Credit Suisse - a victim of "social media run" or a badly managed bank?

Credit Suisse shares fell 25% on Wednesday after news that Saudi National Bank was unable to offer more financial assistance. This has caused investors to fear that the problems of the bank, which is currently undergoing a deep restructuring, will deepen. The market is very concerned about the bank's future. You can see it after CDS.

Credit Suisse one-year default swaps near distressed zone.

Current level is 18 times the one-year CDS for rival Swiss bank UBS and 9 times Deutsche Bank.

Ouch. pic.twitter.com/qyHZsbAzZi

— Genevieve Roch-Decter, CFA (@GRDecter) March 15, 2023

O We already wrote about the problems of the Swiss bank in October 2022., carefully analyzing its financial situation and the causes of problems. Even then, to put it mildly, his situation was not very interesting but still not tragic. What has changed since then? Is investor fear justified? Is it another Lehman Brothers?

What is social media run?

Banks are very fragile institutions. Their greatest asset is that which cannot be found on the balance sheet. It is trust. It is thanks to it that the bank is able to raise capital on the market and attract customers to deposit funds in the bank. When a bank loses confidence, it can find itself in trouble.

In the age of social media, information spreads very quickly. In extreme cases, this may occur social media runes. It is a modern form of a classic fleece. It consists in the fact that customers, due to rumors about the bank's problems, withdraw funds from it. This causes a further decrease in the bank's liquidity. Social media run differs from the classic one in terms of speed. Information on social platforms reaches recipients instantly. You can now withdraw funds from the bank just as quickly.

The fractional reserve system, which is the greatest friend in good times, suddenly becomes the greatest enemy. The bank must offer high interest rates on deposits and its debt in order to attract takers. Even if such an institution survives the run, it will take a long time to recover without an additional injection of cheap capital.

Credit Suisse is Europe's sick bank?

The bank's problems were widely discussed in the second half of 2022. They were already there then rumors of imminent bankruptcy of the bank. Six months have passed, and the rumors have returned with a vengeance.

The bank is currently undergoing a long reconstruction, which has been going on for almost two quarters. On October 27, 2022, Credit Suisse announced a plan to restructure its business. The purpose of this step was the need to improve the bank's profitability and fundamentally change the operating model of some business segments. The bank's transformation (or rescue?) plan was to be based on three pillars:

- restructuring of investment banking activities,

- improvement of capital ratios,

- cost optimization.

So the plans were ambitious. However, the situation required quick decisions. So let's take a look at the restructuring of the bank in recent months.

Restructuring of investment banking

The restructuring of investment banking is aimed at reducing the risk and increasing the profitability of the bank's operations. The action is to be based on:

- focusing on the Markets segment,

- development of CS First Boston business,

- sale of SPG (Securitized Products Group) to reduce group risk. The remaining activity related to securitized products is to be transferred to the NCU (Non-Core Unit).

The restructuring was to take place by changing the risk profile. According to the bank, by the end of 2025 the RWA (risk-weighted assets) indicator is to fall by 40%.

The SPG deal was announced on November 15, 2022. According to Credit Suisse, the transaction is expected to close in the first half of the year. The structured products division is to be sold to Apollo Global Management. This transaction is intended to reduce the risk to which Credit Suisse is exposed. On February 7, 2023, Apollo and CS completed the first phase of the transaction. 16 days later, the second phase of the transaction was completed. Credit Suisse intends to report $800 million in profit from the transaction (before tax). The deal is expected to raise CET1 by around 30 basis points. Thanks to the sale of part of the SPG business, the balance sheet was reduced from USD 74 billion to USD 35 billion. With the further sale, assets related to SPG fell to $20 billion. In addition, the company reduced the share of the RMBS segment (Residential Mortgage-Backed Securities).

