What does the copper barometer indicate? [Market comment]

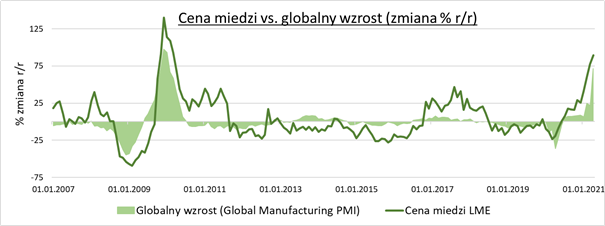

Copper is considered by economists to be a very good barometer of the economic situation in the world. It is even said that copper does "PhD in Economics". This is because it is widely used and used in many industries. And also correlated with market trends. When the economy is expanding rapidly, copper prices will rise, and when a slowdown and recession appear on the horizon, prices fall.

In the last year copper prices increased by 33%, reaching the highest level in 10 years. Now the market consensus says that the LME copper price will drop by 10%. by the end of the year (up to USD 8,66 thousand per ton), however, these are very cautious predictions.

About the author

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

The copper barometer, or what it says Dr. Copper?

The demand for copper is growing due to the increase in industrial production, mainly in China (50% of global demand) as well as in the USA and Europe (20%). About 45 percent copper is used in construction, and 20 percent. in the production of electronics. Copper benefits from the transition to a 'green economy' as it is widely used in battery production (including electric cars) and in solar and wind installations. Global demand in the last year amounted to 25 million tons and was only slightly higher than the supply (by 100 thousand tons).

Source: Refinitive, own calculations eToro

The supply of copper will increase by 3-4% this and the next year, after several years of stagnation. Finding new deposits and building mines is getting more and more difficult. And currently exploited deposits are slowly depleting. Poland remains an important exporter of copper. KGHM in 2020 produced 709 thousand. tonnes of copper (1,1% more than in 2019). Apart from Poland, the company also has mines in Chile and the USA. It is in South America that the largest deposits of this raw material are found. And the political situation in them may affect the prices of raw materials in the near future. Chile, which is responsible for 29% of world production, intends to raise taxes related to mining. In Peru (11% of production), Pedro Castillo, who advocates the nationalization of mining companies, has a good chance of victory in the presidential election on 6 June. Higher copper prices also increase the demand for workers and put pressure on higher wages. The result may be strikes, such as recently in the Escondida BHP mines in Chile.

Large mining companies listed on global stock exchanges include BHP, Freeport-McMoRan, Glencore, Southern Copper and KGHM. Shares of companies in this sector increased by 30% over the last year, as did the prices of raw material. On the four markets, the share of mining companies in market capitalization is significant. These are Brazil (27%), South Africa (25%), Mexico (22%) and Australia (20%). In Poland, KGHM's share in the WIG20 index is 11,3%.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![What does the copper barometer indicate? [Market comment] copper, industrial metals](https://forexclub.pl/wp-content/uploads/2021/06/miedziowy-barometr.jpg?v=1622623832)

![What does the copper barometer indicate? [Market comment] facebook cryptocurrency diem](https://forexclub.pl/wp-content/uploads/2021/06/kryptowaluta-facebooka-diem-102x65.jpg?v=1622620391)

![What does the copper barometer indicate? [Market comment] Wallstreet 25 On-Line conference](https://forexclub.pl/wp-content/uploads/2021/06/konferencja-wallstreet-25-on-line-102x65.jpg?v=1622693030)