Compound interest - the eighth wonder of the world

Compound interest is a powerful tool in the hands of a conscious investor. Understanding how it works can be a powerful help in achieving financial independence, which is a goal for many passively investing. However, many traders are unaware of the impact this can have on the final size of profits.

A very popular sentence is the following quote:

"Compound interest is the eighth wonder of the world. Those who understand it earn money from it. Those who don't understand have to pay it. "

The simplest understanding of how much "magic" can be behind compound interest is to choose between two types of salary that employees can receive:

- PLN 50 for 000 days.

- PLN 300 for the first day, 10% more on each subsequent day than on the previous day.

- 15 groszy on the first day and on each subsequent day 50% more than on the previous day.

- PLN 1 on the first day and twice the amount on the previous day on each subsequent day.

For simplicity, each month has 30 days. Which salary will be the most profitable?

- In the case of first the employee will receive offers at the end of each day PLN 1666,66.

- In the case of the second The employee will get PLN 300 for the first day, and PLN 330 for the second day. Only at the end of the 19th day will he receive it PLN 1667,98.

- For the third variant, the day wage similar to the first variant occurs only after 24 days (PLN 1683,41).

- In turn for fourth variant, during the first 17 days of work, the employee will earn PLN 1310,71 (on average PLN 77,1 per day). However, after 30 days, the employee choosing the fourth option would earn the most. For 30 days, he would earn less than PLN 11 million (PLN 10,737 million).

The next most profitable option would be third. In this case, the employee will earn PLN 57. So the fourth variant of the remuneration gives as much as 186 times higher earnings. Despite the fact that on the first day, the salary in the third variant was 15 times higher (PLN 15 vs PLN 1).

Option 2 offers the lowest earnings, because within 30 days the employee will earn PLN 49. This amount is comparable to option 348. The difference is PLN 1, even though the employee received lower remuneration for the first 652 days.

Why such shocking values for the fourth variant? It is a situation of doubling the value of an investment in the perspective of 30 periods. Most of this stunning result is made up of the last four days, which generated PLN 10. On the last day, the employee received the same amount as for the previous 066 days of work.

Be sure to read: What is passive investing? Advantages and disadvantages [Guide]

Compound interest and long term

It is thanks to the magic of compound interest that "details" have a great impact on the final investment result. These "details" include the initial investment amount, the average return on investment, and taxation.

Taxes and investment result

Let's deal with the last case, which is very rarely mentioned in the case of long-term investing as well "Passive investment". The tax rate can significantly "distort" the final result on invested capital.

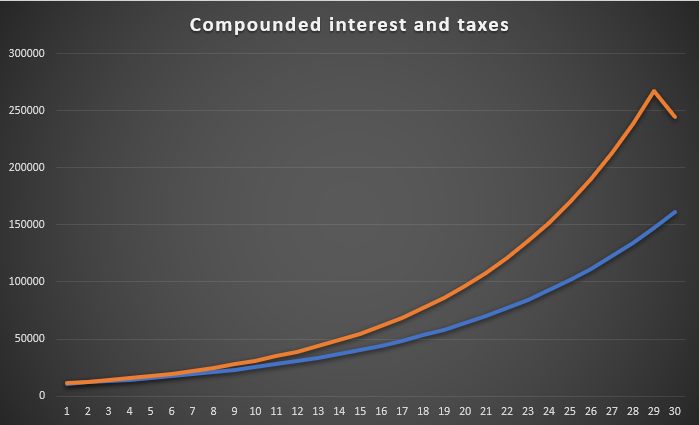

The chart below shows an investment of PLN 10 which gives a 000% return on capital each year. The blue line shows the amount invested at the end of the year, however, at the end of each year, the investor pays capital gains tax (12%). The orange line, on the other hand, represents an investment return of 19% per annum, but the capital gains tax is not paid on all profits until the end of the 12th year. By paying the tax every year, the investor at the end of the 30th year accumulated a wealth of PLN 30 thousand. PLN. However, if the tax was deferred, only at the time of exit from the investment, the accumulated amount would be PLN 161,65 thousand. PLN. The tax deferral gave over 244,58% more capital at the end of the investment.

Source: own study

This example shows that it is in the investor's best interest to defer the tax as long as possible. How can taxation be avoided? The easiest legal way is to delay the moment "Outputs" from investment. For this reason, people constantly changing stocks as well ETFs in the portfolio they must achieve a higher return on investment than the person applying the strategy buy & hold. The higher the taxation of capital gains, the greater the required rate of return that active investors must achieve.

Check it out: FINAX - Invest, do not speculate, or how to invest passively

Average rate of return on investment

It is no surprise that the higher the rate of return, the higher the value of assets at the end of the investment period. However, many investors do not realize how big the difference can be in the perspective of 5, 10 or 30 years.