Acquisition of Klein & Company

On February 9, Credit Suisse acquired the investment business from The Klein & Company for $175 million. After the acquisition, Michael Klein was hired as CEO of First Boston. It is worth noting that The Klein & Company has participated in many complex merger and acquisition transactions. The acquired company had, among others:

- merger of IHS and Markit (transaction value of USD 13 billion),

- Dow DuPont merger (transaction value $130 billion),

- merger of Glencore and Xstrata (transaction value of USD 80 billion).

However, to develop the business related to this activity, the bank is looking for $500 million of additional capital.

Capital Release Unit

From January 1, 2023, CRU was established as a separate activity of Credit Suisse. This is to separate some of the assets for their subsequent resale and to continue the deleveraging and risk reduction process.

Improvement of capital ratios

The improvement of capital ratios is to be carried out through:

- activities increasing the CET1 indicator,

- sale and divestment of certain bank activities,

- leaving low-margin activity,

- allocating approximately 80% of capital to more profitable activities.

In Q2022 4, Credit Suisse raised capital by CHF 14,1 billion gross. The offer of shares was addressed to existing shareholders and new investors. As a result, the CET indicator increased to 2023%. Nevertheless, the bank expects the ratio to decline in the coming years. Between 2025 and 1, CET13 is to be at 13,5% and only then it is to increase to XNUMX%.

The NCU is tasked with collecting assets for later resale. The capital obtained in this way will be reinvested in a part of the business with much higher profitability. In 2025, 80% of RWA will be located in the following segments:

- Wealth Management,

- swissbank,

- Asset Management

- markets.

CS First Boston's operations alone will account for approximately 14% of revenue in 2025. In turn, the risk-weighted assets of this activity will amount to 9%.

It is also worth mentioning that the bank from October 27, 2022 to the date of publication of the annual report, raised approximately CHF 10 billion by issuing debt. However, this did not solve all the bank's problems. The fact that Credit Suisse is looking for capital began to be mentioned in 2023. The bank's offers to deposit funds with interest rates of up to 7% began to appear in the network. This is a very high interest rate. It is possible that the bank will have a problem with profitable investment of such funds. There were rumors on the market that the bank was in a very difficult liquidity situation. Of course, it is worth remembering that Credit Suisse is a systemically important bank not only for Switzerland but also for banking around the world.

READ NECESSARY: SMI 20 - How to invest in Swiss blue chip companies? [Guide]

Cost transformation

The cost transformation is to take place through:

- employment reduction,

- process automation,

- optimization of operational activities.

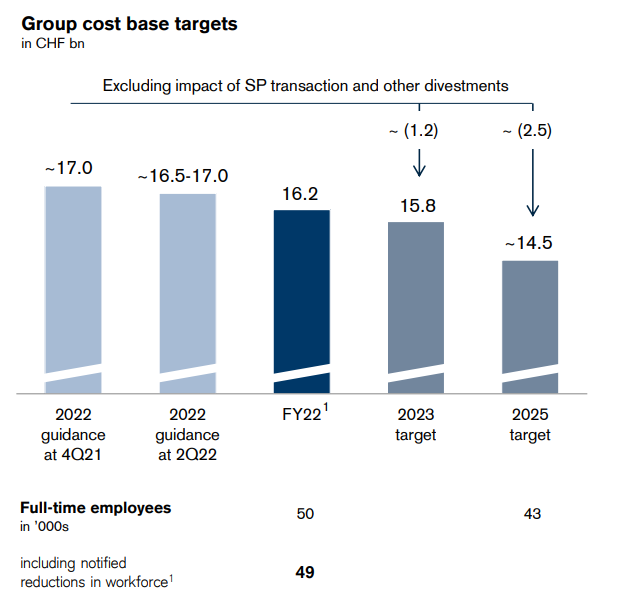

By 2025, Credit Suisse plans to reduce its cost base by approximately CHF 2,5 billion. In 2023, the bank intends to reduce costs by CHF 1,2 billion. The bank is cutting costs where it can. About 30% of contractors were made redundant, and the number of consultants by 20%. The bank plans to reduce expenses related to consulting services by 50%. Moreover, the bank reduced employment by 4%. By 2025, Credit Suisse intends to reduce the number of employees from 43 to 000.

