Hong Kong Forex Brokers - 47% more clients than 10 years ago

Forex brokers operating in Hong Kong are enjoying ever-growing interest. The Securities and Futures Commission (SFC) has published a report of a thorough analysis of all 40 companies operating in this country. It turned out that 39% of their clients reported profit during the year, and the record holder among individual investors earned USD 9,5 million.

FOREX BROKERS - LIST OF OFFERS

Report has been prepared on the basis of an examination of the period from 01.01.2018/31.12.2018/40 to 8/32/XNUMX. He was subjected to all XNUMX brokers registered at that time in Hong Kong, but XNUMX of them were no longer operating, so the data concerns XNUMX broker companies licensed to operate in that country. Interestingly, according to the local law, licensed corporations are subject to SFC supervision, but if investments in the financial market, also through leverage, are dealt with by companies, they are exempt from the requirement to obtain a license.

Huge turnover and large growth of customers over the years

In 2018, the turnover of licensed brokers amounted to USD 1 844 billion. Mainly on roll-spot currency contracts, which accounted for 99,6% of turnover on the market in 2018.

As at December 31, 2018, brokers had 15 active clients, and 096% of them were individual investors. The number of people involved in investing and speculating on the Forex market has grown rapidly over the past 98 years. In 10 there were 2009 10, while in the 297 survey it was already 2018 15, which means an increase in the number of active customers by 096%. To this must be added the referral of a total of 47 clients to companies and affiliates with whom Hong Kong brokers permanently cooperate.

Let's add that the population of this country in 2018 was 7,451 million people. Therefore, 0,2% of residents actively dealt with Forex, which is one of the best results in the world. Every 500 Hong Kong citizen had an active Forex account.

Who earns how much he loses?

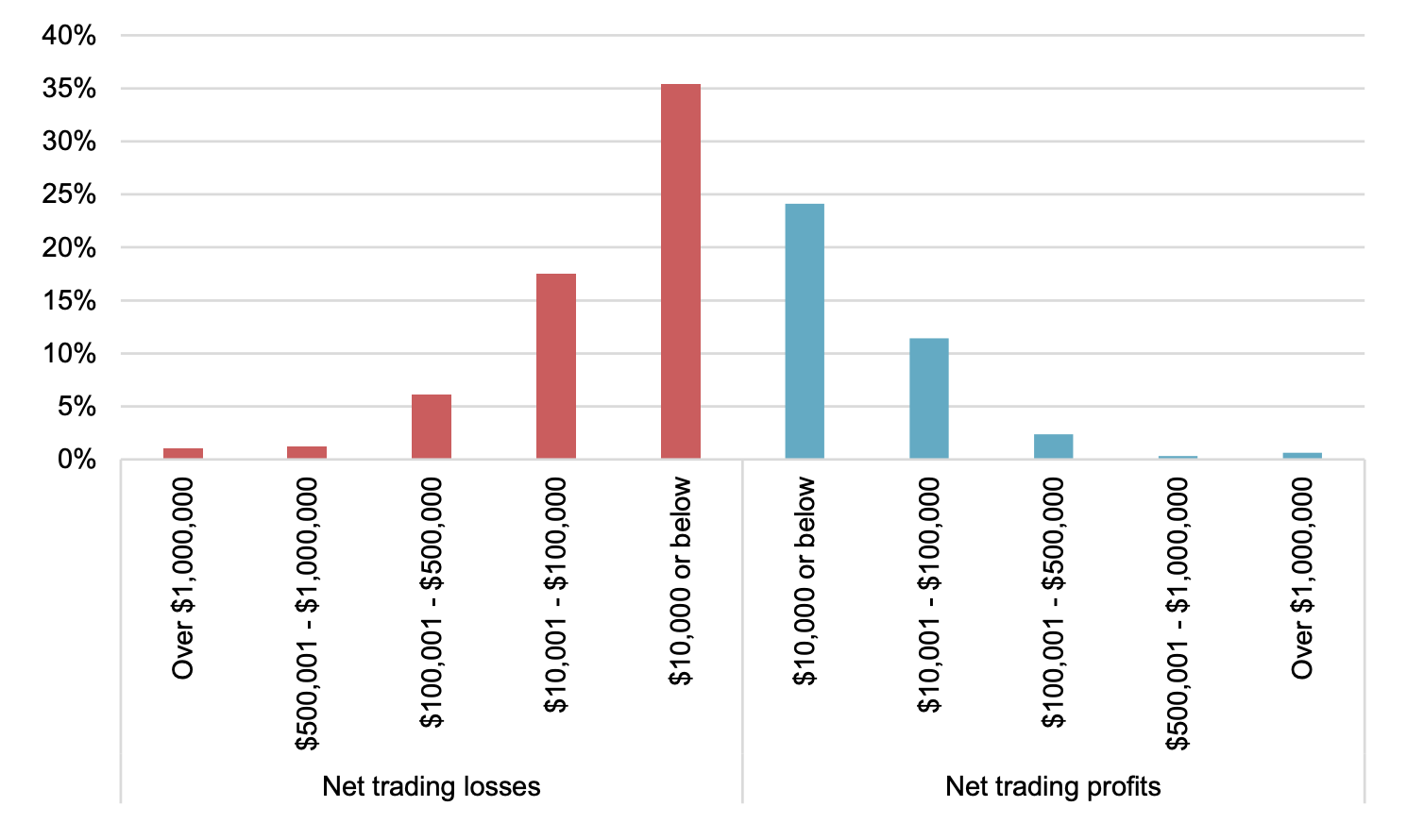

Profit and loss statistics are similar to other parts of the globe. However, more customers lose with the market. Exactly 61% of accounts recorded net trading losses, and 39% achieved trading profits in 2018. 26% of people suffered a net commercial loss of over 10 USD, with 1% losing as much as over USD 1 million in 2018. The largest net loss on one account was about USD 7 million.

