Brown & Forman - How to invest in Jack Daniel's producer?

In recent years, there has been a clear trend to change the taste preferences of alcoholic beverages consumers. An increasing proportion of the population prefer to buy spirits at the expense of beer and wine.

Of course, a very lucrative business is manufacturing as well sale of luxury spirits or products from the premium shelf. It is such a company Brown & Formanwhose shares can be purchased, among others, on the American stock exchange. Brown & Forman is an American competitor of the British company Diageo. So it is another manufacturer of well-known alcohol brands. The following article will answer what it is and how to invest in Brown & Forman.

Check it out: How to invest in luxury alcohol [Guide]

The story of Brown & Forman

George Garvin Brown

The history of the company dates back to 1870, when a young pharmaceutical salesman George Garvin Brown from saved capital ($ 5) was opened by JTS Brown. His product was bottled whiskey. It was an innovative solution as until then whiskey was sold in barrels. The flagship brand was Old Forester Kentucky Straight Bourbon Whiskey. In the following years, a partnership with George Formanwho was a friend of Brown's. In the 1917s, the company changed its name to Brown & Forman. After George Brown's death, his son took over the company in XNUMX - Owsley Brown. The prohibition era in the United States was very difficult for the company. One of the "workarounds" was selling whiskey as medicine. In 1923, the company was the first to take over Early Times. After prohibition was lifted the company made its debut on the stock exchange in order to obtain capital in order to regain the "lost" as a result of prohibition of the American market.

In the following years, the company gained an increasing share in the American market. In 1953, Early Times became the largest seller of bourbon in the United States. Three years later, one of the most important transactions in the company's history took place. In 1956, Jack Daniel Distillery was acquired. In 1960, the company's sales exceeded $ 100 million for the first time. In the following years, there were further acquisitions of alcohol brands (including champagnes, wines). In 1991, a separate wine segment was created to help diversify the company's products (a year later, the Fetzer Vineyards winery was acquired).

The following years brought further product and geographic expansion. In 2000, sales surpassed $ 2 billion for the first time. In 2004, Brown & Forman finalized purchase of the brand Finland. Despite the dynamic development and acquisitions, the company shared its profits with shareholders. This is one of the dividend aristocrats. Brown & Forman has been paying quarterly dividends for 76 years and has been increasing it for 34 years. So it is an interesting idea for investors looking for stable dividend companies.

Check it out: Sin Stocks - when sin pays off [Guide]

Brown & Forman is a company listed on the New York Stock Exchange. It is also a component the S&P 500 index. At the end of the financial year 2020, the company employed 4 employees, of which 1 in Louisville, Kentucky. The company is the owner of alcohol brands, both high-proof (whiskey, vodka) and "lighter" alcohol (wine, liqueur). It is worth mentioning that despite 150 years of history, two world wars, prohibition, the company is still controlled by the heirs Georg Garvin Brown (the Brown family owns over 50% of the company's shares).

Brown & Forman chart, interval W1. Source: xNUMX XTB.

Management and salaries

For much of the company's history, the CEO has been associated with the Brown family. However, since 2007, the second CEO in a row is a person "outside" the family. A similar situation took place between 1966 and 1975.

Lawson Whiting

The current CEO is Lawson Whiting, who has held this position since 2018. However, Lawson Whiting is someone who has been with the company since 1997. So it is difficult to call this person a "hired manager". Over the course of over 20 years, he has performed many roles in the company. He worked, among others, as COO (Chief Operating Officer) and EVP (Executive Vice President).

On April 15, the company announced a planned change in the position of CFO (Chief Financial Officer). Leanne Cunningham, who has been working for the company since 1995, was hired to replace Jane Morreau. From August 2020, she was the SVP (Senior Vice President) where she was responsible for relations with shareholders (Shareholder Relations Officer).