A quick reminder of the 2022 results

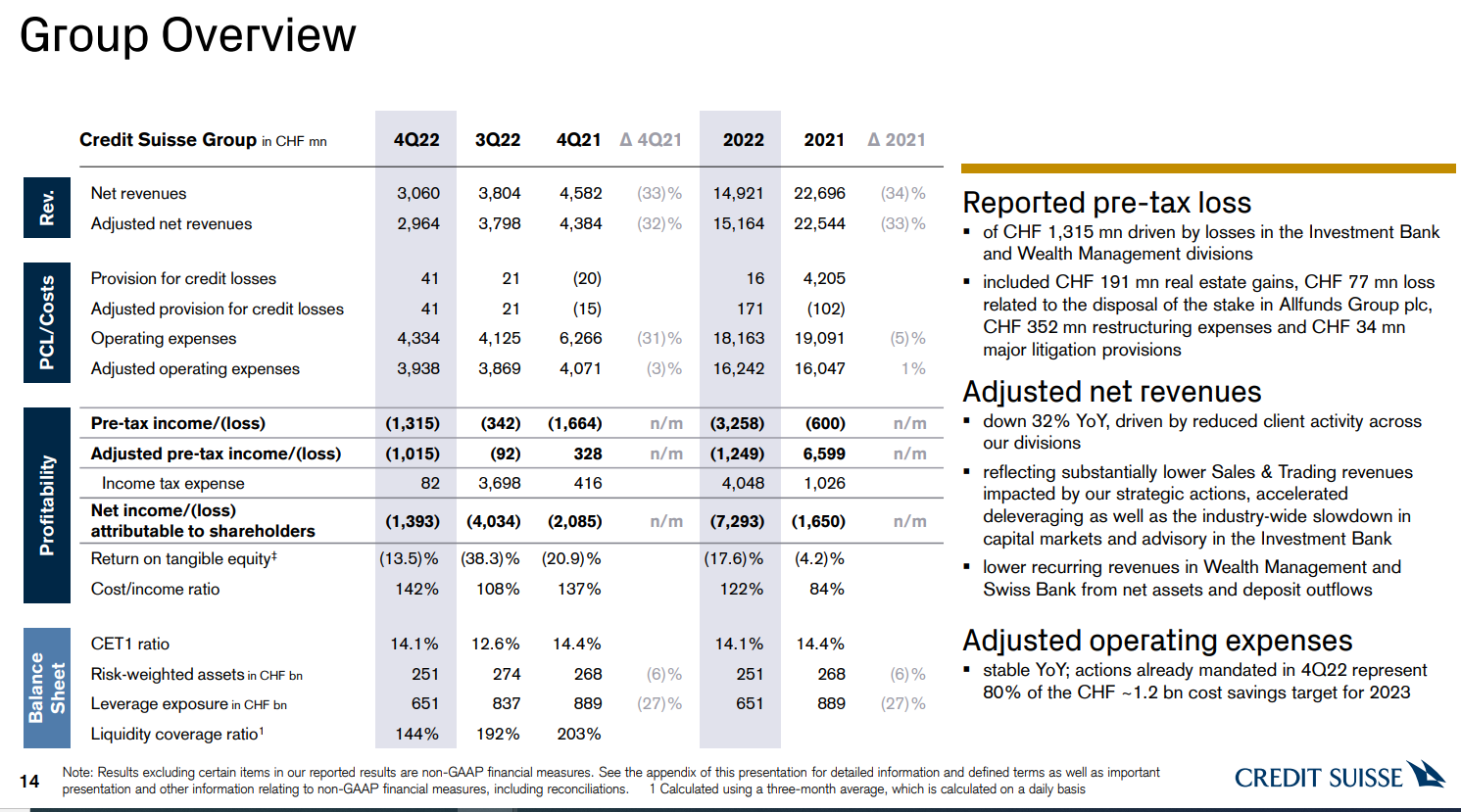

The bank's performance was very poor. It is worth noting that Swiss Bank itself is profitable, but the bank's investment activity generated a huge loss. The sector's pre-tax loss was CHF 1,26 billion. It is worth noting that the restructuring costs in Q2022 350 amounted to as much as CHF 2022 million. The net loss in Q1,4 XNUMX amounted to as much as CHF XNUMX billion.

Looking at the results for the whole year can be scary. A pre-tax loss of CHF 3 billion may scare many investors. In 2022, there was a decrease in revenues by as much as 33%. In turn, all costs related to the bank's operating activities fell by only 5%. No wonder Credit Suisse reported a huge loss. However, it is worth delving into why this situation happened.