For this 15% of people earned over 10 thousand USD, while traders who generated over USD 1 million in a year, were less than 1%. The individual winner was the winner who increased his account by USD 9,5 million.

How transactions are made

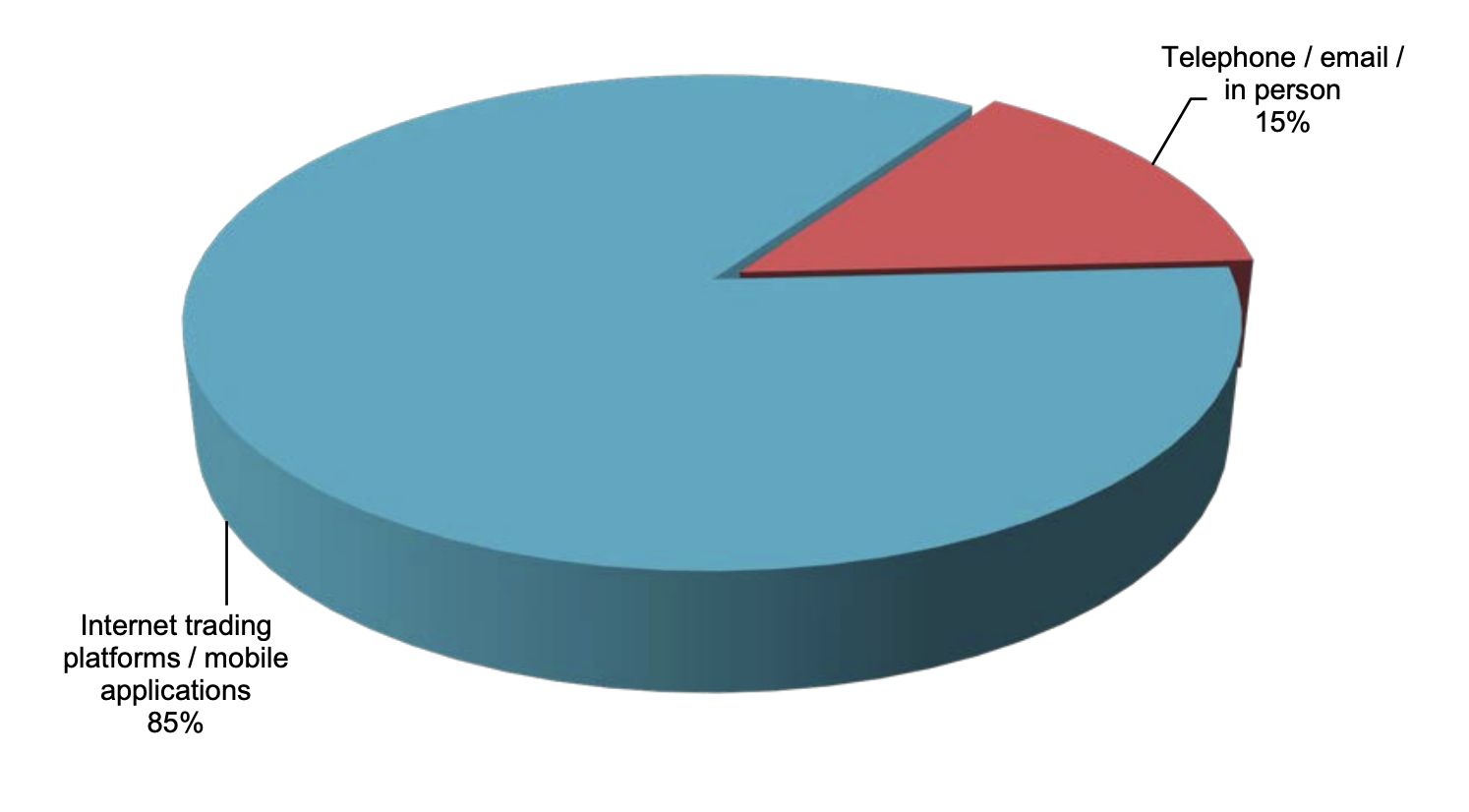

Many people may think that there is nothing to research here - everyone has access to the platform and makes decisions and places orders on their own. Especially in a country much more technologically developed than Poland. Nothing could be more wrong. Although about 85% of transactions in terms of turnover were concluded electronically via online trading platforms or mobile applications, the remaining instructions were issued ... by phone, e-mail or in person at the broker.

Individual customer protection

The Securities and Futures Commission (SFC) also points out that brokers should avoid using negative price slip. This is a well-known topic in Poland. "Slip" is the difference between the price of the order as seen by the client and the actual price of the order. The price may differ from the client's order, because the market is moving dynamically almost all the time when the broker sends the client's order to the liquidity provider for execution. "Positive slip" refers to a favorable price difference for a customer, while "negative slip" refers to a negative price difference for a customer.

The proposed solution is the ability for customers to set the maximum slip. If it is larger than the customer has allowed, the transaction will not be carried out. Brokers are also to disclose slip data and transaction rejection rates.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)