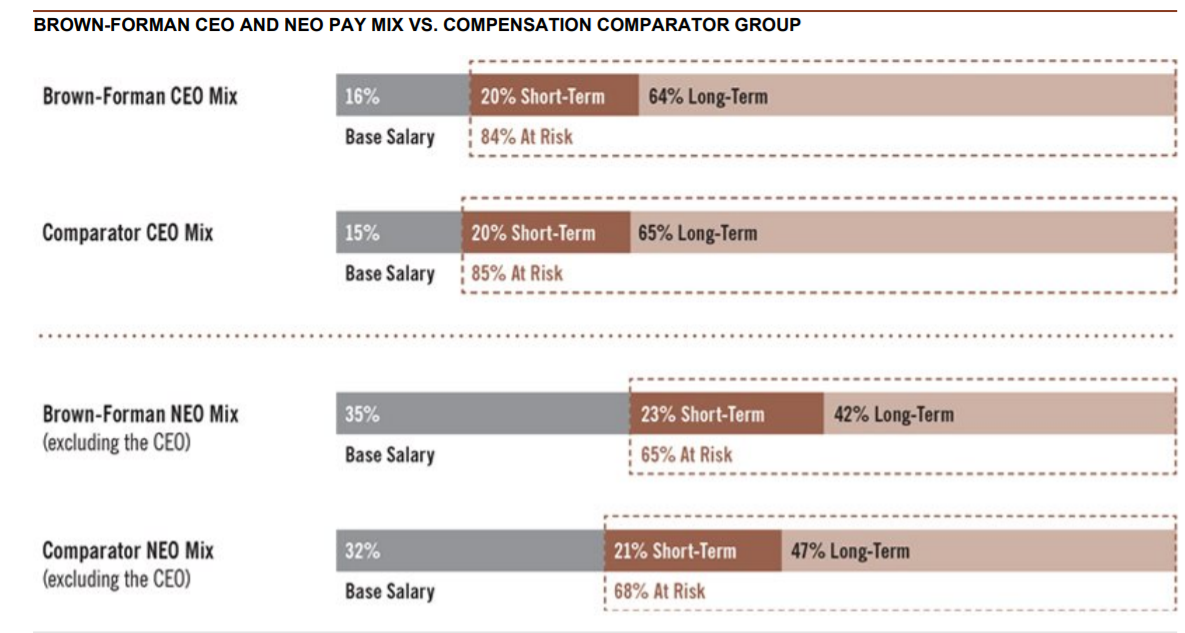

The company's remuneration policy rewards a long-term view of the company's development. This avoids reckless investments to "achieve" short-term goals. As a rule, senior management is remunerated in three ways: base salary, short-term goal compensation, and long-term target bonuses. The goals concern, inter alia, the achieved operating margin, changes in the operating result in relation to the competition and individual goals of employees.

Below is a summary presentation of the remuneration structure depending on the "level" of employees:

Of course, the level of salaries and bonuses depends on the job position. Lawson E. Whiting earns the most, with over $ 5 million in bonuses.

Brands belonging to Brown & Forman

Brown & Forman is a world-famous owner of high and low alcohol brands. It has the rights to over 40 brands. It is a "pearl in the crown" Jack Daniel's Tennessee Whiskeywhich in 2019 was recognized as the most valuable brand of spirits in the world. The list was prepared by Interbrand “Best Global Brands”. In the same statement, Jack Daniel's was classified as 3 most valuable alcohol brand in the world (after Budweiser and Corona). Henessy was in 5th place, followed by Johnnie Walker. The most popular type of Jack Daniel's is No. 7. Of course, there are also versions with liqueurs on sale: Tennessee Honey (with honey liqueur), Tennessee Fire (with cinnamon liqueur) or Tennessee Apple (with apple liqueur).

It should also be noted that Brown & Forman has a very famous brand of alcohol which is vodka Finland. Vodka is sold to 195 countries around the world. To increase sales, Finland is expanding its offer. The first flavored vodka from the Finlandia brand was introduced in 1994 (cranberry). In the following years, new flavors were introduced (including grapefruit, mango, coconut, currant, raspberry).

Other important brands in the portfolio are American whiskey such as Early Times or the oldest brand in the portfolio - Old forester. Brown & Forman also has a Scotch whiskey in its portfolio, such as Glenglassaugh or GlenDronach. The "portfolio" of brands also includes, among others, a wine brand Tankard or tequila Horseshoe.

