Sleeping Markets - June volume in currencies fell by 25%

2019 year took off quite interesting in terms of volume on the currency market. The momentum was clearly falling from month to month. What's worse, this trend continues practically until now.

In recent days, a large number of reports on turnover, issued by leading companies and financial institutions related to forex. The reasons for low variability can be found practically everywhere. It is already classically pointed to a trade war between the United States and China and the related stagnation of markets awaiting key decisions on an agreement. There is still a heavy specter of the economic slowdown over the currency market, which is only confirmed by the ever-published data readings coming from global industry.

Currently, the volatility on the foreign exchange market does not spoil. Markets are turning to lower and lower turnover, which means that speculators are becoming less and less involved in forex trading. However, they increase their shares in markets with significantly higher price movements (among others kryptowaluty). Of course, as shown in the reports, we are talking about contracts for digital assets. It is vain to expect improvement in the issue of higher volumes in the near future. Let's look at the current rotation image.

20% less than a year ago

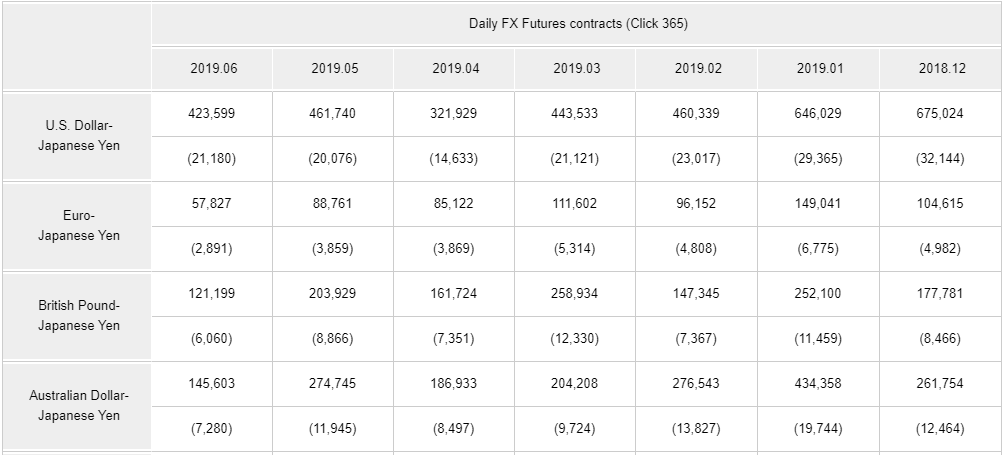

One of the first reports that came to the market came from TFX-Click 365. The first glance at the published data can give you some chills. Considering futures contracts traded on the stock exchange via TFX-Click 365, the total trading volume of 1 644 505 was recorded. This means the average daily turnover of 82 224 contracts. It seems quite a relatively large number. Comparing it to the month back this means a decrease of 25,2%. With the last year in mind, this figure is even worse. Regres reaches 33,1%.

Turnover on currencies on the TFX 365. Source: https://www.tfx.co.jp/en/historical/fx/transit_fx.html

If we look at futures contracts directly on specific currency pairs, and not the entire forex market, we can find a few exceptions (they usually concern one month). The table presents the most attractive and most frequently purchased instruments by investors. Depending on the interest and the degree of involvement of a given currency in political disputes (even trade wars) or inferior market data, we can observe increased periods of lack of interest of traders in a given pair. This is basically due to a small potential profit, in view of exposing capital to a high socio-political risk. A good example can be EUR / USD.

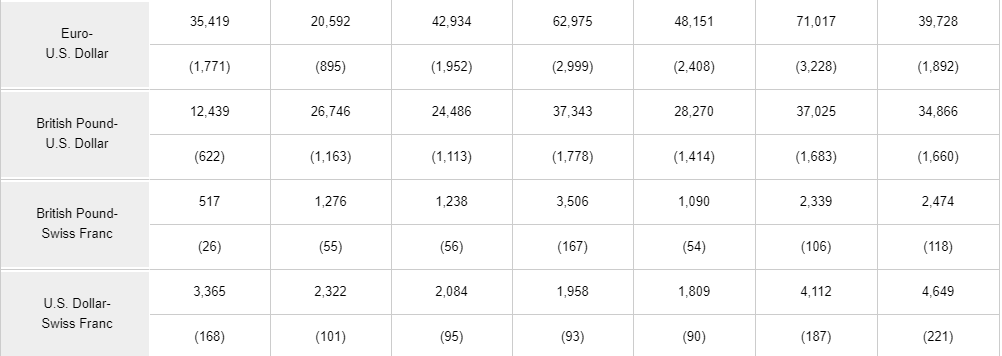

Turnover on TFX 365 futures contracts. Source: https://www.tfx.co.jp/en/historical/fx/transit_fx.html

In June, according to TFX-Click 365, Eurodollar was the only pair to record a monthly increase in turnover - with a total volume of 35 contracts, 419% more than a month earlier.

The deposit is growing, the volume is falling

We also took a closer look at the report released by Gaitame. The Japanese giant of intermediation in foreign trade (mainly forex) published its turnover for the month of June. They are not the worst. Nevertheless, data on the growth of accounts and deposits, which do not translate into the transaction volume on the currency market, are quite surprising. Within a month, Gaitame reported that he had 2 508 bills, or 0,5% more than last month. From June 2018, the number of accounts increased by 31 585. However, by looking at the amount of the deposit, the broker in the report informed about the strongest result in the whole year. We are talking exactly about the 113,0 billion ¥ (1,04 billion USD). By comparing money on investors' accounts, to those accumulated in May, we are talking about an increase of 0,8%. It is also an 1,2% better result than the April data.

