The price of gold and silver in consolidation after a strong increase

When I started my vacation in mid-July, the price of gold was stable at around $ 1 / oz. Just three weeks later, its value rose by more than $ 800, a quarter of which was revised down. At the same time, silver appreciated 250% and its relation to gold approached the ten-year average.

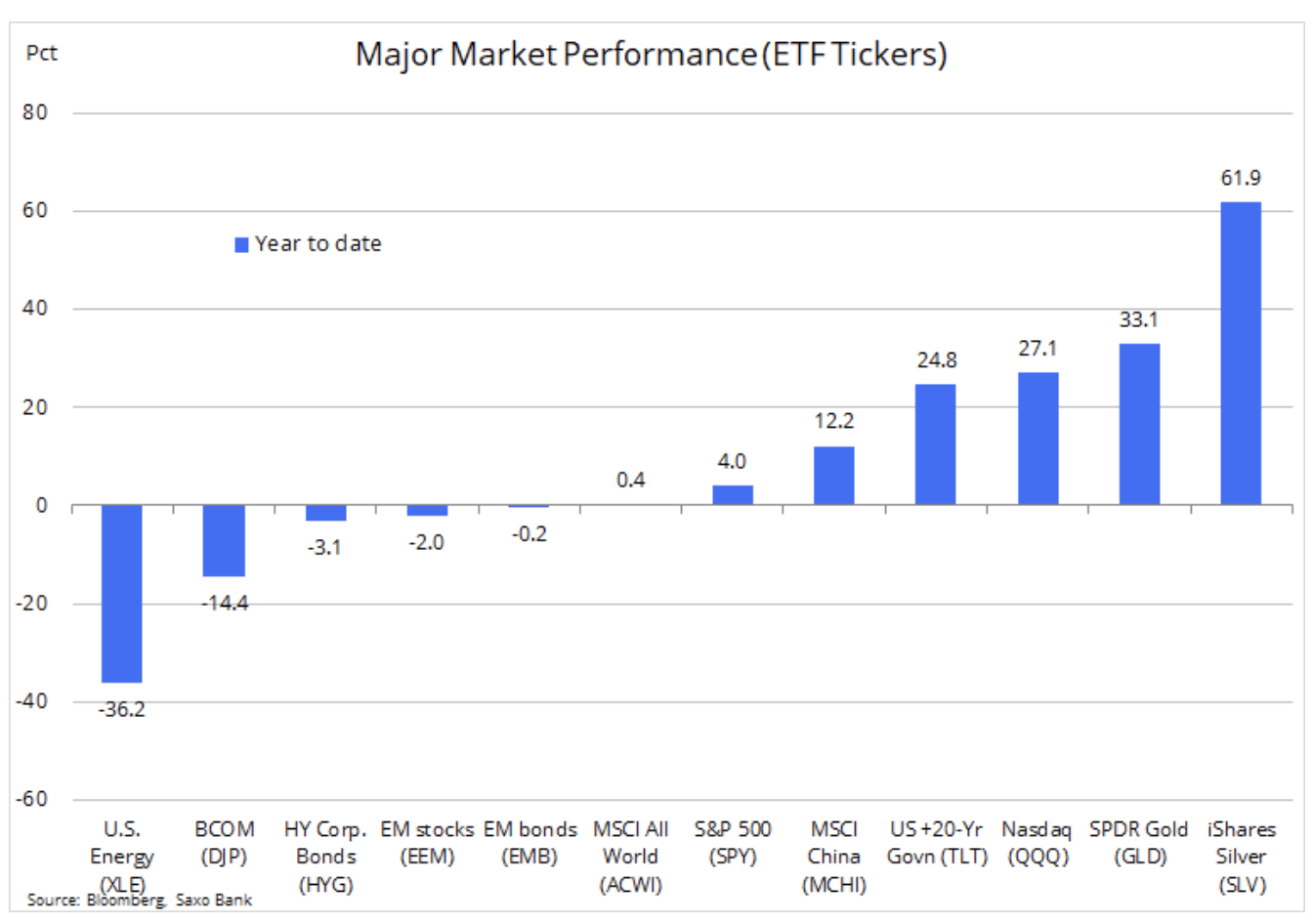

Gold and silver are the two best performing assets this year, even outshining the very popular Nasdaq technology index.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Why right now?