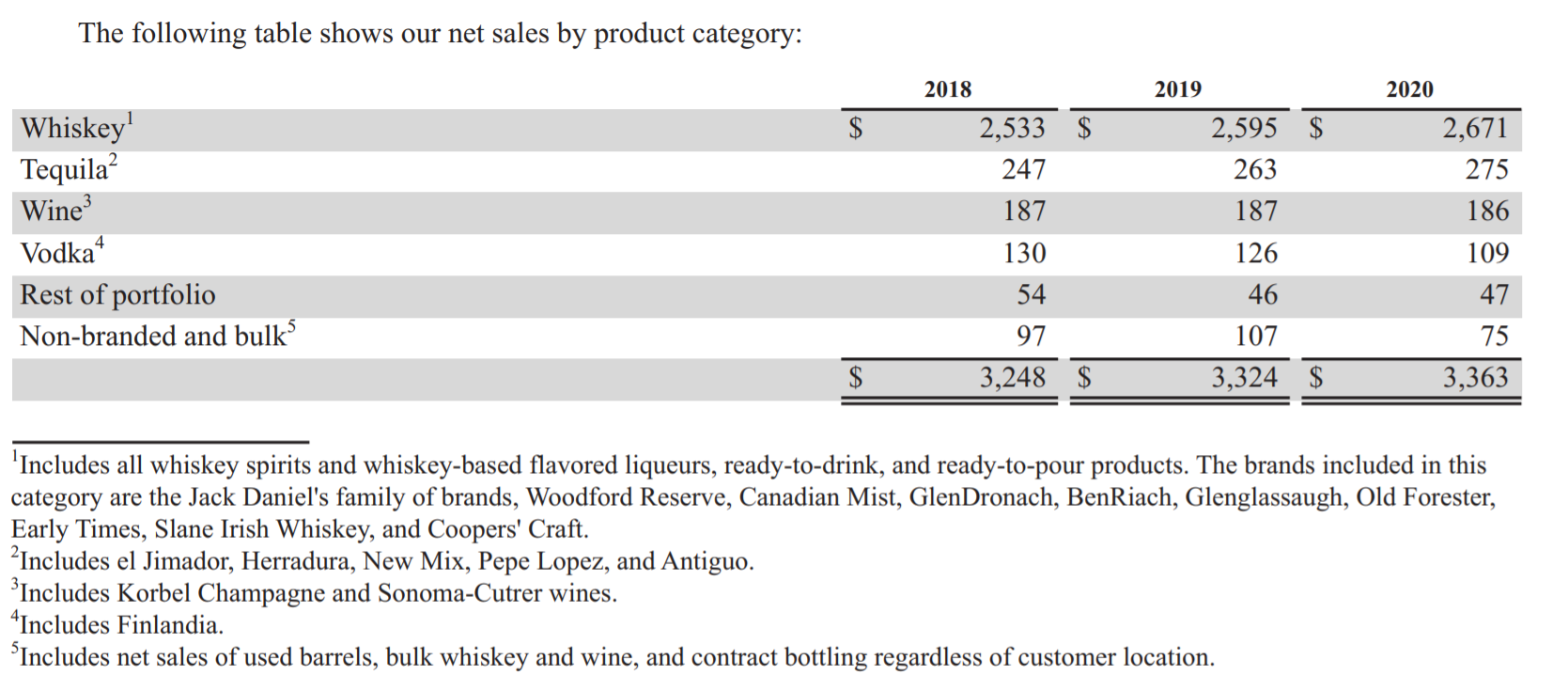

Products - general structure

Brown & Forman divides its sales into particular types of alcoholic beverages. According to the data presented by the company, it has the largest share in sales whiskey (79,4%). The products included in this segment include Jack Daniel's, Woodford Reserve, Canadian Mist, GlenDronach, BenRiach, Glenglassaugh, Old Forester and Early Times. The volume of this product increased by 2% in the fiscal year 2020. Reported net sales increased by approximately 3% y / y. The increase in sales was helped by the introduction of Jack Daniel's Tennessee Apple (JDTA) and the sale of Jack Daniel's based drinks (e.g. with Cola). Jack Daniel's Tennessee Whiskey (JDTW) was a slightly weaker product.

The second most important category of products is tequilawhich generates approx 8,2% revenues. The company manages to systematically increase revenues from this segment. In 2020, we managed to increase sales by 4,6%.

