Commodities down through the strengthening of the dollar, silver is the biggest loser

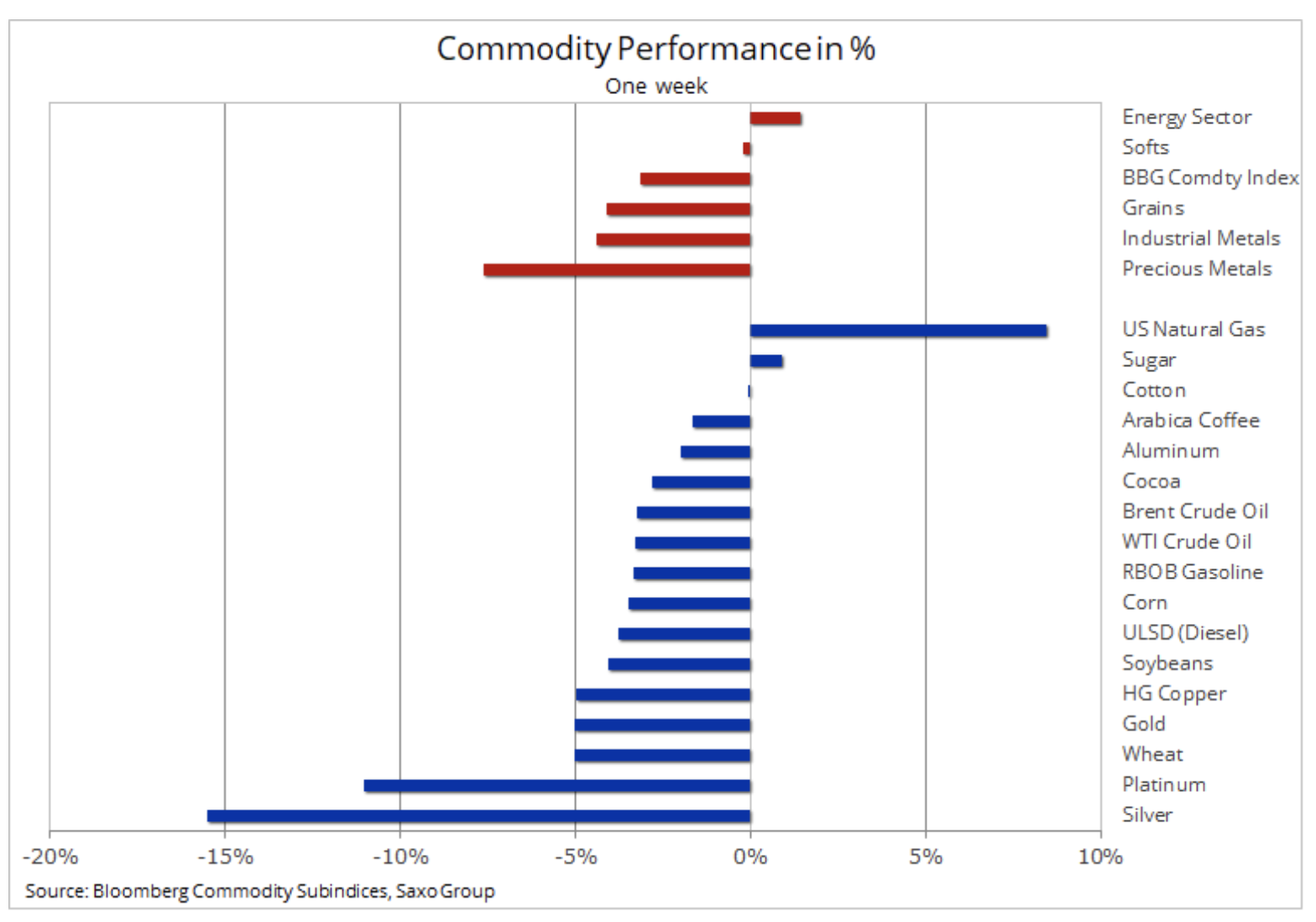

Commodities fell weekly after the stronger dollar struck a blow to many markets. The Bloomberg commodity index, which monitors a basket of major commodities proportionally broken down into energy, metals and agricultural products, plunged 3,2%, with energy, due to the strong performance of natural gas, proving to be the only sector able to counter the negative impact a stronger dollar.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Currency market

The dollar appreciated to the highest level in two months against the euro as risk aversion returned. This was in response to the continued rise in coronavirus cases around the world and to the internal conflict in Washington that raised concerns over Congress' ability to adopt another fiscal stimulus package. The negative stance towards the dollar, which has been intensifying in recent months, was particularly visible, given the speculative positions in the futures market in the form of an almost record long position in the euro.

