China in the game of global fragmentation

It is worth discussing China's strategy of seeking alliances and bloc-building while taking advantage of globalization to secure access to markets and resources. China is actively pursuing bilateral deals and creating regional ecosystems to expand its sphere of influence and secure its position.

The benefits of globalization are disappearing

As of 2020, China is moving towards a new economic development strategy emphasizing "internal circulation" as opposed to "external circulation". China has not stopped considering exports as an important factor for economic development, but only wants to avoid becoming overly dependent on exports of goods.

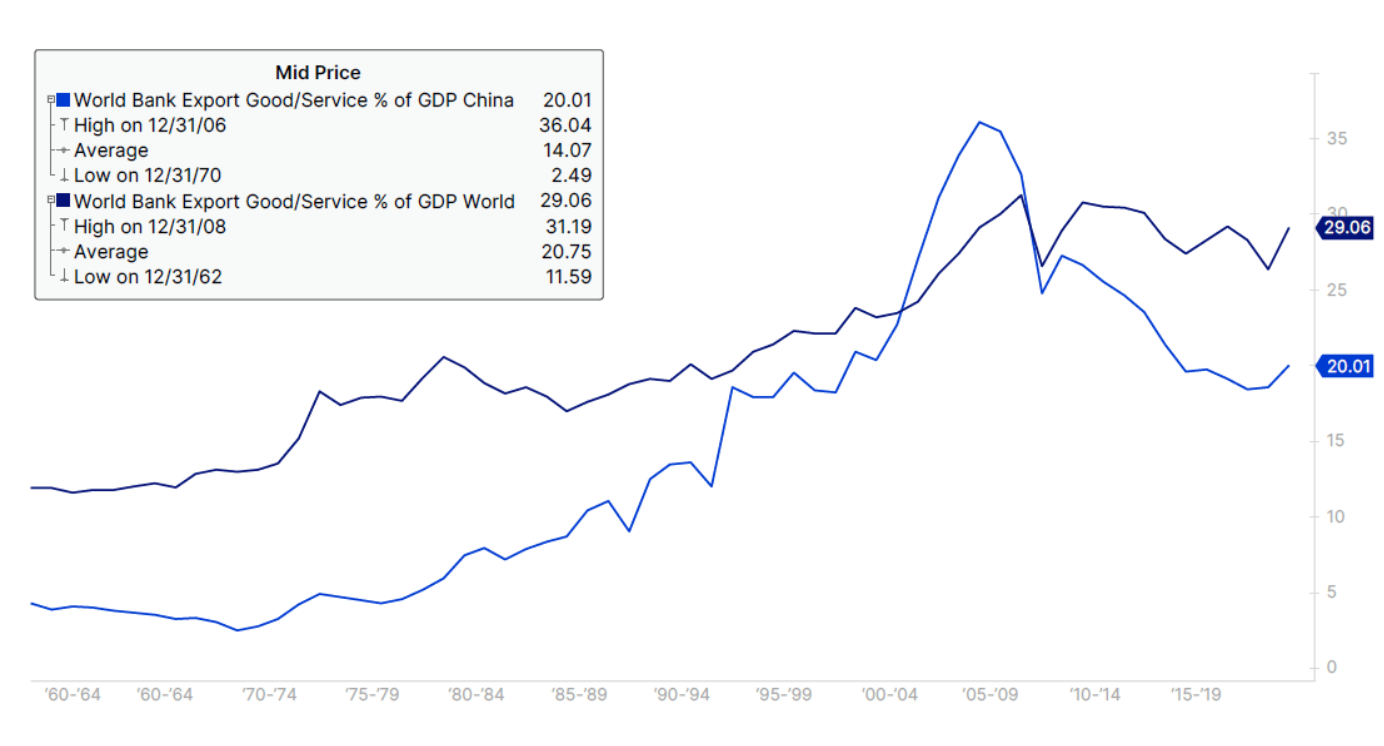

The labour-intensive and energy-intensive model of the export-focused economy, which has been implemented for several decades, has benefited from globalization. Since the economic reforms and opening in the 80s, the Middle Kingdom has been increasingly integrated into the world economy. Percentage share of exports in CBA it increased from 5% in 1980 to 36% at its peak in 2006.

After the global financial crisis, global trade fell to 26,5% of GDP and then fluctuated between 27% and 30%, except for a brief drop during the Covid-19 pandemic. However, China's foreign trade as a percentage of GDP has steadily declined to around 20%, well below the world level.

A game of global fragmentation

China is seeking to play a greater role in the multilateral economic institutions of the dominant international economic order established by the United States after World War II. Beijing has brought its officials into senior positions in these institutions, such as the deputy director general of the World Trade Organization (WTO), and is actively pushing for WTO reform to ensure its voice is heard and interests are taken into account.

