Credit Suisse at its 15-year low and an energetic phoenix

Credit Suisse tells the story of a long series of bad decisions, but also of a structurally weak European banking sector that, 14 years after the global financial crisis, is struggling to achieve a return on equity exceeding the cost of equity capital throughout the economic cycle.

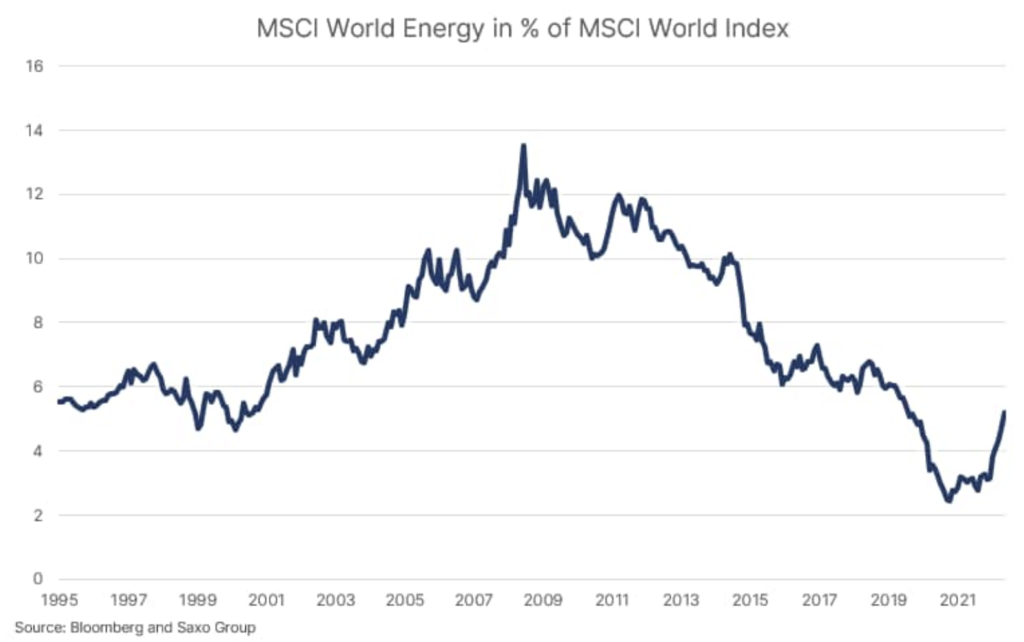

While the financial sector is in decline in many ways, the energy sector is rapidly growing in strength, regaining its share of the overall equity market; a company can serve as an example here Exxon Mobil, which rose by 71% this year and is now the eleventh largest US publicly traded company by market value.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

Will Credit Suisse's earnings warning lead to an acquisition?

We do not remember when the last time we were positive about European banks, except in rare cases of a tactical nature. European banks remain structurally weak and yesterday's warning from Credit Suisse about the possibility of a loss in QXNUMX is proof of this. Credit Suisse's investment division is likely to post its third consecutive quarterly loss as a result of losing market share across all business lines. The Swiss bank has suffered hard in recent years as a result of the spectacular collapse of the Archegos hedge fund and the bankruptcy of its supply chain financing partner Greensill Capital. The bank offered a long list of excuses for its underperformance, ranging from geopolitical tensions to sudden changes in monetary policy.

