What will the Monetary Policy Council do on Wednesday? [Market comment]

What will the Monetary Policy Council do on Wednesday? Will it respond with a large hike to soaring inflation in Poland? Or maybe he will listen to President Glapiński that the rate hikes are a school mistake and, to everyone's surprise, he will not raise rates?

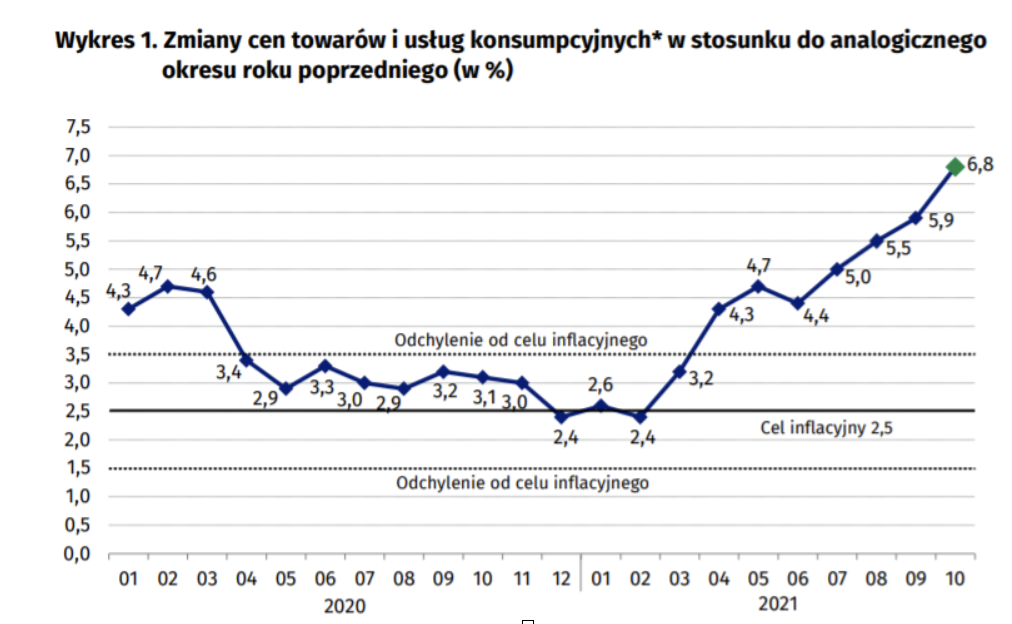

Inflation in Poland has accelerated sharply and is at the highest in 20 years. In October, consumer inflation, according to the estimated data published by the Central Statistical Office last Friday, soared to 6,8 percent. annually from 5,9 percent. in September. This is the highest price increase since May 2001. Inflation it was also higher than market expectations (6,4-6,5%). And this is less surprising, as since the beginning of the year these data have regularly surprised with higher-than-expected readings.

This is not the end of price increases yet. Even before the end of the year, inflation will significantly exceed 7%, and at the latest at the beginning of 2022, it will start an affair with the level of 8%. The Ministry of Finance has already got used to this thought, seeing even faster inflation growth and the possibility of attacking 8 percent. this year.

Inflation will drop?

At the moment, it seems that the aforementioned area of 8 percent. this will be the peak of inflation. From the second quarter, it should decrease. However, it will not start falling quickly. Economists are already forecasting that the average annual inflation next year may reach as much as 5%. A stronger pullback is expected only in 2023, when inflation, according to economists' forecasts, may drop to around 3,5 percent. It will still be a high level, because the upper limit of the inflation target National Bank of Poland (1,5-3,5 percent).

The consequences of the sharp acceleration of inflation in Poland should be realized by the Monetary Policy Council (MPC), which meets tomorrow for a one-day meeting and will learn the latest inflation projection. And if the Council does not want to undo inflation expectations, wind up a wage-price spiral, and strongly weaken the already weak zloty, it must definitely raise interest rates. By 50 basis points (bp), because these are market expectations, at tomorrow's meeting. And by another 50 bp at the next meeting, in order to bring the rates to the minimum level just before the pandemic (the main rate is 1,50% as compared to 0,5% now).

The zloty will react to the MPC decision. The 50 bp hike should strengthen it, because after the Council unexpectedly raised rates by 40 bp in October, now the market will start to play for further decisive hikes. A smaller hike, and especially the lack of it, will overestimate the zloty.

The decision alone is not enough. What will be said by President Glapiński at the Wednesday press conference will also be of great importance. This is because it will have an impact on expectations, and it is the expectations that will largely shape the zloty exchange rate. If further rate hikes are announced or the NBP governor threatens with an intervention aimed at strengthening the zloty, then the zloty will strengthen. However, if it finds that the MPC will adopt a wait-and-see position under two hikes (in October and possibly in November), then the zloty will not be helped by a 50 bp rate hike.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![What will the Monetary Policy Council do on Wednesday? [Market comment] disinflation in Poland](https://forexclub.pl/wp-content/uploads/2020/02/inflacja-w-polsce.jpg?v=1582035494)

![What will the Monetary Policy Council do on Wednesday? [Market comment] fall in oil prices](https://forexclub.pl/wp-content/uploads/2021/11/spadek-cen-ropy-102x65.jpg?v=1635851682)

![What will the Monetary Policy Council do on Wednesday? [Market comment] bitcoin forecast](https://forexclub.pl/wp-content/uploads/2019/06/bitcoin-prognozy-102x65.jpg)