Data about volume does not look good any more. Within a month Gaitame reported transaction turnover at 155,3 billion USD. This number, however, is lower in comparison to June and May by 16,4 percent. (exactly from 185,7 billion recorded last month). So why, with growing deposits, such a small capital involvement in the market? The answer seems basically simple. Traders may be preparing capital for improving the mood on the stock market. It is hard not to notice the economic slowdown, which also strongly affects the currency market.

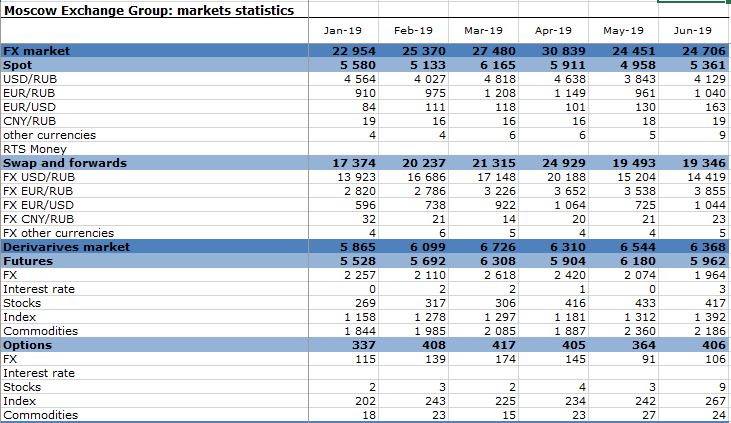

The Moscow stock exchange confirms poor results

Data from the Moscow Stock Exchange reports confirm the trend currently observed in publications of large brokerage companies. MOEX, the largest trading system in Russia, presented just a few days ago a report on monthly results. In the publication, we do not find such a momentum as in the first months of the 2019 year. Variable market conditions also "caught up" with Russian traders.

Turnover on the Moex exchange. Source: https://www.moex.com/s867

In June this year, the total turnover on the MOEX currency market was 24,7 bln RUB (which translates into USD billion). Therefore, the decrease from month to month is approx. 390% (we remind you that May was 30,8 bln RUB, or 471 billion USD). In addition, the latest publication confirms the fall in volumes on the stock exchange on a year-on-year basis. We are talking about a regression about 12,7% from 28,3 trillion rubles in June 2018 year.

Looking closer to the derivatives market offered by the Moscow stock exchange, you can have very mixed feelings. On the one hand, we see improvement in results on a monthly basis (by 1,4%), while comparing them to the same period from last year (June 2018) they are definitely lower (a drop by 7%). The economic slowdown, which can be heard mainly in PMI readings, also includes MOEX as its results show.

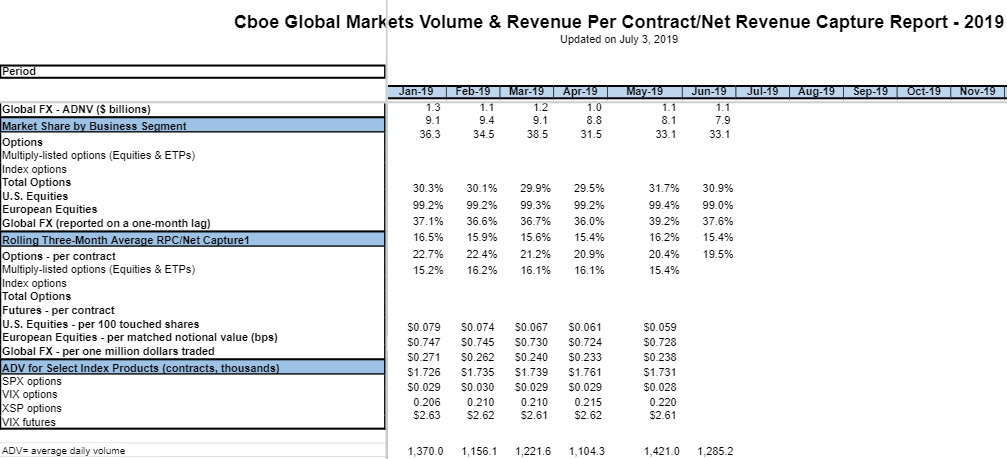

33,08 billion USD, Cboe FX is clearly weakening

It will not be a big surprise that another platform or brokerage company publishes poor data on June turnover. The Cboe FX report shed some light on the involvement of American investors (incl clients of intermediary companies in stock exchange trading, registered in the USA).

In June 2019, Cboe published the total volume of trading in option contracts at the 142 million level. In practice, this means a decrease of four percent compared to last year. June 2018 reported a total of 148 million contracts. This result, when converted into the average daily trading volume (ADV), is exactly 7,09 million contracts a day.

Summation

The economic slowdown is evidently also reflected in the currency market. There is a growing aversion of investors to the involvement of capital on forexie. We observe (with few exceptions) more and more stagnation for half a year. Will the next months bring us any improvement? We look forward to the data for July.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)