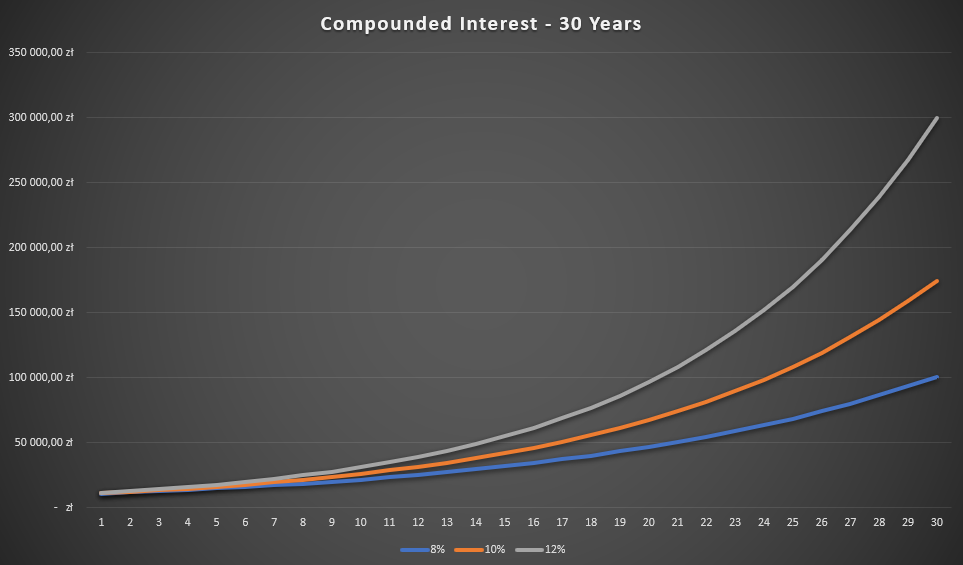

Source: own study

The chart above shows the net return on investment at the levels of 8%, 10% and 12% per annum. In the perspective of 30 years, the difference is stunning. The investment of PLN 10 after 000 years gave PLN 30 thousand. PLN, with an investment giving a rate of return of 100,6%. In turn, if the same amount were to be invested at the rate of 8%, it gives 12 thousand after 30 years. PLN. The longer the investment period, the greater the difference between the rates of return on investment. Below is a table summarizing the impact of time and interest rate on the investment result:

| CAGR% of investment | 8% | 12% |

| Initial investment amount | 10 000 PLN | 10 000 PLN |

| Investment value after one year | 10 800 PLN | 11 200 PLN |

| Investment value after 5 years | 14 693 PLN | 17 623 PLN |

| Investment value after 10 years | 21 589 PLN | 31 058 PLN |

| Investment value after 30 years | 100 627 PLN | 299 599 PLN |

| Investment value after 50 years | 469 016 PLN | PLN 2 890 022 |

Source: own study

Compound interest - regular investment versus one-time payment

Another issue is the impact of the investor's investment strategy on the result of the investment. We are talking about paying a certain amount on a regular basis, or paying the entire amount at once. Each of these strategies has its advantages and disadvantages, as will be shown in the examples.

Average was achieved in four options CAGR at the level of 10%. However, there were different "paths":

- "Variant of a smooth curve"that is, every year an increase of 10% per annum for 10 years.

- "Drop in the first year by 20%" and in the next 9 years an increase of 13,9618% annually.

- "Increase in the first year by 20%" and in the next 9 years an increase of 8,9416% annually.

- "Decrease in the first 3 years by 10%" and in the next 7 years an increase of 19,8786% annually.

In the case of a one-off investment, the investor initially achieves a rate of return of 10% per annum. The amount of investments at the end of 10 years was 25 937 PLN.

In the case of regular payment of PLN 2000 at the beginning of the first 5 years, the capital value in the case of the "smooth" variant was 21 631 PLN. The difference was as much as PLN 4306. This was due to the fact that the paid-in capital worked for a shorter period than in the case of a one-off payment.

Second variant it was already more advantageous in the case of a payment divided into tranches. The amount invested generated an investment at the end of the 10th year 26 735 PLN. The difference was PLN 798. In this case, the investor benefited from declines in the first year and faster price increases after the first year (13,9618%). It more than covered the impact of the shorter investment period by the subsequent tranches of the investment.

Third variant was the least beneficial for the investor in tranches. In the first year, there was an increase of 20%, and in the following years, the average rate of return fell below 9%. At the same time, subsequent tranches “worked” for a shorter period than in the case of the first tranches. As a result, the capital at the end of 10 years amounted to 20 464 PLN.

In turn, fourth variant it is most beneficial for the investor in tranches. Thanks to the initial dips, the investor was able to invest a significant amount at lower prices than the initial ones. In addition, the investor has caught a strong upward move since the fourth year, when the market "earned" less than 4% per year. As a result, the capital at the end of the 20th year amounted to 31 680 PLN.

It is clearly visible that each of the investment methods has its advantages and disadvantages depending on the rate of return on investment in particular years. In times of strong bull market or slight corrections, it is best to invest the amount as early as possible. On the other hand, in the period of a long bear market (eg three years), the “tranche” strategy performed better.

Summation

Compound interest is the investor's greatest ally. Very often the aspect of compound interest is taken to the extreme. On the one hand, there are "tables" showing that even with 10 zlotys you can become a millionaire ("only 000% per year is enough). On the other hand, there is the argument that "no one lives for 50 years." The truth usually lies in the middle. In building assets, both the level of invested capital (it is easier to “make a million” out of PLN 200 than PLN 300), the achieved average rate of return and the investment time (the longer the investment takes, the lower the required rate of return is). Of course, taxes should not be forgotten. The longer an investor manages to avoid the tax, the higher the capital accumulated at the end of the investment. This is because of the compound interest effect, which allows more capital to be "reinvested".

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Day Trading or Scalping? Money Management – Mr Yogi, part 2 [VIDEO] Money Management - MrYogi. Time frames and position size risk](https://forexclub.pl/wp-content/uploads/2023/11/Money-Management-przedzialy-czasowe-v2-300x200.jpg?v=1701591046)

![Building a risk management plan - How to do it? [Guide] risk management](https://forexclub.pl/wp-content/uploads/2021/12/zarzadzanie-ryzykiem-300x200.jpg?v=1639495023)