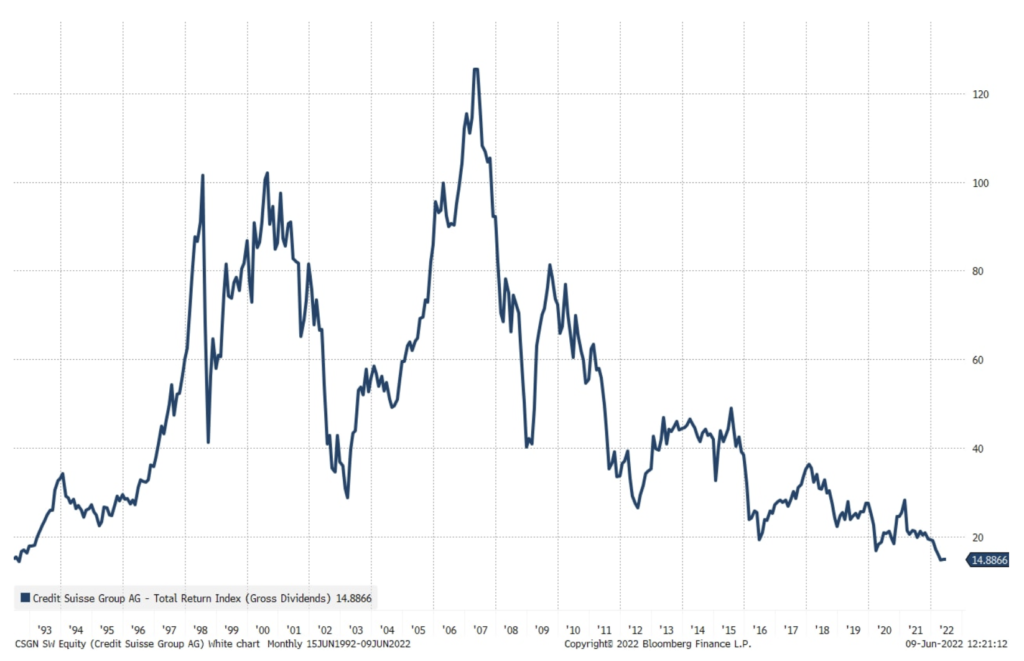

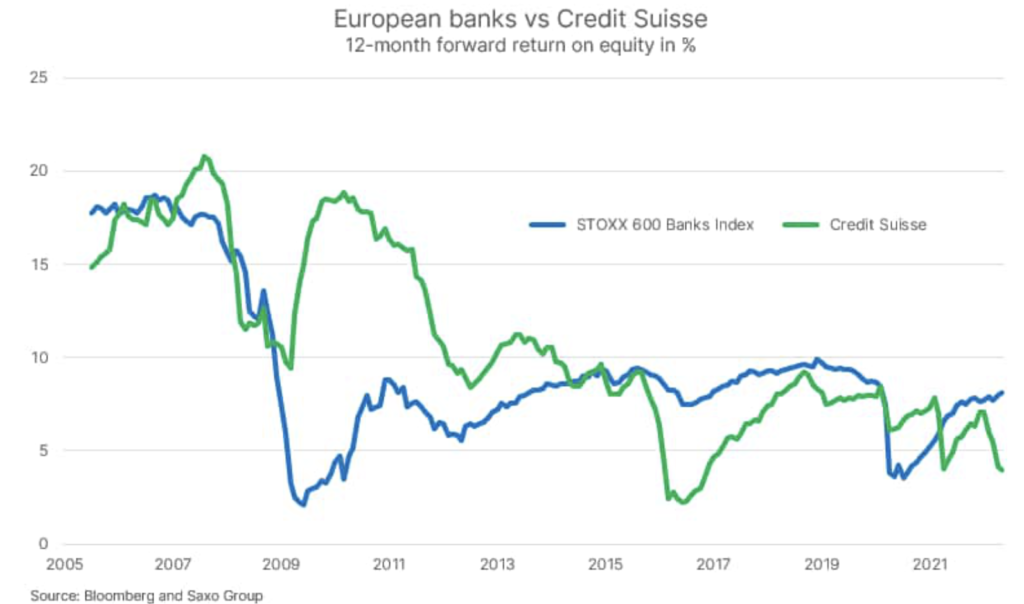

The facts are that since the peak of the economy in 2007, Credit Suisse has tirelessly worsened the situation for shareholders and has not achieved a positive total return since late 1992, destroying capital at a rapid pace after adjusting for inflation. After the global financial crisis, Credit Suisse had a few years in which to do better return on equity (ROE) than the European banking sector as a whole, but since 2011, the bank's performance has regularly deteriorated compared to the rest of the industry. Currently, the 3,9-month ROE is only XNUMX%, which is well below the cost of equity. Credit Suisse is a symptom of European banks stuck in a difficult regulatory environment, an economy with low growth and an overhang of bad debts. Structurally, it is difficult to accept a positive outlook for European banks.

Exxon Mobil is close to returning to the top ten on the S&P 500 index

Exxon Mobil, America's largest oil and gas company, surged 71% this year with a market value of $ 440 billion at Wednesday's close. As a result, the company's shares ranked 11th on the S&P 500 index in terms of market capitalization, regaining some of the losses of energy companies on this index. Despite its recent growth, Exxon Mobil is trading at a 9-month free cash flow return of 6%, compared to around XNUMX% for the index MSCI World.

As we wrote recently, energy stocks are the cheapest in 27 yearsand their share of the total market value of the S&P 500 index rose from just 2,4% to 5,2% in May, with a long-term average of 7,5%. Assuming the ongoing energy crisis and the consequences of the low level of investment over the past 8 years, energy prices will continue to remain high, providing energy companies with a high return on invested capital. Structurally, we are reiterating a positive outlook for oil and gas equities.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)