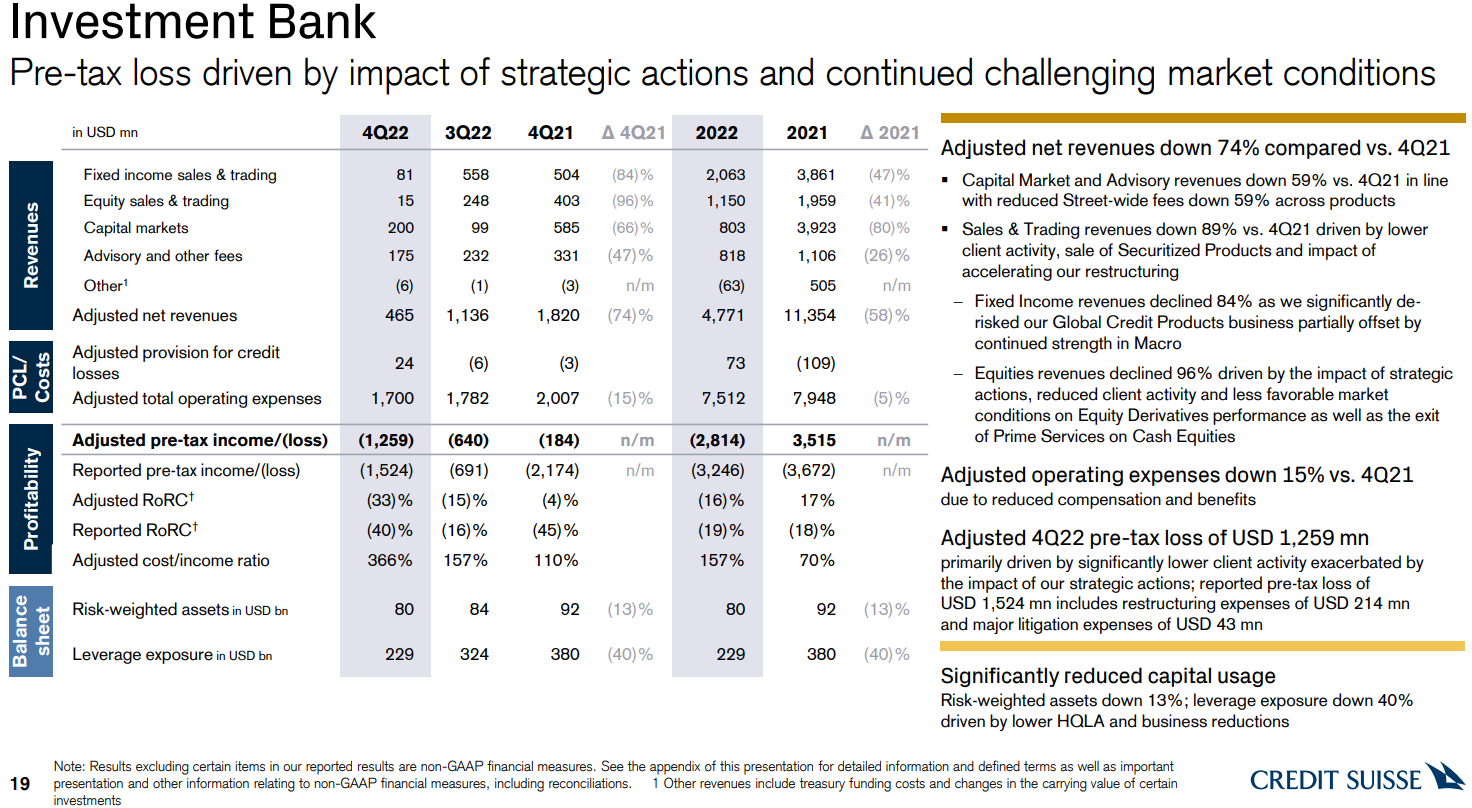

Investment banking

The biggest problem of the bank is investment activity. The results of this segment in Q2022 74 alone were disastrous. Revenue decreased by 68% y/y. The reason was very weak trading activity and lower fees for advisory services. In addition, the bank is trying to restructure its operations, which also has a negative impact on profitability. As you can see in the chart above, the Capital Markets and Advisory segments performed "best". Revenue declines in these segments were 47% and XNUMX%, respectively. Trading and sales activities looked much worse. This was influenced, among others, by the bank's withdrawal from Global Credit products.