In turn, sales fault behaves relatively flat, revenues from this segment oscillate around $ 186-187 million. The segment is responsible for approx 5,5% company revenues. In terms of volume, wine sales decreased by 1% y / y.

The segment was doing poorly vodka (Finland brand), which reports a second consecutive decrease in net sales. The volume of this segment decreased by 2020% y / y in the fiscal year 9.

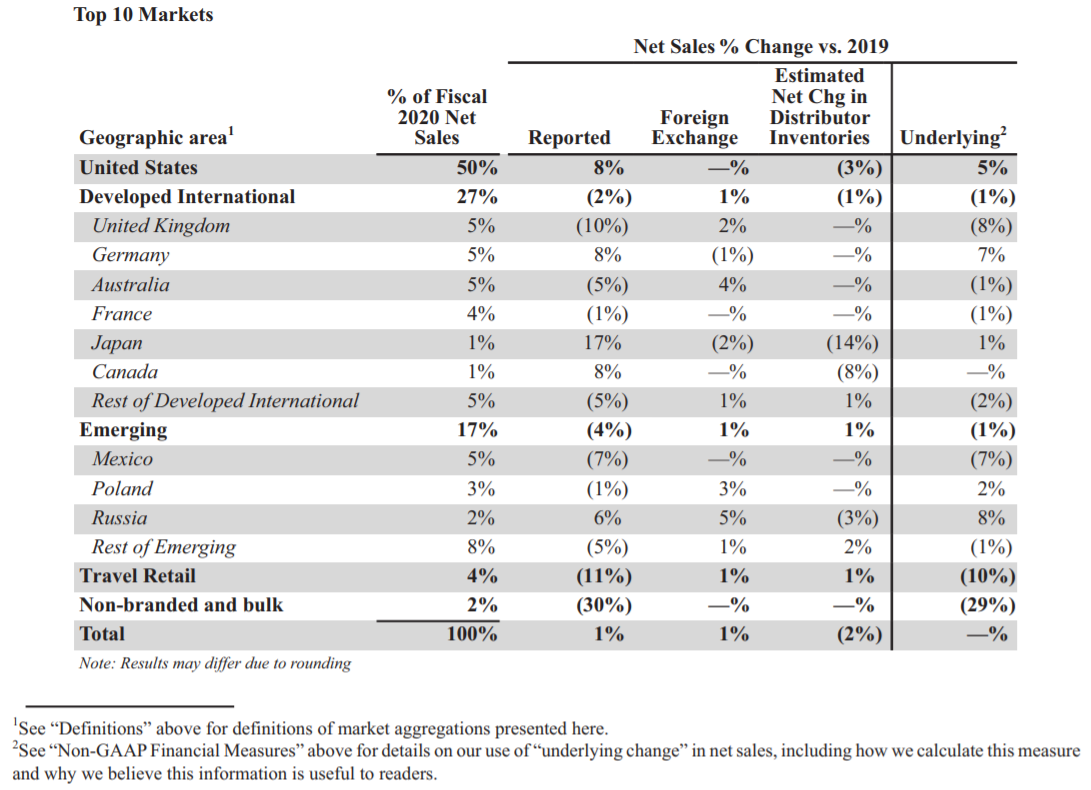

It has the largest share of revenues the American market, which was responsible for 50% of revenues. In the United States, revenues increased by 8% y / y. The sales were helped by the very good sales of Woodford Reserve and Old Forester. Another factor was the successful launch of the JDTA. This more than compensated for the decline in sales of JDTW products.

Sales fell in developed markets, which accounted for approximately 27% of total sales. Revenues from these countries decreased by 2% y / y. Sales in the United Kingdom were particularly weak, with sales falling by 10% y / y. The company's sales on the Australian market were also weak (-5% y / y). Brown & Forman did very well on German market, where the increase was 8% y / y. Big increases on Japanese market and Canadian These were due to a net change in distributor inventories, therefore "clean" growth was + 1% in Japan.

In the case of emerging markets, a decrease in sales was recorded, reported by approximately 4% y / y. The Mexican market was doing particularly poorly (-7% y / y), while the Polish market was a bit better (-1% y / y). The Russian market was doing well, with sales growing by around 6% y / y. In the case of other developing markets, sales decreased by 5% y / y. However, it is worth noting that sales grew, among others, on the Turkish and Chinese markets.