A fall below EUR 1,1700 therefore triggered some fears of a deeper correction, negatively affecting in particular markets with strong upward positioning, such as the precious metals and industrial markets. Silver has plunged sharply and has already seen two revisions of + 20% since it hit nearly $ 30 / oz just six weeks ago. Such strong volatility dealt a blow to investors, raising some doubts about the metal's ability to continue growing.

Raw materials and agricultural commodities

The monthly boom in the cereals market slowed as a stronger dollar and signs of a slowdown in Chinese demand called into question the potential for further increases in soybean and maize prices. Speculative investors hold the largest combined long position in wheat, maize and soybeans since 2013 compared to similar periods. In view of the imminent harvest season and in the absence of any particular problems associated with it, they may have to reduce their exposure. Soybeans, which benefited the most from strong Chinese demand, saw the largest weekly decline in six months after exceeding $ 10 / bu, and foreign investors began opting for agricultural products from Brazil.

Although there are no signs that the dollar has peaked yet, market sentiment slightly improved before the weekend. Despite the stalemate over Trump's planned appointment of a supreme judge in the weeks leading up to a potentially violent election, Democrats, surprised by the improvement in the incumbent president's poll results, are devising a new, albeit relatively modest, stimulus package worth $ 2,4 trillion, and the treasury secretary in Trump administration, Steven Mnuchin, spoke positively about the prospects for the negotiations.

Gold fell below $ 1 / oz, but managed to find support ahead of the key level of $ 900 / oz, a 1% retracement of the bull market between March and August. Silverwhich - as already mentioned - experienced a second bearish (a drop by 20% from the last peak) showed a decline in the relative value of gold almost to the level of the two-month low.

In the short term, both metals will struggle with problems related to the recent decline in inflation expectations, which led to an increase in real yields, as well as the strong dollar and the recent high correlation with stock prices, which means that until the US elections in November may be quite nervous.