Wealth Management

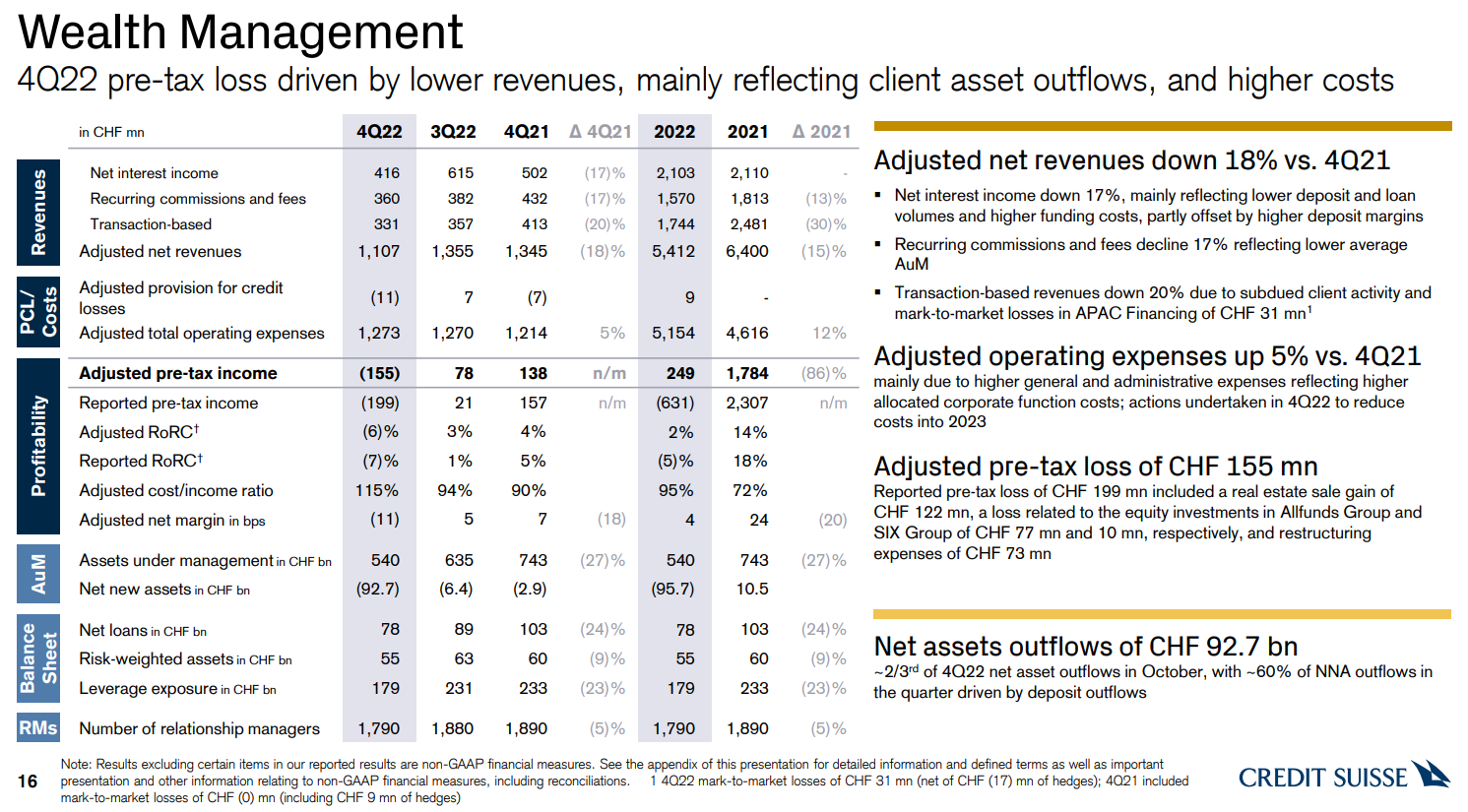

The bank also has problems in the wealth management and Wealth Management segment. The reason is the decline in assets under management. The reasons are both market declines in asset prices and the withdrawal of capital by investors.

It is worth saying that customers' concerns in October 2022 had a major impact on the outflow of funds from the Wealth Management segment. About 66% of the outflow took place in October alone. The reason was, among others news in the media about the bank's large losses and the need to raise capital. During the quarter, assets under management (AuM) in this segment fell by CHF 95 billion to CHF 540 billion. Outflows alone amounted to CHF 93 billion.