Below is a detailed summary of sales by country:

Financial results in 2020

Historically, the company approx He generates 30% of his annual sales in the last 3 months calendar year. Please note that Brown & Forman has a shifted fiscal year. The company's fiscal year ends in April. For this reason, in addition to the annual data, the results for the nine months of 2021 FY (ending in January 2021) will be presented.

It is clear that the company is not dynamically increasing the scale of its operations. This is due, first of all, to the market in which it operates. The alcohol market is growing at a single-digit rate. At the same time, the scale of operations does not allow for significant organic growth, therefore Brown & Forman can achieve double-digit growth only through acquisitions. However, the "supply" of spirits brands is limited as a result of the consolidation that has taken place over the past several decades.

However, keep in mind that Brown & Forman has a very large "Pricing power", which allows you to "protect the margin" in the event of an increase in employee costs or raw materials. This is due to having a strong portfolio of alcohol brands. As a result, the target group of customers is not sensitive to price increases, as in the case of consumers of "economy" brands (lower price range).

| Brown & Forman | 2017 | 2018 | 2019 | 2020 |

| Net revenues | $ 2 million | $ 3 million | $ 3 million | $ 3 million |

| operational profit | $ 991 million | $ 1 million | $ 1 million | $ 1 million |

| operating margin | 33,10% | 31,71% | 33,57% | 33,10% |

| net profit | $ 717 million | $ 835 million | $ 827 million | $ 911 million |

| equity capital | $ 1 million | $ 1 million | $ 1 million | $ 1 million |

| ROE | 52,34% | 63,45% | 50,21% | 46,13% |

Source: own study based on the company's annual reports

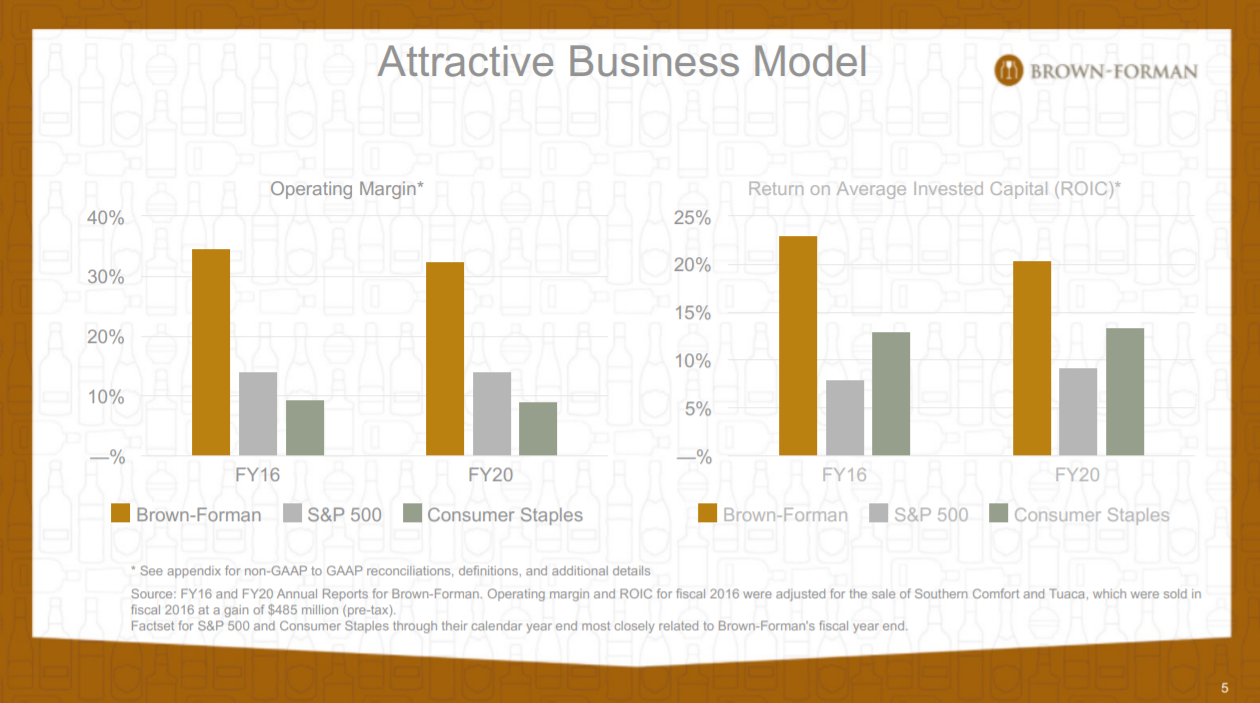

It is also worth paying attention to high levels of return on equity. In its activity, the company pays great attention to capital management. The company usually focuses on improving ROIC (Return on Invested Capital), which is less sensitive to changes in the level of debt than in the case of ROE. Below is a comparison of the ROIC achieved by the company with the S&P 500 and the consumer goods sector. The higher the ROIC index, the better the company manages its capital (equity and foreign capital).