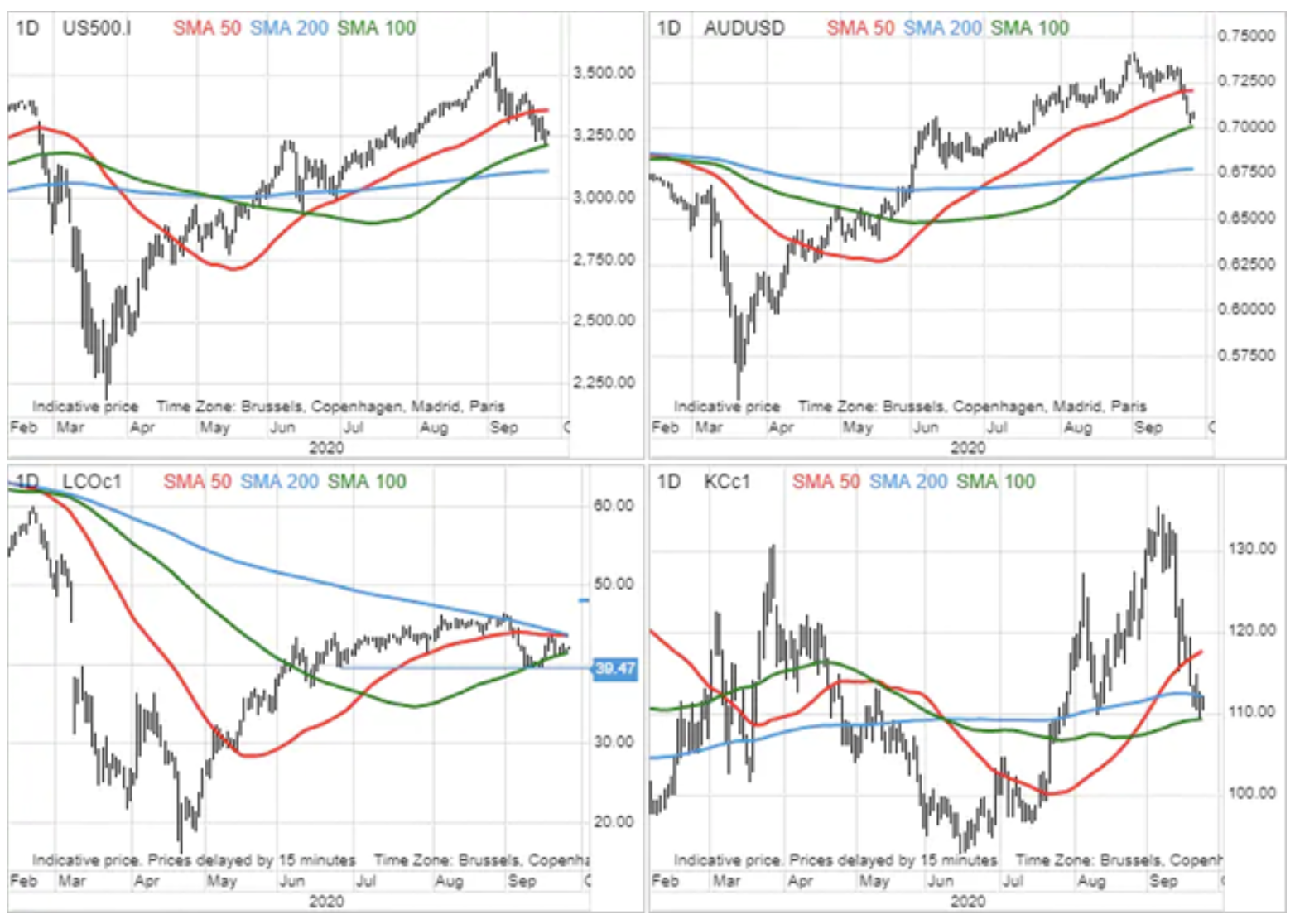

This proves that the markets of different asset classes continue to show a high degree of correlation. In the context of recent price movements, it is clear how the dollar is having a huge impact on the overall level of risk appetite. It is therefore not surprising that a number of different markets, from the S&P 500 and AUD / USD to gold, crude oil and coffee, have managed to find support and attempt to rebound from the well moving average.

Another loser from the strengthening of the dollar and the related decline in risk appetite was copper. The impressive rise in the price of white metal from the March low is already starting to hold back: the price of HG copper is struggling to break above $ 3,1 / lb. The boom in the industrial metals market, especially copper, in recent months has been fueled by the recovery in Chinese demand after the pandemic, supported by credit and supply disruptions.

While the fundamental outlook remains positive, the lack of new stimulus for growth and the high net long position of speculative investors such as hedge funds and trend-followers (CTAs) have led to a correction to $ 2,91 / lb. Depending on the resistance of speculators and developments in other markets, the price correction may move towards the low from early August at 2,77 USD / lb.

Petroleum

Despite some difficulties, unlike many other raw materials Petroleum managed to avoid a wave of sales. Despite the weekly decline, crude oil managed to maintain its levels against fears over demand caused by the imposition of further restrictions in the fight against the coronavirus, the risk of an increase in supply and the strengthening of the dollar. All this may indicate that the market took a firm verbal approach seriously intervention by the Saudi minister of energy, Prince Abdulaziz bin Salman. At the last OPEC + meeting, he criticized members of the organization who did not adhere to the agreed mining regime, as well as short sellers in the futures market who held a combined short position in WTI and Brent crude oil of 11m barrels in the week ending September 250.

The additional support came in the form of an overall weekly decline in US crude oil and product inventories, as well as the results of a monthly survey published by the Fed in Dallas, where 160 oil and gas company executives answered questions about the current market situation. According to approximately 66% of respondents, production in the United States has already peaked, with the vast majority saying that the price of WTI crude oil must exceed $ 50 / barrel to significantly increase the number of wells. Accordingly, given the lack of indications of an increase in prices, US oil production may decline even further in the coming months.

The decline in production in the United States and an increase in inventories worldwide contributed to a reduction in the discount of WTI crude oil to Brent below two dollars a barrel. Overall, however, we remain skeptical about crude oil's ability to grow in the short term, and as shown in the chart below, Brent crude currently hovers between $ 39,50 / b and a resistance of $ 43,60 / b, which is a point. convergent for the XNUMX- and XNUMX-day moving average.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

Leave a Response