi. It focused on a very fast-growing India. The country was experiencing rapid urbanization and modernization. According to analysts' estimates, by 2050, 700 million Indians will move from the countryside to the cities. Rapid urbanization will accelerate the modernization of the "islands of prosperity" which will be the big cities in India.

source: Goldman Sachs

According to forecasts from those years, as many as 10 out of the 30 fastest-growing urban areas in the world will be from India. This is to be one of the driving forces of the country's development. There will be a wealthy middle class that will consume more luxury goods. Urbanization will force investments in the real estate and infrastructure sectors. The service offer will also develop and will slowly catch up with more developed countries. However, the development will be uneven, cities will get richer faster than the province. The forecasts were very optimistic. According to Goldman Sachs, GDP per capita will increase fourfold between 4 and 2007. As a result, in 2043, according to the forecast, India was to overtake the United States in terms of the size of the economy.

The prospects for Russia were much worse in the aforementioned report. According to the authors of the study, Russia was to continue to dominate the European energy market, but due to demographic problems, it would experience worse development conditions.

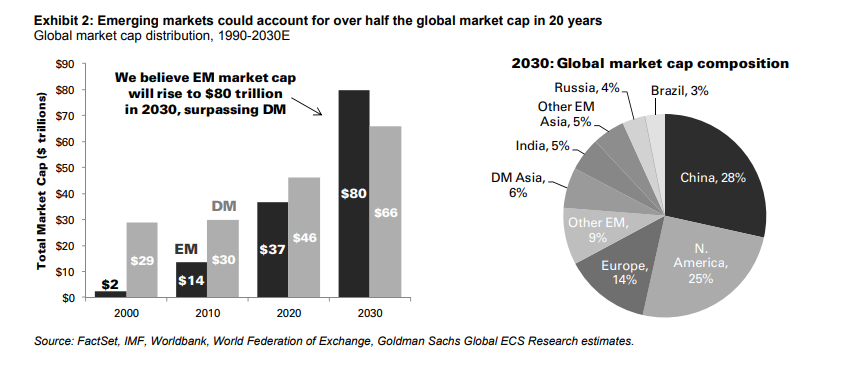

E. M. Equity and Two Decades: A Changing Landscape

Another report was created already in 2010, i.e. after the crisis caused by the bursting of the bubble on the American real estate market. This report focuses on the outlook for the stock market in the BRIC countries. According to the authors of this report, the future of the Chinese stock market looked very bright. According to forecasts, by 2030 the Chinese stock market in terms of capitalization will surpass the American one. As a result, the world's largest stock market will be created in the Middle Kingdom. The BRIC countries will dominate the stock market thanks to China and India. According to forecasts, in 2030 the share of the BRIC countries in the global stock market (in terms of capitalization) will be 41%.

source: Goldman Sachs

Furthermore, it became clear at the time of writing the report that China would be ahead Japan in terms of GDP and will become the largest economy in Asia and the second in the world. According to Goldman Sachs analysts, in 2020 the US GDP will be slightly higher than China's.

The authors' optimism also applied to Brazil, which was fresh from an economic boom caused by high hydrocarbon and food prices. Goldman Sachs expected the country to overtake the UK in terms of GDP in 2012 and become the 6th largest economy in the world.

Other concepts than BRIC

In 2009, South Africa was invited to BRIC. It was supposed to arise BRICS. The fact that this country joined the BIRC bloc was more political than it was based on meeting the criteria. On the other hand, it was a kind of promotion nomination, because the BRIC countries did not have their representative in Africa. Considering the huge birth rate and development potential, it was expected that the next decades would be very good for the countries of this continent. However, the mention of joining "promoted" does not explain the gulf that exists between South Africa and the other BRICS countries. South Africa's GDP was the 31st country in terms of GDP when it announced its accession. On the other hand, South Africa was the region's largest economy and a kind of "gateway" to the countries of the South and the Center of Africa. Jim O'Neill himself was of the opinion that the S should apply to the entire region SADCand not just South Africa. SADC is different Southern African Development Communitywhich brings together countries from Congo to South Africa.

The BRIC concept has become very popular among financiers and economists. Thanks to this, new concepts began to appear like mushrooms after the rain. Among the popular solutions can be found:

- BRICK – where K is an abbreviation for South Korea,

- BRIM – where M is an abbreviation for Mexico,

- BRICA – where A are the countries of the Gulf Cooperation Council (Saudi Arabia, Qatar, Kuwait, Bahrain, Oman and the United Arab Emirates),

- BRICE – where E is an abbreviation for Eastern European countries and the letter T is for Turkey.

Alternatives to BRIC

The acronyms mentioned above have not gained as much popularity as BRIC and BRICS. Of course, the marketing success of Goldman Sachs caused rival banks to develop similar concepts. Terms such as:

- 7 percent club – grouped countries whose GDP grew at a rate above 7% per year;

- EAGLES (Emerging and Growth-Leading Economies) - also important countries with rapid economic development;

- CIVETs (Columbia, Indonesia, Vietnam, Egypt, Turkey and South Africa).

Just like on the stock exchange, investors are looking for a “new Amazon” or a “new Tesla”, so in the economy there are new acronyms that are supposed to group countries with very good prospects. The most well-known proposals of other prospective countries include:

- MIKT,

- MINT,

- NextEleven.

MIKT is short for Mexico, Indonesia, South Korea and Turkey. On the other hand MINT are Mexico, Indonesia, Nigeria and Turkey. Next Eleven is another group of countries that faced rapid economic growth (including Bangladesh, Egypt, Indonesia, Turkey).

Of course, many acronyms died right after birth. Perhaps it is because there is no country in any of them that would evoke such great emotions as China. After all, the Middle Kingdom, due to its size, has become the second economy in the world. The growth rate of this country has put India behind by several lengths, which was richer than China in the 80s.

Summation

BRIC is a very interesting example of an acronym that gained immense popularity after its birth. The success certainly exceeded the expectations of the creator of the concept - Jim O'Neill. Currently, the BRIC countries meet regularly at the government level. What's more, they are also trying to build a bloc of countries that will be able to be the "voice" of the poor south on the international arena (including countries in Africa, South America and Asia). Currently, China plays the first violin in the stake, and India is trying to keep pace with the Middle Kingdom. By contrast, Russia and Brazil are economically less and less important. In the next section, we'll take a closer look at China's economy. For some, the country is an example of exemplary economic transformation. For others, it is an example of an authoritarian country that falsifies economic growth statistics.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)