Cash generated

The company generously shares the generated cash with shareholders. Over the past 3 fiscal years (2018-2020), Brown & Forman generated approximately $ 1,82 billion in free cash (cash generated from operating activities less capital expenditure).

The funds were allocated to: acquisitions ($ 22 million), dividends ($ 1,41 billion) and share repurchase ($ 209 million). As a result, in the last 3 years of the financial year, the company increased its funds by $ 400 million.

| Brown & Forman | 2018 | 2019 | 2020 |

| Cash flows from operating activities | $ 653 million | $ 800 million | $ 724 million |

| CAPEX | - $ 127 million | - $ 119 million | - $ 113 million |

| FCF | $ 526 million | $ 681 million | $ 611 million |

| acquisitions (net) | - | - | - $ 22 million |

| dividend (-) | - $ 773 million | - $ 310 million | - $ 325 million |

| share buyback (-) | - $ 1 million | - $ 207 million | - $ 1 million |

Source: own study based on the company's annual reports

Results for Q2021 XNUMX FY

The company's revenues in Q2021 2021 FY (end of quarter in January 1,3) increased by 911% y / y to the level of $ 5 million. It is worth noting that this was the first increase in quarterly revenues (y / y) in 299 quarters. At the same time, operating profit declined from $ 276 million to $ 33,26 million. As a result, the net margin decreased from 30,30% to XNUMX% during the year. It is worth noting that the company managed to maintain a high margin despite the difficult macroeconomic environment.

| Brown & Forman | Q2020 XNUMX FY | IQ 2021 FY | Q2021 XNUMX FY | Q2021 XNUMX FY |

| Net revenues | $ 709 million | $ 753 million | $ 985 million | $ 911 million |

| operational profit | $ 218 million | $ 251 million | $ 325 million | $ 276 million |

| operating margin | 30,75% | 33,33% | 32,99% | 30,30% |

| net profit | $ 128 million | $ 324 million | $ 240 million | $ 219 million |

Source: own study based on the company's annual reports

Thanks to the stable generation of operating flows and low CAPEX expenditure, the company was able to generate a solid FCF in the "crisis" 2021. This allowed the company to continue paying dividends and carry out a small share buyback.