Why did these two metals recover so dramatically at a time when equity risk appetite was solid and economic data began to stabilize? There are several reasons for this; one of them is, of course, the fact that liquidity tends to be reduced during this time of year as traders walk away from their desks and head to the beach. Overall, however, the two main drivers of this boom are the new decline in US real yields and the unexpected depreciation of the dollar.

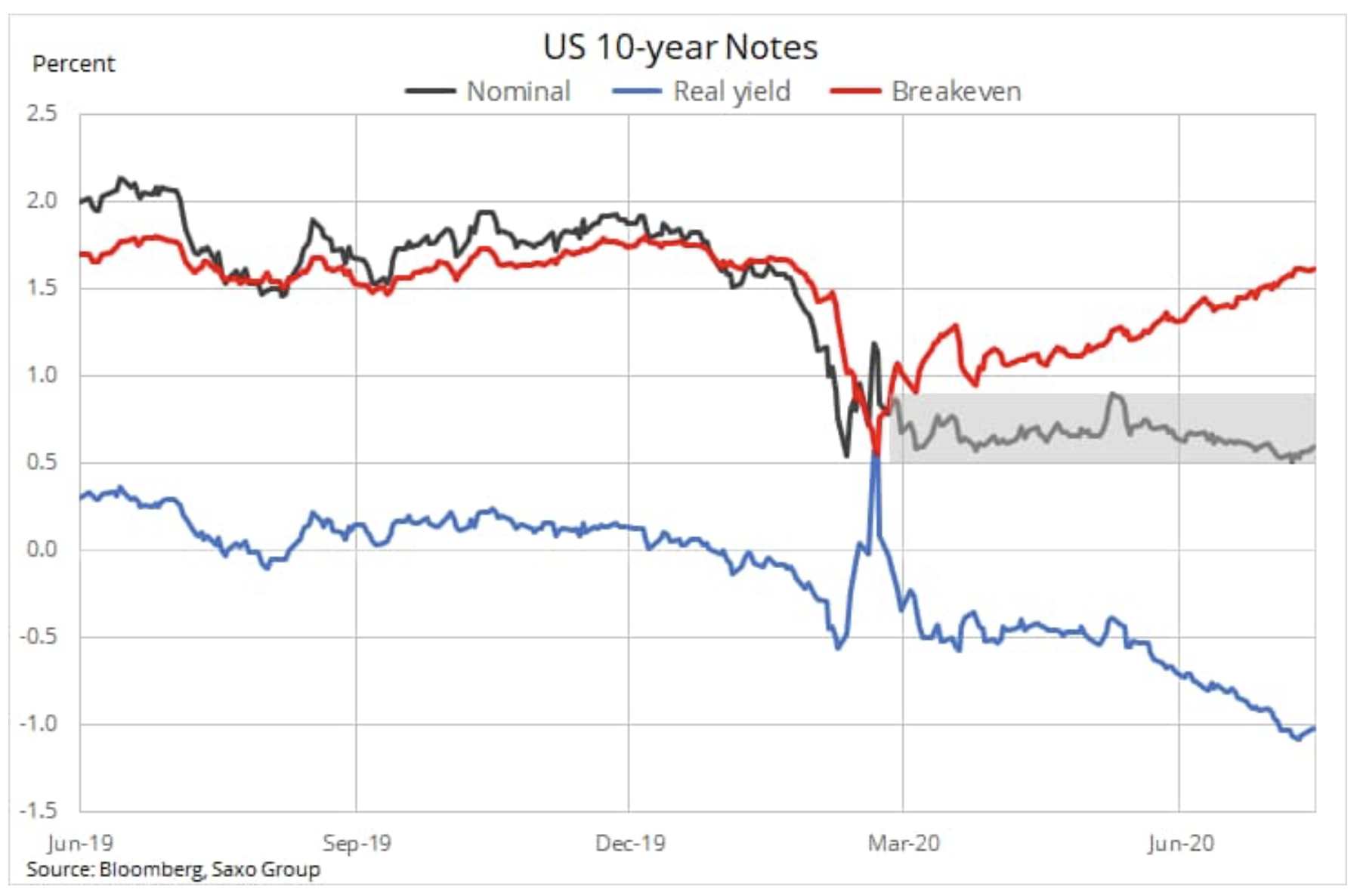

Since the breakout of gold in June above USD 1 / oz, which started its boom, we emphasized the importance of real yields. Some of the significant movements in gold over the past decade have been driven by changes in the bond market. Real yield is an investor's return on holding a bond position after nominal yield has been adjusted downward for projected inflation over the bond period. A rise in inflation expectations usually raises nominal profitability as investors want to compensate for lower real profitability.

Yield curve control, exchanged by the American Federal Reserve as a potential further step in monetary policy, it locks the nominal yield at a specified maturity at a certain level above which the central bank intervenes by redeeming any bonds offered to prevent further yield increases. Such a decision would render fixed income investments wholly useless as a safe asset, particularly in a period of projected rising inflation. This is due not only to the enormous liquidity provided by central banks, but also to the fact that unprecedented stimulus introduced by governments is creating a political need for higher inflation to support rising debt levels.

The US bond market has been behaving as if yield curve control has already been implemented since April. While the profitability of the US XNUMX-year debentures (shown in the chart above) remains within a relatively narrow range, the real profitability and profitability above the break-even point went in two opposite directions. This phenomenon demonstrates the legitimacy of a fundamental investment in the form of keeping precious metals in a sustainable portfolio.

HOW TO BUY GOLD [GUIDE]

The decline in real yields is also otherwise beneficial to gold as it contributes to the weakening of the dollar. The Bloomberg dollar index fell to its lowest level in two years, while the euro hit 1,19 until profit-taking on Friday, when real profitability rose on the better-than-expected US jobs report.