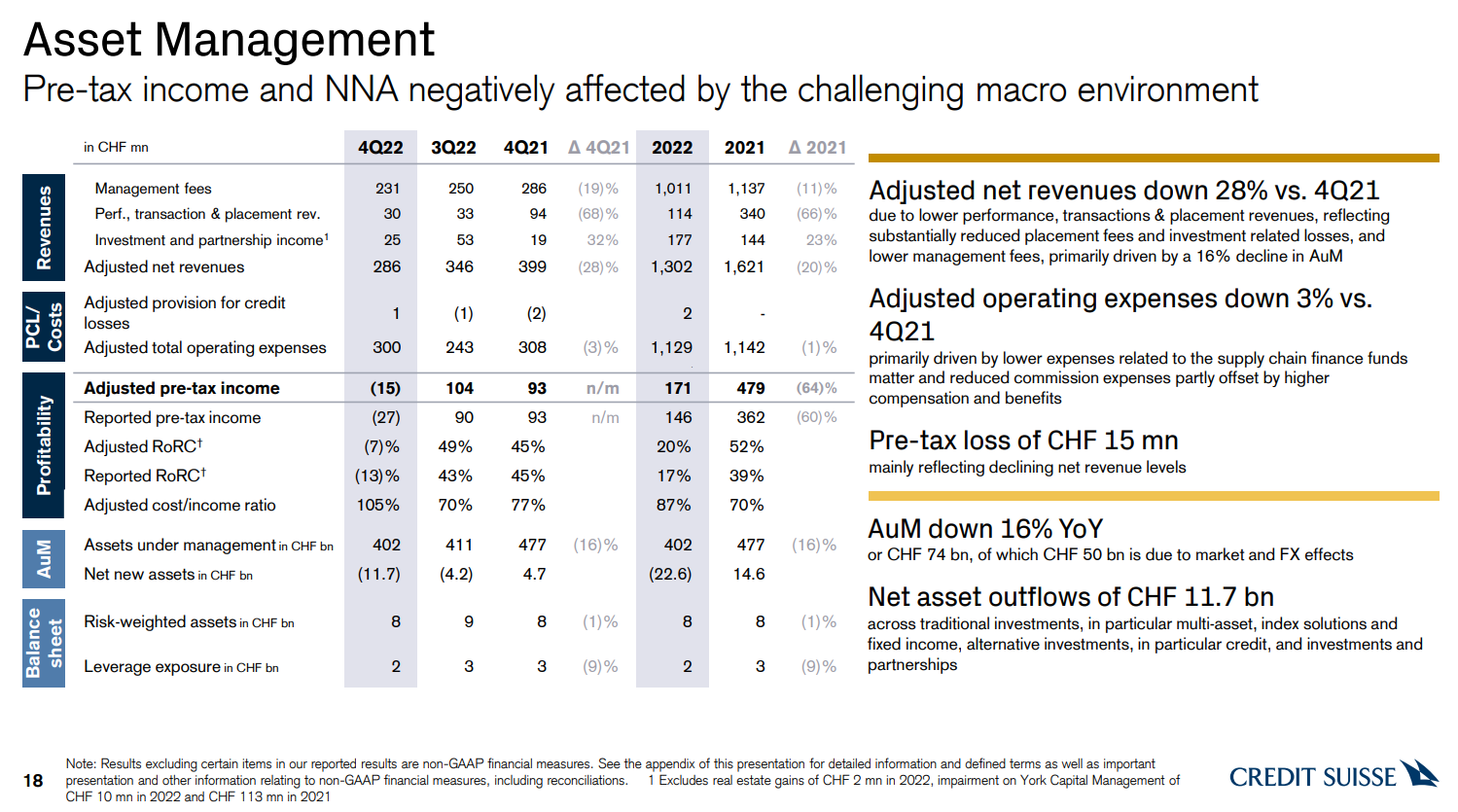

Asset Management

The reason for the decline in revenues was a lower number of transactions on the market and a decrease in assets under management (AuM). Asset Management fell by CHF 9 billion to CHF 402 billion during the quarter. Outflows alone amounted to CHF 12 billion. As in other segments, operating costs fell more slowly than revenues. This segment recorded a small loss in Q2022 XNUMX. Despite this, the segment has a very large potential due to the good margins of this business.