Debt structure

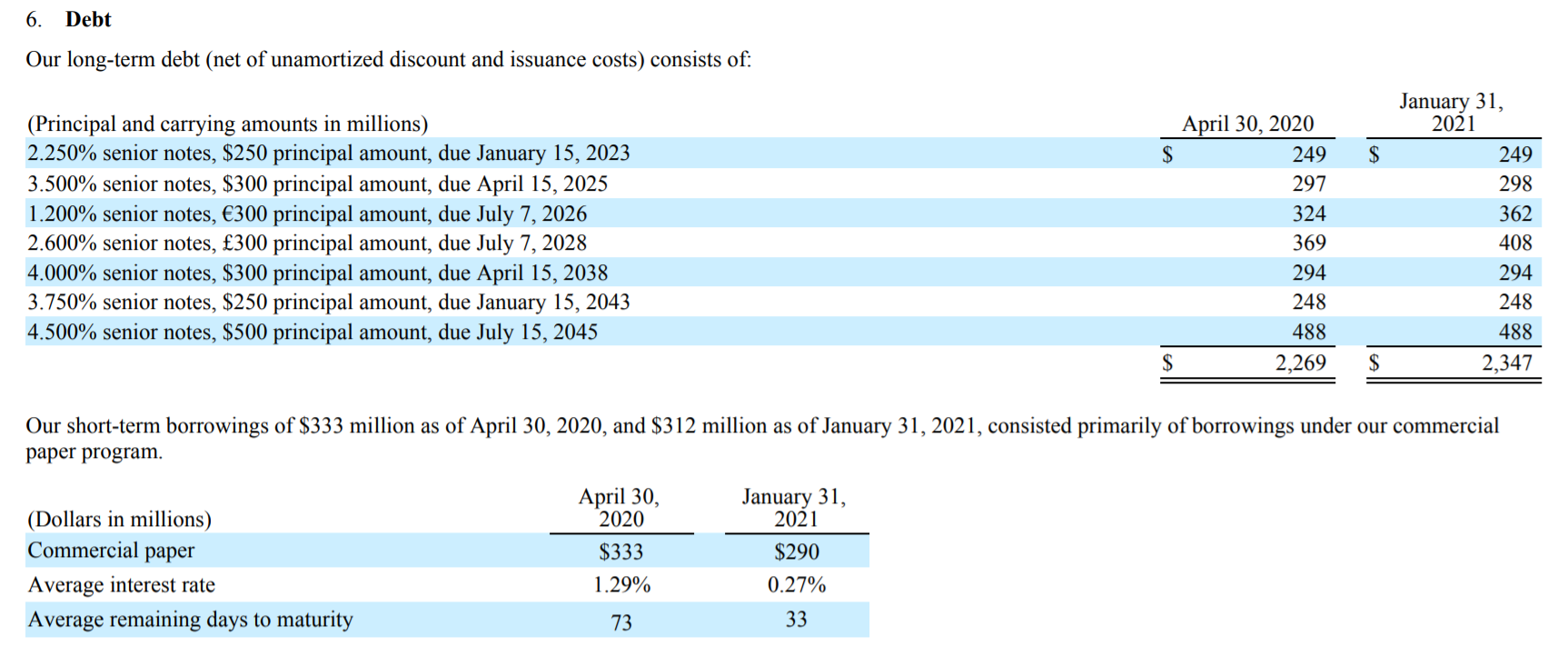

Brown & Forman has $ 2,64bn in interest debt (long and short term) at the end of Q2021 2021 FY. The company has a stable liquidity situation. At the end of January 290, the company had $ 2021 million in short-term debt. The average interest rate on bills was 0,27% in January 1,02, which means a decrease by 2020 percentage point compared to April 2020 (end of the financial year XNUMX).

Long-term debt, on the other hand, has a "stretched" maturity. By the end of 2026, $ 909 million of debt is due. The company is also a beneficiary of the low interest rate environment. The debt with maturity in 4,5 had the highest interest rate (2045%). Below is a list of potential liability payments:

Over the last 4 years, the Company has not significantly changed the level of net debt, which can be seen both in nominal terms and in terms of the ratio of net debt to EBITDA. The debt is at a safe level, which is just over 1,6.

| Brown & Forman | 2017FY | 2018FY | 2019FY | 2020FY |

| net debt * | $ 1 million | $ 2 million | $ 2 million | $ 1 million |

| EBITDA | $ 1 million | $ 1 million | $ 1 million | $ 1 million |

| debt / EBITDA | 1,64 | 2,12 | 1,80 | 1,62 |

Source: own study based on the company's annual reports

* Net debt includes interest liabilities less cash and cash equivalents. source: own study based on the company's annual reports

Competition

Brown & Forman, however, does not work in a vacuum. Competition in the alcohol market is very demanding. Companies compete both in terms of consumer preferences (high and low alcohol drinks) and competition on individual price levels. The company's competitors are both large corporations with a wide portfolio of products (eg Diageo) and local alcohol producers (eg craft beers, local vineyards).

In the case of a "mass" customer, companies with recognizable brands that are "remembered" by the customer have an advantage. The brand allows you to attract customers who will not be too sensitive to price increases (premium brands).

The world stock exchanges are full of companies related to the alcohol products sector. These companies include producers of strong alcohols and beer. Below is a list of selected companies from this sector.