China recognizes the hegemonic international economic and financial order created and defined by the United States, and has operated mainly within it since the 80s, striving for economic development. With the rise of national power and the intensification of strategic rivalry with Washington, the Middle Kingdom seeks to supplant the American order, perhaps not completely, but in a selective and regional way.

This is similar to the strategy in an Asian board game go, in which victory does not mean eliminating the opponent's stones, but placing your own stones at the appropriate intersection points to ensure a larger sphere of influence. China invests in selected countries in key geopolitical regions to control key resources, offset US influence, and expand its own influence. While continuing to accept globalization and its benefits, China seeks to extend the global order to its advantage, with an added layer of bloc and alliance building.

In order to secure its position and achieve a strategic advantage, China actively seeks to conclude bilateral agreements and create regional ecosystems to ensure access to markets for its products and, more importantly, to the supply of key resources that are essential to China's economy, as well as to increase its sphere of influence in the context of national security. In 2013, Beijing launched the Belt and Road Initiative, in parallel with the China-centric Asian Infrastructure Investment Bank and the New Development Bank. Since 2015, the pace of concluding numerous bilateral and regional free trade agreements has accelerated. China has also actively sought to sign bilateral currency exchange agreements to push the use of the renminbi (RMB) in foreign trade, reducing its own dependence on the US dollar as well as the use of the dollar by its trading partners.

At the same time, as part of its strategic rivalry with Beijing, the US has begun fragmenting its global order to deny China access to some advanced technologies, investment, capital and markets, and to address higher tariffs and other trade barriers.

China marches west to secure energy supplies

After more than a two-year break in foreign travels caused by the pandemic, President Xi visited Central Asian countries in September 2022 - Kazakhstan and Uzbekistan, in December 2022 - Saudi Arabia, and in March 2023 - Russia. February 2023 During Xi's visit, China and Saudi Arabia concluded a series of trade, investment, technology and infrastructure deals. Xi also calls on Saudi Arabia to accept the renminbi in oil trade settlements. China also recently brokered the restoration of diplomatic relations between Saudi Arabia and Iran. Beijing is tightening ties with the Middle East in order to secure its oil supplies, and in the process slightly weaken American power in its own sphere of influence.

The location of Central Asia is of key importance to China's Belt and Road Initiative; the area is also an important source of petroleum and natural gas. This landlocked region was once in the Russian sphere of influence and most of its pipelines still run to Russia. While Moscow is busy waging war and needs China for strategic reasons, the Middle Kingdom is expanding its economic power in Central Asia.

Financial fragmentation

Despite the acceptance of globalization over the last few decades, China has firmly stuck to its own currency, capital account and banking system. Beijing exercises tight control over cross-border capital flows, and the Chinese currency is pegged to a basket of currencies of major partners. The banking sector is dominated by banks with a significant share of the state treasury.

China hedges its financial system against external shocks and uses its banks to channel funds to the corporate sector and local governments to finance economic growth and political initiatives. While the problems of US regional banks and the Swiss bank saga negatively impacted US and European bank stock prices, listed banks in China were much less affected as they are relatively insulated from these types of shocks. Nevertheless, Chinese banks face the unique problem of having to comply with the People's Bank of China's lending guidelines in line with Beijing's policy initiatives. Banks in China are often at a very different stage of the credit cycle than the rest of the world at any given time, and their operating environment is outside the global financial system.

In March 2023, China announced the establishment of new structures under the direct authority of the Chinese Communist Party to take over the policymaking and oversight of the financial sector from the government, with the aim of centralizing and tightening ideological control over the financial sector.

Fragmentation of technology and data

As part of its pursuit of technological self-sufficiency in the face of Washington's restrictions on access to advanced technologies, China has established a central science and technology commission under the Communist Party of China to mobilize nationwide resources and efforts from numerous government agencies to accelerate technological innovation and scientific discoveries.

Data, often referred to as the new oil in the context of the information economy, is a key strategic asset that China seeks to isolate from the rest of the world. The Middle Kingdom also prohibits its citizens from accessing many foreign websites.

Investing in fragmentation

Given China's recent push for infrastructure projects in Saudi Arabia, and potentially other resource-rich countries in the Gulf and Central Asia, it may be worth keeping an eye on some of its leading infrastructure companies, such as China State Construction, Nari Technology or China Energy Engineering.

For additional inspiration, investors can browse Saxo themed baskets containing stocks - China Consumer and Technology (Chinese companies from the consumer staples and technology sector) and China's Little Giants (Chinese little giants), including lists of companies that are affected by the growth of domestic consumption and technology development in China.

Author Redmond Wong, market strategist, Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response