Co dalej?

The weakening seen since Friday's release of the better-than-predicted US jobs report has led to a fight between short-term technical traders seeking to sell as they broke a strong uptrend and long-term buyers who missed the first move above $ 2 / oz . In the days to come, as the market consolidates, gold's ability to frustrate investors will come to the fore. We expect support to be at $ 000 / oz, followed by a very significant $ 1 / oz, the 980 high.

Overall, we maintain a positive outlook for gold and silver, with loose monetary and fiscal policies around the world supporting not only these two metals, but potentially other fossil resources as well. Real yields, as outlined above, have been the main driver of the gold price so far, and the potential introduction of yield curve controls combined with the risk of rising inflation - as the US authorities seek to extraordinarily stimulate the economy - should keep these yields at record lows. thus supporting the demand for metals.

An exceptionally nervous election period in the United States, combined with the current US-China conflict, may further strengthen this support due to the demand for safe assets. The third factor behind the growth of investments in precious metals is the possibility of an even greater drop in real yields, which should contribute to a further depreciation of the dollar.

Silver's price is on a swing this year, ranging from $ 18,5 / oz in February to $ 12 / oz in March to the current $ 28 / oz, highlighting just how extreme the volatility generated by this semi-precious metal can be. In addition to the strong impetus attracting new investors, the significant increase in the price of silver was the result of the metal's relative cheapness compared to gold - this factor is absent at present - as well as an increase in demand from the industrial sector.

In particular, the further increase in demand from solar panel producers was significant due to the accelerating pace of the process of abandoning coal in industrial production. The potential increase in demand in the coming years may lead to a permanent deficit of silver, as was the case in 2006-2011, when the price of this metal rose to almost $ 50 / oz.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)