Pernod Ricard

French producer of spirits. Listed on the Paris Stock Exchange. The history of the company dates back to 1805. Pernod Ricard owns brands such as Ballantine's, Malibu, Chivas, Jameson, Martel, Olmeca and Absolut vodka. The company's capitalization exceeds the level of € 44,5 billion.

Pernod Ricard chart, interval W1. Source: xNUMX XTB.

AB Inbev

The company was established as a result of the merger of InBev (Belgian-Brazilian company) with the American Anheuser-Busch. The company owns brands such as Budweiser, Beck's, Cass and Casle. The company's capitalization is $ 137,5 billion.

AB Inbev chart, interval W1. Source: xNUMX XTB.

Heineken

A company listed on the Amsterdam Stock Exchange. Heineken is one of the largest beer producers in the world. He is the owner of, among others brands such as Heineken, Amstel or Desperados. It also has ciders such as Bulmers, Strogbow. The company is valued at approximately € 55bn.

Heineken chart, interval W1. Source: xNUMX XTB.

Carlsberg

The company was founded in 1847. It is listed on the Danish Stock Exchange. The company owns brands such as Carlsberg, Somersby, Baltika and Zatecky. The company's capitalization is 165 billion Danish kroner.

Carlsberg chart, interval W1. Source: xNUMX XTB.

Diageo

It is one of the largest producers of alcohol in the world. The company sells, among others whiskey, rum, gin, tequila or beer. The most famous brands include Johnnie Walker, Smirnoff, Guinness and Captain Morgan. The company also holds a minority stake in Moët & Chandon. The company's capitalization is £ 73,7 billion.

Diageo chart, interval W1. Source: xNUMX XTB.

How to invest in Brown & Forman

The company is one of the components of the S&P 500 index. In addition to investing in stocks, an investor can buy ETF with exposure to the sector in which the companies operate. One can give as an example Invesco Dynamic Food & Beverage ETF. As of April 26, 2021, Brown & Forman had 4,4% weight in this ETF.

Another option is to invest in Vanguard Dividend Appreciation ETFthat groups "Dividend aristocrats". One of the companies that make up this ETF is Brown & Forman with a 0,25% share.

Brokers offering stocks and ETFs

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

| End | Poland | Denmark |

| Number of exchanges on offer | 16 exchanges | 37 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

| Commission |

0% commission up to EUR 100 turnover / month | according to the price list |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

In recent years you can see single-digit increase in alcohol sales, both in terms of volume and value. According to World Bank As societies in the world (especially developing countries) become richer, 2030 ml of new alcohol consumers (adults) will appear by 600.

There is also a change in consumer habits. In the sales mix high-percentage drinks have an increasing share. This also applies to countries with "Strip of beer and wine", that is the countries of the South, West and Central Europe. At the same time, the popularity of alcohol consumption from the premium brand is increasing ("Drinkong better, not more"), benefiting companies such as Diageo, Brown & Forman or Pernod Ricard.

The said trend will favor the company. A growing middle class will consume more and more high-end alcohol. The company has a particularly high growth potential in developing countries, where consumption of the company's products is relatively low (especially in India). It should be remembered that as much as 77% of the company's revenues are generated in the United States and other developed countries. The developing country market accounts for only 17% of Brown & Forman's revenues. This still gives a lot of "potential" for future growth of revenues and profits.

Despite the enormous competition that prevails on the alcoholic beverage market, the company owns strong premium brands that have greater market recognition and the potential to monetize it than local alcohol brands. The jewel in the crown is Jack Daniel's, which is one of the strongest brands on the spirits market. Thanks to this, the company has "pricing power", which protects the company against price struggle and allows the increasing costs to be passed on to customers.

Brown & Forman it very stable companythat operates in a competitive consumer market. The company is counted among the "dividend aristocrats" who have been regularly sharing profits with shareholders for several decades. At the same time, the company has stable owners, who are the Brown family. This allows the company to limit the "short-term view" that affects many companies with "contract management".

However, it should be remembered that even the best company should be properly valued. Too expensive purchase of even a good-quality company reduces the rate of return on investment. The company's capitalization as of April 23, 2021 was approximately $ 36,2 billion. This gives high price to profit ratios (P / E = 39,7) and price to free cash flow (P / FCF = 59,2) to the results of fiscal year 2020.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)