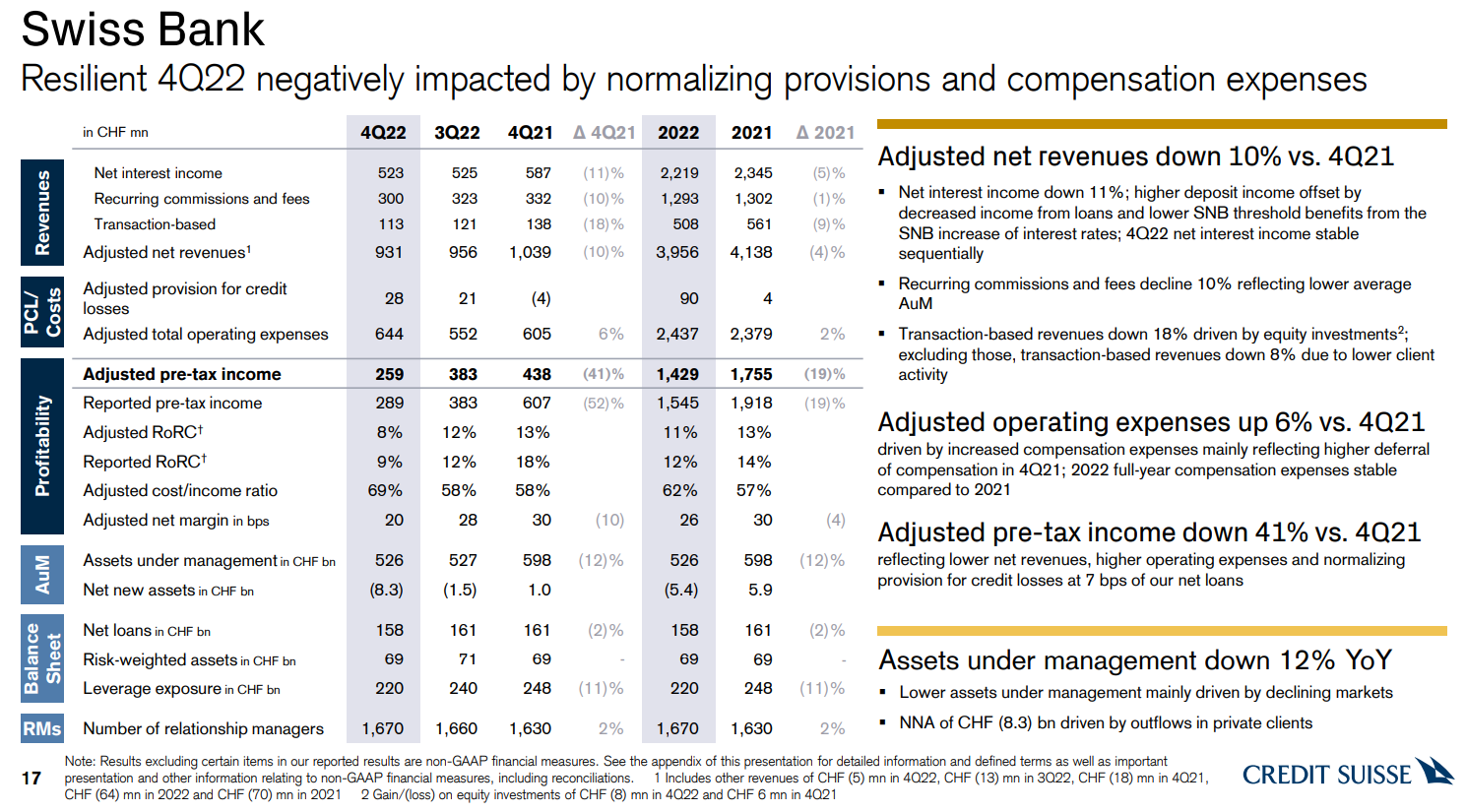

Swiss bank

The last segment we will consider is Swiss Bank. This is a profitable segment that is generating profits for the time being. However, Q2022 11 was very weak. There was an 6% decrease in revenues and a 41% increase in operating costs. As a result, there was a XNUMX% decrease in profit before tax.

Assets under Swiss Bank management fell by CHF 1 billion. The reason was the outflows, which amounted to CHF 8 billion and changes in exchange differences - CHF 3 billion q/q. This more than covered the increase caused by the change in market prices of assets (+CHF 10 billion q/q).

Summation

As you can see, the bank has big problems, which can be seen on the market CDS. The cost of CDSs even reached the level suggesting big problems for the bank. As can be seen from the results for Q2022 XNUMX, the bank's losses are still high and it will be more and more likely that it will be necessary to raise additional capital to undergo restructuring on a dry foot.

In a previous article about the bank, we mentioned that VIEs and their unconsolidated assets are a potential problem for the bank. It is a bit of a "black hole" in which it is not known how much losses this bank is exposed to.

Another problem is the so-called “social media bank run”. For many the first such case was SVB. Credit Suisse had to face a similar situation in October 2022. Then the bank managed to survive a small run caused by rumors spread on social media. Will this time also be able to survive the next turbulence? We'll find out in the coming weeks or months. Few people remember that until a few years ago, investors had similar concerns about Deutsche Bank. It all depends on whether the panic subsides or whether there is an institution capable of injecting liquidity into the bank. It is worth remembering a sentence that perfectly fits this type of situation:

"Markets stop panicking when authorities start panicking" –Michael Hartnett

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)