China, FED, MPC - What will count this week?

The second week of November, which will be a shorter week for domestic investors due to the Independence Day, promises to be as exciting as the first week, when cards were dealt in the markets Fed, data from the US economy and rumors from China.

China and the US remain in the spotlight

In the starting week, this US-Chinese market mix will again shape the moods and decide which direction the stock markets, debt market and major currencies will take. In Poland, the meeting will be an additional event Monetary Policy Council (MPC).

Last week, rumors about a possible departure of China from zero-Covid policy supported risky assets, becoming a strong counterweight to the results of the Fed meeting and data from the US labor market. Recall that the Fed, in line with its forecasts, raised interest rates by 75 basis points, and Jerome Powell, although he suggested that the pace of interest rate hikes may be lower, at the same time made it clear that ultimately US rates would rise more than the bankers themselves had assumed until recently. . The market received confirmation of his words fairly quickly. It was still very good, and even better than economists' expectations, data from the American labor market. With such a hot labor market, even if there are problems in the real estate market, it will be difficult to bring down inflation in the US quickly.

Interestingly, over the weekend, the Chinese health commission denied rumors that China would abandon the zero-Covid policy, but ... the markets did not believe it. This is perfectly demonstrated by today's behavior of Asian stock exchanges, where green dominated. Particularly noteworthy is the very strong increase in the Hong Kong stock exchange index.

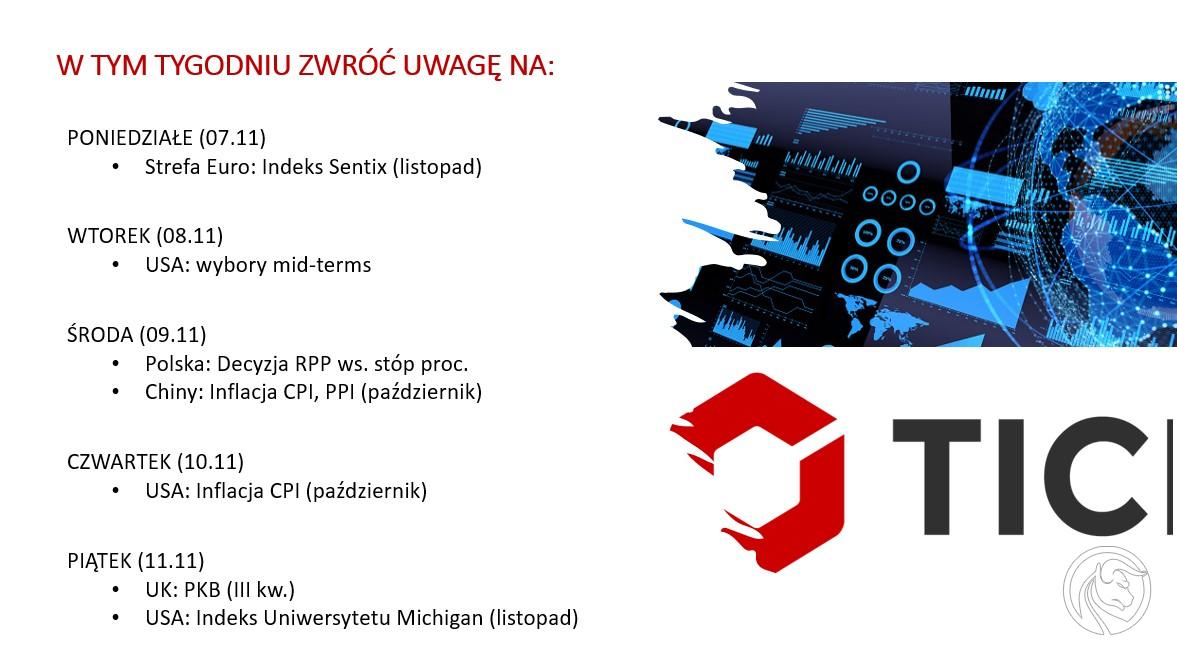

In the coming days, news from the US will continue to absorb investors' attention. On the one hand, these will be the "half" elections to the Congress scheduled for Tuesday, November 8. On the other hand, the October CPI inflation data released on Thursday, November 10th. Economists forecast that CPI inflation will decline to 8%. from 8,2% Y / Y in September, while core CPI inflation will drop to 6,5%. from 6,6% These data will be a simple reference to the December Fed decision. The lower the inflation, the better the chances of a smaller rate hike and the lower their target. And vice versa.

China will continue to be in the second scales of the market. It can be expected that despite the denial of rumors about a possible departure from the zero-Covid policy, the markets will continue to play for the fact that in the face of the weakening economy, the Chinese authorities will have to take such a step one day.

Rumors and speculations about China's health policy will be more important than the published macroeconomic data from China. This is perfectly demonstrated today, when the data on the first decline in Chinese exports since 2020 did not make the slightest impression on investors. It can be suspected that the inflation data in China, released later in the week, will also raise little emotions.

On Wednesday, the MPC decision on interest rates

The situation on global markets will be the main factor shaping the sentiment and interest in Polish assets. However, it is not the only one. Investors will closely watch the Wednesday's decision of the Monetary Policy Council. Especially that at the same time new forecasts from the November inflation report will be published, which will be an important hint regarding future decisions of the Council. From the statements of management National Bank of Poland shows that the report will show a stronger decline in GDP and, at the same time, an increase in inflation until February and its strong decline since March 2023. This suggests that neither in November nor in the following months the Council will not raise interest rates. The zloty, perhaps not particularly strong, also partially supports the lack of a rate hike in November, but it was weakened in the last month.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)